Unexpectedly, after six months, we witnessed another earnings report squeeze on Friday with $AVGO$. With two cases now in hand, let's analyze and summarize the characteristics of this special trading pattern for future reference.

Why should we master identifying this pattern? Because of the massive profits. The Friday closing末日call $AVGO 20241213 215.0 CALL$ saw a 3489% increase - this is true small-bet-big-return trading.

The beauty of this pattern is that after Friday's surge, the stock continues to rise on Monday. If you missed Friday's rally, don't worry - you can enter at any time during trading hours, as the stock price will continue to rise next week.

What is an Earnings Report Friday Squeeze?

This is my informal name for the pattern.

The pattern name contains four elements: earnings report, Friday, squeeze, and Friday squeeze.

The earnings report could be replaced with other long-term positive news, though all cases I've closely tracked involved earnings reports. Since earnings reports occur quarterly, they're the most common positive catalyst that can trigger this pattern.

Friday signifies options expiration day, when in-the-money options are exercised. In-the-money call options are those with strike prices below the stock price. For example, with Broadcom closing at 224, all call options expiring that week with strikes below 224 would be exercised or assigned.

For newcomers: While buying options gives you rights without obligations, if you don't close your position before expiration, in-the-money options will be settled as stock in your account. Before this happens, brokers check if your account has sufficient margin to take delivery, forcing liquidation if not.

Options trading involves end-of-day settlement. Brokers check margin requirements for both buyers and sellers. Call sellers effectively short 100 shares and must maintain sufficient margin to deliver -100 shares. Retail investors typically face random liquidation, while market makers usually hedge by buying the underlying stock.

This leads to the third element - the squeeze. As the stock price rises and more options become in-the-money, market makers who sold options need to buy shares to hedge. When multiple strike prices become in-the-money in succession, market makers must continuously buy shares, driving the price higher, which triggers more options buying, creating a self-reinforcing upward spiral.

Why is Friday squeeze a separate element? After Friday's squeeze, many exercised options must be settled after hours - buying shares for exercised calls and selling for exercised puts. This forces many shorts to cover on Monday, creating another up-trending day.

Specific Characteristics

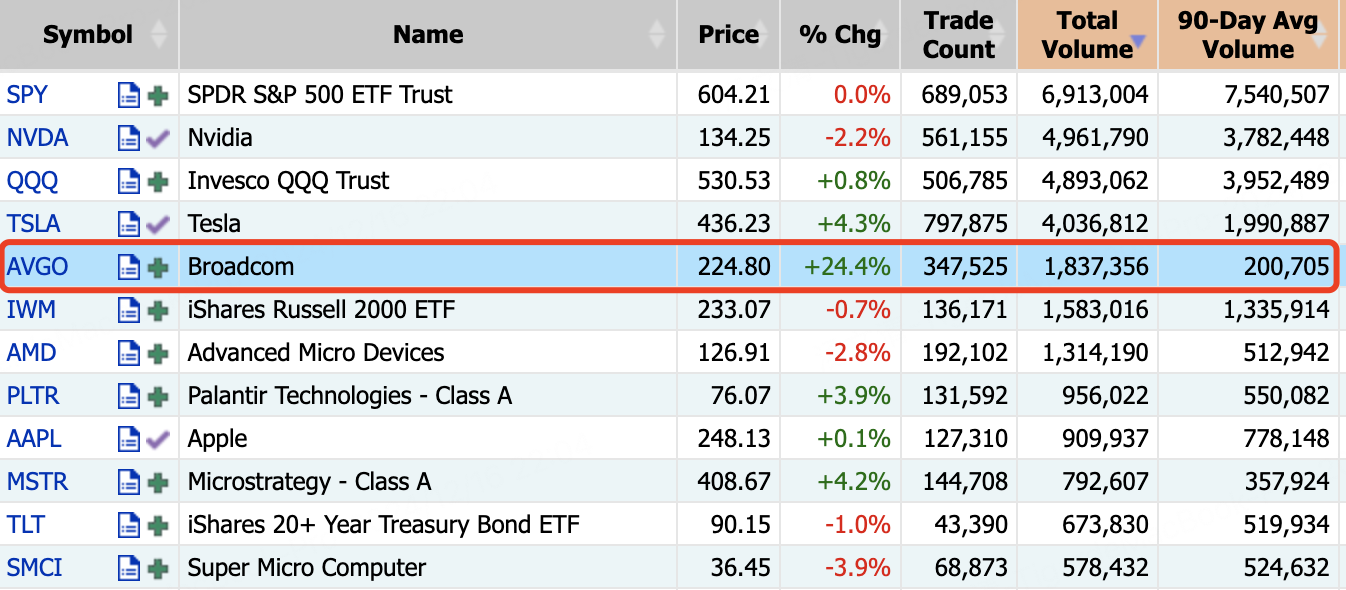

How much volume constitutes "heavy buying"? On December 13, AVGO ranked 5th in US options market volume at 1.83 million contracts, versus normal volume of around 200,000 contracts.

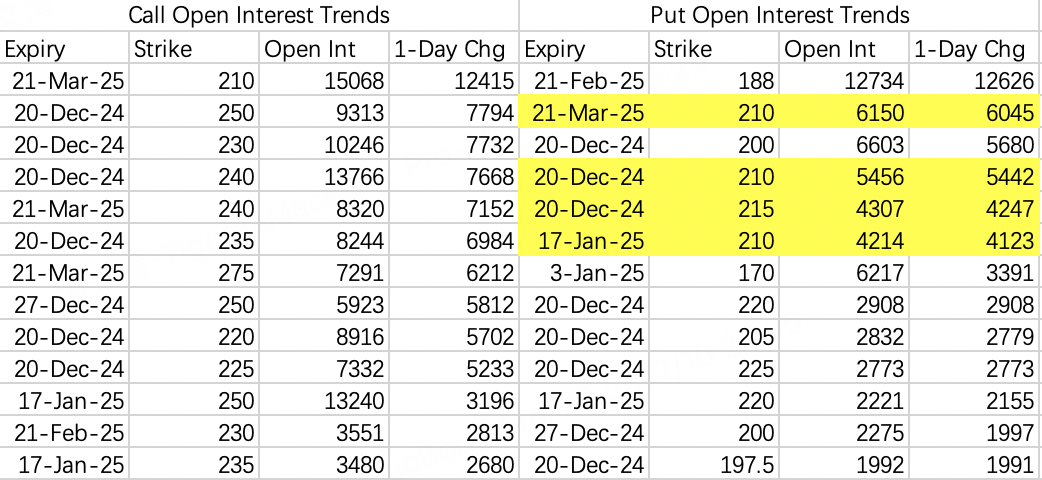

Individual options chain volume is 10-50 times open interest. For example, the December 13 220 calls traded 77,100 contracts versus 2,875 open interest.

Next week expiration shows lower but still elevated volume - typically 10x ratio.

Setting aside squeeze dynamics, heavy options volume indicates aggressive stock buying, given the stock's superior liquidity and 30-50x higher trading volume.

Generally, if volume explodes before 1:30 PM, an earnings Friday squeeze becomes likely. Brokers typically check client risk between 2-3 PM, when the squeeze begins.

Previous Cases

The last earnings Friday squeeze was NVIDIA in May, pre-split. I confidently predicted Friday's price movement but didn't anticipate the squeeze.

Similarly, the stock went parabolic starting at 1:40 PM.

As a top-5 options volume stock, NVIDIA also saw 10x+ trading volume to open interest that day.

After Friday's squeeze and exercise settlement, Monday brought another squeeze in perfect sequence.

Whether post-Monday movement repeats depends on broader market conditions.

Even Monday's up-trend is highly probable but not guaranteed - black swan events can happen over weekends. All trading carries risk.

AVGO Price Outlook

While most focus on upside targets for surging stocks, I'm more interested in where shorts expect downside. Heavily rising stocks always attract shorts, but when even bears see limited downside, upside becomes a matter of time.

Friday's put opening details show an average bearish target of 210 - impressive.

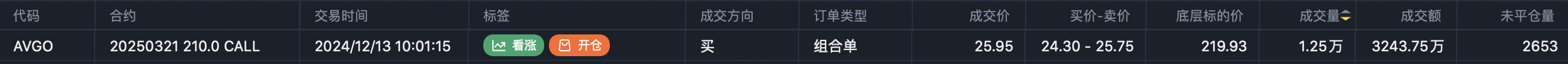

Institutional long-term call rolling saw $AVGO 20250321 210.0 CALL$ volume of 12,500 contracts, up from previous 146 strike positions. So writing 210 puts isn't losing strategy.

In summary, this special pattern requires several key elements: long-term positive news, Friday timing, options volume 10x+ open interest, and stock gapping up then surging after 1:40 PM.

Meeting these conditions and holding calls through Monday likely captures two squeezes: Friday's and Monday's.

Comments

Good