As a cloud cybersecurity company with an unnatural month in its fiscal quarter, $Zscaler Inc.(ZS)$ pulled back more than 8% after announcing its 1Q FY2025 results.Given that the quarterly results beat market expectations, investors are still concerned about the ability to deliver strong results going forward.The company's Q2 guidance fell slightly short of expectations, but it also raised its guidance for the full fiscal year.

ZS may not just need to work itself out if it can get back to the highs of late last year again.

Financials and Market Expectations

Key Financial Indicators

Operating income: $628 million, up 26% year-over-year, compared to expectations of $606 million;

Adjusted EPS: 77 cents, versus market estimate of 63 cents;

Deferred revenue: $178.37 million, up 27%;

Billings: $516.7 mln, up 13% y/y

Free cash flow: $291.9 million, up 30% year-over-year

Business performance by segment

Core Zero Trust Security Solutions performed well, with billings up 13% year-over-year to $516.7 million;

The company made significant progress in customer engagement and sales execution as demand for cybersecurity increased.

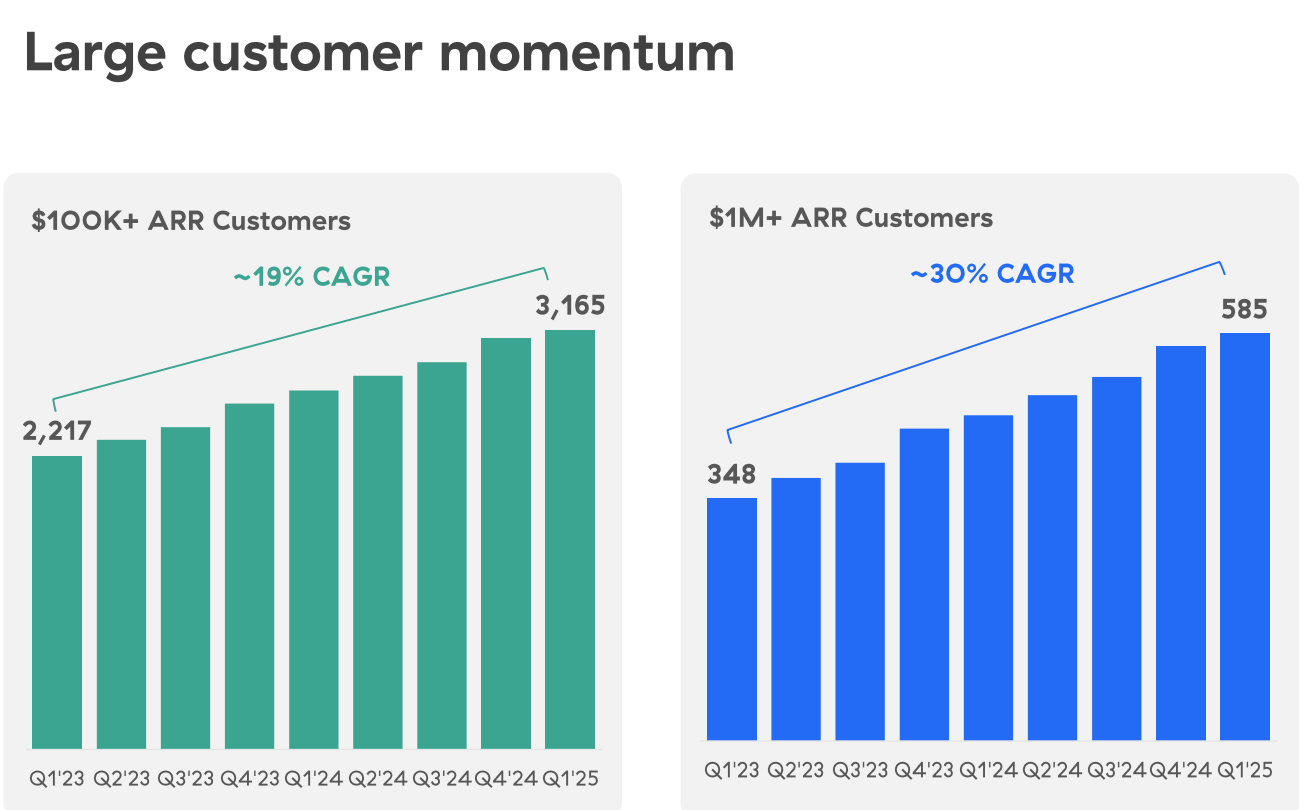

Large customer retention: 100K+ large customers rose to 3,165, while 1M+ large customers rose to 585, a 30% CAGR from Q1 2023.

Company Outlook.

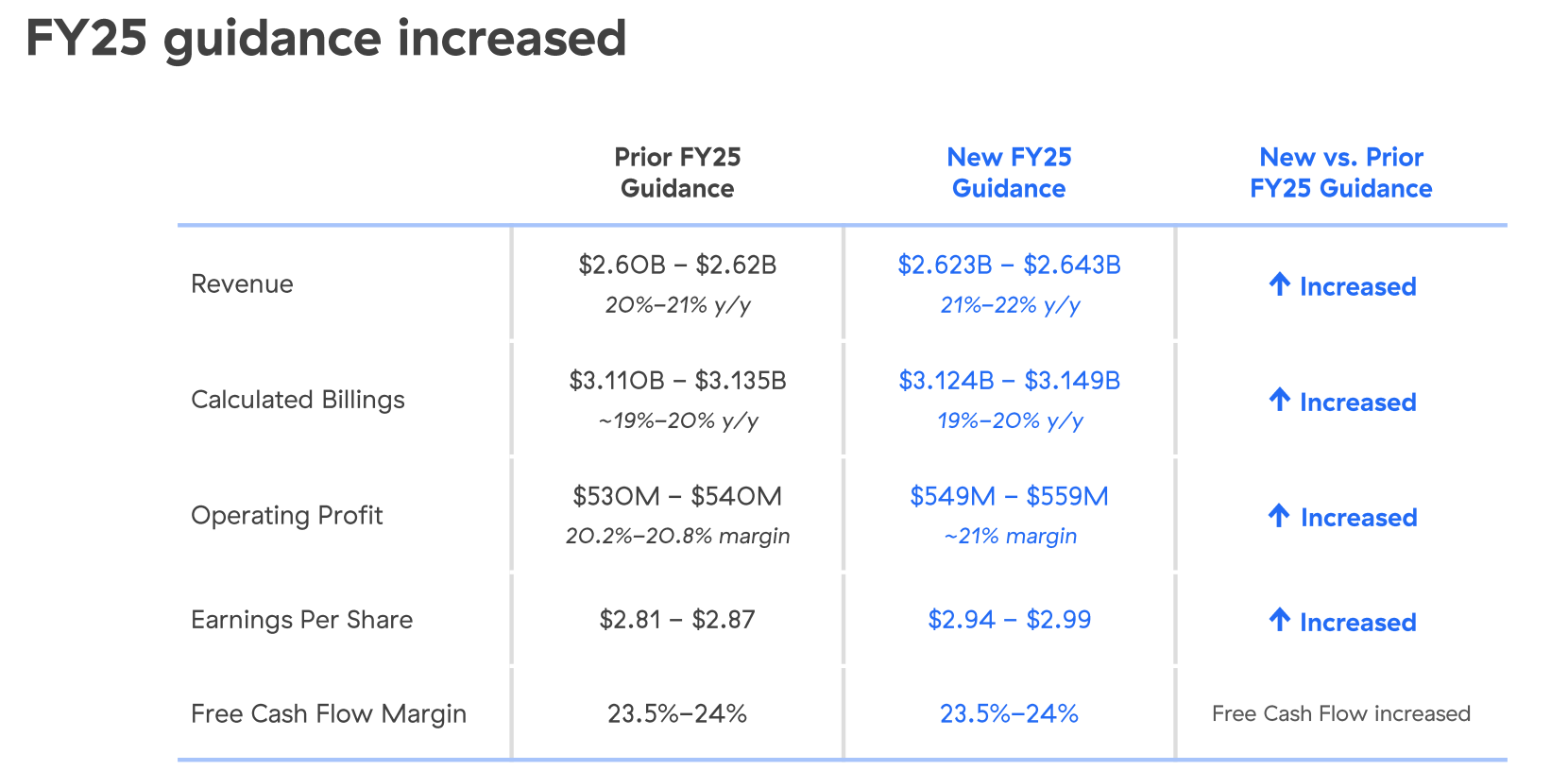

For Q2 of fiscal 2025, the company expects operating income to be in the range of $633-$635 million, essentially unchanged from the market's estimate of $634 million; adjusted EPS is expected to be 68 cents to 69 cents, below the market's estimate of 70 cents

For the entire fiscal year 2025, the company raised its full-year revenue estimate to $2,623 million to $2,643 million, compared to $2,600 million to $2,620 million previously; adjusted EPS is expected to be $2.94 to $2.99.

Investment highlights

The company's confidence in future growth is still good, but it also reflects the market's caution about the rate of earnings growth in the short term, mainly

Increased competition in the market: the cybersecurity sector is highly competitive, especially with challenges from other cloud security companies.

Macroeconomic factors: Uncertainty in the global economy may affect corporate spending on cybersecurity.

Technology transformation: while AI presents new opportunities, how effectively companies integrate these technologies to enhance product competitiveness will have a direct impact on future performance.

Integration with CrowdStrike

Zscaler's partnership with $CrowdStrike Holdings, Inc.(CRWD)$ is designed to enhance security operations and provide more advanced threat detection, response, and risk management through artificial intelligence and zero-trust policies.Included:

Falcon Foundry Integration: this integration enables Zscaler users to leverage threat intelligence from the CrowdStrike Falcon platform to facilitate threat sharing and customized SOAR (Security Orchestration, Automation and Response) workflows.

Risk Quantification and Visualization: With the combination of Zscaler Risk360 tools and the CrowdStrike platform, security teams can gain insight into their cybersecurity risk factors.This integration provides detailed event, asset and vulnerability data to help organizations quantify and visualize their cyber risk.

Adaptive Access Policy Enforcement: CrowdStrike enhances Zscaler's adaptive access engine to provide proactive security event signaling from the Falcon platform.This level of integration makes zero-trust access control based on device state more robust.

Integration with Okta

$Okta Inc.(OKTA)$ a leader in identity management and single sign-on solutions, has partnered with Zscaler to focus on the following areas:

Authentication and Access Control: By combining Okta's authentication capabilities with Zscaler's zero-trust architecture, organizations are able to achieve stronger user authentication and access control, ensuring that only authenticated users have access to sensitive data and applications.

Simplify the user experience: This integration is also designed to enhance the user experience, enabling users to enjoy a seamless and secure login experience when accessing different applications.

About Cost Management and Profitability

The company emphasized its effective cost management strategy, including smart cost control through employee stock options, and that while it expects to continue to post a net loss in the short term, it will be profitable in the long term through continued investment in technology innovation and market expansion.In addition, the company cited strong free cash flow performance that will support its future growth plans.

Comments