Core logic: The commercialization prospects, monetization paths, and timetables are different.

Stakeholder disclosure: I hold the common stock but do not intend to hold it for a long time.

Recently, quantum computing stocks have risen sharply. For example, $Amazon.com(AMZN)$ launched the "Quantum Embark" service, and $Alphabet(GOOG)$ 's "Willow" quantum chip and other new developments have heated up this field. However, quantum computing cannot be commercialized on a large scale so quickly. $Alphabet(GOOGL)$

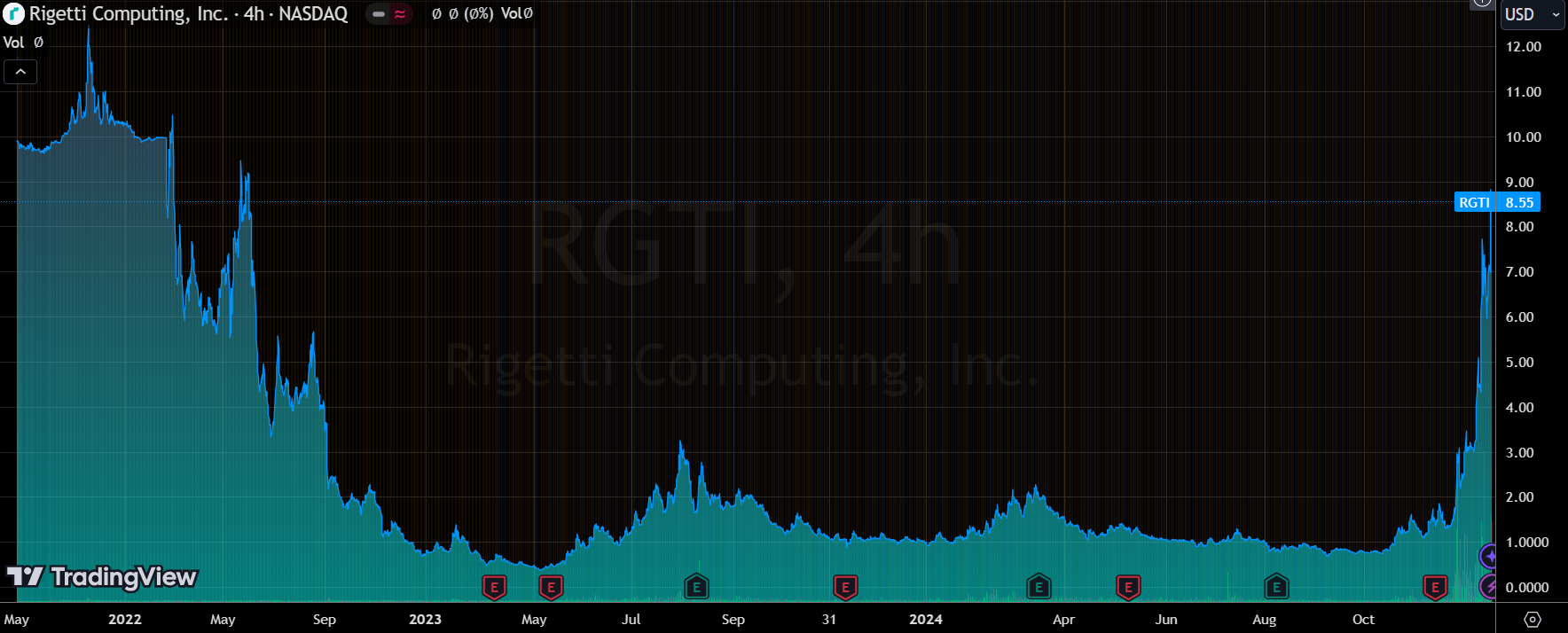

Take $Rigetti Computing(RGTI)$ that I am following. Although it has also risen a lot following this market trend, it still has many problems.

Technically, it is extremely difficult to increase the number of qubits while ensuring accuracy. The previous products of RGTI were not good in terms of fidelity. Now, it has developed a new modular platform. The 9-qubit chip looks passable, and its speed and accuracy are somewhat satisfactory. But it is really hard to say whether the 36-qubit platform to be launched next year will work.

Commercially, it is not so good either. Most of its income depends on government research subsidies. Not only is it unstable, but it also affects profits.

Quantum computing is not meant to replace the CPUs and GPUs we use now. They are not doing the same thing at all. Quantum computers are indeed powerful in certain specific applications, such as drug research and development, but in many aspects, they are still inferior to traditional computers. For example, for RGTI, it is very difficult to expand the platform to more than 9 qubits while ensuring accuracy.

The superconducting qubit technology chosen by RGTI also has flaws. Compared with other technologies, it has a short coherence time and poor accuracy, and it also needs to work in an ultra-cold environment. However, this technology is easy to control and theoretically can be integrated well with traditional computing.

From a financial perspective, RGTI has a market value of 1.7 billion US dollars, but it only has about 200 million US dollars in cash. It just raised 100 million US dollars last month. I think issuing more stocks at the current stock price is a good way to get more money and also reassure shareholders. In the past two or three years, RGTI diluted a lot of equity to raise only 80 million US dollars. If it dilutes by 20% at the current price, it can get 340 million US dollars, which is enough to last for three years.

In general, RGTI is still far from making a salable product. The entire quantum computing industry is still in its infancy, and Alphabet's Willow is also far from ready. Quantum computing will definitely not replace CPUs and GPUs in a short time, and it will only be useful in specific fields like drug research and development for a long time in the future. So I think the current sharp increase in RGTI's stock price is only temporary. My rating for it is "sell". If it can do a good job in product commercialization, then the rating may be upgraded. Although it has cloud services that make it more convenient for everyone to use, it only earns 13 million US dollars a year. Compared with the potential 7.5 billion US dollars market for the entire quantum computing industry, it is still a long way off.

So currently, companies with quantum chips as their main business, no matter how much they increase, can only follow the trend of meme stocks.

And don't forget that emerging technology companies like RGTI are often listed through SPAC, which already has a lot of valuation moisture and speculative large investors. Therefore, there will be pressure at the $10 position.

Comments