Hey option traders! If you’ve dabbled in buying calls or selling puts and want to level up with Delta-based strategies, let’s dive into $Oracle(ORCL)$ , the hottest AI downstream play right now. Buckle up—this one’s a wild ride!

Why ORCL is the Talk of the Town

Earnings Bombshell: RPO Hits $455B, Up 359% YoY

ORCL dropped a jaw-dropping Q1 FY2026 earnings report, with Remaining Performance Obligations (RPO) soaring to $455 billion, a 359% year-over-year explosion. For the uninitiated, RPO is the “future revenue backlog” for cloud/software firms, signaling rock-solid customer demand. This surge screams enterprise adoption of ORCL’s AI cloud, database, and AI server services—think massive orders for AI infrastructure. The market went nuts, with a single-day 35%+ stock spike, echoing $NVIDIA(NVDA)$ s 2023 ChatGPT-fueled rally. This isn’t just hype; it’s proof AI demand is cascading from chips to enterprise services.

TikTok Rumor Sparks New Fire

Yesterday (9/15), whispers hit that ORCL might join a deal to keep TikTok running in the US, potentially partnering with ByteDance. ByteDance is a GPU-hoarding beast, and ORCL’s OCI (cloud biz) is itching to dominate AI infrastructure. This synergy could be a match made in Wall Street heaven, pushing ORCL’s stock up 3% to close at ~$302. After peaking at $340 post-earnings and pulling back to $300, this rumor could ignite a new leg up (likely consolidation with upside to $320-330).

My 4 Bullish Option Plays (10/17 Expiry, S=$302)

I’ve crafted four bullish strategies, from safe to spicy, using 10/17 expiration options. The first three are classics, but I’m hyping the fourth—an Asymmetric Call Butterfly—as the star for its insane risk-reward. Let’s break it down:

A: Bull Put Spread (Low Risk, Credit)

Sell 300P ($16.37), Buy 290P ($11.74). Net credit: $4.63.

Max Profit: $4.63, Max Loss: $5.37, Breakeven: $295.37.

Why? Rock-steady, profits at current levels, perfect for conservative bulls.

B: Bull Call Spread (Medium Risk, Debit)

Buy 300C ($19.30), Sell 310C ($14.90). Net debit: $4.40.

Max Profit: $5.60, Max Loss: $4.40, Breakeven: $304.40.

Why? Balanced leverage, 127% ROI if stock hits $320+, great for mild upside.

C: Long 310 Call (High Risk, Pure Debit)

Buy 310C ($14.90). Net debit: $14.90.

Max Profit: Unlimited, Max Loss: $14.90, Breakeven: $324.90.

Why? Aggressive, 236% ROI at $350, but time decay stings hard.

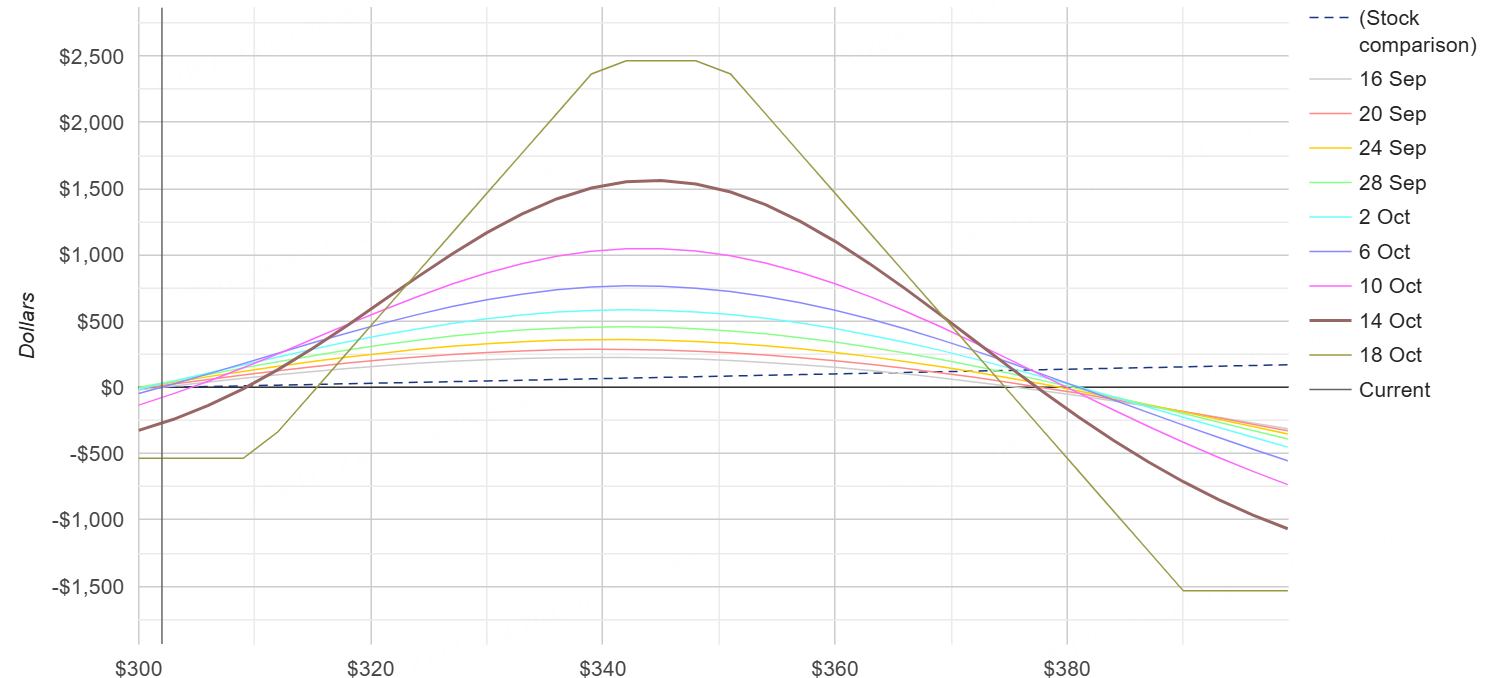

D: Asymmetric Call Butterfly (High Risk, Event-Driven Beast)

Buy 310C ($14.90), Buy 390C ($1.75), Sell 340C ($6.45), Sell 350C ($4.85).

Net Debit: $5.35 ($535/contract).

Max Profit: $31.30 (at $340-350 range).

Max Loss: $5.35 (below $310) or $15.35 (above $390).

Breakevens: $315 (lower), $374 (upper).

Net Delta: ~0.099 (mildly bullish, +$0.099 per $1 stock rise, low directional risk).

Net Vega: ~0.28 (high positive, thrives on IV spikes from events like TikTok).

Why the Butterfly (Strategy D) is My Top Pick

This Asymmetric Call Butterfly is a gem for ORCL’s setup. Here’s why it shines:

Insane Risk-Reward: For just $535 upfront, you cap downside at $535 (or $1535 if stock moons past $390). If ORCL lands in the $340-350 sweet spot by 10/17, you’re looking at a 528% ROI ($31.30 profit). That crushes the other strategies’ max returns (A: 86%, B: 127%, C: 236% at $350).

Delta-Neutral Vibes: With a net Delta of ~0.099, it’s barely fazed by short-term wiggles. You’re betting on ORCL converging to $345-350, not a relentless moonshot. Perfect for a “consolidation + slight lift” scenario post-earnings and TikTok buzz.

Tailored for ORCL’s Narrative: The 35% earnings pop and TikTok rumors have ORCL’s sentiment red-hot. Post-earnings IV crash has settled, but low IV (0-6%) sets the stage for a spike if TikTok talks heat up. The $345-350 range aligns with a dense trading zone if the rumor fuels a 10-15% rally.

Vega Sensitivity: Net Vega of 0.28 means IV jumps (say, 5%) boost value by ~$140/contract (+26% on debit). It’s slightly less IV-sensitive than C’s 0.33 but way more than A’s -0.089 or B’s 0.011, making it ideal for event-driven plays in a low-IV environment.

Downsides?

Narrow Sweet Spot: Max profit requires ORCL to hit $340-350. Miss it, and returns fade (e.g., -100% below $315, -287% above $390). Early exit at $345-350 can lock in gains.

IV Risk: High positive Vega cuts both ways—IV spikes amplify profits, but a collapse pre-event hurts. Still, current low IV favors buyers.

ROI Scenario Analysis (Expiry Prices)

Here’s how the strategies stack up across scenarios (capital = debit or max loss):

Takeaways:

A is a safe bet, locking 86% ROI even at $302, but capped upside.

B shines for moderate gains (127% at $320+), low risk but limited pop.

C scales linearly (236% at $350), great for moonshots but pricey and theta-heavy.

D dominates with 528% ROI at $350, low cost, and event-driven leverage, but needs precision.

My Play & Final Thoughts

ORCL’s $455B RPO and TikTok rumors scream premium pricing for the next month. I’m betting on a bullish consolidation to $320-330, with $345-350 as a sweet spot if TikTok talks escalate. The Butterfly (D) is my go-to for its dirt-cheap entry and monster 528% ROI potential—perfect for event-chasing degens like me. Risk-averse? Go Bull Call/Put (A/B). Feeling YOLO? Long Call (C) is your rocket.

Strategies are like poetry: some crave the steady glow of a “carved chariot,” others chase the fleeting blaze of a “meteor shower.” What’s your ORCL vibe—safe harvest or starry gamble? Drop your thoughts, like, and share!

Comments