$Zeta Global Holdings Corp.(ZETA)$ beat market expectations again in Q3 2024 and was volatile after hours, jumping 20% at one point before turning lower.The company's shares have risen about 303.4% since the beginning of the year, significantly outperforming $.SPX(.SPX)$ index

Financial Overview

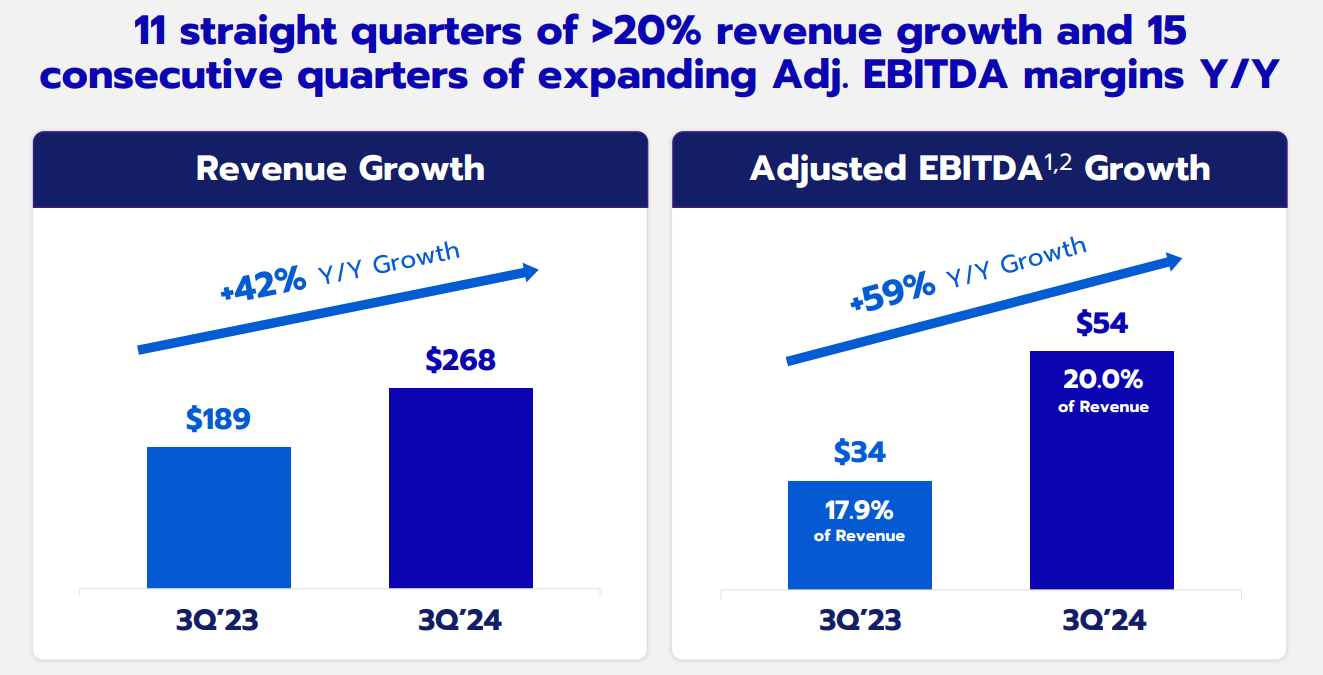

Revenue: total Q3 revenue was $268.3 million, up 42% year-over-year, and up 31% excluding political candidate revenue

Earnings per share (EPS): the company reported EPS of $0.16, slightly below market expectations of $0.17;

Adjusted EBITDA: Adjusted EBITDA was $53.6 million, an increase of 59% year-over-year, with an adjusted EBITDA margin of 20%, up from 17.9% a year ago[1][2].

Net Loss: GAAP net loss was $17.4 million, or 6% of revenue, an improvement from $43.1 million, or 23%, in the same period last year

Performance Analysis.

AI Technology Driven.The Company's investment and application of AI has enabled its marketing platform to gain a significant competitive advantage in the marketplace, and its innovations in the area of data-driven marketing have enabled it to offer more efficient solutions, thereby attracting more customers and driving customer demand.

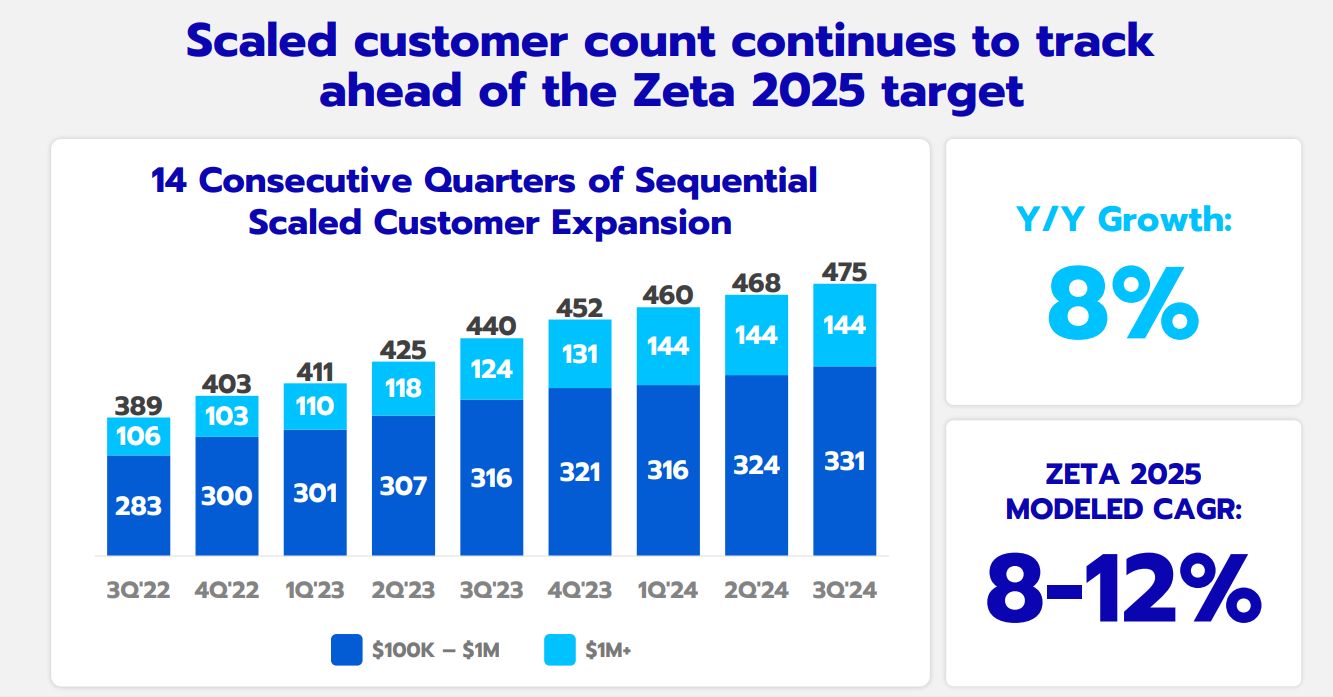

Expanded customer base: the number of customers increased to 475 as of Q3, with the number of super customers remaining stable at 144, resulting in a 41% year-over-year increase in direct platform revenues, which accounted for 70% of total revenues, demonstrating the strong performance of the Company's core business.

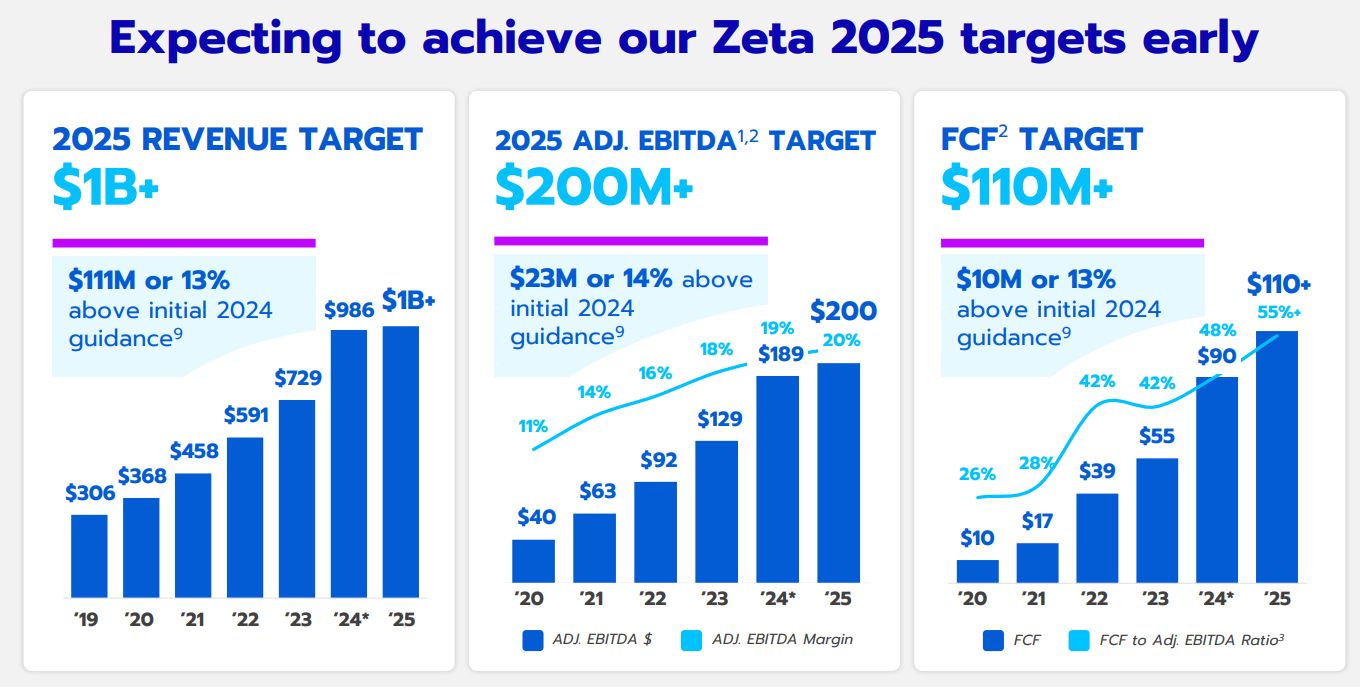

Costs and Margins.The Company has managed to control costs by optimizing operational efficiencies and investing in technology, and despite inflationary pressures, Zeta has managed to maintain a high Adjusted EBITDA margin (20%), which is expected to continue to improve in the coming quarters.

On Competition.The company is responding to competition through continuous innovation and improving the quality of its services.He noted that Zeta Global has unique data assets and technological capabilities, which provide it with a differentiating advantage.In addition, the company is actively seeking strategic partnerships to expand its market share.

About the Guidance.For Q4 2024, the company raised its revenue guidance to $293 million to $297 million, an increase of $32 million from the midpoint of its previous forecast, and expects to realize year-over-year growth of 39% to 41%.It also raised its adjusted EBITDA guidance to $64.9 million to $66.9 million.

Comments