$NVIDIA Corp(NVDA)$ On October 11th, I wrote an article about an unknown billionaire's massive purchase of NVIDIA call options. On October 10th, this wealthy investor swept up nearly all available call options expiring March 21st, 2025.

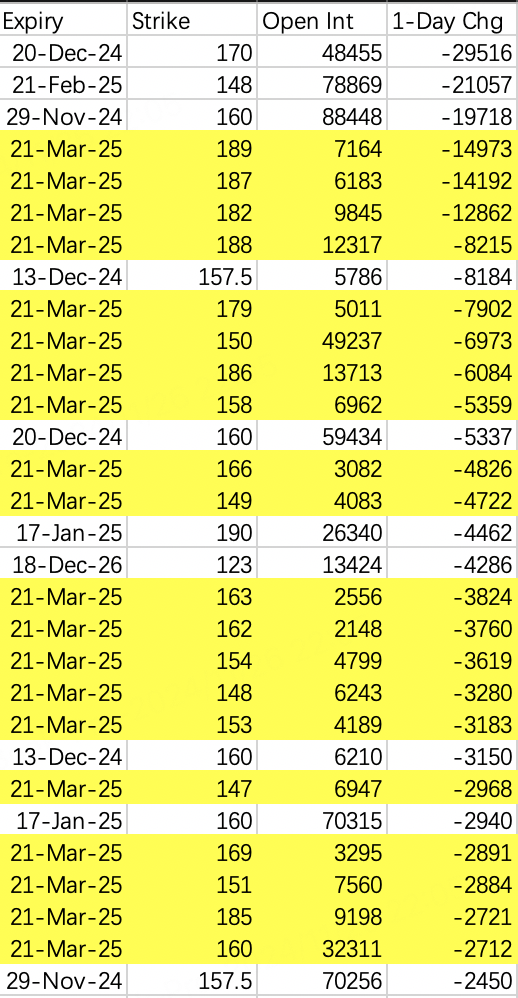

On November 25th, updated open interest data showed that the billionaire closed all previously purchased call positions:

According to the options price chart, this trade resulted in a loss:

NVIDIA closed at 134.8 on October 10th and at 136.02 on November 25th. After more than a month of volatility, the stock price returned to its starting point. While the underlying stock made a small profit and options sellers gained slightly, call option buyers lost time value, with out-of-the-money options suffering particularly severe decay. I believe this is why the billionaire liquidated the position.

As we predicted in our previous article, NVIDIA would experience a correction towards year-end with continued volatile trading. For out-of-the-money options expiring in March 2025, this could mean another month of decay, and the billionaire's exit indirectly confirms our volatility prediction.

However, as I've mentioned before, if the initial position was poorly timed, the closing trade is likely problematic too. From a speculative perspective, holding long-term call options in such situations should involve rolling positions rather than closing them.

While options experience comes at a cost, this loss seems particularly wasteful. This purchase was essentially like buying calls at every strike price to personally experience the ups and downs. Wouldn't it have been better to share this money with our community members? The wealthy really do enjoy burning money.

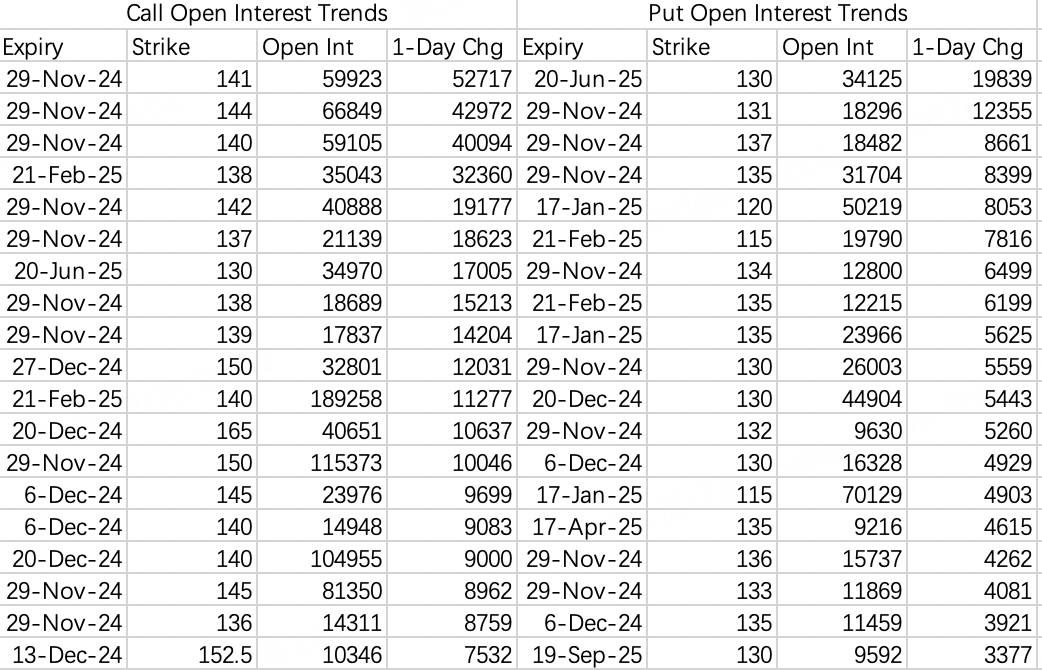

On Monday, the stock suddenly dropped 4%, triggering a new wave of large-scale position rolling and opening, mainly focused on call spreads and protective strategies:

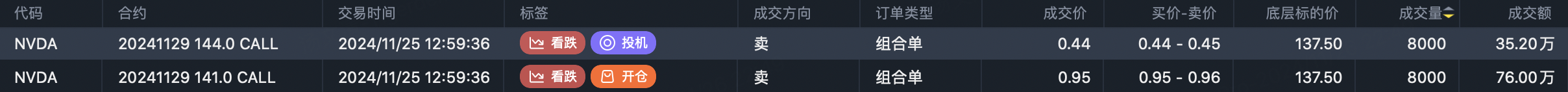

This week's 141 and 144 calls saw increased opening activity, with unclear directional bias:

However, same-week expiry options are only suitable for day trading or overnight trading. If NVIDIA cannot bounce back to 140 by Tuesday, market makers will profit from calls above 140. In plain language, if it doesn't rebound, it will continue declining.

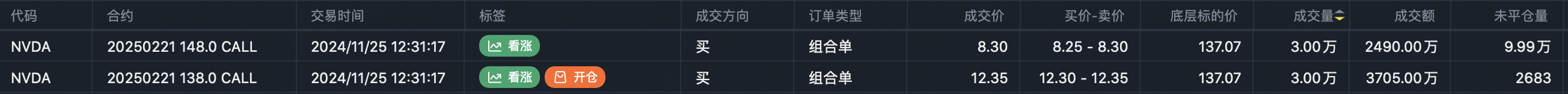

February 148 calls rolled to 138, reducing risk:

Closed $NVDA 20250221 148.0 CALL$

Rolled into $NVDA 20250221 138.0 CALL$

Large protective orders included straddle + sell call:

Sold $NVDA 20250221 160.0 CALL$

Bought $NVDA 20250221 140.0 CALL$

Bought $NVDA 20250221 135.0 PUT$

The overall effect is similar to holding stock + buying put options. Those with stock positions might consider buying puts for protection or selling deep out-of-the-money options for premium collection.

Comments