As one of the more "resilient" Chinese stocks in this rally, $Bilibili Inc.(BILI)$ has naturally attracted investors with a greater appetite for risk, and the market's expectations for the company's performance were quite full, leading to strong trading.

However, on November 14th after the announcement of Q3 results, the company fell 12.6%, to some extent, is the early pricing of funds due to high expectations, at the same time, the market on the uncertainty of future performance, the company continued to maintain high growth is still a concern.Investors are generally concerned about management's articulation of its future growth strategy in the conference call, and how it will respond to the increasingly competitive market.

Really, from a performance standpoint, B Station's performance in Q3 wasn't too shabby.

Financial data

Revenue.

Q3 total revenue reached 7.31 billion yuan ($1.041 billion), up 26 percent year-on-year.

Among them, mobile game revenues realized an 84% increase to RMB 1.82 billion;

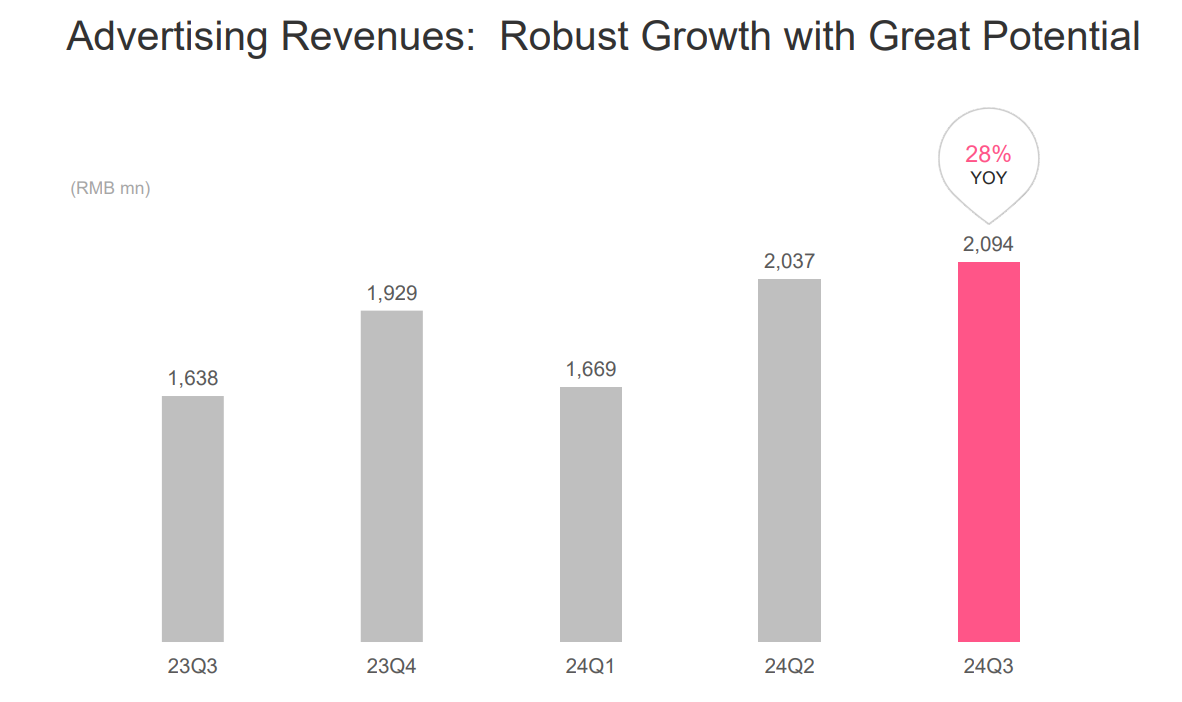

Advertising revenue grew 28% year-on-year to RMB 2.09 billion.

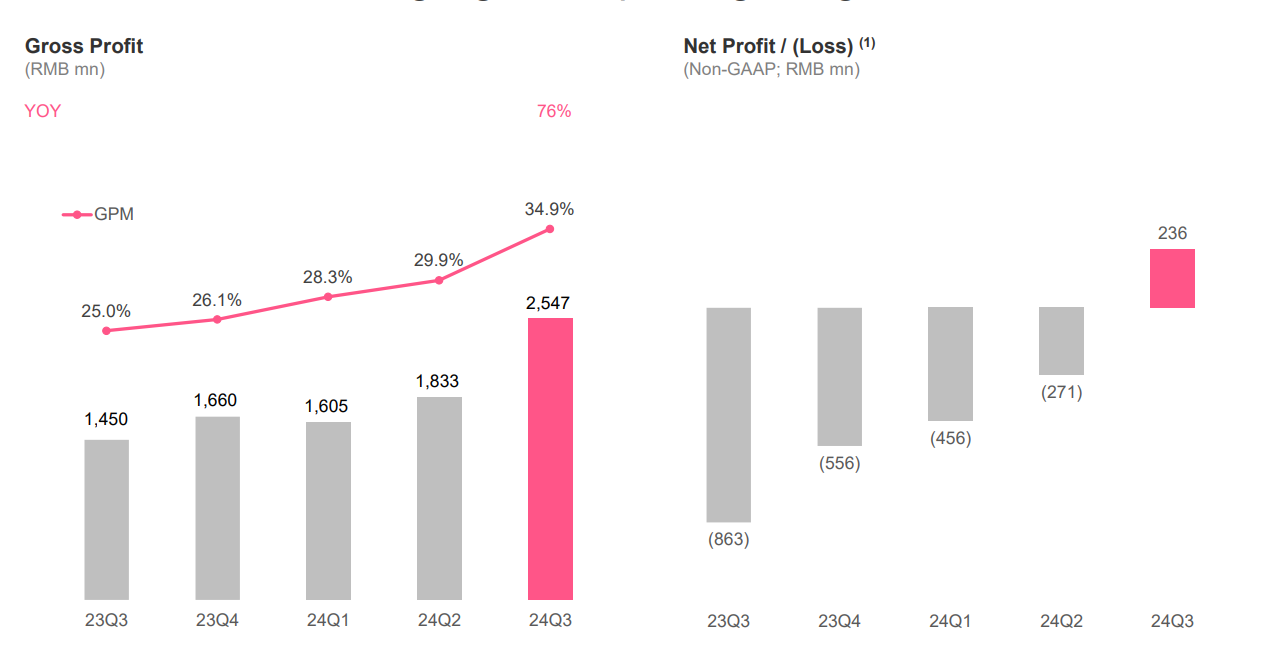

Profit.

Gross profit was RMB2.55 billion, with a significant improvement in gross margin to 34.9%, compared to 25% in the same period last year.

Non-GAAP net profit was RMB236 million, an improvement from the loss in the same period last year, and slightly short of market expectations.Analysts had expected earnings per share of CNY0.54, while it actually came in at CNY0.57.

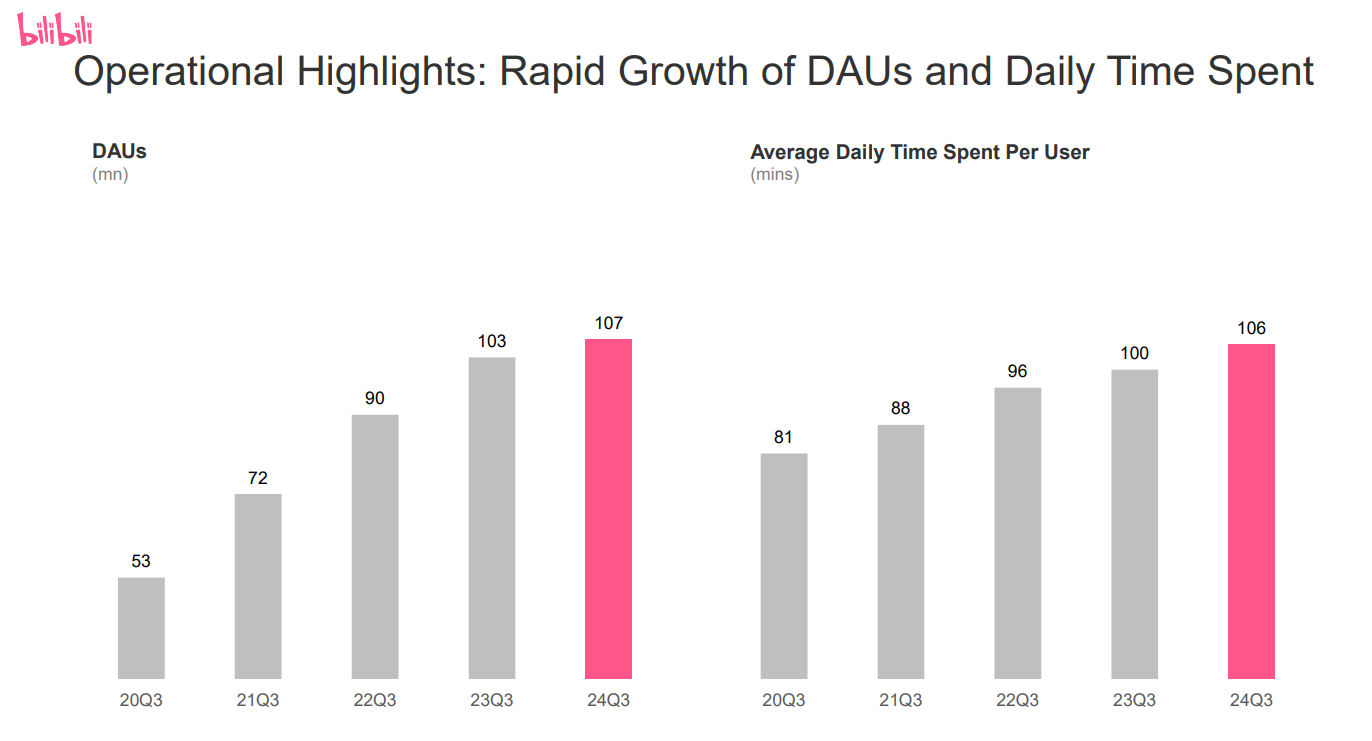

Operation

Daily active users reached 107.3 million, monthly active users reached 348 million, average daily usage time reached 106 minutes

Performance Analysis by Business

Games Business:

The strong growth in mobile game revenues was mainly attributable to the success of the new game "Three Kingdoms Mapping the World", which quickly attracted a large number of players after its launch.Despite the excellent performance of overall game revenues, revenues from older games declined, indicating that Bilibili still needs to work hard to maintain user stickiness.

Advertising Business:

Advertising revenue continued to grow, demonstrating Bilibili's success in optimizing its advertising system.The Company has further enhanced its advertising cash flow capacity by improving the accuracy of its algorithmic recommendations and launching new tools for UP owners.

Value-added services and membership:

Live streaming and large membership subscription revenue grew only 8.7% year-on-year and slowed down sequentially, reflecting the fact that Bilibili is facing a loss of subscribers in a highly competitive market environment.In this regard, the competition from Xiaohongshu also put a lot of pressure on B station.

Cash flow position:

Bilibili's net cash inflow from operating activities reached RMB2.2 billion, an increase of RMB0.5 billion from the previous quarter, showing a significant improvement in the company's cash flow position and providing financial support for future growth.

Reasons for miss

Although Bilibili's results for the quarter exceeded some market expectations in general, the company's overall performance was somewhat affected by the fact that game revenues failed to meet higher expectations.

Increased competition in the market: Direct broadcasting and large membership services faced competitive pressure from other platforms.

Lack of user stickiness: Despite the increase in DAU and MAU, the increase in user activity has not been effectively converted into paying users.

Rising R&D expenses: With the promotion of new games and increased R&D expenses, the company's cost pressure has increased.

For investors, the focus should be on how Bilibili can improve user stickiness, optimize its cost structure and the continued performance of new games.

Outlook

Looking ahead, the advertising business is expected to continue to grow as the Double 11 shopping season is just around the corner.However, whether the game business can sustain its momentum will be key.

On the flip side, Q3 deferred revenue grew 10% YoY and continued to grow at a high rate year-on-year, and the significant increase in current-quarter streams also implies that Q4 game performance is expected to continue.

In summary, Bilibili demonstrated strong financial performance and subscriber growth potential in Q3 2024, but still needs to address some core issues to ensure sustainable growth in the future.

Comments