$Wal-Mart(WMT)$ reported Q3 2024 earnings, which beat market expectations and remained strong.And it raised its full-year revenue guidance for the third time, confident in its growth momentum for the upcoming holiday shopping season.

Financial data and market expectations

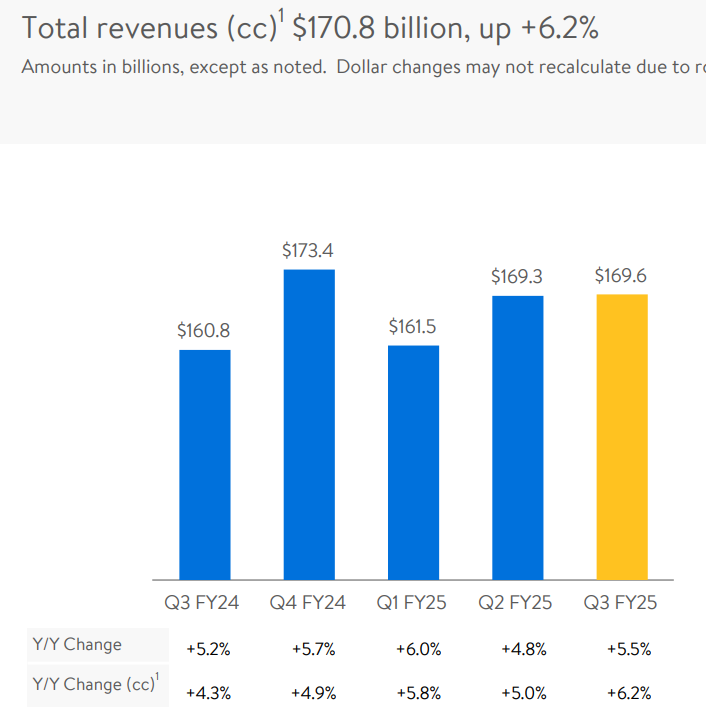

On the revenue front, total revenue was up 5.5% year-over-year to $169.588 billion, beating analysts' expectations of $167.49 billion, with net sales up 5.4% to $168.003 billion.Others, such as membership fees, were up 16%.

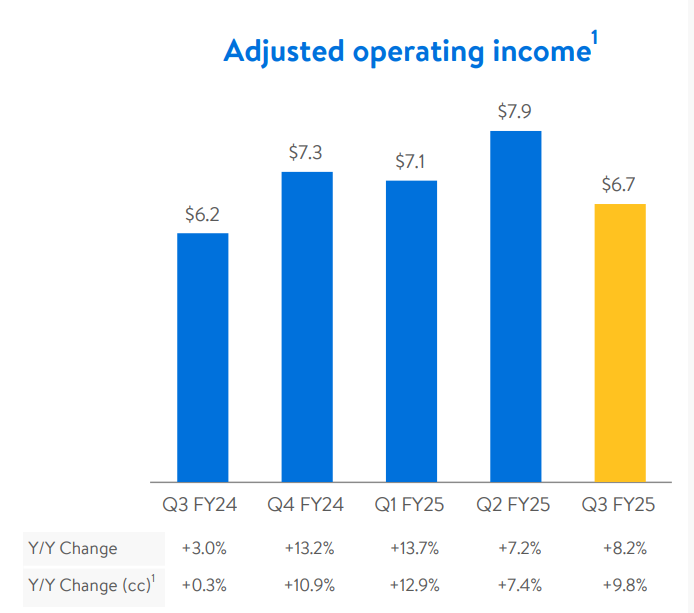

In terms of profit, Q3 operating profit was US$6,708 million, an increase of 9.8% year-on-year, which was higher than the revenue growth rate, indicating that the overall business mix has improved, while the business efficiency has increased and good profitability has been maintained.

Business performance by segment

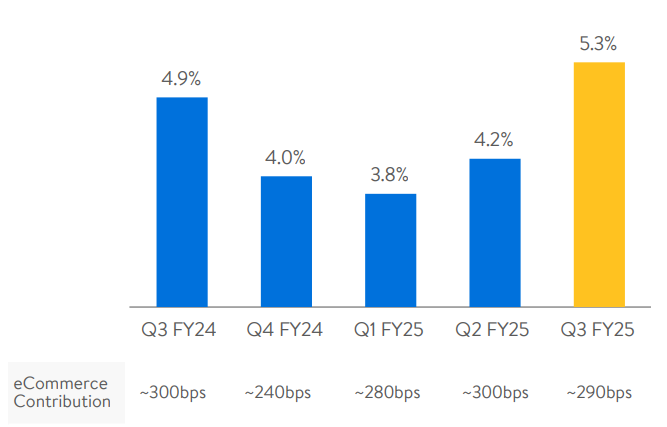

Walmart's U.S. net sales were $114.9 billion, up 5% year-over-year, or 5.3% excluding fuel.Total revenue was $5.4 billion, up 9.1%, with significant e-commerce sales growth of 22%, along with gross margin and membership revenue expansion

Walmart International adjusted revenue was $1.3 billion, up 16.7% year-over-year; net sales were $30.3 billion, up 8% excluding fuel.Sales in the e-commerce channel were up 43% and advertising revenue was up 50%.

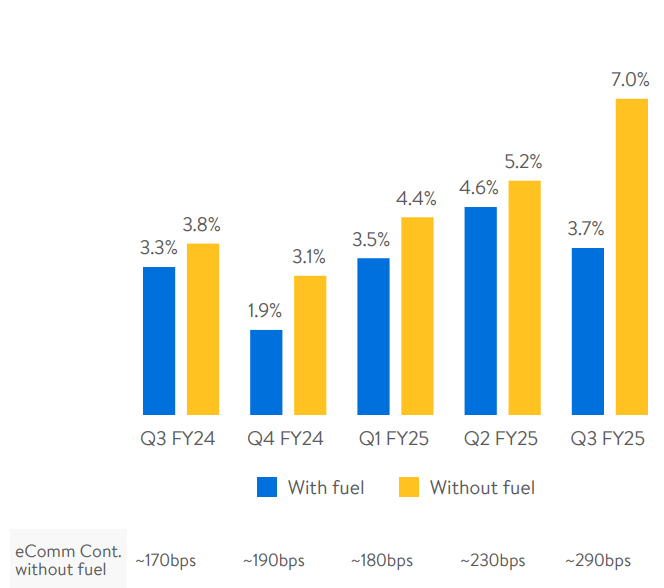

Sam's Club revenue increased 6.9% year-over-year to $600 million and 3.9% to, excluding fuel growth improved to 7% from 3.8% a year ago

Across business segments, Walmart's food and general merchandise sales performed particularly well, driving overall results.

The e-commerce side of the business also showed strong growth, particularly in the run-up to the holiday season, when consumers saw a significant uptick in online shopping, visiting Walmart's U.S. stores and website more often and often spending more.Walmart U.S. transaction volume increased 3.1% year-over-year and average ticket price increased 2.1% year-over-year.

Additionally, membership and other revenues increased, demonstrating Walmart's success in expanding its membership business

Company Outlook

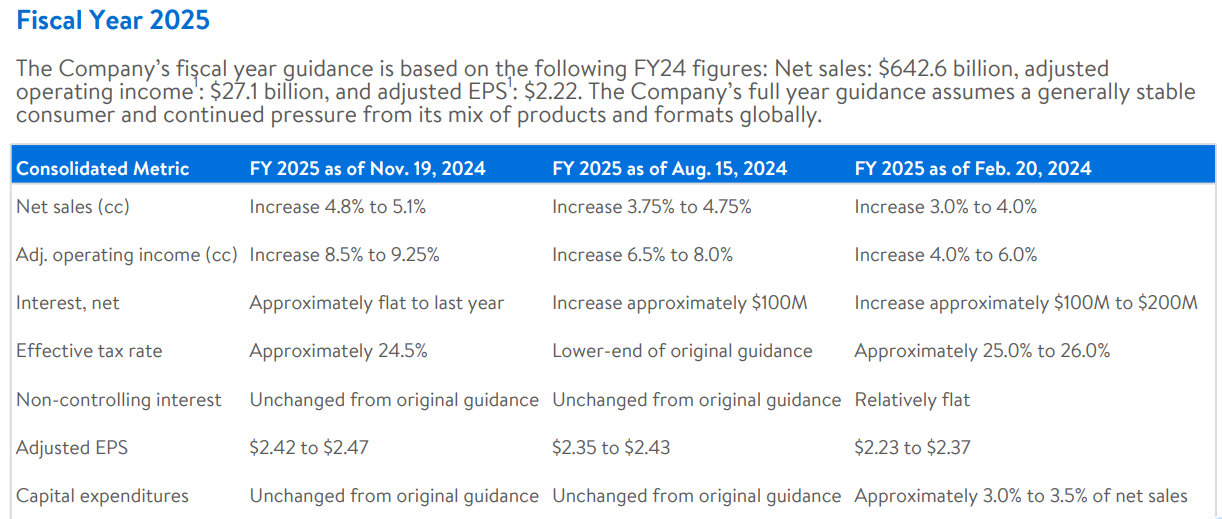

Looking ahead, Walmart has raised its fiscal 2025 sales guidance to 4.8% to 5.1% and adjusted EPS guidance again to $2.42 to $2.47, based primarily on strong consumer performance in the U.S. market as well as the company's continued optimistic vibe on e-commerce and member services.

Investment Highlights

The earnings beat was mainly attributable to the following factors:

Consumer demand remained strong: Demand for food and daily necessities continued to grow as the economy recovered and consumer confidence improved.

Sales growth on e-commerce platforms: The development of e-commerce platforms has enabled Wal-Mart to attract more online shoppers.

Cost Control and Efficiency Improvement: the company's continued efforts in operational efficiency and cost control have helped to improve margins.

Investors should pay attention to the following focuses:

Future consumer trends: changes in consumer spending may impact Wal-Mart's performance as the holiday season approaches.Meanwhile, consumers are cautious about spending, despite Walmart's overall sales growth and being more selective in their purchases, especially in the general merchandise category where sales growth was slow, achieving only low single-digit year-over-year growth.

Increased competition in the overall market: Walmart faces stiff competition in the retail market from other large retailers and e-commerce platforms.In particular, online retailers such as Amazon are putting pressure on Walmart in terms of price and convenience.Although Walmart has maintained its competitiveness through its "Everyday Low Prices" strategy, the market environment is changing rapidly and it remains a challenge to continue to attract customers.

Tariffs and cost pressures: Walmart faces the risk of higher commodity costs as a result of the U.S. government's policy of potentially increasing tariffs.Although the company has no current plans to increase prices, the tariff policy may lead to an increase in the price of certain goods in the future, which will affect the company's pricing strategy and profit margins.In addition, Walmart needs to find a balance between keeping its pricing strategy low and dealing with cost pressures.

Global Supply Chain and Inventory Management: Despite Wal-Mart's investments in technology and supply chain optimization, uncertainty in the global supply chain remains a potential problem.The company needs to effectively manage inventory to respond to fluctuations in demand, while ensuring stability of product supply to meet consumer demand.This complexity may affect the company's operational efficiency and profitability.

Walmart in Q3 demonstrated strong financial performance and positive growth prospects, with its success attributed to strong consumer demand, an effective e-commerce strategy, and good cost control.Whether the company can continue to maintain this momentum as the holiday season approaches will be an important issue for investors.

Comments