After the bell on October 29, $Reddit(RDDT)$ the parent company of wsb, the forum with the highest concentration of retail investors, released its Q3 financial report, and its overall performance exceeded market expectations, showing strong growth momentum.

Shares jumped 24% after hours to more than $102, and have risen more than 140% since this year's IPO.

Financial Overview

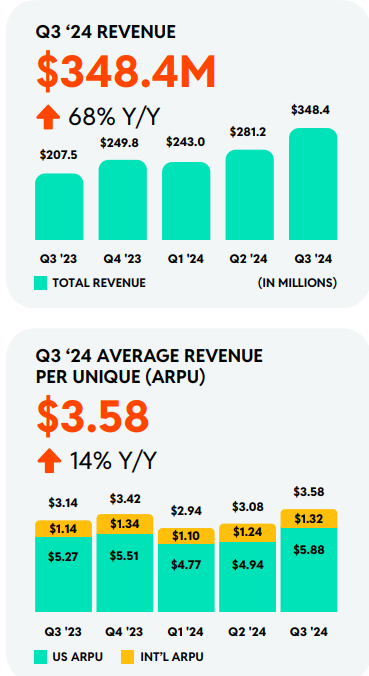

Revenue: Q3 sales increased 68% year-over-year to $348.4 million, well ahead of market expectations of $312.8 million.

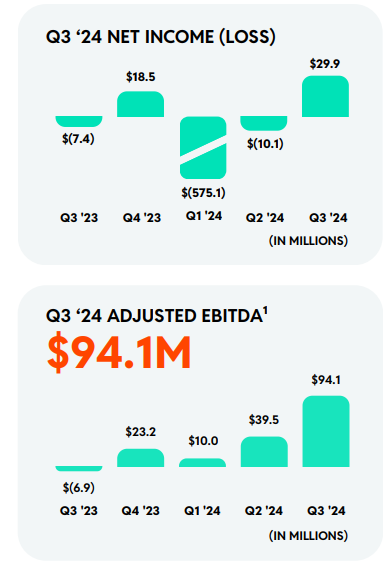

Profitability: Gross margin was 90.1%, up 280 basis points from the same period last year; adjusted EBITDA was $94.1 million, realizing the first profit in the company's history, compared to a loss of $6.9 million in the same period last year.

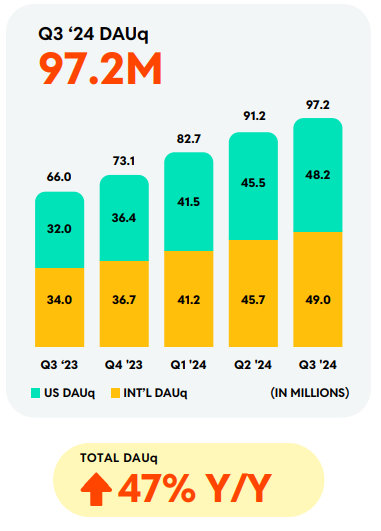

Operational Data: DAU increased from 66 million to 97.2 million, a significant increase in user activeness

Analysis of operational details

Advertising growth was driven by large company partnerships.Advertising revenue was $315 million, or 90.4% of total revenue, up 56% year-over-year.The growth was tied to partnerships with large tech companies, such as Alphabet and OpenAI, which also drove diversification of ad content. $Alphabet(GOOG)$ $Alphabet(GOOGL)$ $Microsoft(MSFT)$

CAPEX: Reddit was prudent in terms of capital expenditure, which was only $1.4 million, or 1% of total revenue, and the company took effective measures to control costs.

Future Guidance

Q4 revenue forecast: sales are expected to be in the range of $385 million to $400 million, well above analysts' expectations of $356 million.

On the profit side, adjusted EBITDA is expected to be in the range of $110 million to $125 million, higher than market expectations of $101 million.

Investment highlights

Q3 was a very strong performance, with triple growth in daily users, revenue, and margins, while the strength of Reddit's differentiated operating model was further demonstrated.Its key growth drivers include:

International expansion: localized content for different markets to attract more users

Product investments: product investments targeting user engagement and enhancing relationships with advertisers

Data license agreements: particularly with OpenAI and $Sprinklr, Inc.(CXM)$ , which will drive future revenue growth

Guidance increase also implies growth potential due to the company's strong user base and advertising business capabilities

With continued diversification and cost control, future profitability is expected to be further enhanced.Through technology investment and operational efficiency improvement, the company is able to effectively control costs and improve gross margins.

Focus

Sustainability of advertising revenues, particularly in light of heightened economic uncertainty.The Company has indicated that it is continuously optimizing its advertising products and enhancing its partnerships with advertisers, and expects to continue to attract additional advertising spend.

Still less than a year after its IPO, the company's liquidity remains limited at this time and could see post-release pressure in the future.

Comments