$ServiceNow(NOW)$ 24Q3 results were strong and continue to reflect the company's continued growth in digital transformation and enterprise services.Shares are slightly lower after hours and are still near new highs.

Overall results overview

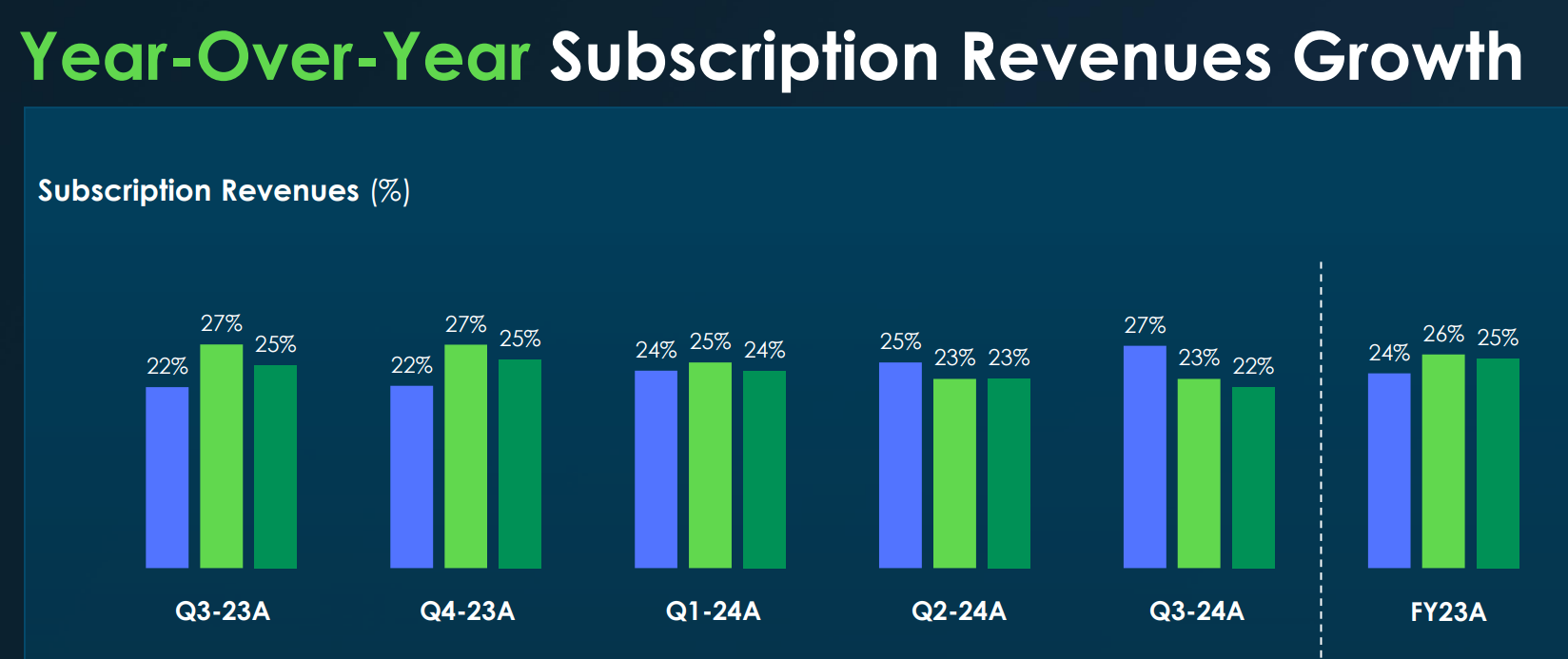

Revenue growth: Q3 total revenue reached approximately US$2,797 million, an increase of 23 per cent year-on-year, and exceeded expectations2 mainly due to increased customer demand and new product launches.

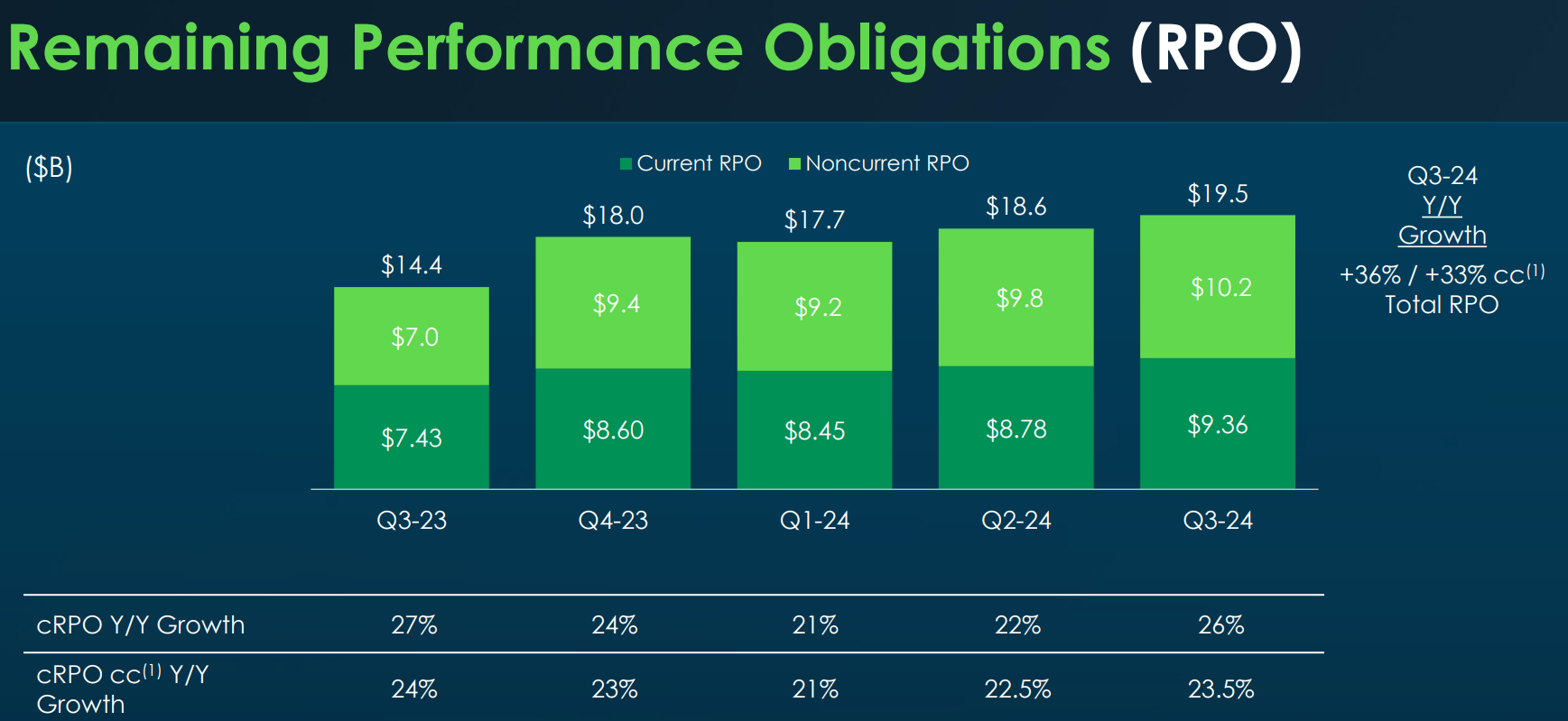

Current Remaining Performance Obligations (RPOs) were $9.36 billion, up 26% year-on-year and ahead of expectations of $9.12 billion, while Total Remaining Performance Obligations (TREOs) were $19.5 billion, up 36% year-on-year and 33% on a constant currency basis, and ahead of market expectations of $18.4 billion.

Profit: Q3 net income was $320 million, up 30% from the same period last year, as the company excelled in controlling costs while improving operational efficiencies; non-GAAP EPS was $1.80, exceeding market expectations of $1.75.

Business Segment Analysis

Cloud computing services revenue grew 28 per cent year-on-year, reflecting the continued rise in demand for cloud solutions in the enterprise.

IT service management revenue grew by 22 per cent.The market demand for ITSM is expanding as organisations increasingly rely on digital tools to manage IT processes.

Revenue from human resource management solutions grew by 20 per cent year-on-year, with companies introducing new features and integration options that are attracting more customers, particularly in the areas of remote working and employee experience management.

Revenue growth in customer service management reached 24 per cent, with significant potential for growth in this area as companies look to optimise the customer experience to increase customer loyalty.'

Future Guidance.

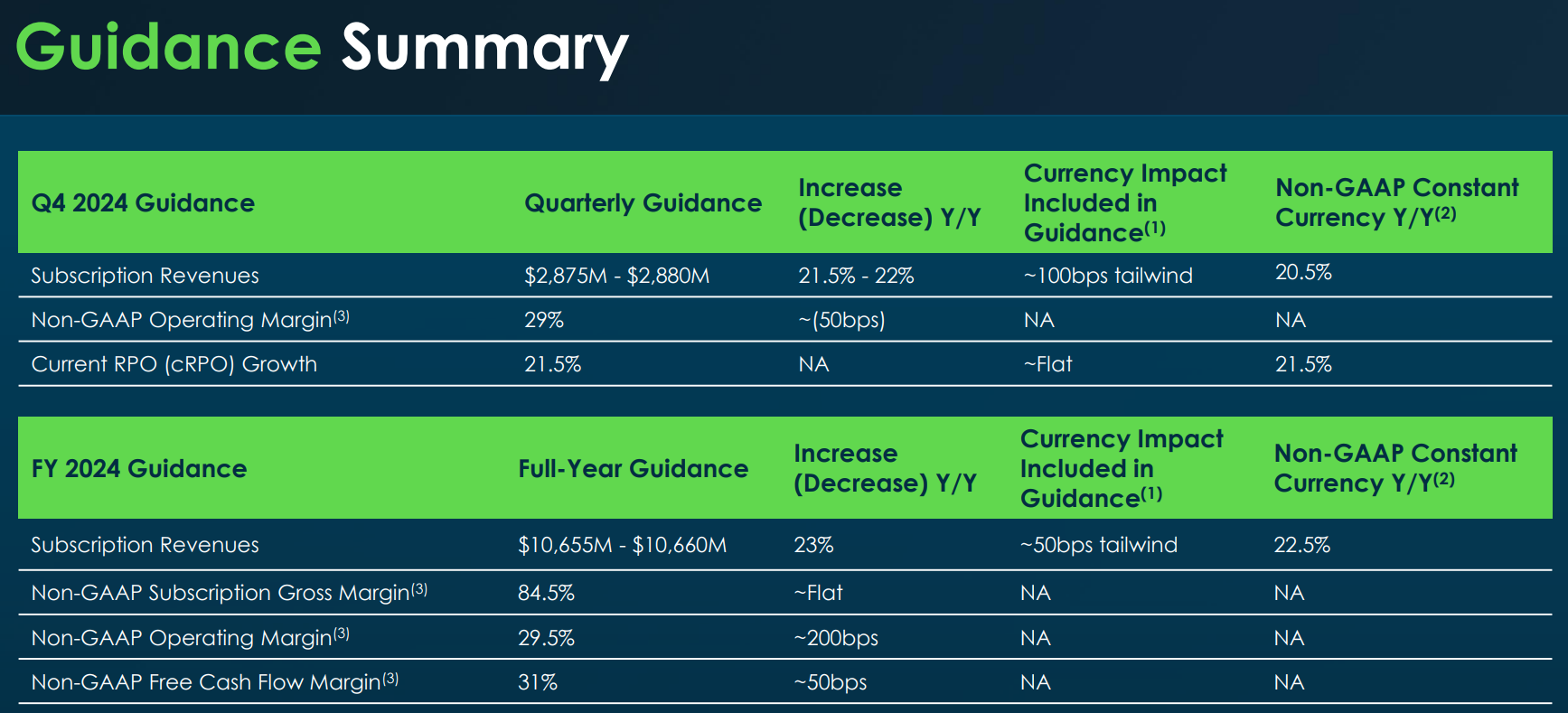

The Company expects subscription revenues to be in the range of $2,660 million to $2,665 million in Q4 2024, representing year-over-year growth of 20 per cent to 20.5 per cent.12 This growth is primarily driven by the addition of new customers and the expansion of existing customers.

The company expects current RPO to grow 22.5 per cent year-on-year in the fourth quarter, with strong customer demand and future revenue sustainability.Meanwhile, operating margins are expected to improve to 29.5 per cent.

LONG-TERM STRATEGY: ServiceNow plans to continue investing in artificial intelligence and automation technologies to enhance its product portfolio and improve customer satisfaction.The company will also focus on expanding internationally to achieve broader customer coverage.

Investment Highlights

Innovation

Generative Artificial Intelligence (GenAI)

ServiceNow has launched its Generative AI capabilities, designed to enhance the user experience through features such as content generation, summarisation and personalised responses.These capabilities can be applied across multiple modules such as IT Service Management, Customer Service Management and Knowledge Management.

New features for application development

New GenAI features have been added to make application development more efficient, including Service Catalogue Item Generation, Application Generation and Operation Manual Generation.These tools significantly reduce the time required to build new applications.

Now Assist Integration

ServiceNow's integration with Microsoft Copilot allows users to seamlessly use generative AI in their workflows.This integration helps employees complete tasks quickly and increase productivity.

Innovation Management Platform

ServiceNow has launched an innovation management tool that allows organisations to collect and manage ideas, facilitates cross-departmental collaboration and rapid decision-making, thereby motivating employees to engage in the innovation process.

Newly opened Innovation Centre

The innovation centre opening in Singapore provides a digital incubation platform for companies to simulate and test digital strategies, including generative AI and low-code applications.The centre will also offer training sessions with academics, customers and partners to boost the digital skills of local talent.

Partnerships

Strategic Partnership with Microsoft

ServiceNow has a strong partnership with $Microsoft(MSFT)$ to drive the adoption of generative AI.This partnership enables users to leverage Microsoft Azure resources on the ServiceNow platform, enhancing interoperability between the two3.

Academic Collaboration

ServiceNow has signed an academic partnership agreement with NTUC LearningHub Singapore, committing to train more than 1,000 local residents in digital skills by 2024.This is in line with Singapore's "Smart Nation" programme, which aims to enhance the employability of its citizens56.

Industry Partnerships

ServiceNow has partnered with a number of industry-leading companies such as $Accenture PLC(ACN)$ $Fujitsu Ltd.(FJTSY)$ and others to drive digital transformation and provide better services to customers.These partnerships not only facilitate technology sharing, but also enhance market competitiveness.

In addition, ServiceNow expanded its partnership with $NVIDIA Corp(NVDA)$ and Databricks to drive enterprise adoption of Agentic AI, and announced other collaborations with Snowflake (SNOW) and...

Comments