ASML pre-announced disappointing Q3 results, with orders down 50%, sending semiconductor stocks tumbling. However, ASML's CEO noted: "Other end markets will take longer to recover, while AI continues to show strong development and upside potential."

Nvidia dropped 5%, which is fairly contained considering the recent run-up. The key upcoming catalyst is Taiwan Semi's earnings guidance on the 17th.

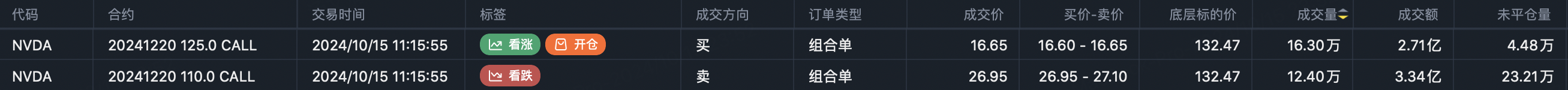

In a surprise move ahead of earnings, the "Million Dollar Man" decided to roll his position higher, keeping the same December expiry but rolling the $110 calls ($NVDA 20241220 110.0 CALL$ ) up to the $125 strikes ($NVDA 20241220 125.0 CALL$ ).

The new position size increased to 163,000 contracts for $271 million in premium, below the prior notional.

The good news is continued bullishness into earnings, targeting $140. The bad news is that rollups from this trader have tended to precede some consolidation in the stock.

A reasonable downside target to expect would be around $115. But no need to panic - stay the course with your positioning. Today's dip for instance presents attractive put sale opportunities like the $NVDA 20241025 120.0 PUT$ .

There's a bull market joke about the bulls and bears crossing paths, trading insults as they pass each other by. Well, that became reality this week with $Pinduoduo (PDD)$.

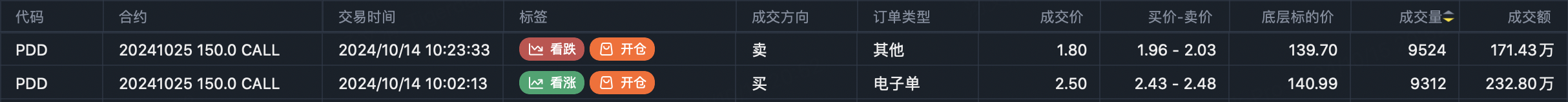

On Monday, we saw large and offsetting flows in the $PDD 20241025 150.0 CALL$ :

Around 10am, a buyer emerged for 9,312 contracts, bullish for PDD to close above $150 this week.

Around 10:20am, a seller unloaded 9,524 contracts, bearish for PDD to stay below $150 into weekly expiry.

At first glance, I thought it could be the same trader buying then closing. But looking at the new open interest created that day of over 20,000 contracts, it's clearly two separate positioning flows targeting that $150 strike from opposite sides.

As the chart shows, $150 sits just above the gap area, with one camp betting on a gap fill and the other against it happening this week. Based on current price action, the sellers appear to be winning out.

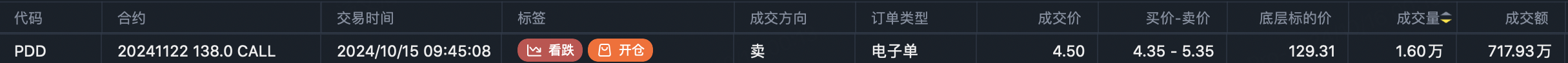

Capping the week, we saw a massive sell flow tonight in the $PDD 20241122 138.0 CALL$ - over 16,000 contracts hitting the bid in outright call sales.

It makes sense to see some near-term frothiness getting cleared out, lest the entire nation gets caught in a momentum trap if the A-share frenzy continues at the recent pace. Overall, sentiment in Chinese equities remains quite heated from both bulls and bears - time to turn our focus back to the US earnings cycle and semi bellwether results.

Financials have enjoyed a solid run but are due for some pullback. We're seeing an institutional put spread buyer in $XLF$, buying the $46 puts while selling the $44.5 puts as a downside hedge:

Buy $XLF 20241101 46.0 PUT$

Sell $XLF 20241101 44.5 PUT$

Nothing too extreme, just some expected mean reversion to moving averages after the recent strength.

Comments

Great article, would you like to share it?