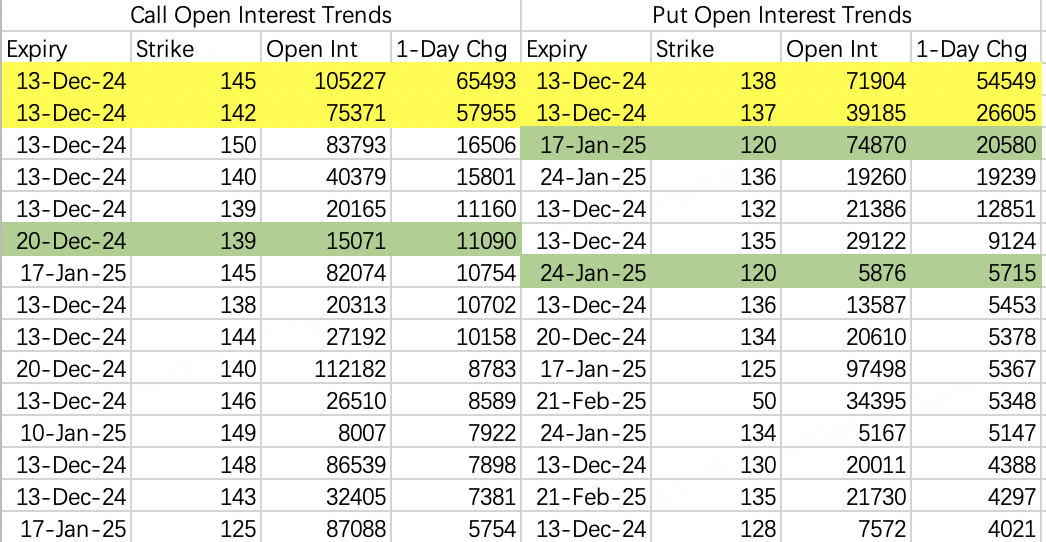

For those holding shares, consider hedging with sell calls in the near term. Based on opening positions, this week's closing price should be between 137-145.

On Monday, NVIDIA fell 2% at open due to alleged violations of China's anti-monopoly laws. This has little real impact - it's just an excuse for a decline, like being fired for entering the office left foot first.

However, the pullback isn't groundless, so hedging is advisable.

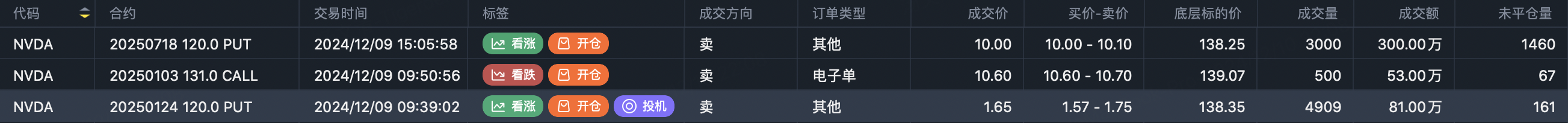

Monday's options activity was dominated by sellers for both calls and puts.

This week's 138 and 137 puts were mainly sold, and two January 2025 120 puts $NVDA 20250117 120.0 PUT$ and $NVDA 20250124 120.0 PUT$ were also primarily sold.

However, as we've mentioned before, overall trend depends on position opening rather than direction, meaning the market is now targeting 120 on the downside.

The severity of this pullback is unknown, with no large-scale put buying yet seen. Following the sellers' lead makes sense - if you don't mind assignment, selling the 120 put $NVDA 20250117 120.0 PUT$ is quite attractive.

On the call side, sellers also dominated.

145 calls (65K contracts) and 142 calls (57K contracts) ranked first and second in new positions - a combination order as our familiar institution rolled positions again.

After being forced to cut losses and roll positions mid-last week, when Monday's gap down appeared, the institution immediately sold 142 calls $NVDA 20241213 142.0 CALL$ and bought 145 calls $NVDA 20241213 145.0 CALL$ to hedge. Sincerely hope they won't face margin calls this week.

December 20 139 calls $NVDA 20241220 139.0 CALL$ saw large sell orders, indicating strong bearish sentiment.

It's good to understand market participants' attitudes, but follow with caution. Using sold calls to short can lead to short squeezes.

Some might ask why not buy puts to short. Because the trend isn't clearly defined yet, buying puts would waste time value.

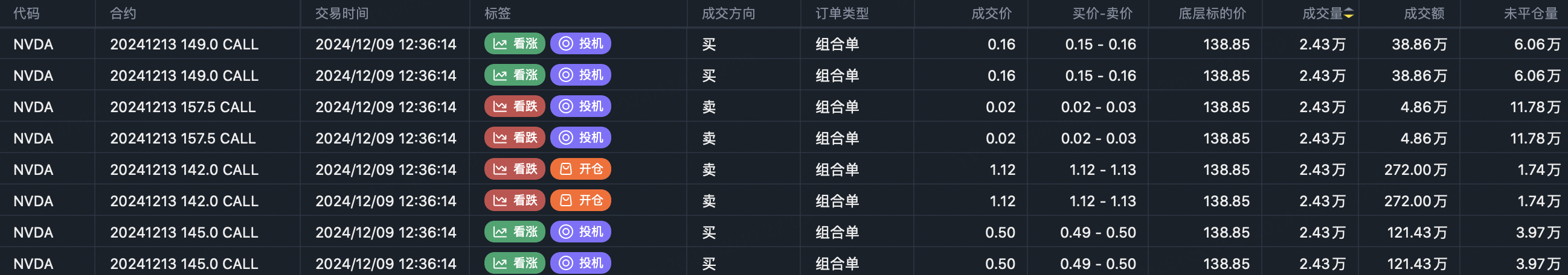

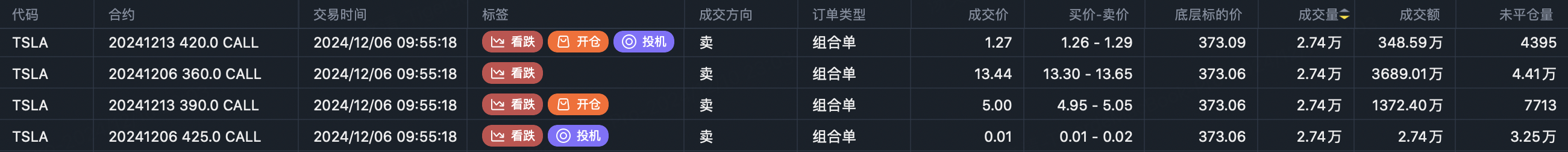

Monday's top Tesla call position was the December 20 400 call $TSLA 20241220 400.0 CALL$ with 31K contracts, mostly sold.

The institution that sold 390 calls on Friday held through Monday's rise without closing, but Tuesday is uncertain. Remember - when institutions close positions, stock prices pull back. If they close Tuesday, Wednesday could be good for selling calls.

Tesla should close between 365-420 this week.

Lastly, regarding Chinese ADRs, the large $YINN 20260116 27.0 CALL$ position hasn't exited - something to think about.

Comments