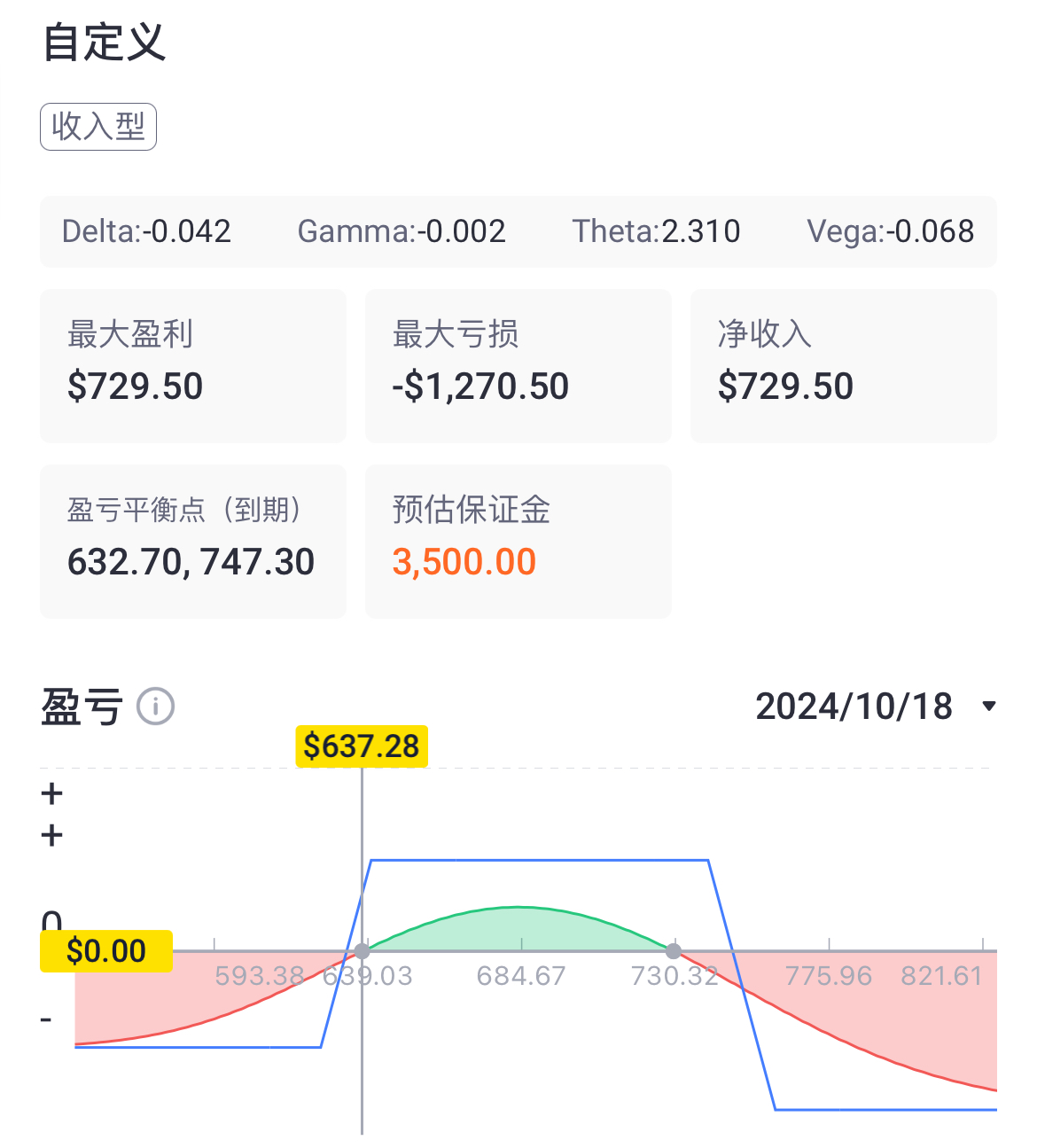

$Netflix(NFLX)$ Q3 earnings report, strategy for the quarter: short-biased "short volatility strategy"

In terms of volatility, choose an asymmetric condor with a bias towards SHORT volatility; and

Be bullish on earnings, but keep a short mindset.

Explain the reasoning:

I'm actually not down on NFLX's earnings, instead it should beat expectations, especially since the ad business was just getting off the ground in Q3 last year, the base should be very low, and now it may be able to eat a wave of growth benefits.Again, because of the crackdown on shared accounts, the number of subscribers will probably continue to grow, and ARPU will also be not weak because of the advertising business.

The call may also announce information about Squid Game 2 and price increases, which will continue to be good for the next two quarters.

But good results don't equal a "stock price surge," as is all too common in earnings season trading.The key is how it "compares to investor expectations".

My concern:

The above positives were basically taken into account by investors in the past quarter, in other words the stock can now go up 700, it has Price-in quite a bit; unless the earnings data really greatly exceeds expectations, it will be difficult to drive a big rally

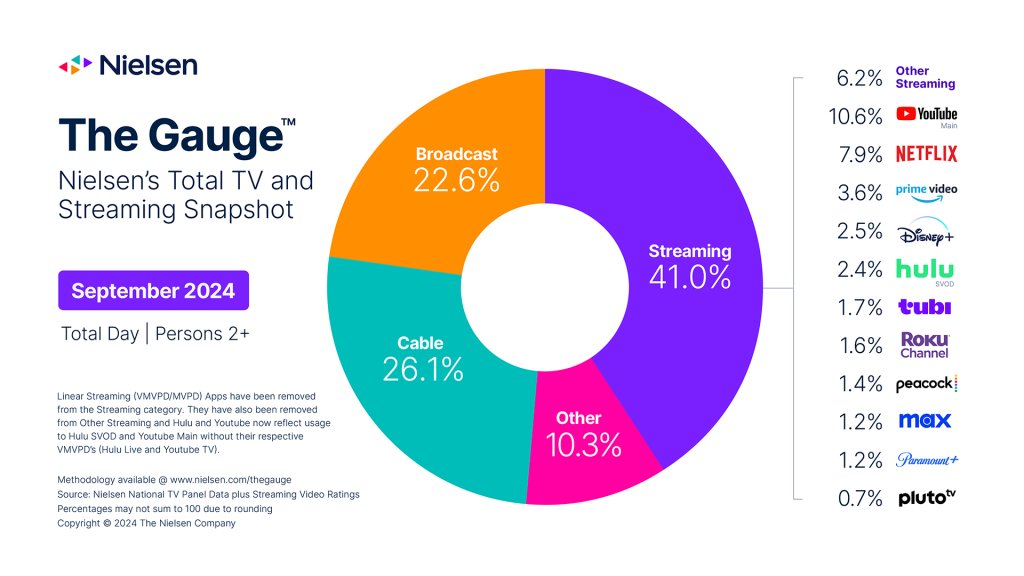

Something to think about in terms of subscriber viewing hours (from Nielsen's survey): 7.9% market share is a level that Netflix has largely managed to hold on to, but it's not as marked an improvement as YouTube, and it's looking like it's struggling in the Shorts' clutches.Also not pulling away from Disney+ $Disney(DIS)$.

On the flip side, as much as people may be expecting good news from Netflix, it's often the expectation of too much that makes more people close a day or two after earnings.

Keep in mind: individual stock options are all priced at Friday's closing price, not some instantaneous price after earnings.

Option IVs for the 10.18 expiration are currently at 127, and 67 for the 10.25, compared to the usual less than 50.If you look at doomsday options, a post-earnings IV crush could be extremely damaging to option prices.

Therefore, the following "asymmetric" short IV strategy was chosen

Sell 640P Buy 625P

Sell 740C Buy 760C

Overshooting is a bigger loss than undershooting (because of the bearishness) and the overall balance is at 631/753.

Sell 610P Buy 580P

Sell 770C Buy 800C

Happy Trading!

Comments