Tesla might replicate NVIDIA's movement pattern from this week next week.

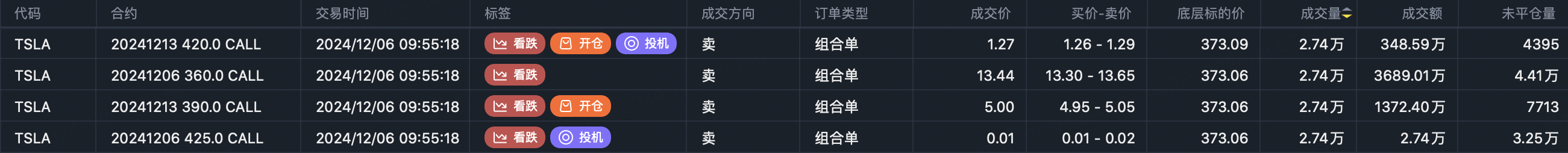

Due to Thursday's failure to break through, expectations for call and put options began to diverge.

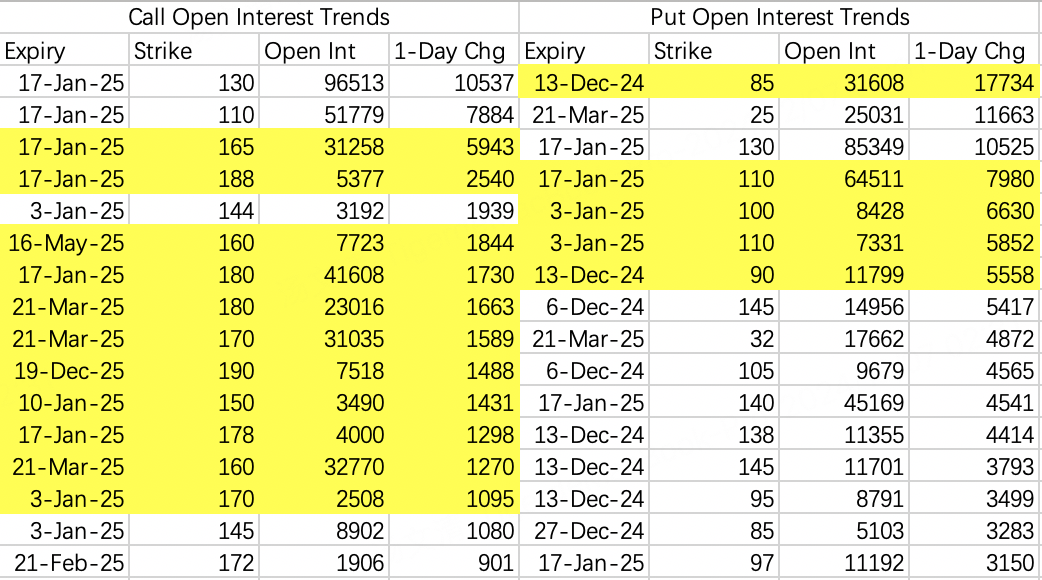

Call options are targeting above 160 for January, while put options have started partly betting on 110:

Why didn't the stock price continue breaking through on Thursday?

Because the market's biggest short position holder, the institution doing weekly sell calls, was forced to roll positions:

They likely expected a pullback this week, so they sold 141 calls at the borderline, but Wednesday's breakthrough forced them to roll to next week, selling calls at a higher 148. After these "shorts" disappeared, the stock price stalled Thursday and pulled back after Friday's opening.

This script is very familiar. Last time with $MicroStrategy(MSTR)$, it was the same operation - the day after institutions massively closed their sell calls, the stock showed a high open but low close pullback pattern:

Actually, we could make a worse speculation - the institutions selling calls were targeted. Because shortly after Wednesday's opening, there was a massive 100,000 contract opening of sell put 141 $NVDA 20241206 141.0 PUT$ , which closed at Thursday's opening, showing very precise timing.

Next week, NVIDIA might continue range-bound trading between 135-148, requiring close attention to put option betting expectations.

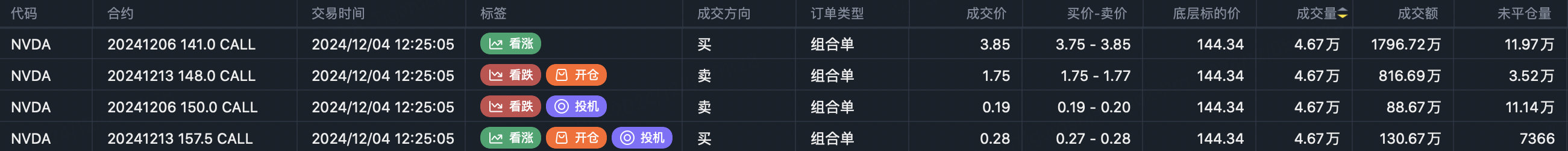

This week's NVIDIA short squeeze might happen to Tesla next week.

Next week's institutional bull spread roll involves selling 390 calls and buying 420 calls:

Sell $TSLA 20241213 390.0 CALL$

Buy $TSLA 20241213 420.0 CALL$

With Tesla currently at 377, just 3.4% from the sold strike price of 390, institutions are likely to get squeezed next week. So on Friday, we can start with sell put $TSLA 20241213 340.0 PUT$ , and when it rises next week, check for institutional position closing the next day before doing sell calls.

Some might wonder why not buy calls if it's going up? I previously bought calls $TSLA 20250117 400.0 CALL$ , using a buy call + sell put strategy. If it rises next week, I'll close the call position; if not, I'll close anyway.

I don't recommend buying weekly calls specifically for next week, because buyers are betting on events that haven't happened, while sellers are betting on events that have already occurred - the latter is clearly more stable.

Comments

Great article, would you like to share it?