$Oracle(ORCL)$ announced its financial results for Q2 FY2025 on Dec. 9. The company was down more than 9% after hours due to miss Q2 results and weaker-than-expected guidance, and was one of the relatively worse-performing cloud services companies in this earnings season.

Key Financials

Financial Overview

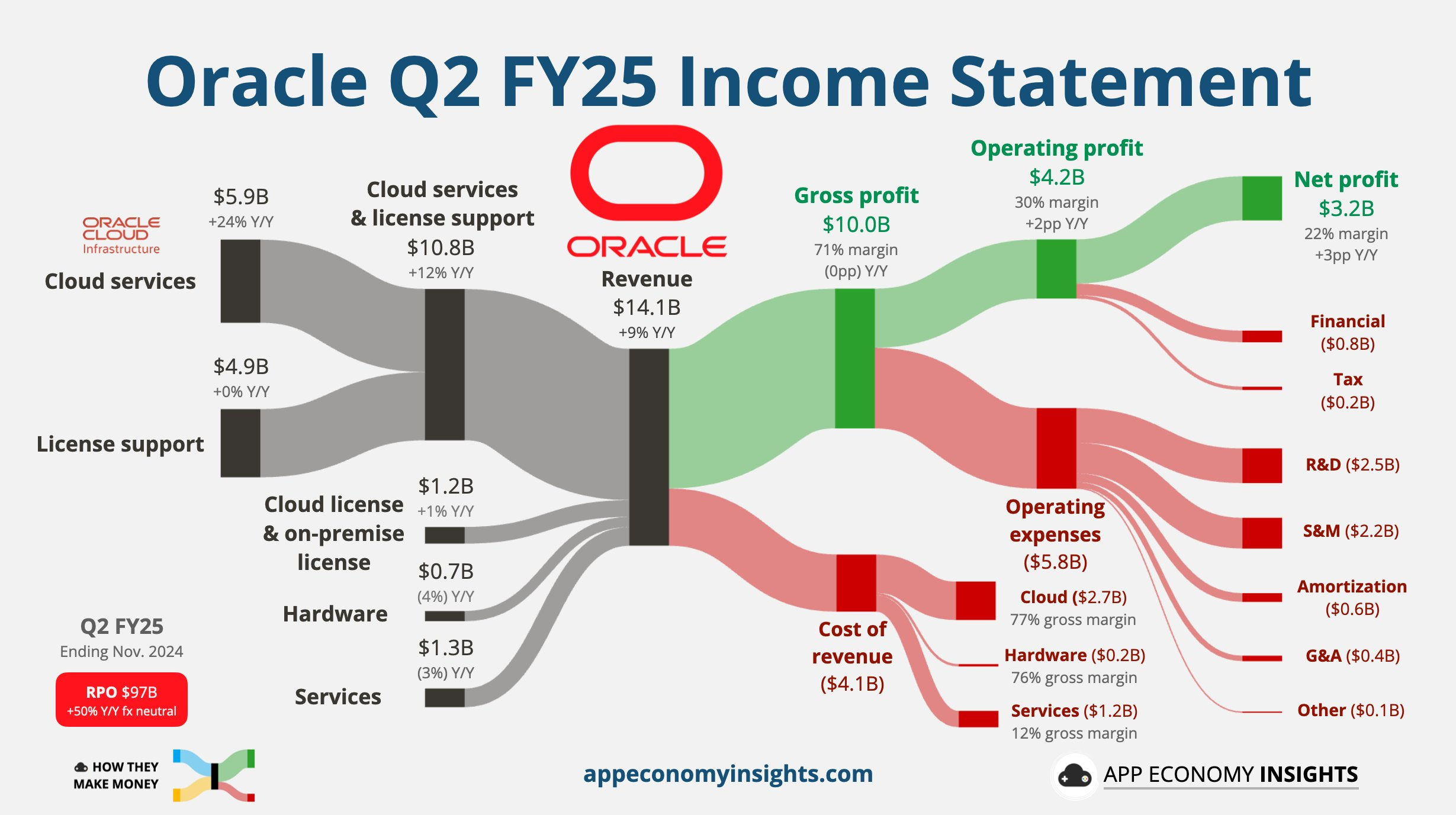

Operating income was $14.06 billion, up 9% year-over-year, slightly below market expectations of $14.12 billion.But the growth rate accelerated compared to the previous quarter's 7% year-over-year increase.

Adjusted EPS came in at $1.47, up 9.7% year-over-year, again below the market's estimate of $1.48, compared to 17% year-over-year growth in the prior-year quarter.

Business Performance by Segment

Cloud Services and Licensing Support: revenue for this segment was $10,806 million, up 12.1% year-over-year, up from 10.2% in the prior-year quarter.

Cloud licensing and local licensing: revenue was $1.195 billion, up 1.4% year-over-year, down from 7% in the prior-year quarter.

Cloud services: total revenue of $5.9 billion, up 24.3% year-over-year, slightly below analysts' expectations of $6.0 billion and up 21% year-over-year in the prior-year quarter.Of this, cloud application (SaaS) revenue was $3.5 billion and revenue from OCI, the cloud infrastructure (IaaS) business, was $2.4 billion.

Company outlook

For the 3rd quarter of fiscal 2025, Oracle expects revenue to grow 7% to 9% year-over-year, with a median of about $14.3 billion, which is below market expectations of $14.65 billion.

Adjusted EPS is expected to be in the range of $1.50 to $1.54, again below market expectations.Catz also said it expects cloud revenue to exceed $25 billion for the fiscal year, which is in line with Wall Street's expectations.

Earnings analysis

Oracle's results for the quarter failed to meet market expectations for a number of key reasons:

Increased competition in the market: although cloud infrastructure revenue grew 52%, the overall performance failed to be as strong as investors expected, which could be attributed to market share pressure due to the strong performance of competitors such as Amazon and Microsoft in the market.

Conservative guidance: The company's guidance for the coming quarters is conservative, especially in terms of EPS and revenue, which makes investors concerned about the company's growth prospects in the near term.

Impact of the economic environment: Uncertainty in the global economy may affect corporate IT spending decisions, leading Oracle to face greater market challenges.

Cost control and profitability: Q2's profitability growth rate was not as strong as Q1, cost management and maintaining profitability may become an important indicator for investors to focus on when the market is under competition.

Weak cloud licensing and local licensing revenue growth.Oracle's cloud licensing and local licensing revenue grew only 1.4% in Q2, well below the 7% growth in the previous quarter.The weak performance of this business line could be attributed to the traditional licensing model taking a hit as customers move to more flexible and cost-effective cloud service solutions.

High investor expectations.Prior to the release of the financial results, market expectations for Oracle's performance were generally high, with investors expecting it to significantly exceed expectations.However, the actual results failed to meet these high expectations, and this "gap" led to sharp fluctuations in the stock price after the announcement.

Comments