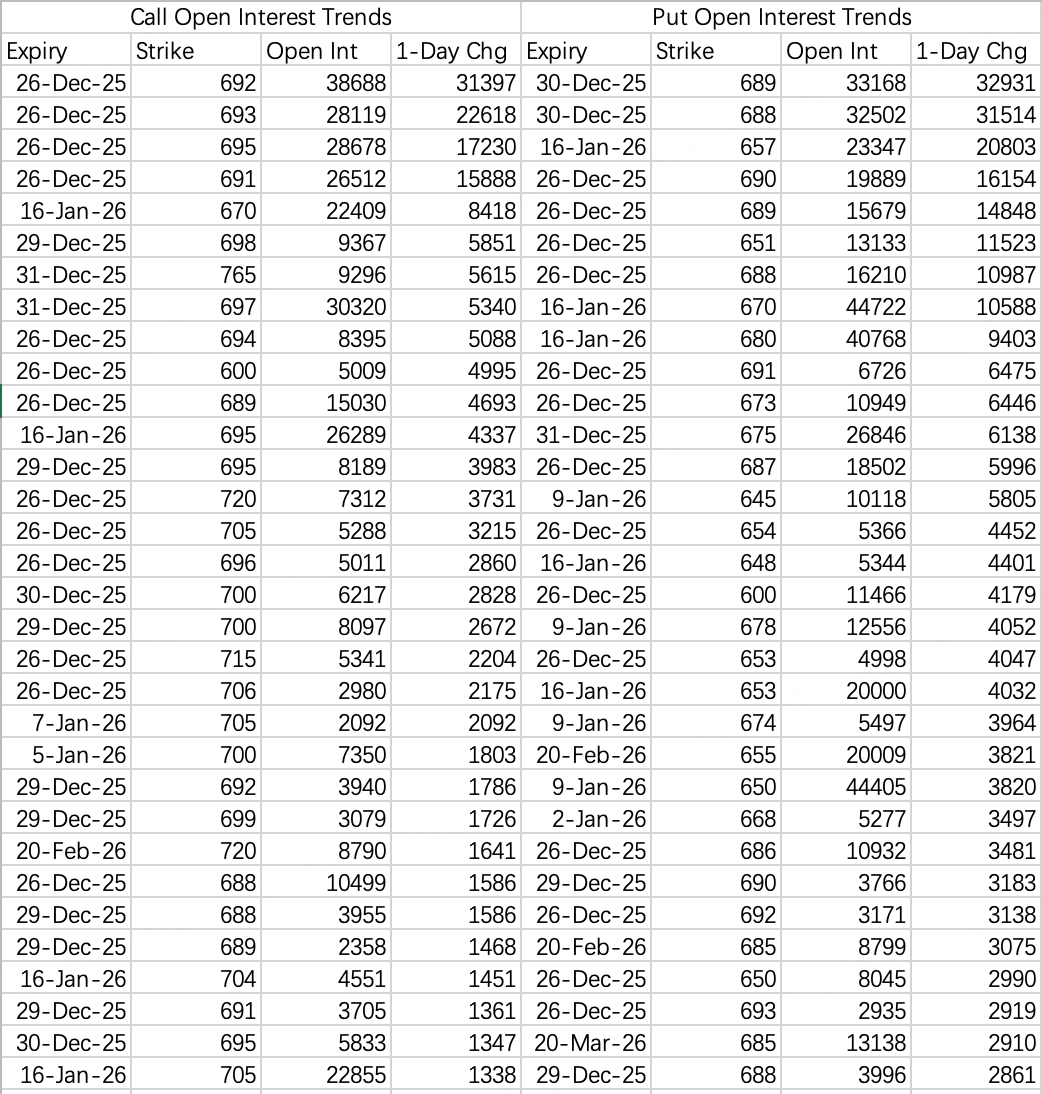

$SPY$

It seems just one step away from 7000 points. The market continues its upward consolidation tonight. Based on options opening positions, 7000 points are not tonight's target, but we can hope for next week.

Tonight's likely range is between 690 and 695. After rising to 700 next week, a pullback is possible.

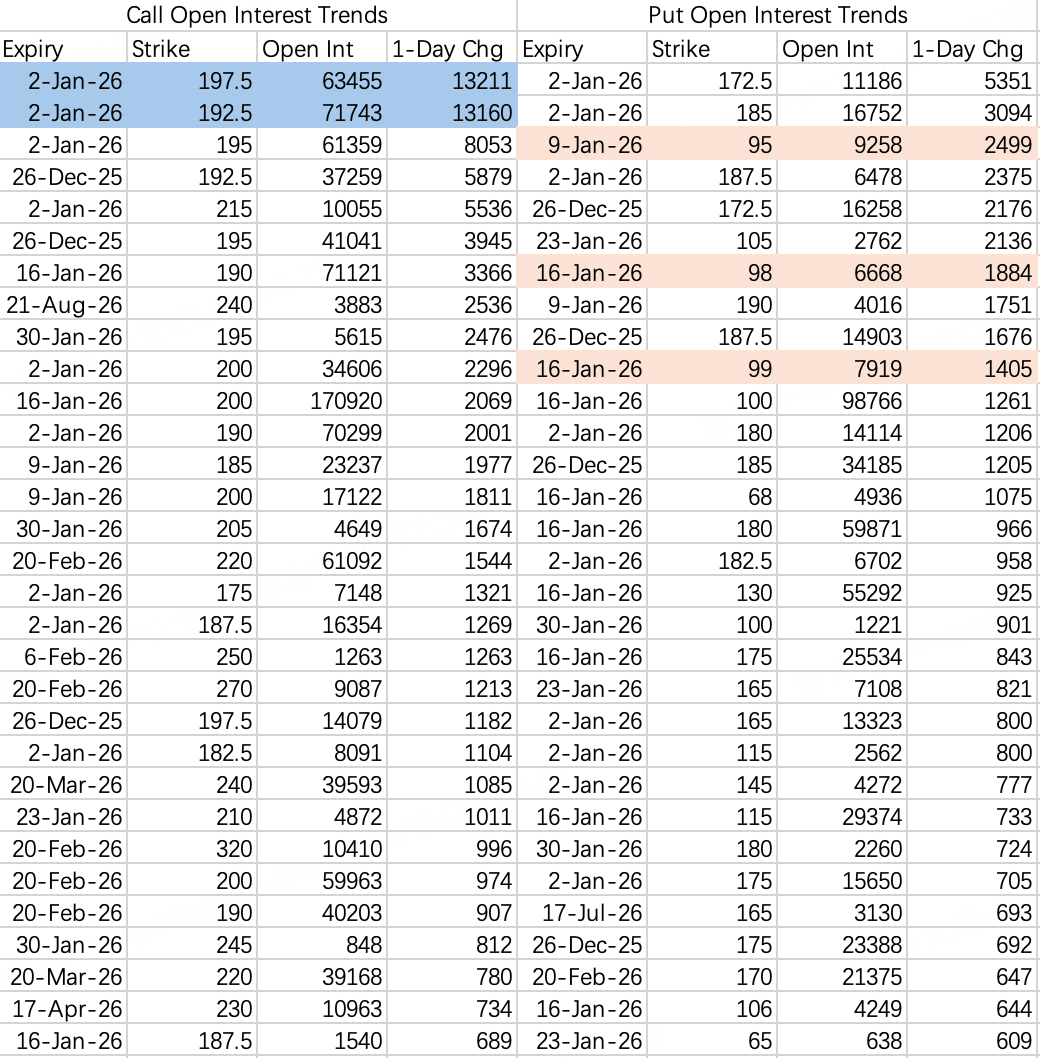

$NVDA$

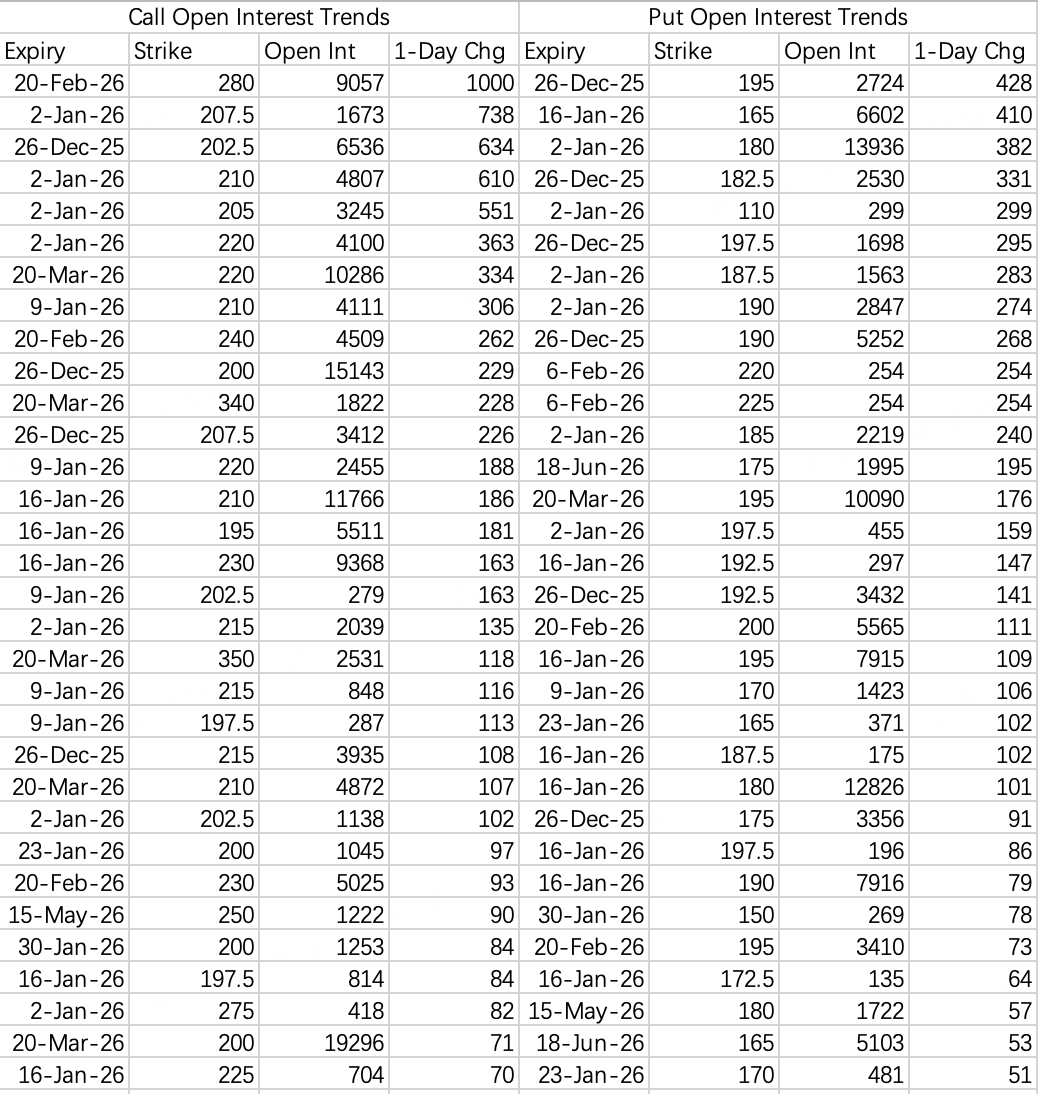

Institutions are selling the 192.5 call expiring next week $NVDA 20260102 192.5 CALL$ and buying the 197.5 call for hedging/arbitrage $NVDA 20260102 197.5 CALL$ . This suggests the stock price is expected to be below 192.5 next week.

Overall long (call) opening data indicates a potential return to around 200 soon, especially with the CES conference starting January 5th likely offering many catalysts.

On the other hand, short (put) opening data shows less optimism, hinting at some unexpected 'black swan' concerns for the post-New Year market, though these extreme expectations may not represent genuine shorting intent. After filtering out this data, the price is expected to stay above 180 in January.

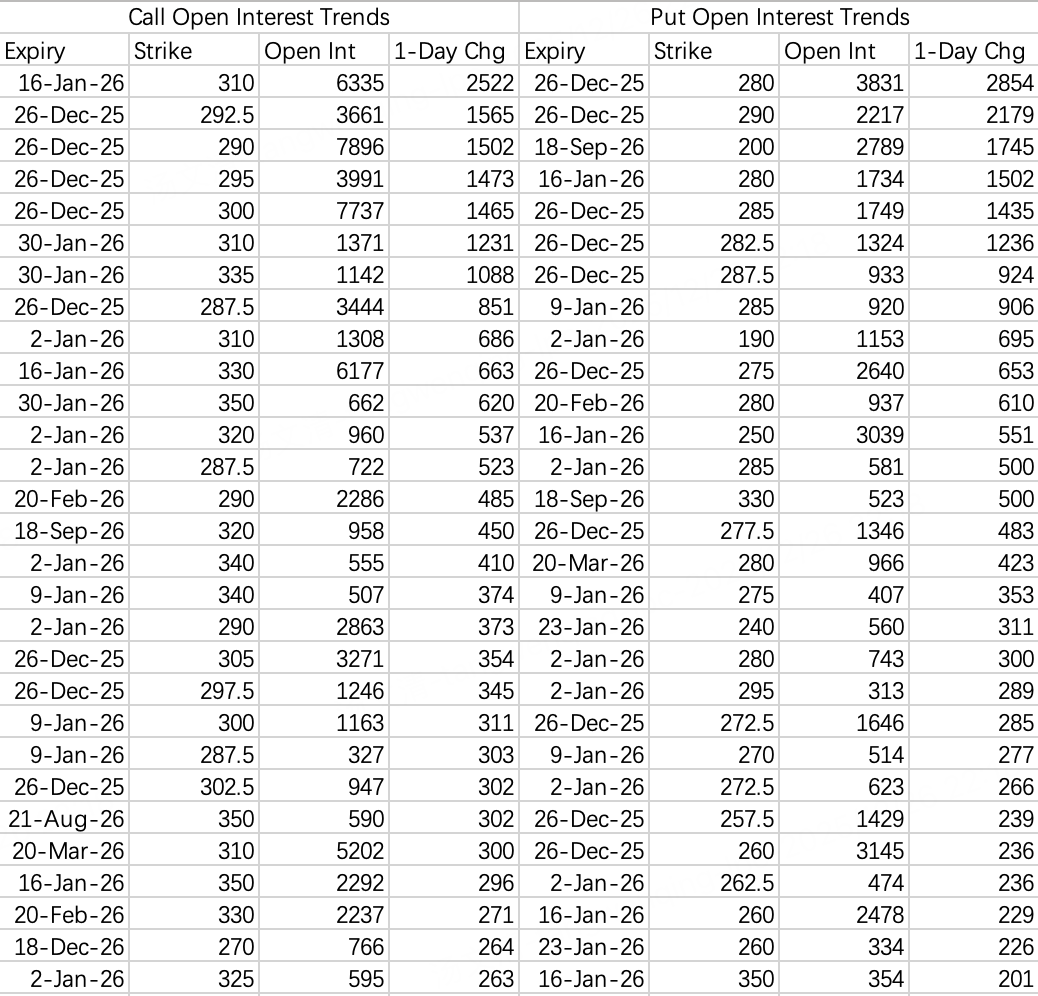

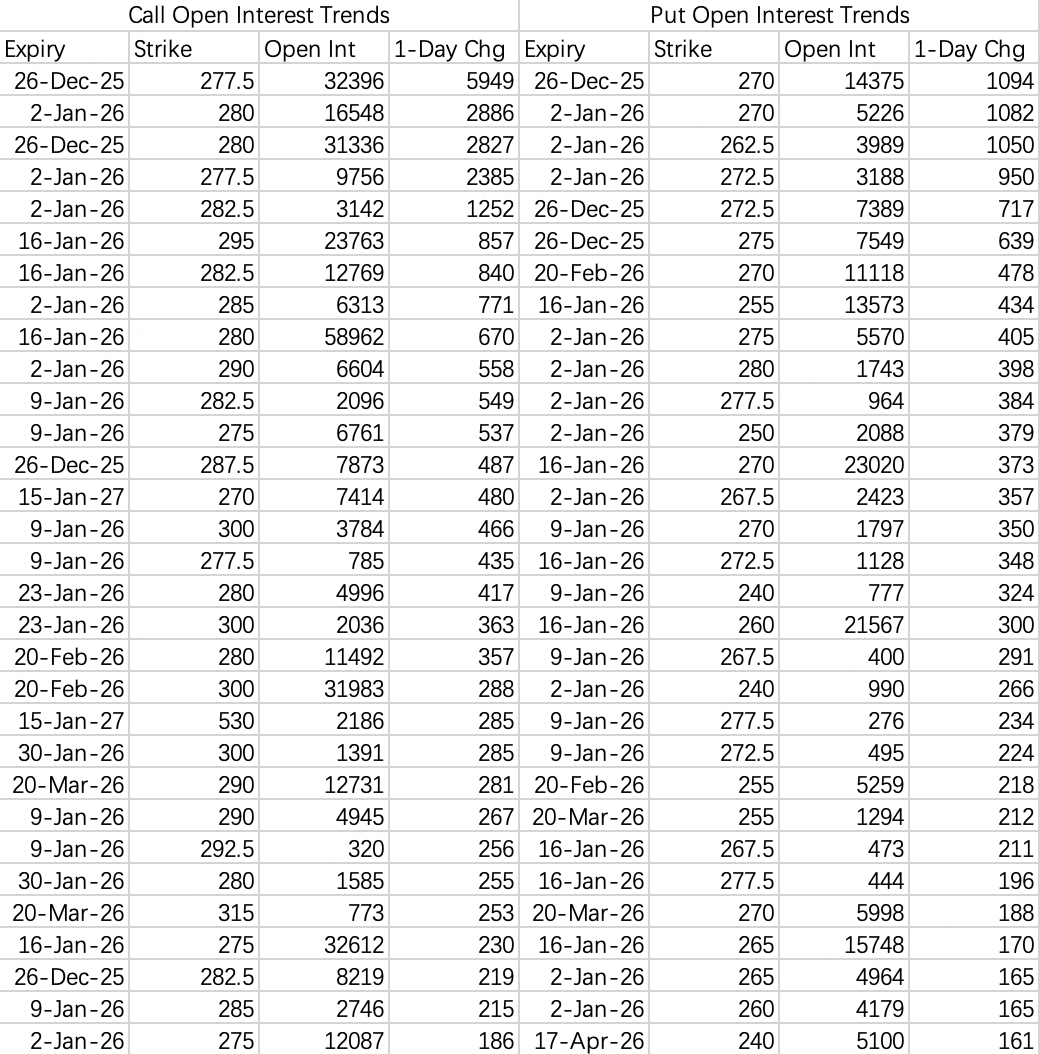

$MU$

Continuing its advance towards 300. A Sell Put on the 270 strike is feasible. $MU 20260102 270.0 PUT$

$AAPL$

Continuing narrow-range consolidation. A Sell Put on the 270 strike is feasible. $AAPL 20260102 270.0 PUT$

$ORCL$

While researching the acquisition case, I discovered Oracle's backstage influence is formidable. For tracking purposes, initiating a Sell Put on the 185 strike. $ORCL 20260102 185.0 PUT$

Comments