$Nvidia (NVDA)$ is set to report Q3 earnings after the close on Wednesday. According to Bloomberg analyst estimates, Nvidia's Q3 revenue is expected to be $33.125 billion, adjusted net income of $18.493 billion, and adjusted EPS of $0.739.

Whether it can rally big after earnings depends on if revenue can exceed $2 billion over expectations again, and if the Q4 revenue guidance can also surpass projections.

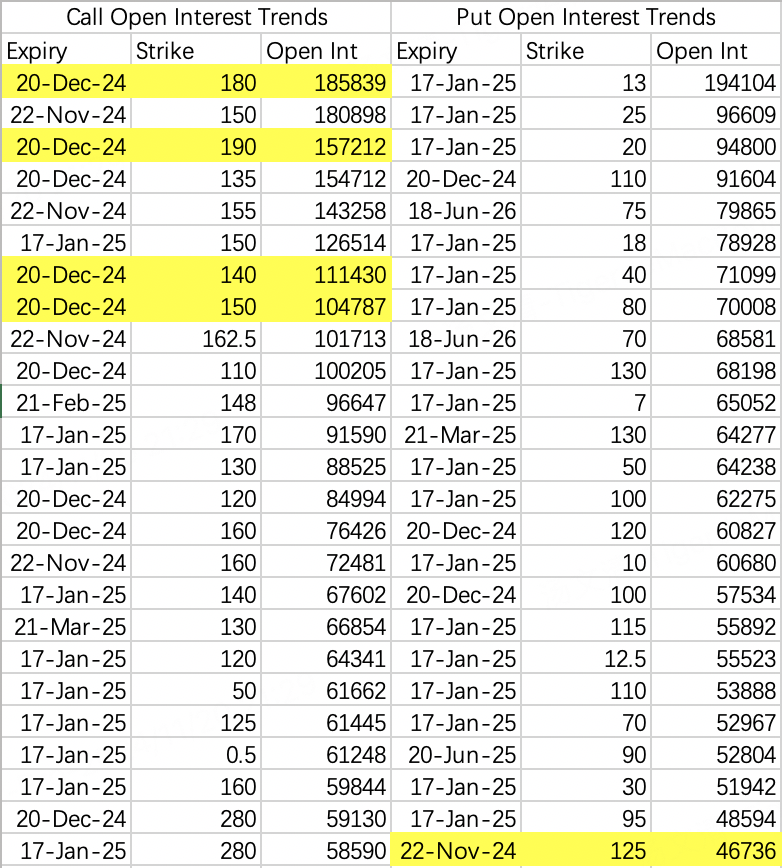

Based on open interest data, large option traders seem positioned more bullishly, with $150 appearing as a key breakout level for these earnings.

Impacted by the stock pullback, earnings flows have been relatively cautious. Here's a roundup of the major option trades over the past few days for reference.

There may be some looking for that perfect three-way strategy that minimizes losses, maximizes gains, and covers all directions. I've looked, but those conditions can only satisfy two out of three.

Trader 1: Very Bullish

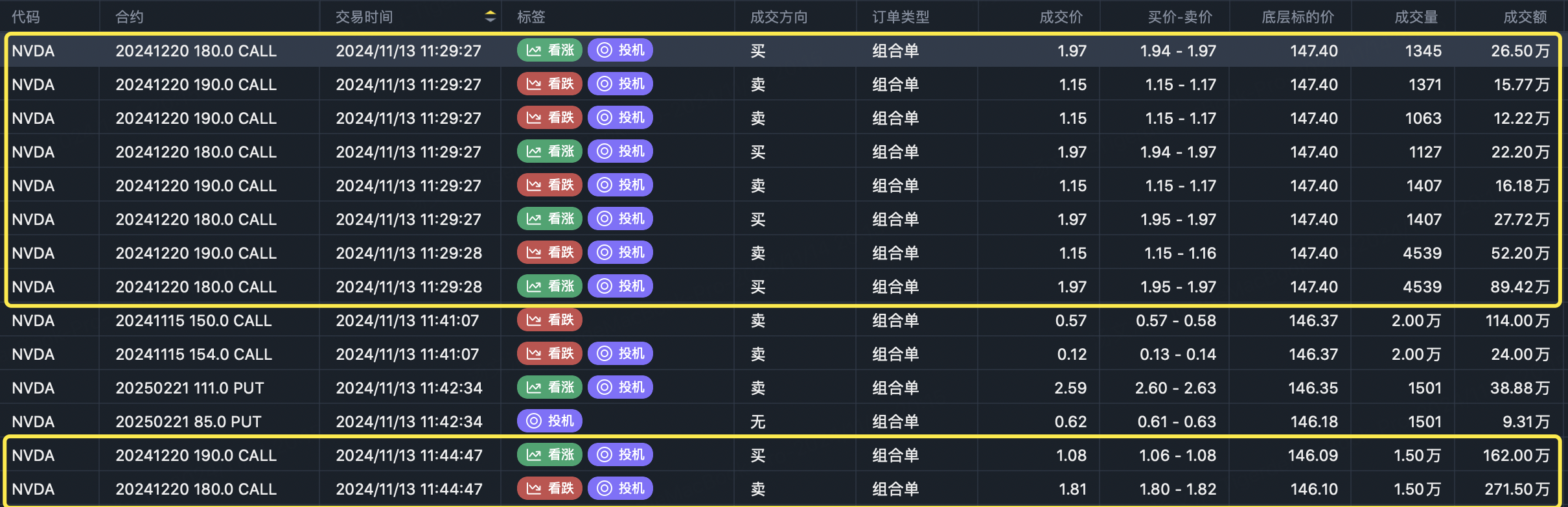

Buying the Dec 20th $180/$190 call spread in massive size:

Buy $NVDA 20241220 180.0 CALL$

Sell $NVDA 20241220 190.0 CALL$

How massive? They've been accumulating this $180/$190 call spread since October 17th for over 100,000 contracts total. Netting out the $190 call sales, their actual debit is roughly 1/3 of the $180 call price, estimating over $10M in premium paid.

Since the $190 shorts cover vega/theta, this doesn't need $180 to profit - theoretically just an 8%+ rally off the $145 price to above $160 is enough.

Trader 2: Below $150

This is the institutional trader rolling their $150/$162.5 collar weekly:

Sell $NVDA 20241122 150.0 CALL$ 78,300 contracts

Buy $NVDA 20241122 162.5 CALL$ 78,300 contracts

Someone asked why they used $162.5 instead of $160? I checked, and $160 has 72,000 contracts open interest - more likely to be a hot strike and get blown through on a rally.

Trader 3: $140-$150 Range

This trader quietly put on a $140/$150 call spread earlier in the week, possibly closing now that stock is $147:

Buy $NVDA 20241220 140.0 CALL$ 20,000 contracts

Sell $NVDA 20241220 150.0 CALL$ 20,000 contracts

$140 and $150 also show up as two of the highest open interest strikes.

Trader 4: No Cost Play Above $155

Selling $130 puts to finance $155 call debit:

Sell $NVDA 20241206 130.0 PUT$ 5,000 contracts

Buy $NVDA 20241206 155.0 CALL$ 5,000 contracts

Elegant - selling the $130 puts offsets the cost of buying the $155 calls. Max gain if NVDA rallies past $155, no loss between $130-$155, with defined risk below $130.

Trading a 1:1 hedge suggests lack of conviction in a big move.

Trader 5: Bullish Above $155

Longer-dated $155 call debit, selling $120 puts and $175 calls to defray costs:

Sell $NVDA 20250321 120.0 PUT$

Buy $NVDA 20250321 155.0 CALL$

Sell $NVDA 20250321 175.0 CALL$

More robust than the last trade, though I'd opt for a nearer-dated short $175 call.

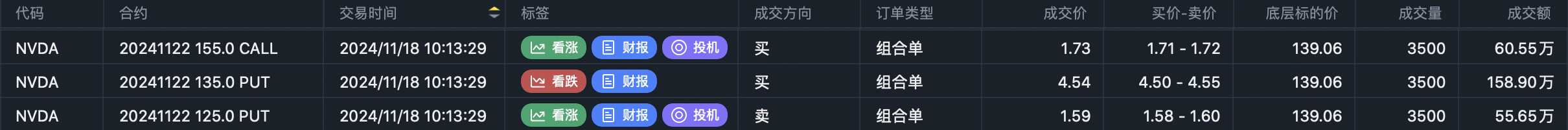

Trader 6: Bearish Below $135

Buying a strangle seemingly more bearish, expecting a move down to the $125-$135 range:

Sell $NVDA 20241122 125.0 PUT$

Buy $NVDA 20241122 135.0 PUT$

Buy $NVDA 20241122 155.0 CALL$

With weekly expiries, the $135 put will have a higher weighting as it's closest to at-the-money, suggesting an overall bearish lean to this trade.

Trader 7: Bullish Above $150

Bullish for a move above $150 but protected against a catastrophic decline:

Sell $NVDA 20241122 105.0 PUT$

Buy $NVDA 20241122 125.0 PUT$

Buy $NVDA 20241220 150.0 CALL$

Sell $NVDA 20250117 180.0 CALL$

With weekly put sales but longer-dated $150+ call exposure, this trader seems cautiously bullish while guarding against a disaster scenario.

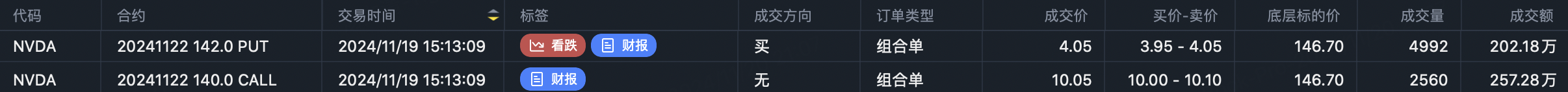

Trader 8: $160+/$124- Strangle

The true degenerate - weekly expiry, using the trick of call strikes inside and put strikes outside to preserve one side if it's a small move:

Buy $NVDA 20241122 140.0 CALL$

Sell $NVDA 20241122 142.0 PUT$ x2

They only make money if we see an extreme up or down move, otherwise one side gets totally wiped.

The $110 put seller from earlier closed their position, not participating in earnings.

Rollers:

There were quite a few bullish flows rolling positions ahead of earnings, suggesting they aren't uber-bullish on this particular report, so are pushing out expirations to reduce time decay. This indecisive stance is a signal itself.

That said, the size does seem uniformly skewed towards longer-term bullish plays targeting $160+.

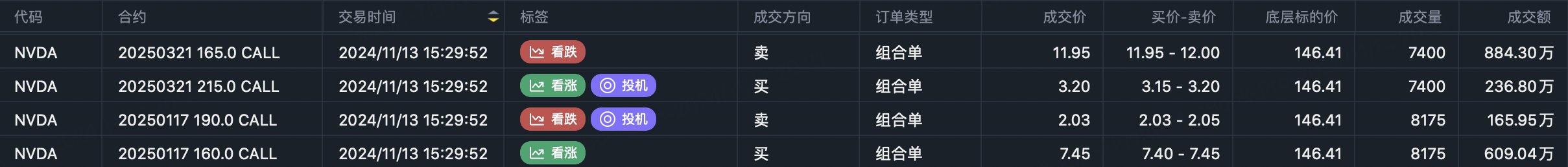

One block traded out of the $215/$165 calls to roll down into the $160/$190 range:

Close $NVDA 20250321 215.0 CALL$ and $165.0 CALL$

Open $NVDA 20250117 160.0 CALL$ and $20241220 190.0 CALL$

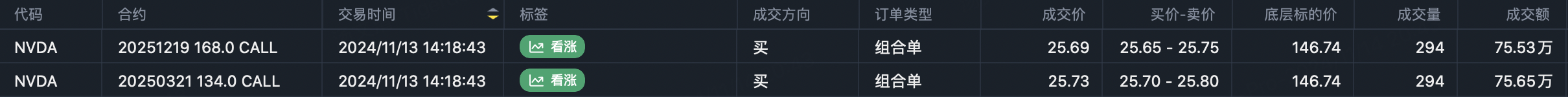

Another rolled from $134 calls to $168 calls, bullish for $160+:

Close $NVDA 20250321 134.0 CALL$

Open $NVDA 20251219 168.0 CALL$

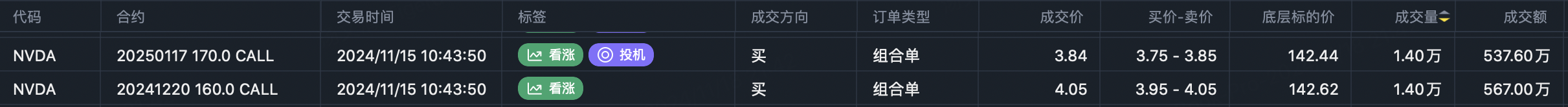

And a third pushed out $160 calls to $170 calls:

Close $NVDA 20241220 160.0 CALL$

Open $NVDA 20250117 170.0 CALL$

Bearish Flow: The $2B Trader Reduces

The ~$200M trader sold 26,000 of their $135 calls on Thursday, and another 17,500 on Friday, leaving ~124,000 contracts remaining in the $NVDA 20241220 135.0 CALL$ position.

Stock Hedges:

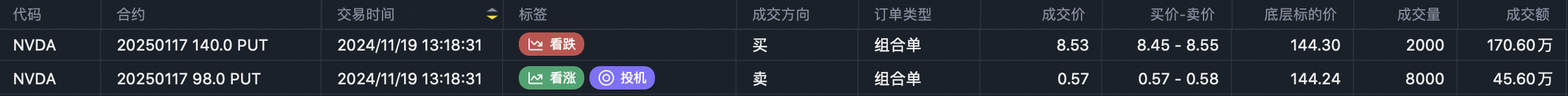

On Tuesday, there was a large volatility trade for stock downside protection:

Buy $NVDA 20250117 140.0 PUT$ x1

Buy $NVDA 20250117 98.0 PUT$ x4

Price-wise they could have used a $120 strike for a full delta hedge without leverage, but seems they really didn't want any risk of being put shares by using the $98 strike instead. Different approach than a typical collar.

Summary:

For bullish plays, $150 and $160 appear as the two key upside levels to target.

For bearish plays, $125 seems to be the line in the sand, though most downside positions are leaning more towards a moderate selloff to the $130-$140 range.

Given Nvidia's longer-term uptrend, no need to get too aggressive with outright bearish bets - even if it sells off, these dips tend to get bought.

The safest way to play earnings is definitely selling volatility by selling out-of-the-money options with delta 0.2.

Personally, I maintain a bullish position, choosing to hold shares while selling $NVDA 20241122 120.0 PUT$ and $NVDA 20241122 160.0 CALL$ .

However, after reviewing the open interest data, selling calls at 165 or higher might have been better. With the current stock price at 145, if after-hours trading shows a 10% increase, a gap up at market open is highly probable. But since I've already sold the calls, there's nothing to do now except be decisive about selling puts when necessary.

Comments