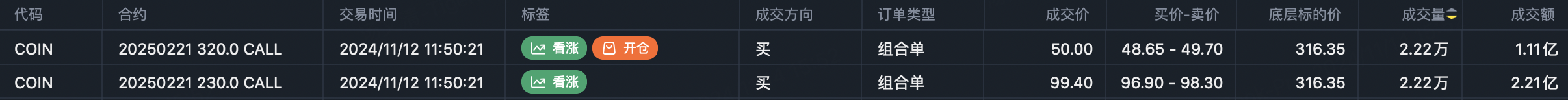

On November 12th, two large bullish option trades printed in $Coinbase Global, Inc. (COIN)$ - buying the February 21st $230 calls for $221 million, and the February 21st $320 calls for $111 million. Upon verification, these were part of a combined roll, with the actual activity being:

Close (Sell-to-Open) $COIN 20250221 230.0 CALL$

Roll (Buy-to-Open) $COIN 20250221 320.0 CALL$

Tracing back their rolling history, shockingly this firm has rolled their COIN calls 7 times in under 2 months.

Let's review these 7 rolls, using it as an opportunity to explain three frequently asked questions:

What is a roll?

Identifying option buy/sell direction

Does rolling represent continued bullish/bearish bias?

For those struggling with early option exits or holding too long into pullbacks on bullish trades, this is a great example of how institutions manage their upside exposure.

What is a roll?

Rolling, refers to closing out a current option position and re-opening a new strike/expiration cycle to maintain the directional view. The term applies to futures and options which have expiration dates. To extend a long/short exposure beyond the current contract, traders must close their existing position and open a different dated contract - this process is called rolling.

Option rolls can keep the same strike price, moving just the expiration date (a roll out). Or they can simultaneously adjust the strike higher (roll up) or lower (roll down) along with extending the expiration.

In the COIN example above, the closing of the $230 calls and opening of $320 calls represents a roll up.

Identifying buy/sell direction

Software often labels the $230 call activity as buying, when it was actually a closing sale (image).

Order marking algorithms typically assume the aggressive side (trading closer to the offer) is the buy-side. But these prints did not follow that convention.

The $320 calls traded at $50, while the quoted market was $48.65 - $49.70. The $230 calls were lifted at $99.40, far outside the $96.90 - $98.30 market.

This is because the orders were institutional fills negotiated off the electronic order book in the trading crowd on the exchange floor.

Electronic order book trading is just one of over a dozen ways to facilitate option transactions. Many institutional traders still execute manually in open-outcry trading pits, especially for larger orders (the trading floors were even temporarily closed during peak COVID to reduce virus transmission). Fully electronic trading only started in 2004 at the NYSE.

So for trades negotiated in the crowd, you cannot solely rely on the buy/sell marking on your platform. You have to study details around price/size to infer the intent of each party.

In this case, analyzing their rolling footprint over prior months confirms the $230 calls were a closing sale and the $320 calls an opening buy.

Does rolling represent continued bullishness?

Yes - by definition, a roll maintains the existing directional view. However, traders can express a moderating outlook through adjustments in strike, expiration, and sizing on their new roll position. We can gauge whether they have more/less conviction by those details.

Here's a breakdown of their rolls from October until now:

October 2nd

Closed $COIN 20241018 195.0 CALL$ at $1.90

Opened $COIN 20241220 165.0 CALL$ at $23.15

This was a 2-day roll completing ~39,000 total contracts after COIN dropped 7% on 10/1. The lower $165 strike suggests a defensive roll as the prevailing price fell below their strike. Given the much higher debit paid, this roll represented a loss from their prior position.

October 14th

Closed $COIN 20241220 165.0 CALL$ at $40.80

Opened $COIN 20241220 190.0 CALL$ at $27.45

After consolidating, COIN rallied 11%+ on 10/14. They rolled up to the $190 strike while leaving some profits on the table by reducing their debit outlay.

October 29th

Closed $COIN 20241220 190.0 CALL$ at $44.70

Opened $COIN 20241220 220.0 CALL$ at $28.30

Two days before earnings, they rolled higher again to the $220 strike expiring on 12/20.

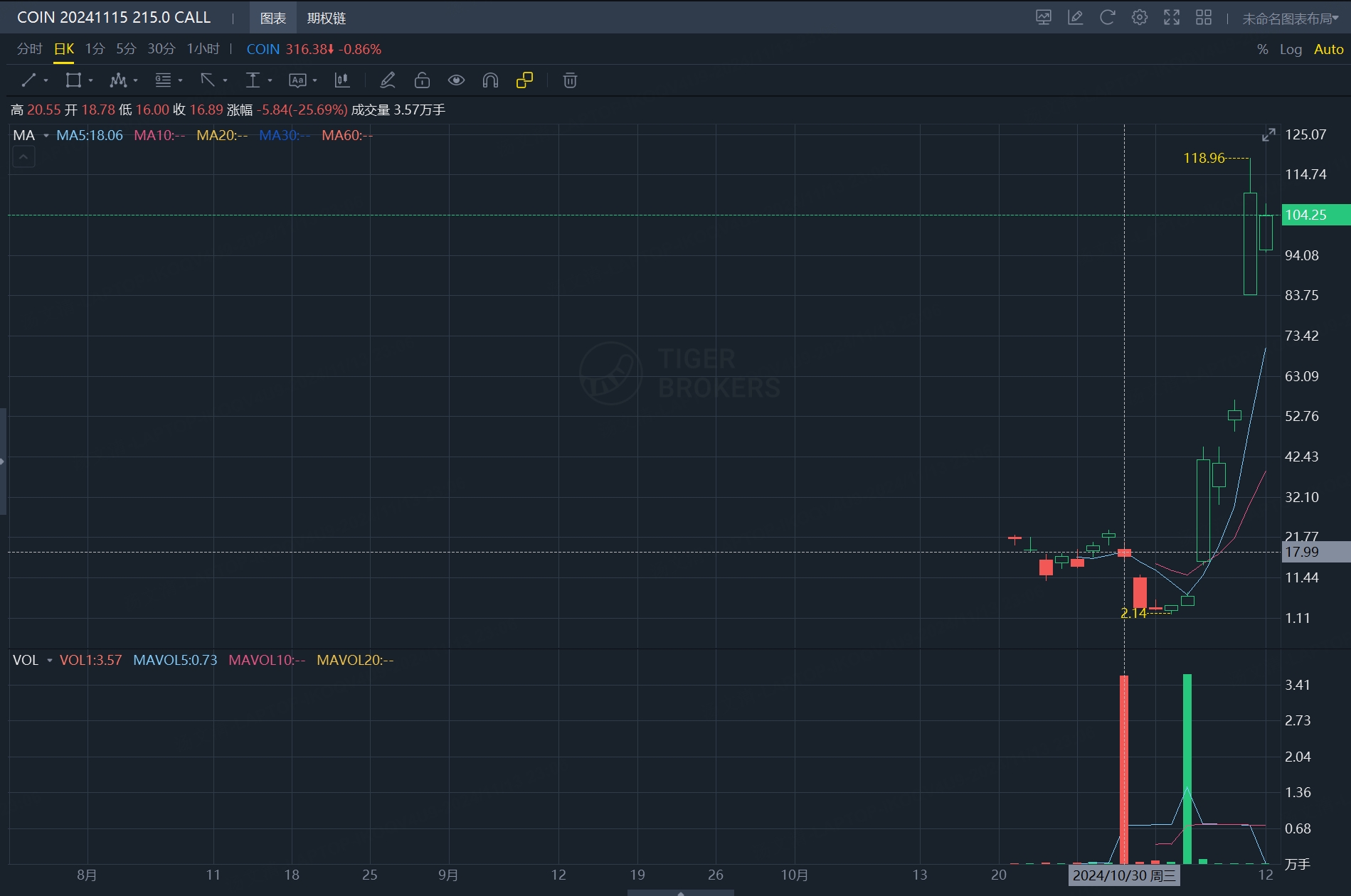

October 30th

Closed $COIN 20241220 220.0 CALL$ at $24.90

Opened $COIN 20241115 215.0 CALL$ at $18.40

However, just one day later they rolled down to the $215 strike and pushed their expiration much earlier to 11/15 - clearly reducing risk into the earnings event after the prior day's roll.

November 5th

Closed $COIN 20241115 215.0 CALL$ at $5.40

Opened $COIN 20250221 185.0 CALL$ at $36.00

After a disastrous earnings send COIN down 15%, they waited until the day before the election results to re-establish upside exposure - going much further dated with the February 2025 $185 calls, but keeping a very similar ~36,000 contract footprint.

November 6th

Closed $COIN 20250221 185.0 CALL$ at $65.60

Opened $COIN 20250221 230.0 CALL$ at $41.00

With COIN +31% after the Trump election victory, they rolled up to higher strikes while maintaining the same February 2025 dated exposure.

November 12th

Closed $COIN 20250221 230.0 CALL$ at $99.40

Opened $COIN 20250221 320.0 CALL$ at $50.00

Two-day roll after COIN further rallied 20%, raising their strike to $320 and expiring in February 2025.

Key takeaways from this multi-month roll cycle:

Buy-side should look to roll up call strikes on rallies to lock in some profits

Even after losses, conviction can remain for further upside by maintaining overall position

Choose expirations at least 1+ month out when initially establishing

Be proactive rolling ahead of catalyst events like earnings

Adjusting shorter-dated, lower strikes, and reducing size can signal a more defensive posture

Comments