With the recent flurry of software growth stock earnings reports, many of which jumped after the results were announced, and most of which have lost half or more of their highs in market capitalization over the past two years in a high interest rate environment, there may be several reasons for the reversal in market sentiment:

Earnings reversal.The main commonality is AI's improvement in company efficiency, especially those where AI can directly lead to revenue improvement, as evidenced by earnings growth rebound, guidance improvement, etc., and often these are also the ones with the biggest Surprise, and investors will be more likely to buy into them;

Billing in anticipation of interest rate cuts.Growth stocks are more sensitive to interest rates, and now that we're entering a cycle of rate cuts, these once-popular names from the low-interest-rate era are back in favor with risk capital;

AI transitions.Because the chip industry headline stocks have risen quite high, the market is also starting to look for the next target sector (concept), software is the important window of realization.

Accumulated short positions have basically been closed and bottoming has been completed, with institutional investors coming back to re-establish their positions.

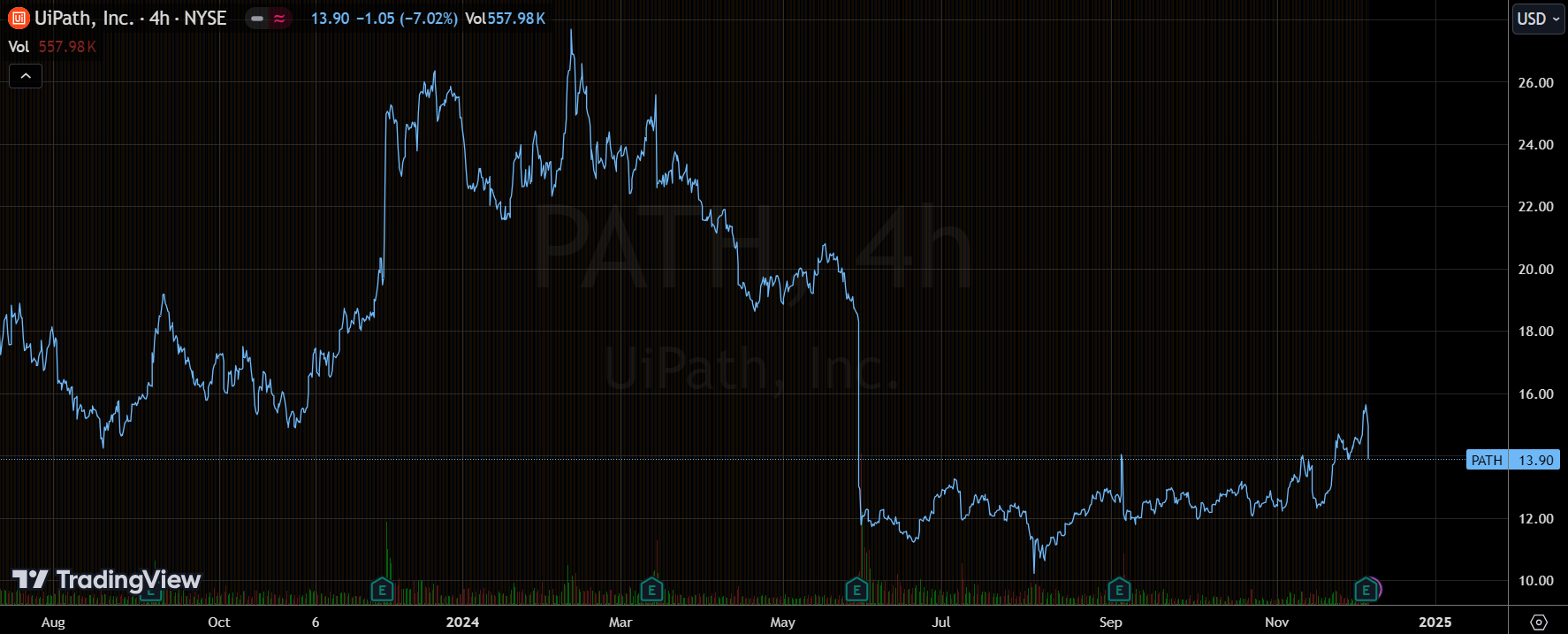

$UiPath (PATH)$ Financials and Market Expectations

Revenue of $347 million was realized in Q3 FY2025, up 10.1% year-over-year, beating market expectations of a 6.7% increase.

Adjusted earnings per share (EPS) came in at $0.07, again above expectations.

Annual Recurring Revenue (ARR) reached $1,508 million, an increase of 21% year-over-year, with a record number of customers with ARR over $1 million, as the company continues to strengthen its competitiveness in the large customer market.

Among them

Software Robotics (RPA): This segment continues to dominate the company's revenue stream and remains the strongest source of revenue, albeit at a slower rate.

Cloud Services: Cloud ARR grew by 65% year-on-year and now accounts for more than half of total ARR, reflecting the success of the company's "cloud-first" strategy.

Professional services and consulting: although more volatile, revenue from this segment also rebounded as customer demand increased.

Analysis of performance

Strong customer demand: Demand for automation solutions continued to rise as organizations accelerated their digital transformation, enabling UiPath to attract more new customers.

Successful implementation of cloud strategy: The rapid growth of cloud services demonstrated the company's significant progress in product delivery and service flexibility, enhancing customer stickiness.

Cost control and improved operational efficiency: Sales and marketing expenses rose, but the company improved overall profitability by optimizing operational processes.

Corporate Challenges

Long-term contracts and customer retention: High retention rates and long-term contracts will provide security for future revenues.

Competitive market dynamics: As competition intensifies in the automation market, companies will need to continue to innovate to stay ahead of the curve.

Technology Integration and ROI: Integration of new technologies such as generative artificial intelligence will be an important driver of future growth.

The company still has to face challenges such as rising cost of sales and increased competition in the market.

Outlook

Management expects to continue to grow at a CAGR of approximately 20% in FY2025 and emphasizes that the Company will continue to focus on enhancing customer experience and operational efficiencies in response to changing market demands.Meanwhile, the company plans to further expand its cloud services capabilities to keep up with industry trends.

So far this year, though, the ticket is down more than 39%.

Comments