In the third quarter of 2024, $Ferrari NV(RACE)$ financial results showed results that fell short of market expectations, mainly in the following areas:

Financial performance overview

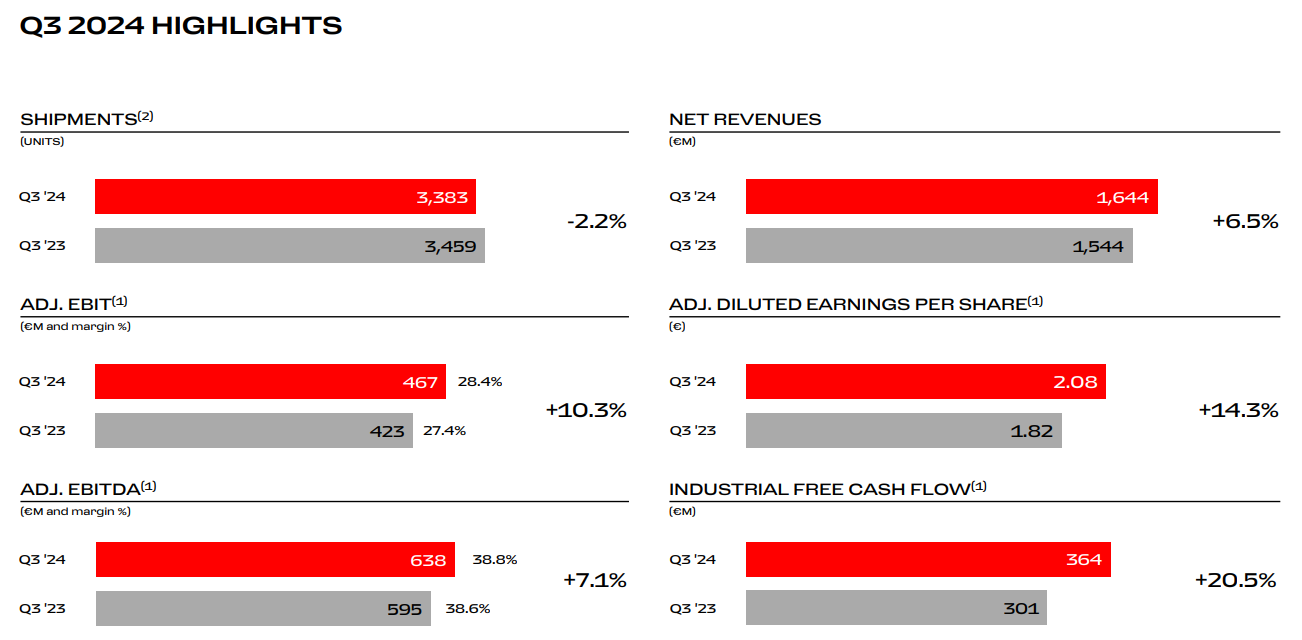

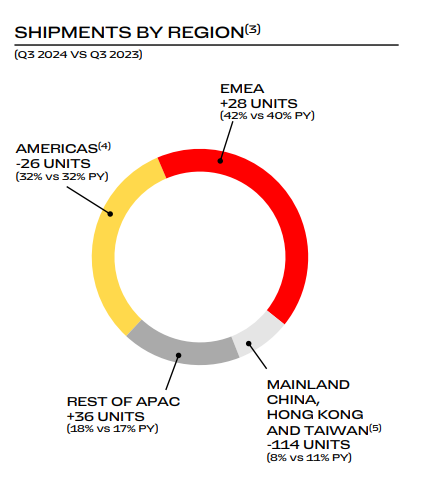

Deliveries: Q3 deliveries were 3,383 units, down 2.2% year-on-year and below market expectations of 3,469 units.Deliveries in EMEA were 1,426 units, up 2% year-on-year, compared with the market expectation of 1,486 units; deliveries in the Americas were 1,070 units, down 2.4% year-on-year, compared with the market expectation of 1,097 units; deliveries in China were 281 units, down 29% year-on-year, compared with the market expectation of 348.4 units; and deliveries in the rest of the Asia-Pacific region were 606 units, up6.3% against market expectations of 582.27 units.

Revenue: revenue was €1.64 billion, up 6.5% year-on-year, essentially unchanged from market expectations;

Profit: adjusted EBITDA of €638.0 million, up 7.2% year-on-year, compared to market expectations of €633.8 million; EBITDA margin of 28.4%, up from 27.4% a year ago, compared to 28% market expectations

Although Ferrari's premium segment remains somewhat attractive, the decline in overall sales had a negative impact on its financial performance.

Reasons for the weaker-than-expected performance

Weak market demand: Uncertainty in the global economy led to weaker demand in the luxury goods market, with consumers becoming more cautious about spending on higher-priced cars.

Production and Supply Chain Challenges: Ferrari faced a number of challenges in its production process, including insufficient supply of components, which directly impacted its production capacity and delivery times.

New model release delays: The launch of some new models has been delayed, which has impacted consumers' willingness to buy, especially in the premium segment where new models tend to stimulate demand.

Market Feedback

Ferrari's shares fell after the release of its earnings report as results fell short of expectations, reflecting investor concerns about the company's future growth prospects.Analysts expressed caution about the company's prospects, with many lowering their earnings estimates for Ferrari in the coming quarters.

In addition, the market is also cautious about the performance of the luxury goods industry as a whole, which could further impact Ferrari's share price performance.

Comments