$Tesla (TSLA)$ Waking up to see the stock price today left me dumbfounded - I thought we were targeting $260 for next week? How did it get there in a single day?

No issue being wrong on my prediction, ramps like this are music to bullish ears. I mainly feel for the funds who sold those $262.5 calls as part of a covered call position and got blown through. Based on Thursday's trend, it seems highly unlikely Tesla stays below $262 next week.

To be fair, the $262.5 strike wasn't an unreasonable one for institutions to sell - it represented a major long-term resistance level. Even if tagged, a pullback was likely to ensue eventually.

But Musk hasn't been playing by conventional rules lately. $260 was the target? He just mashed the accelerator and blew right past it in a day. That throws timing any potential retracement into greater uncertainty. The current landscape certainly favors being long over short.

The main focus today is resetting Tesla's expected Q4 trading range based on the updated options flows.

Taking Nvidia as an example, we've clearly seen its trading range migrate higher this year from $85 to $110. For Tesla, the range has been less obvious, but Q3 centered around $220 (range of $200-$240). Q4 looks to have shifted that midpoint up to $240, implying a new $220-$260 trading range.

First, let's review the institutional positioning changes post-earnings:

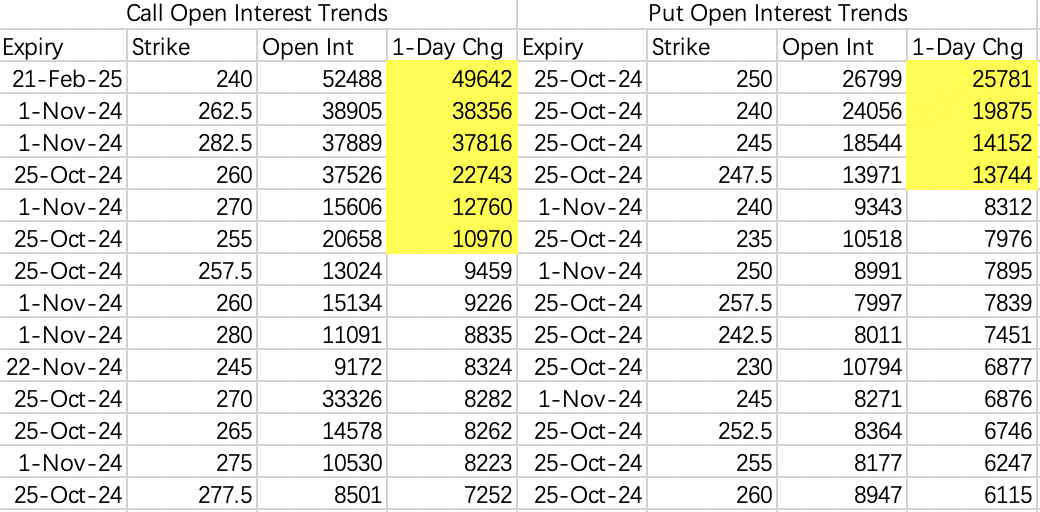

On the put side, most new opening interest is for the front weekly expiration, signaling no major bearish bets for the longer-term.

Two sizeable bullish trades did extend out to 2025 expirations, in addition to the typical covered call rolls.

Those covered call rolls, as mentioned in yesterday's post, involve institutions selling upside calls or call spreads each week based on where they expect shares to top out. Since the residual open interest often acts as an technical resistance level, my put sales tend to focus on covering the highest strike sold as part of those covered call trades as a hedge.

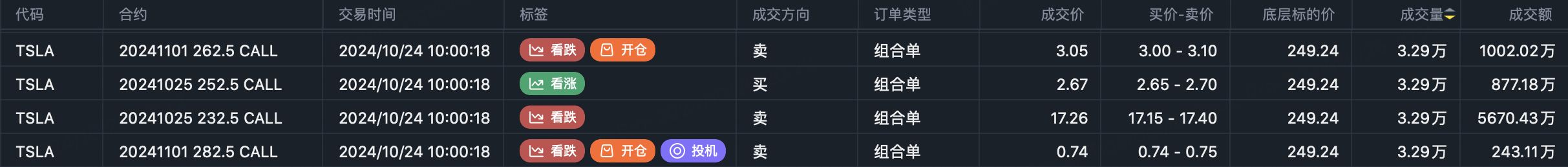

For next week, dealers rolled their $262.5 short call strike higher, buying the $282.5 calls against it. This implies an expected trading range with $262.5 as the upside cap, but with protection in place up to $282.5.:

Sell $TSLA 20241101 262.5 CALL$

Buy $TSLA 20241101 282.5 CALL$ (Hedge)

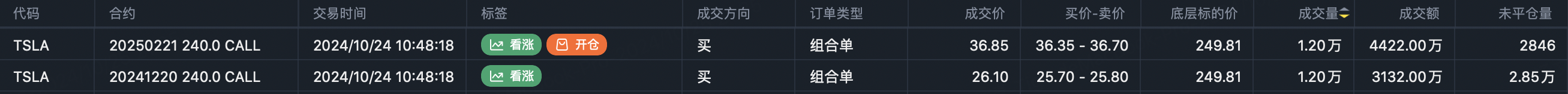

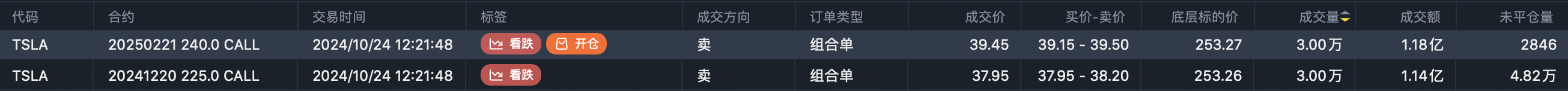

Then we have the two sizable bullish call rolls out to 2025 expirations, both targeting the $240 strike:

Roll from $TSLA 20241220 240.0 CALL$ to $TSLA 20250221 240.0 CALL$ with 12,000 contracts

Roll from $TSLA 20241220 225.0 CALL$ to $TSLA 20250221 240.0 CALL$ with 30,000 contracts

The first trader was seemingly basing their Q3 trading range on $240 as the midpoint. The second was valuing shares at a $225 midpoint for Q3, which in hindsight proved more accurate.

But both are converging towards $240 as the expected midpoint for the Q4 trading range.

Laying out this $220-$260 trading range expectation helps frame optimal strikes for premium selling against long stock positions over the coming months.

Compared to Q3's $200-$240 range, $240 can no longer be considered an aggressive strike for put sales to re-establish longs. The mindset needs to adjust higher to this new range.

Next week brings Big Tech earnings, the October nonfarm payrolls on 11/4, midterm elections on 11/8, and an FOMC meeting that same week. With such a cluster of pivotal events, the extended upside call pricing could reflect optimism on upcoming figures. But it's hard to dismiss the notion of benefiting the incumbent party ahead of elections as well.

Once past midterms, regardless of outcome, the market trajectory becomes less politically-driven.

After putting this together, I looked at Tesla's price action - it's clearly ending the week above $260. This points to an increased probability of a push towards $280 next week.

Comments