Leaning bullish into earnings, but uncertain if an initial gap higher will be sustained through Thursday's close.

Options are pricing a 4.4% earnings move, which has historically overstated MSFT's actual reaction. Favoring put sales around the $430 strike or lower seems optimal:

Sell $MSFT 20241115 430.0 PUT$

With volatility elevated, long calls run risk of decay accelerating into November opex. Puts may be preferred for capturing upside.

META presents the opposite scenario compared to MSFT, where the options may be underpricing the magnitude of the earnings move.

Current at-the-money straddle is pricing a 7.1% move. For buyers, strikes in the $530-$660 range appear neutral. Sellers could look to sell puts or calls out of that range.

The most straightforward META earnings trade tends to be after the event.

Historically, META has extended higher following a positive catalyst, or dipped briefly before resuming its uptrend after disappointments.

With TikTok unable to list and facing coordinated suppression efforts Meta remains the sole publicly-traded social media titan.

$Coinbase Global, Inc. (COIN)$ and $MicroStrategy Incorporated (MSTR)$

These crypto-linked equities are trading in-line with underlying Bitcoin. Based on flows, institutions appear bullish heading into results.

In COIN, there was a 35,000 contract roll up into the December $220 calls:

Buy $COIN 20241220 220.0 CALL$

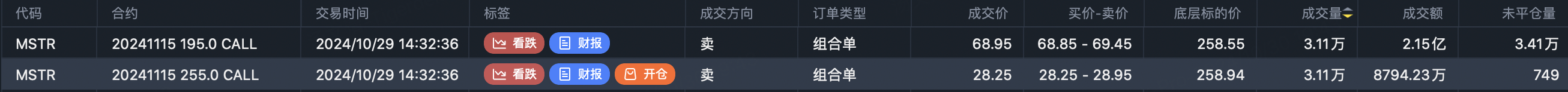

Similarly in MSTR, 31,100 November $255 calls were accumulated:

Buy $MSTR 20241115 255.0 CALL$

While flagged as put buying by exchange order types, reconstructing prior open interest adjustments indicates these were almost certainly call rolls higher in strike.

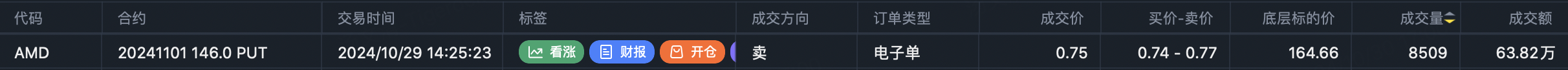

$Advanced Micro Devices (AMD)$

My $140 put sale looks conservative compared to dealer flow, where the heaviest put selling emerged in the $146 strikes for this event.

Friday and Monday's ominous 47,000 contract put buying in the front $42.5 strikes appears to have been an egregious case of front-running ahead of the disastrous earnings release:

Buy $SMCI 20241101 42.5 PUT$

Rough approximations suggest an 8x payout on those puts based on the gap lower at the open.

These purchases printed as sporadic, smaller-sized fills avoiding large order detection filters. Checking individual series open interest changes highlighted this highly suspicious activity.

While obviously hindsight, documenting such blatant abuse of material non-public information remains critical for future cross-references.

Comments