$Birkenstock Holding plc(BIRK)$ shares rose to a four-month high in premarket trading after the company posted solid fiscal fourth-quarter results on the back of the popularity of its closed-toe clogs and double-digit growth in all regions.

Despite being "famously ugly," the company saw 90% of its growth come from existing B2B retail stores, suggesting the channel space is doing well, given its historic brand and loyal customer base, in addition to excellent sales of clogs.

But with the overall market selloff following the Fed's ultra-hawkish interest rate resolution that day, it was the company's shares that ended up closing up around 1%.

Financial data and market expectations

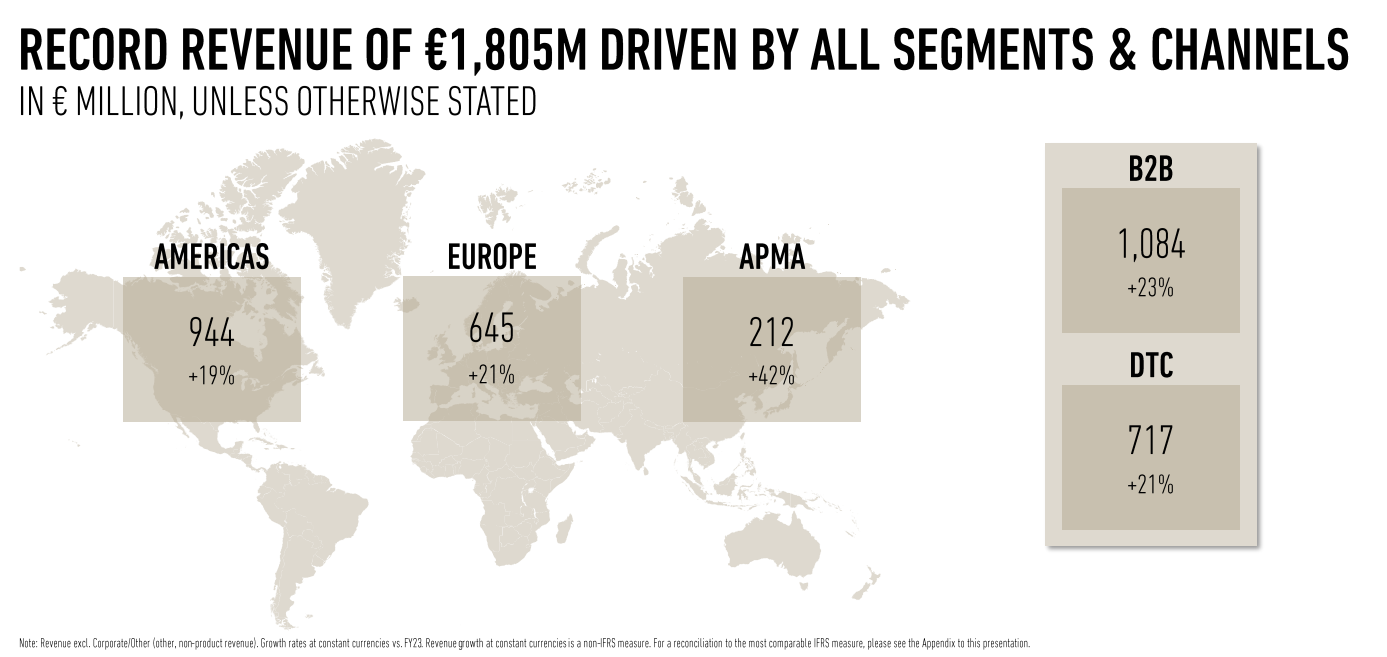

Q4 revenue was €455.8 million, or approximately $478.27 million, exceeding the market consensus estimate of €439.2 million by €28.1 million

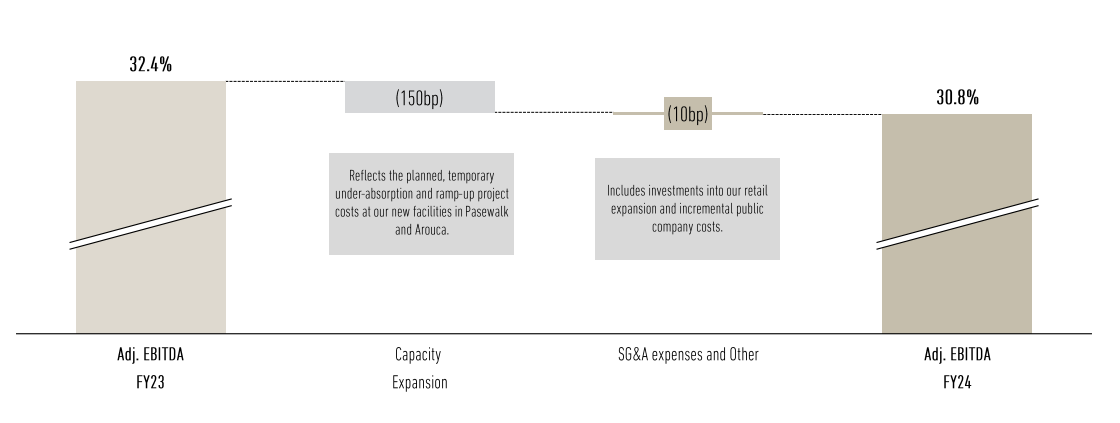

In addition, adjusted EBITDA came in at €125 million, again beating market expectations of €135 million.Overall, the company achieved revenue growth of 22% in FY2024 and 21% at constant exchange rates, both above previous guidance.

In terms of segment performance, the company saw success across multiple channels and continued strong consumer demand for its products.

B2B sales grew 26% in the fourth quarter, significantly above market expectations of 15% growth

DTC sales also performed well, growing 18% year-over-year, beating expectations of 13.7%.

Regional Performance

Regionally, Birkenstock exceeded growth expectations in all key markets.Particularly in Europe and the Americas, the company achieved significant performance improvement by optimizing distribution channels and raising average selling prices.In Europe, Birkenstock achieved growth of approximately 21% despite a weak overall retail environment.

Investment highlights

Birkenstock's results exceeded expectations for a number of key reasons:

Strong consumer demand: the Company's products continue to be popular within multiple market segments.

Successful implementation of channel diversification strategy: significant growth in both B2B and DTC channels.

New product line expansion: Closed footwear line penetration increased to approximately one-third, and good progress was made in product diversification.

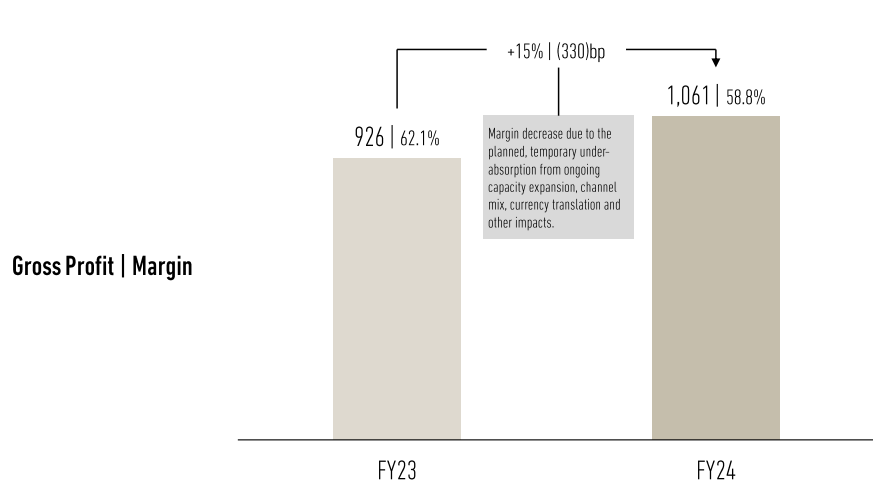

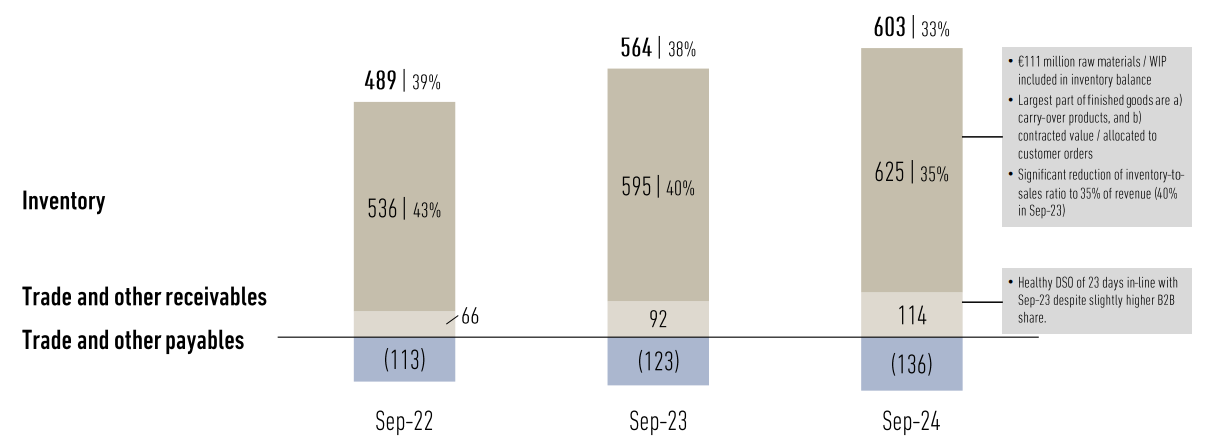

Effective cost control and inventory management: Gross margins were slightly lower than expected due to more inventory clearing actions, but the company still maintained good financial health, with net debt to EBITDA ratio reduced from 3.1x to 1.5x

Blank regional market space.Company executives on the morning's earnings call repeatedly cited the huge success of its closed-toe styles, which now account for about one-third of sales.While sales to other retailers in China have slowed, the region has reached "Mid-Teens" in APMA (Asia, Pacific, Middle East and Africa) revenue.The Company continues to make progress in opening up this important gap market for the brand and sees significant opportunities for growth and will continue to invest in this area, with sales in the APMA region up 38 percent over last year, making it the Company's fastest growing region.In the next quarter, India will be included in the new APMA region and the Middle East and Africa will be consolidated into EMEA.

Future Revenue Guidance

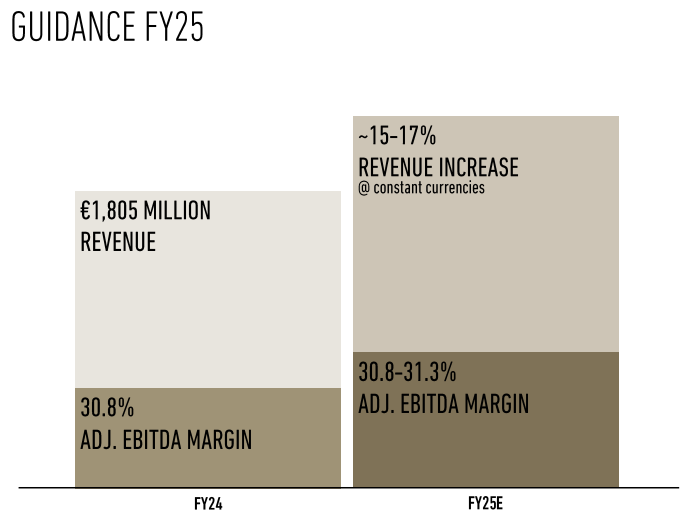

Revenue is expected to grow by 15% to 17% in FY2025, indicating the company's optimism for the future.

Gross Margin Improvement Potential: While current gross margins have declined, they are expected to recover to around 60% in the future as production efficiency improves and product mix is optimized.Meanwhile maintaining adjusted EBITDA margins above 30%

Comments

Welcome to open a CBA today and enjoy access to a trading limit of up to SGD 20,000 with upcoming 0-commission, unlimited trading on SG, HK, and US stocks, as well as ETFs. Find out more here.

Other helpful links: