On Thursday, bitcoin holder MSTR plunged 16%, seemingly due to Citron Research's short announcement. Citron stated that MSTR's trading volume had completely disconnected from bitcoin fundamentals. While still bullish on bitcoin, they're hedging by shorting MSTR.

Notably, Citron's X statement came at 10:43 PM on November 21st, after Thursday's close. MSTR had already fallen 16% before closing, suggesting Citron may be taking credit for the decline.

Citron didn't disclose their short position type - stocks or options. Given options allow for both price and volatility shorts, I suspect they're using options, likely selling calls to short both volatility and price.

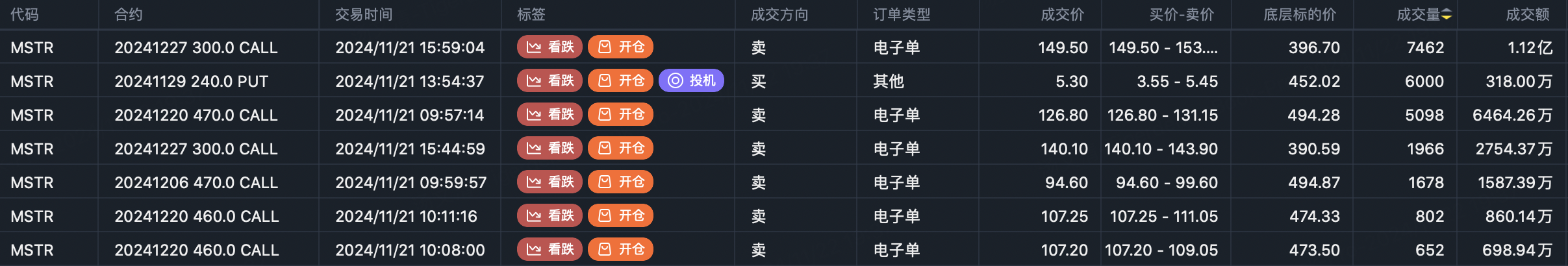

Thursday saw numerous large call sales, any of which could be Citron's position:

Sell $MSTR 20241227 300.0 CALL$ , volume 10,100 contracts, value >$140M

Sell $MSTR 20241220 470.0 CALL$ , volume 7,201 contracts, value >$80M

Sell $MSTR 20241220 460.0 CALL$ , volume 2,705 contracts

Given Citron's size, they likely executed one of the two largest trades - either the 470 or 300 strikes.

Interestingly, the 470 calls traded 30 minutes pre-market, while the 300 calls traded in the final minute.

Is Citron targeting $300?

A quick primer: novice and experienced traders approach short option strikes differently. Novices focus on avoiding margin calls, while experienced traders balance this with maximizing short profits.

Maximizing short profits considers price trends and the ability to short both volatility and price.

Selling OTM calls only shorts volatility, while ITM calls can short both volatility and price, profiting directly from price drops without borrowing costs.

The 300 calls opened at 152.77 with 185.63% IV, while 470 calls were at 64 with 185.14% IV - both well above historical volatility.

Since short call profits are capped at the initial premium, if MSTR realigns with bitcoin fundamentals and bitcoin trends down, selling 300 calls offers higher potential returns than 470 calls.

Another key options concept: US options can be traded freely before expiration, allowing profit-taking through closing positions.

So choosing 300 doesn't necessarily mean traders expect the price to fall that low.

However, I noticed other large orders also targeting the 300 range.

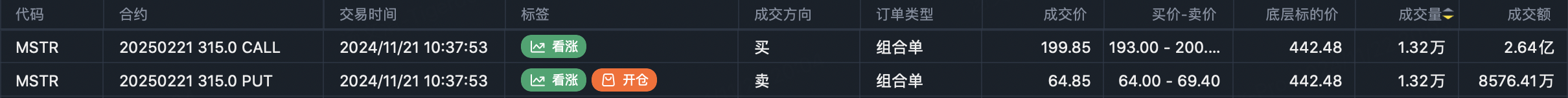

Thursday's largest institutional combination order likely involved long stock + calls + puts, probably buying both options in a straddle strategy, with both strikes at 315:

Long stock

$MSTR 20250221 315.0 CALL$

$MSTR 20250221 315.0 PUT$

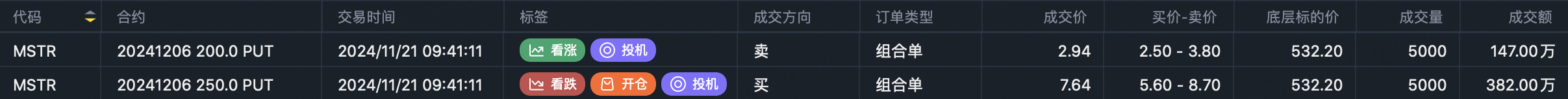

Another notable roll saw a trader buying $MSTR 20241206 200.0 PUT$ then rolling to $MSTR 20241206 250.0 PUT$ , maintaining bearish positioning.

Regular readers know how unusual this is - typically traders choose cheaper OTM options, but this trader doubled down with more expensive strikes.

This makes sense if shorts are targeting 300, expecting MSTR to align with other bitcoin stocks rather than fall further.

Squeezed Institutions

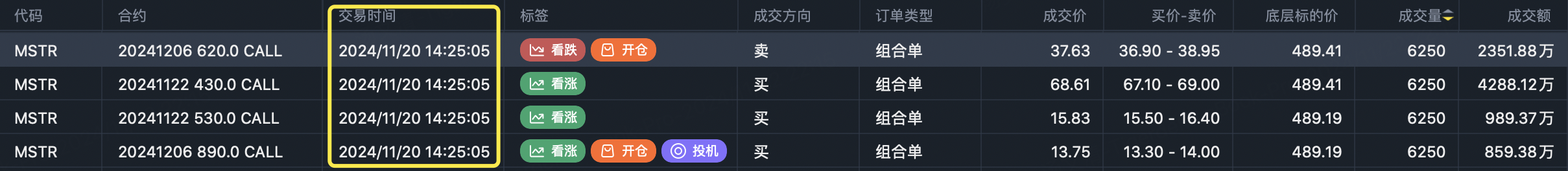

MSTR's irrational surge had some short squeeze elements, making the subsequent crash after clearing out longs predictable. How? On November 20th, institutional covered calls were forced to close sell call 430 buy call 530 positions, rolling to sell call 620 buy call 890. The timing of the next day's drop is notable.

Next Week's Outlook

Since Citron remains bitcoin-bullish, MSTR's bottom can be gauged against other crypto stocks.

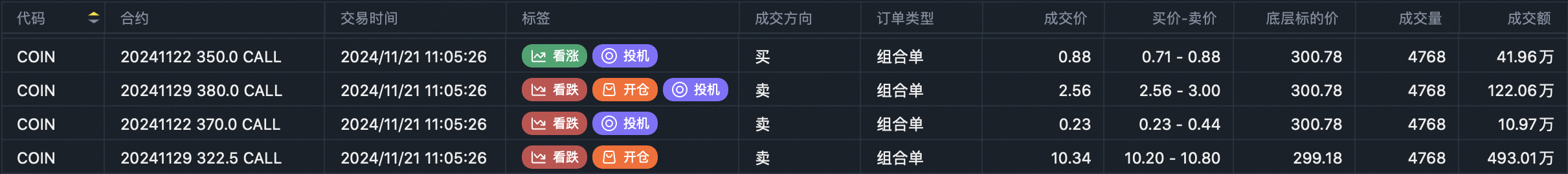

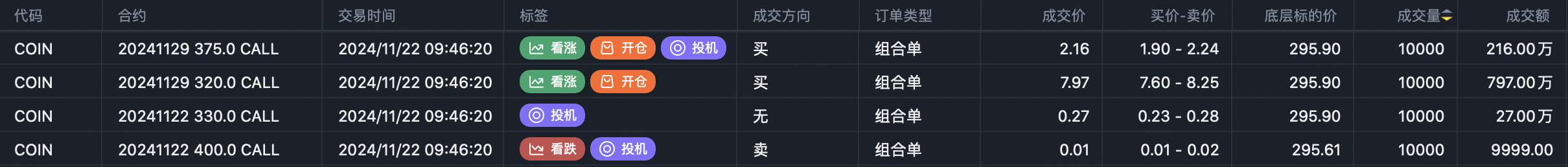

COIN institutional covered calls suggest expectations below 322.5, hedging 322.5-380:

$COIN 20241129 322.5 CALL$

$COIN 20241129 380.0 CALL$

Another institution predicts below 320, hedging 320-375:

$COIN 20241129 320.0 CALL$

$COIN 20241129 375.0 CALL$

The spread ranges show bitcoin's volatility is hard to predict, but lower call strikes compared to last week suggest potentially weaker performance, though large upside moves remain possible.

A broader market correction is expected through December, adding pressure to crypto stocks.

Regardless of volatility, MSTR will likely return to normal bitcoin correlation ranges, which explains Citron's confidence in their call sales.

Comments