This week, all of the large U.S. consolidated banks have finished reporting Q3 earnings, and their performance continues to show differentiation and may be significantly divergent within the same business. $SPDR S&P Bank ETF(KBE)$ $Financial Select Sector SPDR Fund(XLF)$ $SPDR S&P 500 ETF Trust(SPY)$ $.DJI(.DJI)$

Key features

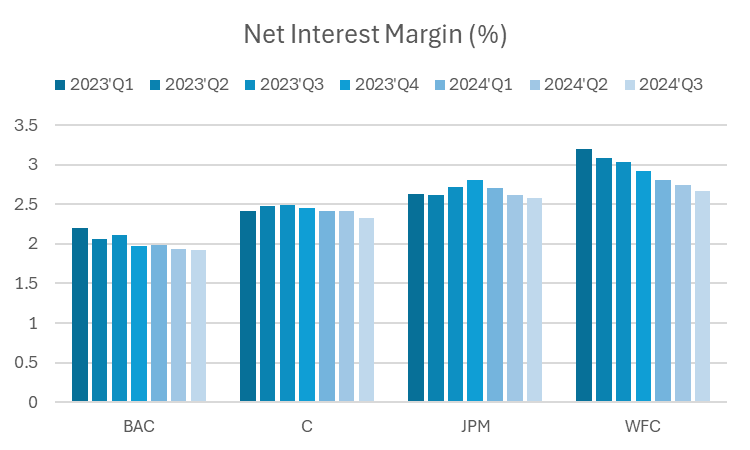

Net interest business was mixed in a lower interest rate environment;

The investment banking business continued to recover and the wealth management division continued its record business;

Diversification factors became a major advantage for large banks;

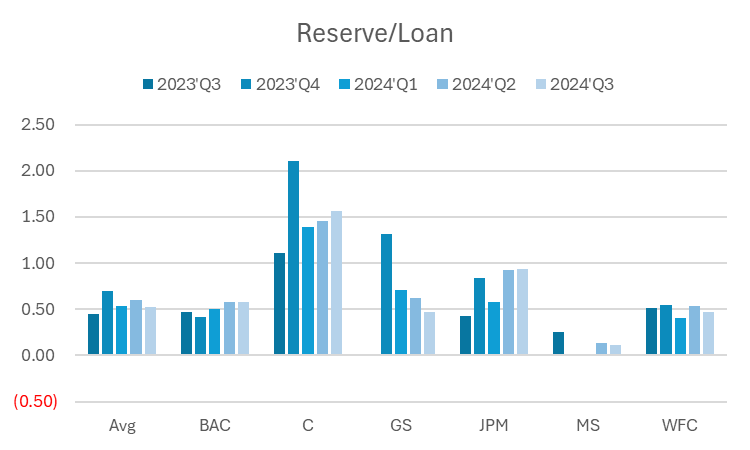

More funds set aside for potential credit losses

Several of the major integrated banks have outperformed expectations in both revenue and profit in the just-passed Q3, and have led the entire sector to new highs. $JPMorgan Chase(JPM)$ $Citigroup(C)$ $Goldman Sachs(GS)$ $Morgan Stanley(MS)$ $Wells Fargo(WFC)$ $Bank of America(BAC)$

How do rate cuts affect bank interest income?

Overall net interest margins are still trending down, though different banks may have different results.For example, JPMorgan Chase's net interest income rose 3% year-over-year to $23.5 billion, while Wells Fargo's net interest income was down 11% at $11.7 billion, and WFC, of course, was off a higher base in Q3 last year.Previously, with higher interest rate levels, banks had to spend more to cushion themselves, depressing spreads overall.But now that the Fed has started to cut rates, the cost of this component has come down.But overall, spreads are expected to decrease further in Q4, with pressure remaining on banks.

Asset Management Business Becomes Contributor, Again

Goldman Sachs' asset and wealth management revenue was $3.8 billion, accounting for more than a quarter of the firm's revenue.The asset and wealth management division is clearly benefiting from the rise in U.S. equities and the recovery in U.S. debt from interest rate cuts.

Bank of America's asset management revenues were up 14% year-over-year, Citi's investment banking revenues were up 31%, and JPMorgan Chase's investment banking revenues were up 31%.Wells Fargo's noninterest income rose 12 percent.

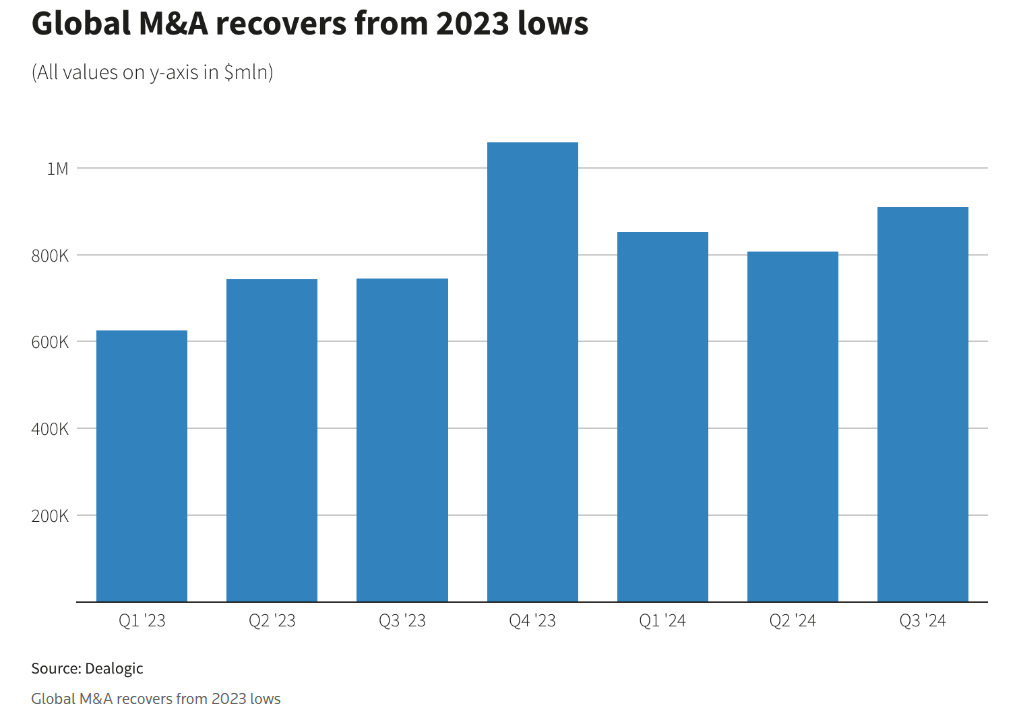

Investment Banking Recovery

Meanwhile, investment banking revenues are up, typified by Goldman Sachs and Morgan Stanley, who both greatly exceeded expectations, with Goldman Sachs investment banking fees up 20% year-on-year on the back of more deals and corporate bond issuance and optimistic expectations for the year ahead.Interest rate cuts by the Federal Reserve and other central banks in the coming months will drive an increase in the deal pipeline amid lower borrowing costs.

On the other hand, a buoyant stock market and increased expectations of a soft landing for the U.S. economy have boosted deal aggregators' confidence.On the other hand, however, there was a lack of M&A activity by large companies, with regulatory scrutiny being the main reason.In addition, new equity and bond issues are gaining momentum.

On the trading side of the business, it was a mixed bag, with equity trading boosted by bullish equity markets, while fixed income, currencies and commodities (FICC) trading lagged at times.

Banks generally set aside more funds for potential credit losses

JPMorgan Chase provided $3.1 billion to cover potential credit losses, more than double the amount provided a year ago.Citigroup provided $315 million, up from $125 million a year ago.Goldman Sachs provided $397 million, up from $7 million a year ago.Only Wells Fargo reduced its provision for credit losses, but its overall deposit and loan amounts also fell.

Geopolitical risks that cannot be avoided

Some bankers believe that while inflation in the U.S. is declining and the economy remains resilient, political uncertainty remains and has even worsened.Issues including the national debt, infrastructure needs, and military spending threaten to make the current situation even more dangerous.

By the numbers.

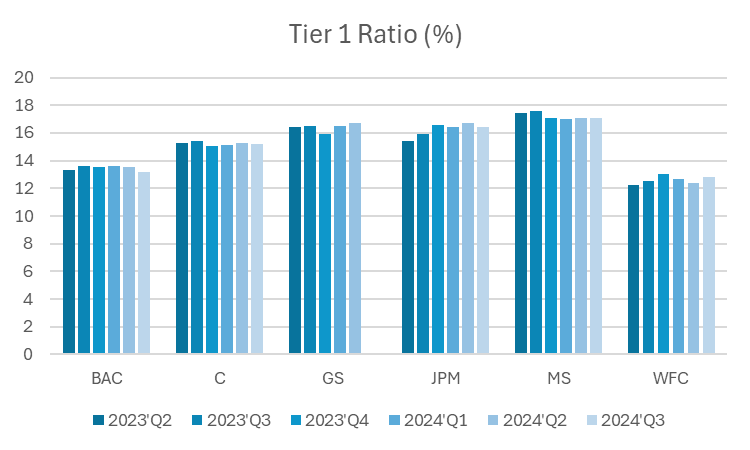

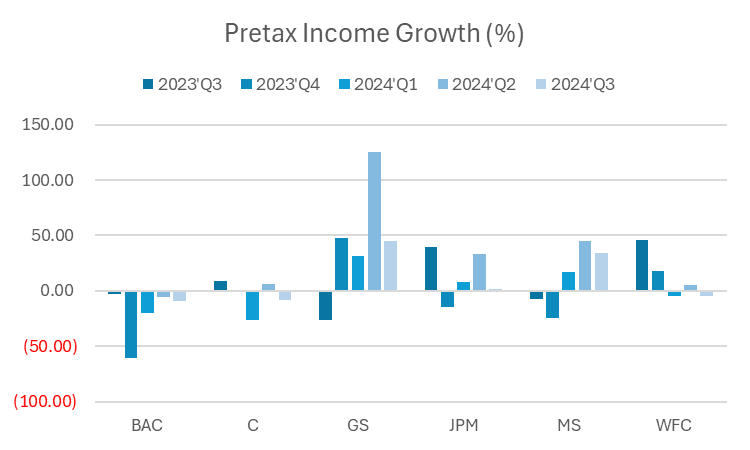

In terms of pre-tax profit growth, $Morgan Stanley (MS)$ $Goldman Sachs (GS)$, which has a higher share of trading business, investment banking, and asset management, fared better, with interest income generally still declining.

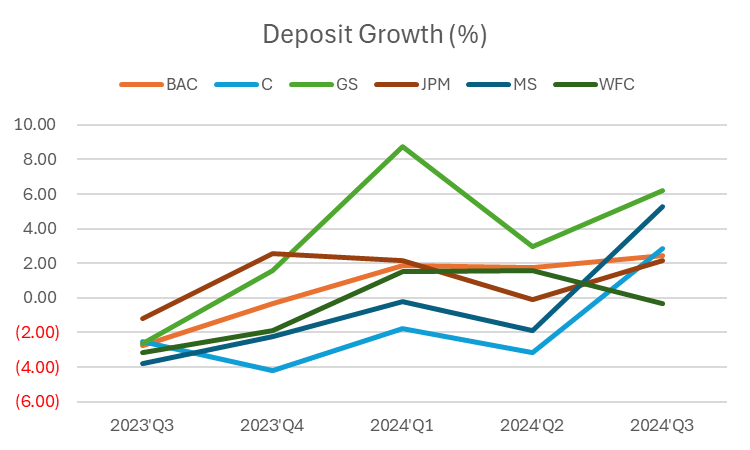

In terms of deposit growth, it is also Goldman Sachs and Morgan Stanley that are the most attractive.

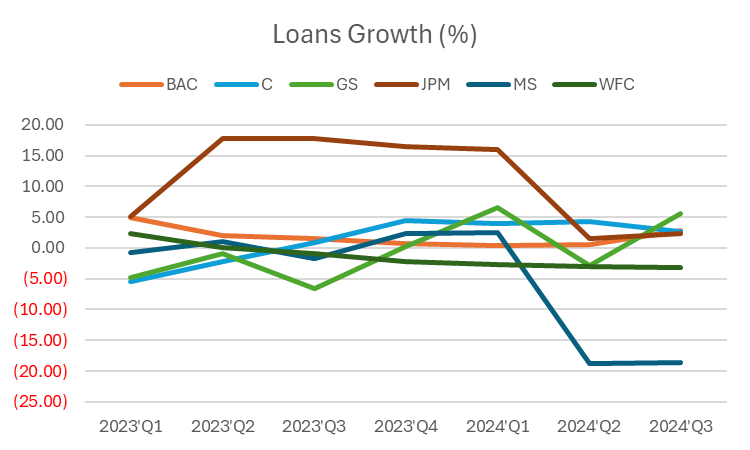

In terms of loan growth rate, Goldman Sachs has the fastest performing growth rate, while MS has a significant decline in loan balances.

Comments