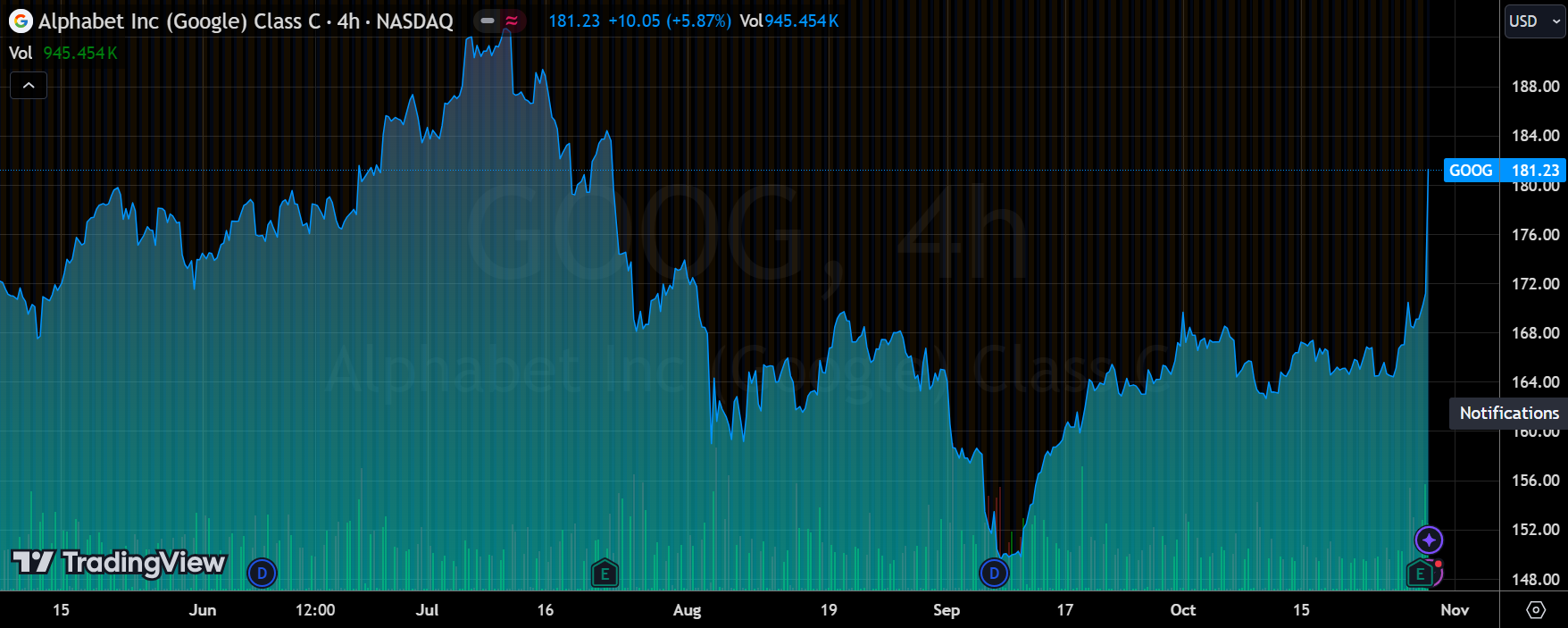

This week's earnings season hit the headlines, as the first big tech company to announce Q3 results, the details of the performance of a large extent can bring guidance to other companies.After the announcement of Q3 earnings after the market on October 29th jumped more than 5%, changing the Q2 part of the less-than-expected after the decadence. $Alphabet(GOOG)$ $Alphabet(GOOGL)$

However, capital expenditures remain high, two pending lawsuits over search as well as advertising, and previous market concerns about the long-term impact of AI search on traditional search continue to be issues that also prevent Google from achieving a higher valuation.

Investment highlights

The strong performance of the search business came partly from lower market expectations, but more importantly from the strength of economic activity and the company's own efficiency.As a result, this Google Service result was +12.5% year-on-year, beating expectations by 1.7%.

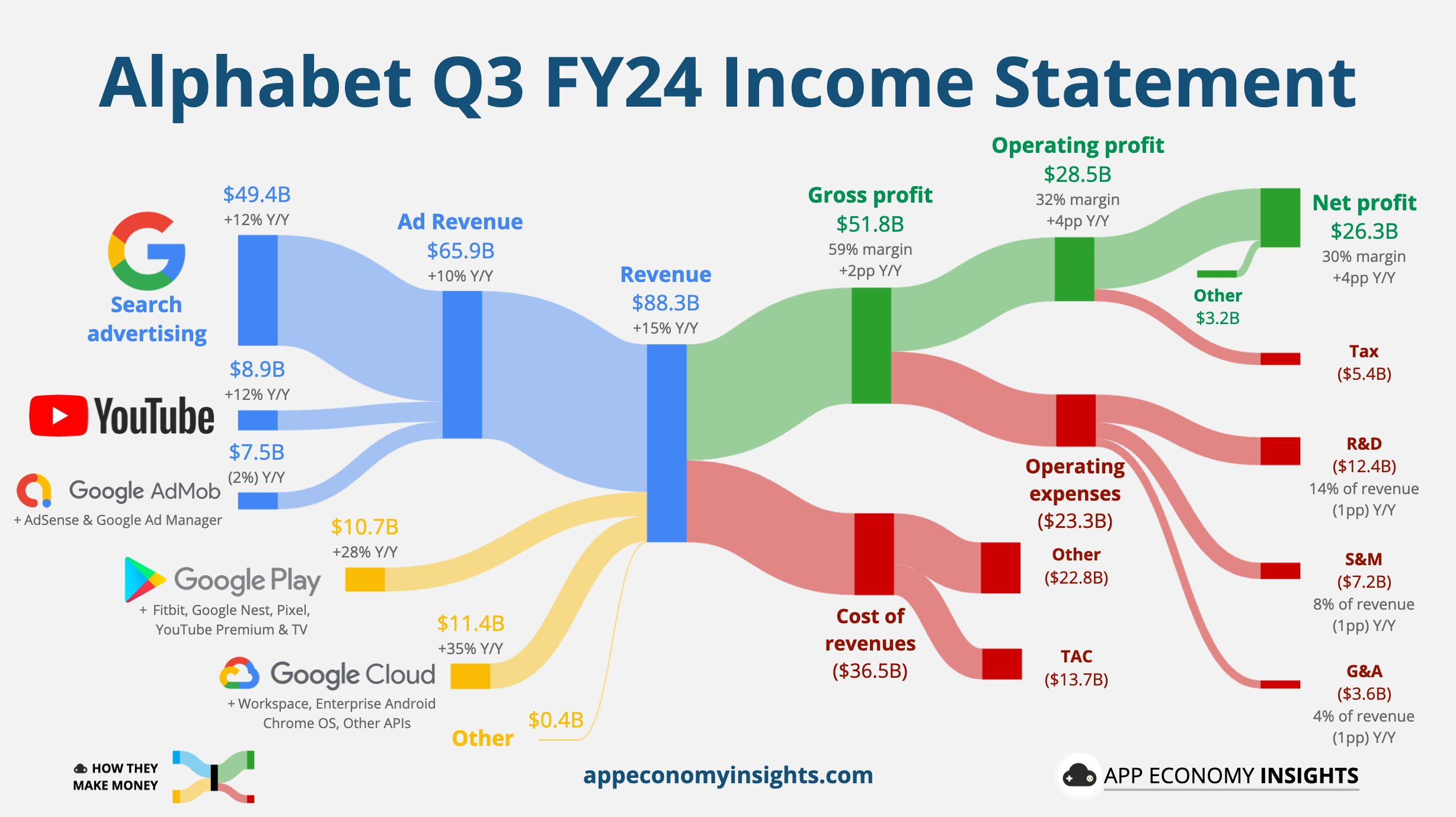

Advertising services overall revenue of $65.8 billion, +10.4% year-on-year, slightly exceeding expectations of $65.5 billion, of which Q3 many analysts lowered their expectations, of which $49.4 billion in search business, year-on-year growth rate of +12.2%, also slightly exceeding expectations of $49.1 billion.Short-term search business by the impact of AI search is not reflected.

Previously, the market believed that consumption started to slow down in Q2 and therefore also lowered expectations, but as economic activity proved to continue to be buoyant and SMEs became more active as a result of the interest rate cuts, the ad spending dynamics remained intact, and Q3 saw growth in search revenues partly benefiting from areas such as financial services.

Performance Max ads have also gained traction with advertisers after incorporating AI tools that utilize machine learning to enable smart bidding and ad placement to improve conversion rates.Advertisers don't need to manually adjust their bids, and the system automatically chooses the most appropriate time and location to display ads, thus improving ROI

The worrying thing about Q2 was YouTube's earnings growth, which also beat expectations after Q3 expectations were lowered, with overall revenue reaching $8.9 billion, +12.2% year-on-year, which is of course arguably a solid growth rate, driven by increased political ad spending in an election year, ad spending in an Olympic year, and incremental cross-border e-commerce.

Q3 Traditional media, streaming, and short-form video site content made a comeback, but according to Nielsen's survey, the market for YouTube's subscriber usage has not declined, suggesting that the stickiness of the YouTube community, especially as driven by Shorts, remains high.

However, there is also some internal competition between YouTube's own CTV and Shorts, the value of the full platform while the CTV ads are highly competitive, and future investment in this area still needs to be observed to see the activity of the main advertisers: cross-border e-commerce, small and medium-sized enterprises, and so on.

Cloud business greatly exceeded expectations, with overall revenue reaching $11.35 billion, +35% year-on-year, compared to the market's expected growth rate of 28%.This shows that cloud services driven by AI remain robust.In terms of squeezing contracts, the overall trend remains positive.

Because $Amazon.com(AMZN)$ 's AWS and $Microsoft(MSFT)$ 's Azure haven't yet reported results to allow for visual comparisons, there is limited additive value on this piece at this point.If either AWS or Azure underperforms, that adds even more gold to Google Cloud's growth.

Operating margins for cloud services improved in a big way to 17%, much more than the 11% expected, and also improved the company's overall margins considerably.

The biggest surprise came from the margin improvement.It also shows that management has put more effort into internal cost reduction and efficiency operations, resulting in an above-expectation increase in overall operating profit to 28.5bn, +34% YoY, with a margin of 32.3%.

This is consistent with the CFO's statement last quarter that he was also looking at cost management, but that the focus was on "optimizing resource allocation and improving model efficiency to control costs" rather than reducing investment.

Although the impact of depreciation and amortization due to the increase in capital expenditures increased, Q3 gross margin improved by a stable 0.4% quarter-over-quarter, while the growth rate of R&D expenses unexpectedly slowed down slightly, which is different from the market's previous expectation that "capital expenditures will also continue to remain at a new high".

Valuation and expectations

Expectations for Google Competition

Google was already lagging behind on the big AI models.

Changes in search consumer habits, AI search will definitely have an impact on traditional search in the long run

The two major existing lawsuits: the commercial search agreement (exclusivity) and Ad-tech's anticompetitive lawsuit, both of which are likely to come to fruition by the end of the year, don't look like materially favorable updates at this point.

Trump's election probably won't require a Google split, but Harris might.

Google Valuation Levels Lag the Index and Other Big Techs

Since Q2, Google's shares have lagged significantly behind other Big Tech companies, with the forward P/E ratio remaining at less than 20x, while $Meta Platforms, Inc.(META)$ remains above 26x.

In terms of shareholder returns, the huge $70 billion buyback at the beginning of the year has remained above $15 billion per quarter in recent quarters, which is #2 in the Mag7, and is considered very generous.On the other hand, it can also show that there are quite a few investors who are still worried about Google.

Comments