$Trump Media & Technology Group (DJT)$

Let me first express amazement at just how much money some people have to gamble with.

The U.S. presidential election results will be announced this Wednesday, November 6th. Whether Harris or Trump prevails will dictate the direction for DJT's stock price.

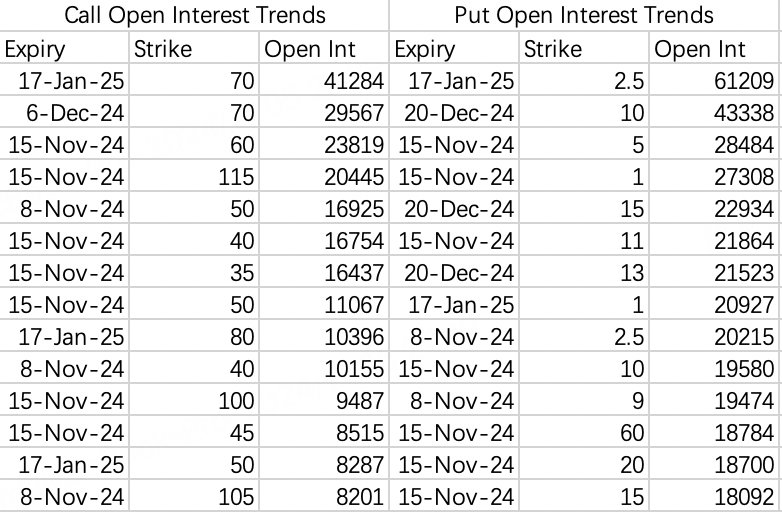

The open interest landscape across DJT options depicts starkly divergent expectations. On the call side, the highest open interest strike is the January 2025 $70 calls:

$DJT 20250117 70.0 CALL$

While on the put side, the highest open put strike is the $2.5 puts also expiring in January 2025:

$DJT 20250117 2.5 PUT$

Such a polarizing outlook for a single equity reflects its lack of fundamental underpinnings. As a pure concept play, the stock's trajectory hinges entirely on the election outcome. Conventional Wall Street wisdom even suggests DJT could sell-off if Trump wins, buying the rumor and selling the fact.

Regardless of whether DJT rallies or plunges, option implied volatilities are destined to collapse after the event risk resolves.

This week's $5 strike puts are pricing a mind-bending 937% volatility!

So reviewing that open interest backdrop, could institutions be actively shorting volatility given the obscene implied levels?

Logically, that would be the rational positioning. Yet the two largest open interest call strikes reveal a predominant buyer flow:

The December $70 calls saw new opening buyer positions emerge on Monday totaling over 27,700 contracts. Referencing time-and-sales data, the trading was overwhelmingly buyer-initiated, with over $96 million in premium paid on an average trade price of $3.50.

With implied volatility above 260%, these calls are guaranteed to expire worthless unless DJT stock price doubles.

The sporadic intraday order flow suggests these may have been issued by individual whales rather than institutional firms. But what specifically catalyzed the buying from 1pm ET onward yesterday?

A similar buyer flow also materialized on October 31st, when over 34,000 contracts were bought in the January 2025 $70 calls:

$DJT 20250117 70.0 CALL$

At an average trade price of $5.50, this represents nearly $187 million in premium paid with volatility at 188%.

DJT shares peaked just under $80 shortly after the Trump Media SPAC merger closed in March. For either of these call positions to expire profitably, the stock needs to immediately double tomorrow at the open.

Contrasting the unbridled call speculation, put flows carry a more calculated, defensive posture.

The sporadic out-of-the-money put strikes like $1 or $2.5 appear to be mostly retail-initiated, with relatively balanced buy/sell ratios.

One more institutional put trade did stand out - an unusual put spread initiated on October 28th and 29th:

Buy $DJT 20241220 15.0 PUT$ for 43,000 contracts

Sell $DJT 20241220 10.0 PUT$ for 33,000 contracts (1.5x ratio)

Whereas the calls reek of blind speculation despite the obscene volatility taxes, this put spread reflects a more fundamentally-grounded hedge implemented over multiple sessions.

My base case leans toward this put spread likely being an institutional market maker's position rather than an outright directional bet.

One final note on some intriguing Chinese equity option flows:

$JD.com (JD)$

With Chinese stocks bouncing, institutions have taken an interest in upside calls in JD while collaring exposure by shorting topside calls:

Buy $JD 20250221 41.0 CALL$ for 10,000 contracts

Sell $JD 20250117 65.0 CALL$ for 30,000 contracts

$iShares China Large-Cap ETF (FXI)$

Similar flows populated in the FXI China ETF, with upside calls bought and topside calls sold:

Buy $FXI 20241129 34.0 CALL$ for 25,000 contracts

Sell $FXI 20241129 37.0 CALL$ for 25,000 contracts

Comments

Great article, would you like to share it?