$Broadcom(AVGO)$ 🔺📈🅱️ṳ̈ l̤̈l̤̈ ï̤ s̤̈ ḧ̤ 📈🐂

📊 $AVGO: Riding the Fib Waves 🌊🚀

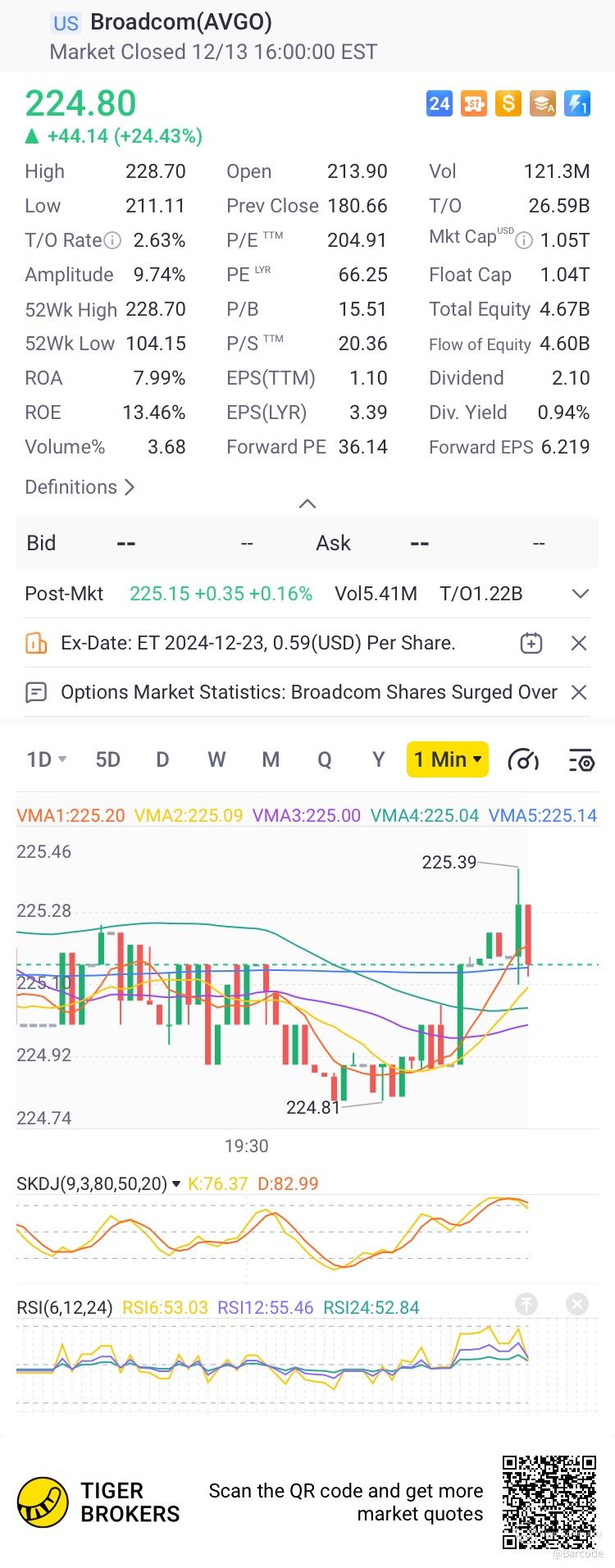

🔑 Price Action: Testing above $220.70 ✅

🔹 Next Stops on the Fib Ladder:

• $225.70 (261.8%) 🎯

• $233.56 (300.0%) 🔥

• $246.27 (361.8%) 📈

Momentum heating up, let’s see if it can hold and climb! 🔥💥

Happy trading ahead❣️ Cheers BC 💰📈🚀🍀🍀🍀

@Tiger_comments @TigerStars @TigerPM @Daily_Discussion @TigerPicks @TigerGPT

💰Stocks to watch today?(13 Mar)

1. What news/movements are worth noting in the market today? Any stocks to watch?

2. What trading opportunities are there? Do you have any plans?

🎁 Make a post here, everyone stands a chance to win Tiger coins!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments

Great article, would you like to share it?

Great article, would you like to share it?

Great article, would you like to share it?

Great article, would you like to share it?

Great article, would you like to share it?

The recent movement in Broadcom (AVGO) stock can be attributed to several factors:

Price Target Raises: Wells Fargo raised their price target on Broadcom from $170 to $230, while Bernstein raised it to $250 from $195. These upward revisions in price targets indicate increased optimism about the company's future performance.

Strong Earnings and Outlook: Broadcom reported better-than-expected earnings and issued a positive outlook, driven by robust AI-driven sales growth. The company's fiscal 2024 AI revenue more than tripled, fueled by its AI XPUs and Ethernet networking portfolio. CEO Hock Tan expressed confidence in significant AI opportunities in the coming years, further boosting investor sentiment.

Technical Breakout: The stock is poised to break out from an ascending triangle pattern, signaling a continuation of its longer-term uptrend. The bars pattern tool suggests an upside target of around $315. Investors are advised to monitor key support levels near $185 and $140 during potential pullbacks.

As a result of these positive developments, Broadcom stock has experienced a significant increase, with the price currently at $219.75, up 21.64% for the day. This is on track for a record high close and the largest intraday percentage increase since March 19, 2020.

Please note that the movement in stock prices can also be influenced by stock capital flow. If there are no significant news articles available in the context, it is possible that the movement is primarily driven by changes in the flow of investments.

It's important to remember that stock prices are subject to various market factors and can be volatile. Investing in stocks involves risks, and it's always recommended to conduct thorough research and consult with a financial advisor before making any investment decisions.

Sources:

Broadcom price target raised to $230 from $170 at Wells Fargo

Broadcom price target raised to $250 from $195 at Bernstein

Watch These Broadcom Price Levels as Stock Soars on Strong AI Sales Growth

Broadcom Up Over 21%, on Track for Record High Close and Record Percent Increase

Daily Scoop🍨: AI Springs Broadcom (AVGO) Stock Upwards! 💪🚀🔥