Two groups of massive new open interest options positions are indicative of future trend directions, with attention on Chinese stock rebound opportunities.

Western Markets Cool:

First, there's a large Microsoft call option sale at the at-the-money strike price of 420, expiring December 13th:

Sell $MSFT 20241213 420.0 CALL$ , opening 10,000 contracts

Choosing the at-the-money strike price for selling calls indicates a very bearish trend for the next two weeks, and opening over 10,000 contracts shows strong confidence in this outlook.

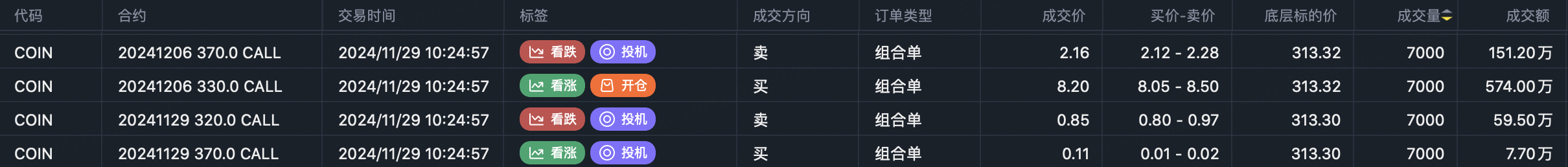

Looking at covered call large orders in other tech stocks like NVIDIA and Tesla, we can see the next two weeks will likely be relatively flat with range-bound trading. Even COIN isn't an exception, with new large call spread orders suggesting this week's high won't exceed 330:

Sell $COIN 20241206 330.0 CALL$

Buy $COIN 20241206 370.0 CALL$

Although major institutions often underestimate Bitcoin's volatility, their expectations still hold some reference value.

While tech stocks might be flat for the next two weeks, SPY positions still lean bullish, with large orders buying short-term 606 calls $SPY 20241213 606.0 CALL$ , indicating sector rotation will dominate near-term.

Eastern Markets Brighten:

$Direxion Daily FTSE China Bull 3X Shares(YINN)$

Large capital heavily bought 2026 expiry 27 strike calls $YINN 20260116 27.0 CALL$ , with 94,000 contracts opened, 98,000 contracts traded, and transaction value exceeding $90 million.

The order type wasn't market trading, but rather straight large capital limit orders to buy. Choosing the at-the-money 27 strike and 2026 expiration might be to minimize volatility or pullback decay.

However, no matter how conservative the expiration and strike choices are, selecting options on a 3x leveraged ETF is already quite aggressive, showing that major players are determined to capture the Chinese stock rebound.

A more conservative bullish approach for future trends would be selling puts, and conservative large orders chose to sell January next year 28.85 puts $FXI 20250117 28.85 PUT$ , opening 30,000 contracts.

Comments

The thought is january would be a bearish month like every year and we recover back on february