$Cisco(CSCO)$ reported FY25 Q1 results after the U.S. stock market closed on Nov. 13, and while overall revenue was down year-over-year, it was still better than the market's expectations, driven primarily by AI demand.

However, optimism about order growth was less than market expectations, so the company's 2025 guidance was revised up in time, still slightly below market expectations.

CSCO was down 3% at one point after hours.

Earnings Overview.

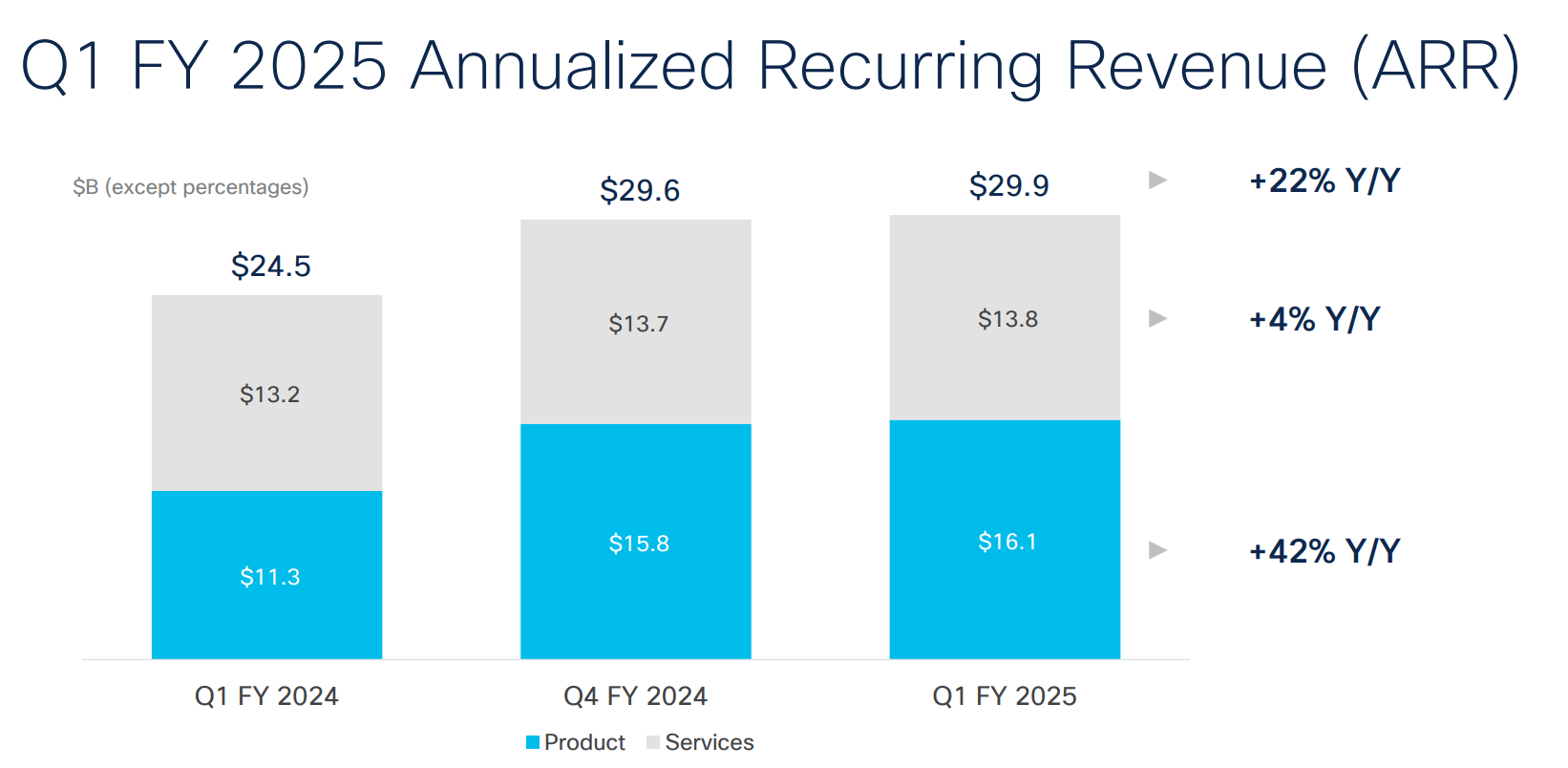

Revenue of $13.84 billion in Q1 of FY25 ended October 26 was down about 6% year-over-year, slightly above market expectations of $13.77 billion, but an improvement from the 10% decline in the previous quarter.

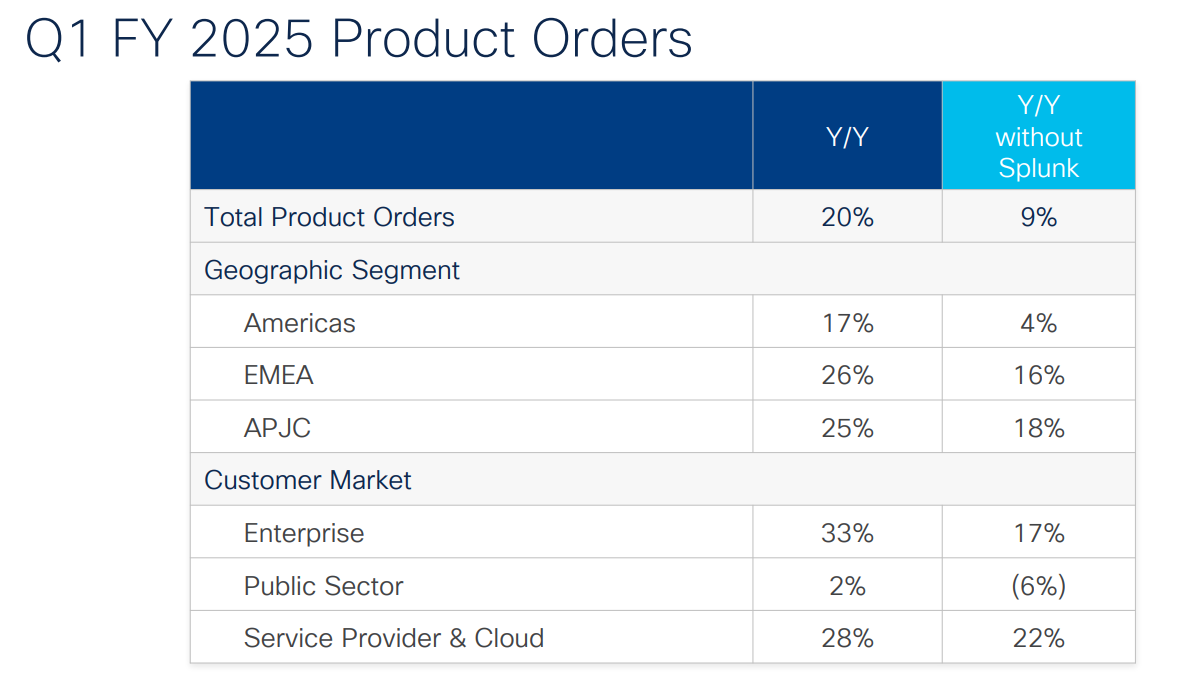

Excluding Splunk orders, product orders grew only 9% year-over-year.Earnings per share (EPS) came in at $0.91, down 18% year-over-year, beating market expectations of $0.87.

In terms of specific businesses, Cisco's performance showed different trends:

Networking business: the company's main source of revenue, networking revenue fell 23% year-on-year to $6.75 billion, below expectations of $6.8 billion, but at a slower rate than in the previous quarter.

Security business: this segment shined, growing a whopping 100 percent year-over-year to $2.02 billion, beating market expectations of $1.93 billion.

Collaboration business: this line of business declined 3% year-over-year to $1.09 billion, also missing analysts' expectations of $1.04 billion.

In terms of guidance, the company's outlook for the future is relatively optimistic, with revenue expected to be between $55.3 billion and $56.3 billion in fiscal 2025, and adjusted EPS expected to be $3.60 to $3.66.This guidance has been revised upward, but the median is still below analysts' expectations of $55.9 billion, showing the company's cautious approach to the future.

Investment highlights

The main reasons for the results exceeding expectations include

Cost Control and Efficiency Improvements: Cisco has made headcount reductions and restructuring over the past few quarters to improve operational efficiencies, which provided some support to its margins.

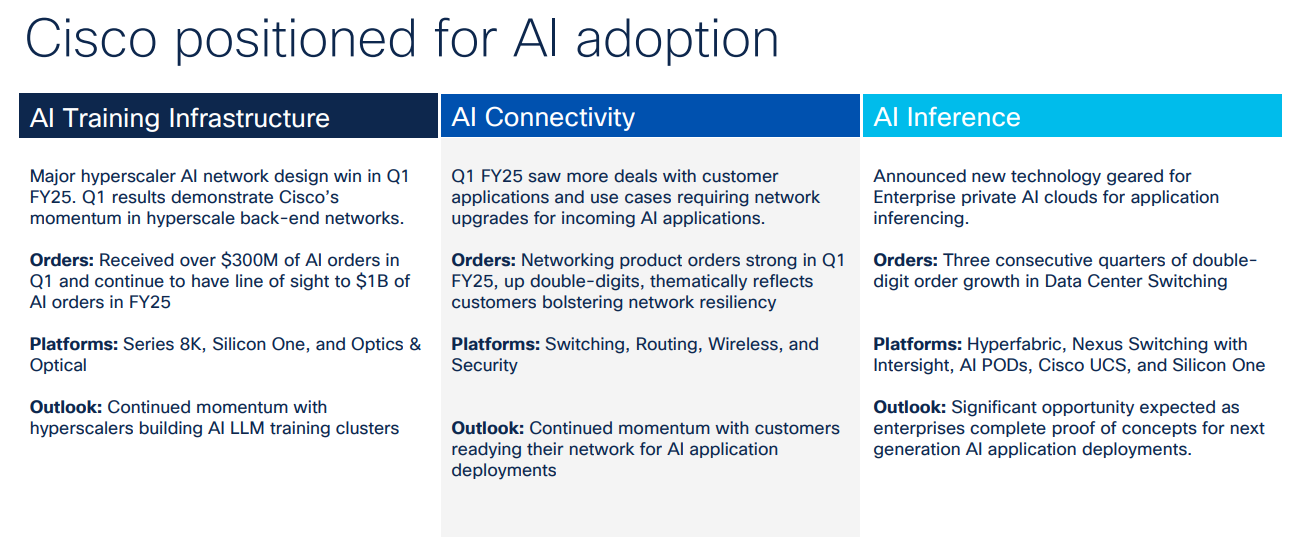

Increased demand for AI and cybersecurity: as enterprise demand for AI technology and cybersecurity solutions rose, Cisco secured notable orders in these areas. q1 AI infrastructure orders from large customers exceeded $300 million, demonstrating strong demand.

Market concerns include

Conservative earnings guidance: Although revenue guidance was revised upward, it was still below general market expectations, making investors cautious about the company's future growth.

Continued decline in core business: The network business declined for the fourth consecutive quarter, reflecting increased competitive pressure in the company's traditional markets.As competition intensified in the cloud computing and network security markets, Cisco faced strong challenges from other technology companies such as $Arista Networks(ANET)$ and $Juniper Networks(JNPR)$

At the same time, uncertainty in the macro-environment and shrinking customer spending many organizations are taking a more cautious approach to IT spending.This led to a decline in Cisco's sales of traditional networking equipment.

In addition, there are challenges in the company's transformation, as Cisco is transitioning from a hardware manufacturer to a software and service provider, a process that, while promising, could lead to revenue volatility in the short term.In particular, a decline in the traditional hardware business will have a direct impact on overall revenue until the cloud services and software subscription models have fully matured.

Comments