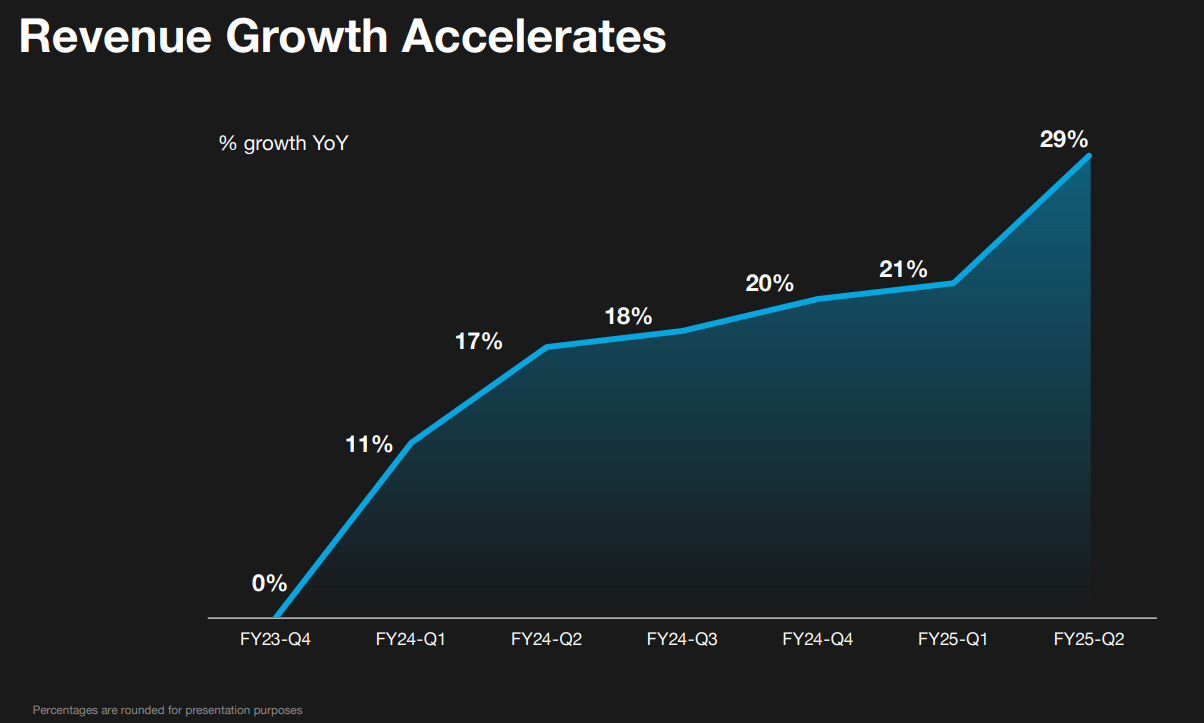

$C3.ai, Inc.(AI)$ which gets the best-sounding code in the market, announced its Q2 FY2025 results after the bell on Monday and jumped more than 20% at one point in after-hours trading, topping expectations and raising full-year guidance, also thanks to continued strength in AI-related spending.Q2 results exceeded expectations and raised full-year guidance, also thanks to continued strength in artificial intelligence-related spending.

At the same time, the Company announced a significant expansion of its strategic alliance with $Microsoft (MSFT)$ Azure, which will significantly increase the velocity of the Company's sales and expand market access.And the company's partner ecosystem continues to expand, notably including major players such as $Google (GOOG)$, $Amazon (AMZN)$ AWS and Microsoft.

Financial Performance

Total operating income was $94.3 million, an increase of 29% year-over-year, exceeding market expectations of $91.3 million, with growth primarily driven by an increase in subscription revenue to $81.2 million, up 22% year-over-year

Non-GAAP gross profit was $66.3 million, with a gross margin of approximately 70%;

Non-GAAP operating loss was $17.2 million, better than the expected $26.7 million.

In terms of business segments, C3.AI's subscription services continued to be the primary source of revenue, contributing 86% of total revenue.Despite strong overall revenue growth, subscription revenue grew at a slightly lower rate than analysts' expectations, which may reflect increased competition in the market or changes in customer demand

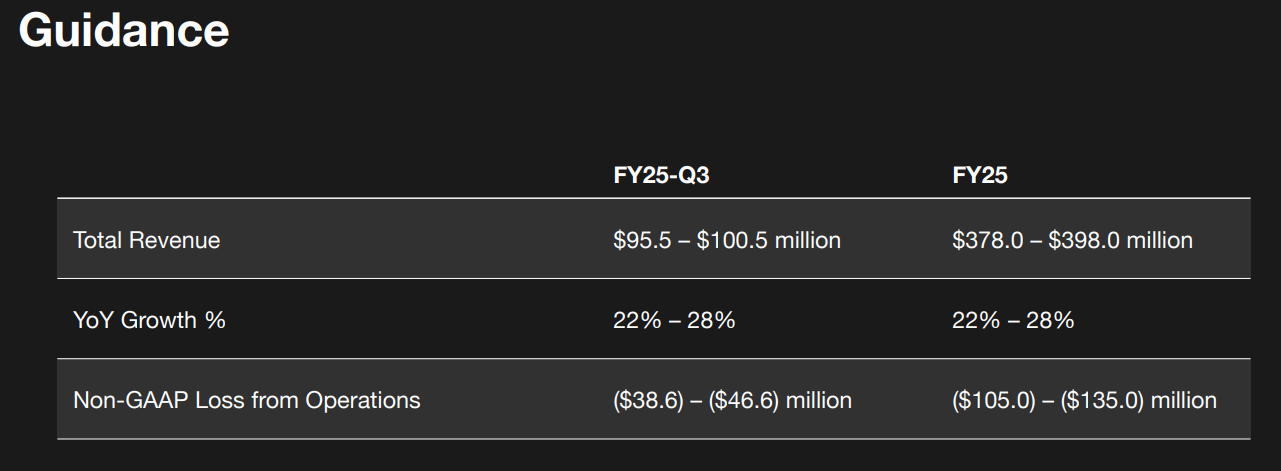

Outlook

The company now expects fiscal 2025 revenues to be in the range of $378 million to $398 million, up from the previous range of $370 million to $395 million.Analysts had previously forecast full-year revenue of $382.6 million.

Looking ahead to the third quarter, C3.ai expects revenue to be in the range of $95.5 million to $100.5 million, with the midpoint of $98 million being slightly higher than the $97.5 million estimate.

Earnings Analysis

C3.AI's results, while exceeding expectations overall, still have some concerns.

First, while total revenue and gross margin performance exceeded expectations, the growth rate of subscription revenue, which investors are concerned about, is slowing.

Increased market competition: as more and more companies enter the AI field, C3.AI faces greater market pressure.

Changes in customer demand: companies' cautious approach to technology investment may have led to less-than-expected demand for subscription services.

The CEO noted that despite lower-than-expected subscription revenue growth, overall demand remains strong, and the company is aggressively expanding its customer base and investing in new products such as generative AI to drive future revenue growth.In addition, market demand for enterprise AI solutions continues to rise, which supports the company's long-term growth.

In addition, cost control and profitability are critical

Increased investment in sales and marketing: the company's investment in generative AI products may have impacted profitability in the short term, but in the long term, it will help increase market share and brand awareness

The CFO stated that the company is implementing strict cost control measures to reduce operating expenses.It is expected that by optimizing operations and improving efficiencies, C3.AI will gradually improve profitability over the next few quarters.Management also reiterated its expectation of an overall operating loss in fiscal 2025 and stated that it will continue to focus on a path to sustainable profitability.

Alliances with large companies

Microsoft's strategic alliance with C3 AI has a lot of potential for the company to make it easier for organizations to adopt and deploy C3 AI apps by establishing C3 AI as the preferred provider of AI apps on Azure and creating a Microsoft-scale go-to-market engine.

Comments