The 50 basis point rate cut to start the cycle surprised at least half of investors.

There are 25 basis points is the compensation for July.Many investors in the market point of view is that July can open the rate cut, and Powell in order to "stabilize" hard to see two more months of data off to September.The 50 basis points, in fact, is 25 basis points in September, plus 25 basis points in July compensation!

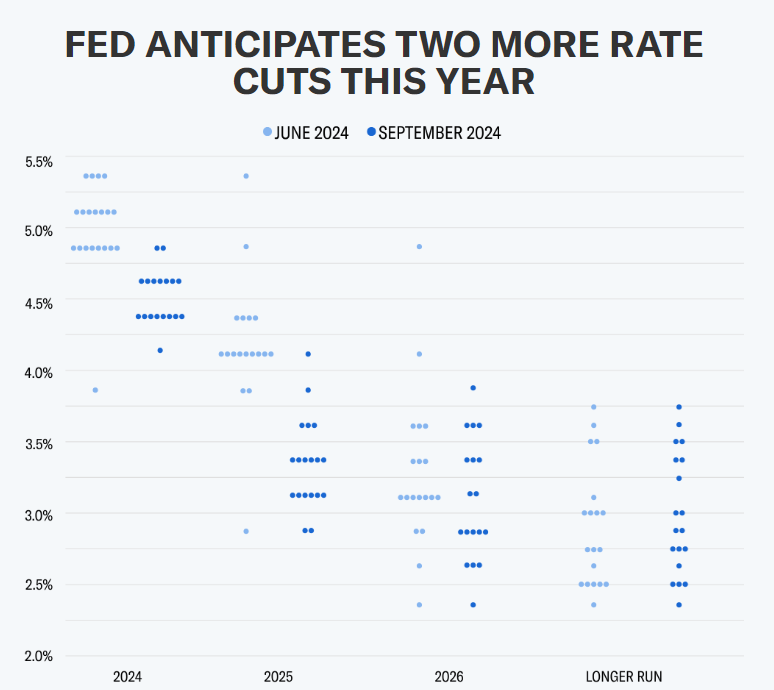

Even 50 basis points, still behind the curve.According to the Fed's own point of view, this time is "calibrated policy stance" - do not want to fall behind the curve, but also do not want to signal the risk of recession, so the action to see at first glance seems to be very large, in fact, just behind the market too much to add.

For the first time did not give the market "clear signal".Powell followed Yellen's style, everything is fully communicated with the market first, rather than lagging behind the market, but also never add surprises to the market.But this time it left the market in suspense, and even within the Fed there are different opinions (first time in 2005)

The Fed really changed the style?

We believe that this is still the Federal Reserve tends to "conservative" results, really prompted the Federal Reserve to take a big step forward, is its policy objectives tend to change.

The central bank's monetary policy objectives focus on two main points: 1. control inflation; 2. enhance employment.

Because of the previous high inflation, control of inflation has been the Federal Reserve's top concern, with the CPI data in the past few months, but also basically stabilized at an acceptable level.The Fed, in turn, has begun to shift its focus to employment.

If the slowdown in inflation is accompanied by weaker employment, then the need for a possible rate cut becomes more urgent, as the Fed has less tolerance for rising unemployment -

"They don't want to risk jeopardizing the rosy prospect of a "soft landing"."

What should investors be aware of after the first rate cut?

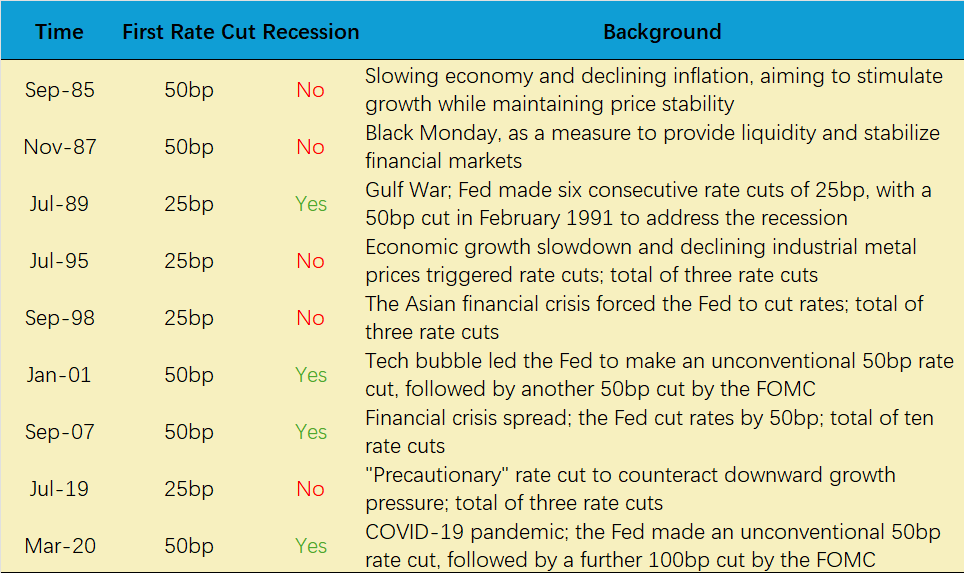

First, a 50 basis point rate cut does not mean a recession.Although word since 1989, the rate cuts opened by 50 basis points have all occurred on the eve of a recession (2001 Internet bubble, 2007 subprime crisis, 2020 Covid-19), there have also been two rate cuts in the 1980s following high interest rates due to inflation that were opened by 50 basis points, and in the year that followed, the $ S&P500 (.SPX)$ index returned more than 10%.

Second, the employment rate will become the new "most critical indicator".Powell even said that if the July non-farm payrolls report before the July meeting, it is likely to start cutting interest rates at that time.The future employment report itself could become a tool for monetary policy, and regardless of Powell's hawkish or dovish statements, we believe that any future unemployment rate above 4.4% could trigger an over-expected rate cut, thus

The market volatility of non-farm payrolls or jobless claims data will increase;

Until the job market data stabilizes, the Fed will act more conservatively (and dovishly in an easing cycle);

The possibility of a soft landing of the economy will rise further.

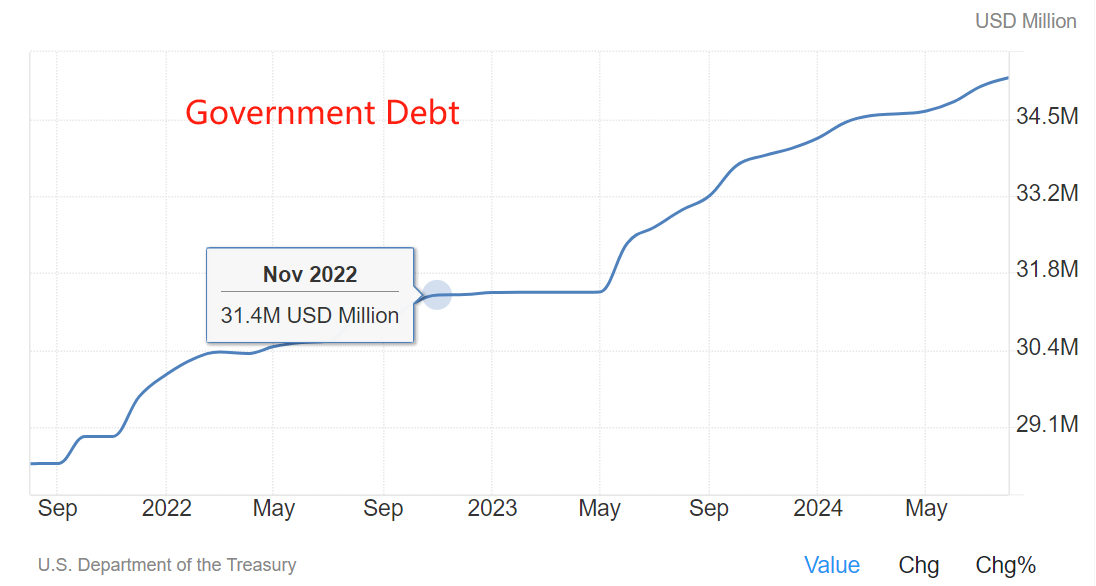

Thirdly, the impact of "fiscal policy" cannot be ignored. August fiscal deficit increased to 380.1 billion U.S. dollars, compared with the same period last year increased 469.3 billion U.S. dollars, 1-August cumulative fiscal deficit has reached 1.39 trillion U.S. dollars, an increase of 25%.Therefore, this year is an expansionary fiscal policy, coupled with the current interest rate cuts, that is, fiscal policy and monetary policy "double stimulus".If the supply side does not show some improvement, then the rebound in demand does not rule out pushing up inflation again.

The impact on the U.S. equity sector is multiple and cannot be explained simply by "Sell the fact".

Judging from the market's reaction , not rushing to do more did have an effect, explaining the decline in safe-haven assets $Utilities Select Sector SPDR Fund(XLU)$ , but the economic "recessionary" pressures have not yet fully convinced the market.But economic "recessionary" pressures haven't fully convinced markets, explaining a similar pullback in risk assets. $Technology Select Sector SPDR Fund(XLK)$ .

$NASDAQ(.IXIC)$ $SPDR S&P 500 ETF Trust(SPY)$ $iShares 20+ Year Treasury Bond ETF(TLT)$ $Cboe Volatility Index(VIX)$ $S&P 500(.SPX)$

Comments