$NVIDIA Corp(NVDA)$ earnings were generally good, but following the year-end pattern, the stock price will likely fluctuate before exploding in January. Those who haven't entered can wait for pullbacks, while those already in can write both calls and puts to profit from the 130-160 range oscillation.

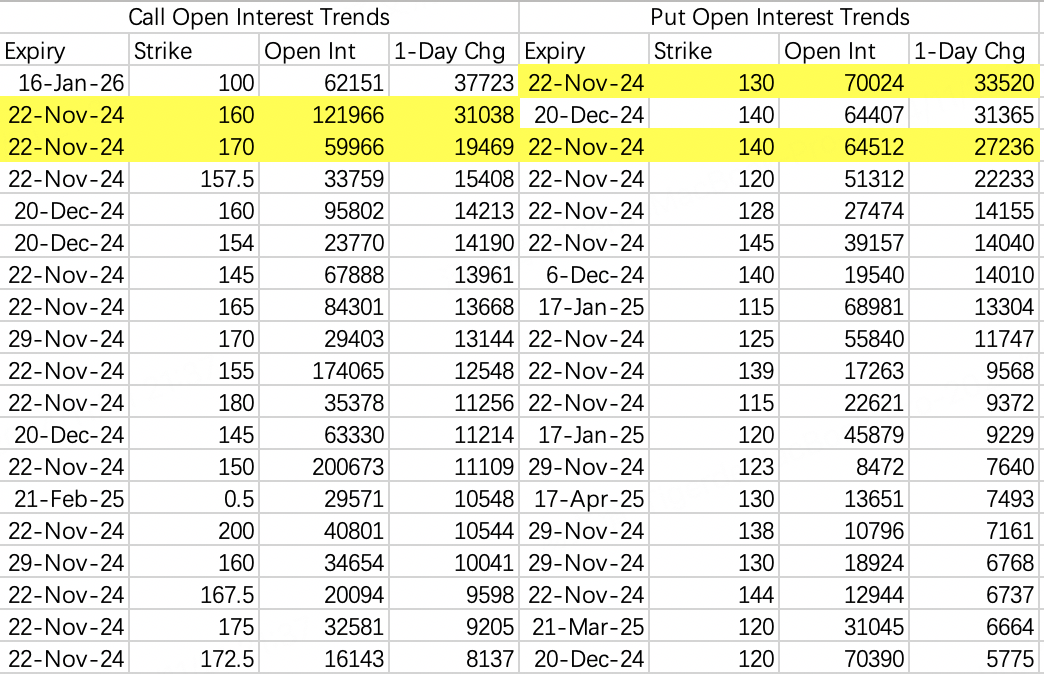

Wednesday's options flow showed significant put volume. Besides the December 140 puts I forwarded overnight, the second-largest opening position was buying this week's 140 puts while selling 130 puts.

Based on today's opening performance, the 140 put strategy wasn't wrong. The error was in the overwhelming buying enthusiasm, as a mere 5% drop got bought up.

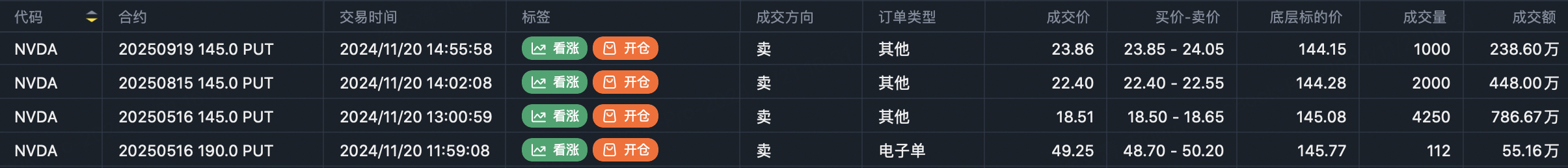

I'm more focused on long-term strategy than short-term plays. You might have noticed large volumes of long-dated put sales last night:

Selling $NVDA 20250516 145.0 PUT$ , volume 4,525 contracts

Selling $NVDA 20250919 145.0 PUT$ , volume 1,020 contracts

Selling $NVDA 20250815 145.0 PUT$ , volume 2,319 contracts

Given the earnings report, selling ATM puts appears quite reasonable.

Looking at NVIDIA's year-end performance over the past two years, the stock tends to oscillate within a 10-15% range. Buy dips at 130, don't chase above 160, as the stock typically soars in January-February.

Whether it rises first then falls, or pulls back before rallying isn't crucial - it's all within the 130-160 range.

Given yesterday's put activity targeting the 130-140 range, we'll likely see at least one pullback to 130 in the next two months.

The $200M trader will likely roll positions tomorrow - my guess is they'll roll to February 2025 135 calls $NVDA 20250221 135.0 CALL$ .

$TSLA$

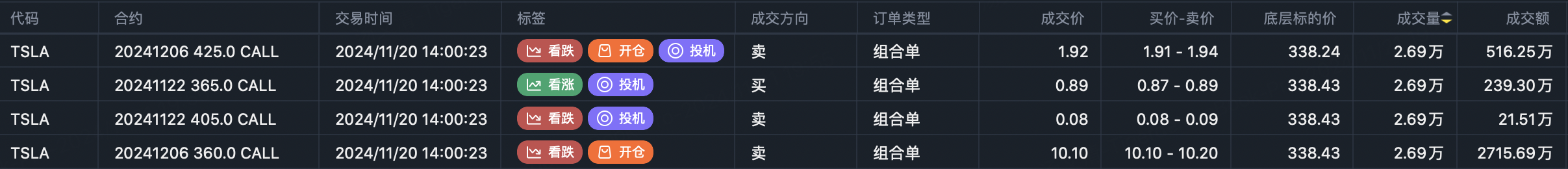

On Wednesday, covered call institutions rolled positions again, but differently this time, choosing December 6th expiration (two weeks out) - perhaps the portfolio manager is going on vacation.

Strike prices were adjusted slightly, lowering the sold call strikes by $5 (365 to 360), and raising the bought call strikes (405 to 425).

Sell $TSLA 20241206 360.0 CALL$

Buy $TSLA 20241206 425.0 CALL$

The next two weeks will either see sideways movement or a surge above 400. I'm sticking with my sell put + buy call position.

Comments

Great article, would you like to share it?