Technical Analysis of FTSE ST REIT Index (FSTAS351020)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased from 725.07 to 748.41 (3.22%)compared tolast month’s update. The S-REIT Index is currently retracing back to the resistance turned support level at about 740, after failing to break above the previous support turn resistance zone of 790-800.

- Short-term direction:Down (retracement is underway)

- Medium-term direction:Up (50D SMA is sloping upward)

- Long-term directionDown (200D SMA is sloping down)

- Immediate Support at740, followed by 712

- Immediate Resistance at790-800 zone.

Previous chart on FTSE ST REIT index can be found in the last post:Singapore REIT Fundamental Comparison Tableon January 1st, 2023.

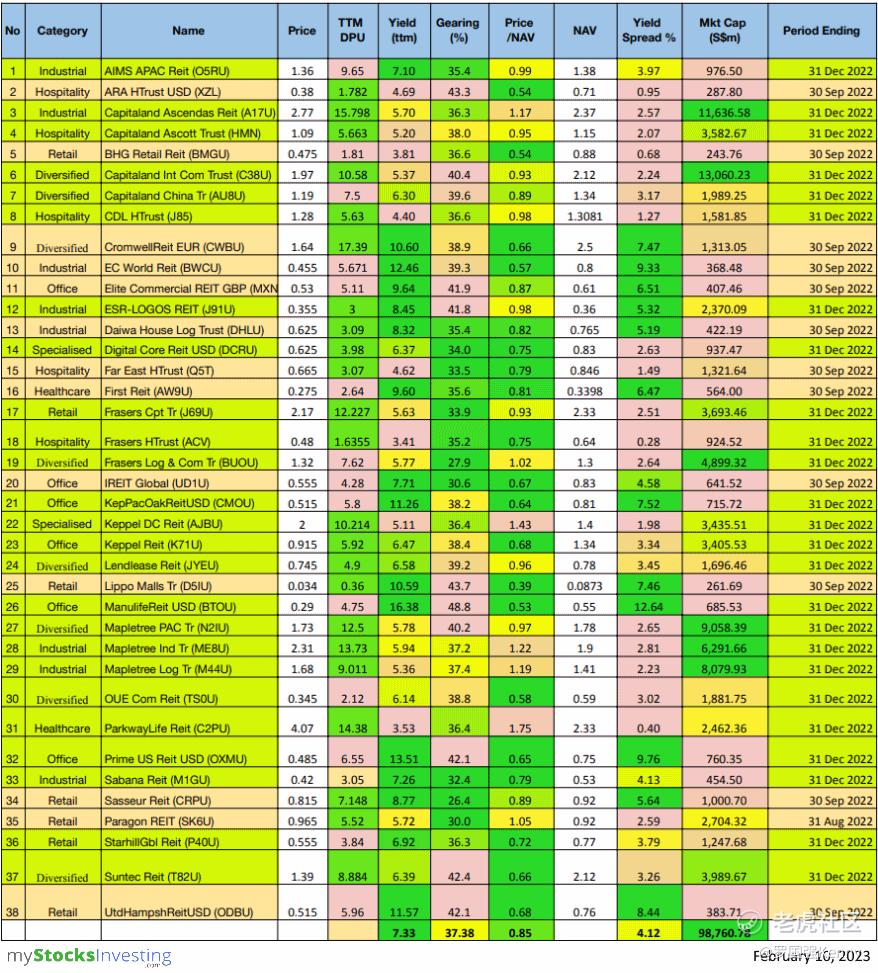

Fundamental Analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- The Financial Ratios are based on past data and these are lagging indicators.

- This REIT table takes into account the dividend cuts due to the COVID-19 outbreak. Yield is calculated trailing twelve months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower for more affected REITs.

- REITs highlighted inyellow-greenare now updated with the latestQ4 2022business updates/earnings.

- REITs highlighted inyellow-orangeare still using Q3 2022 results.

- SPH Reit has been renamed to Paragon REIT since January 3rd, 2023.

Data from StocksCafe REIT Screener. https://stocks.cafe/kenny/advanced

What does each Column mean?

- FY DPU: If Green,FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters.If Lower, it isRed.

- Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Priceas of February 10th 2023.

- Daiwa House Logistics Trust: Yield calculated from trailing six months distribution, TTM yield is annualised.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price over Net Asset Value per Unit.

- Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs trading in USD is referenced to US Gov Bond Yield, everything else is referenced to SG Gov Bond Yield.

Price/NAV Ratios Overview

- Price/NAV increased to 0.85.

- Increased from 0.80 in January 2023.

- There has been a recent sell-off in September-October period.

- Singapore Overall REIT sector is undervalued now.

- Take note that NAV is adjusted upwards for some REITs due to pandemic recovery.

- Most overvalued REITs (based on Price/NAV)

- Parkway Life REIT (Price/NAV = 1.75)

- Keppel DC REIT (Price/NAV = 1.43)

- Mapletree Industrial Trust (Price/NAV = 1.22)

- Mapletree Logistics Trust (Price/NAV = 1.19)

- Capitaland Ascendas REIT (Price/NAV = 1.17)

- Paragon REIT (Price/NAV = 1.05)

- Only 7 REITs are overvalued now based on Price/NAV value.

- No change in the Top 2 compared to the past 2 months.

- Most undervalued REITs (based on Price/NAV)

- Lippo Malls Indonesia Retail Trust (Price/NAV=0.39)

- Manulife US REIT (Price/NAV = 0.53)

- ARA US Hospitality Trust (Price/NAV = 0.54)

- BHG Retail Trust (Price/NAV = 0.54)

- EC World REIT (Price/NAV = 0.57)

- OUE Commercial REIT (Price/NAV = 0.58)

Distribution Yields Overview

- TTM Distribution Yielddecreased to 7.33%.

- Decreased from 7.90% in January 2023.

- 15 of 40 Singapore REITs have distribution yields of above 7%.

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to COVID-19, and economic recovery.

- 9 REITs have a ttm yield of over 10%!

- Highest Distribution Yield REITs (ttm)

- Manulife US REIT (16.38%)

- Prime US REIT (13.51%)

- EC World REIT (12.46%)

- United Hampshire US REIT (11.57%)

- Keppel Pacific Oak US REIT (11.26%)

- Cromwell European REIT (10.60%)

- Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- A High Yieldshould notbe the sole ratio to look for when choosing a REIT to invest in.

- Yield Spread tightened to 4.12%.

- Tightened from 4.69% in January 2023.

Gearing Ratios Overview

- Gearing Ratio increased to37.38%.

- Increased from 37.20% from January 2023.

- Gearing Ratios are updated quarterly.

- S-REITs Gearing Ratio has been on a steady uptrend, from 35.55% in Q4 2019.

- Highest Gearing Ratio REITs

- Manulife US REIT (48.8%)

- Lippo Malls Indonesia Retail Trust (43.7%)

- ARA Hospitality Trust (43.3%)

- Suntec REIT (43.1%)

- United Hampshire US REIT (42.1%)

- Prime US REIT (41.9%)

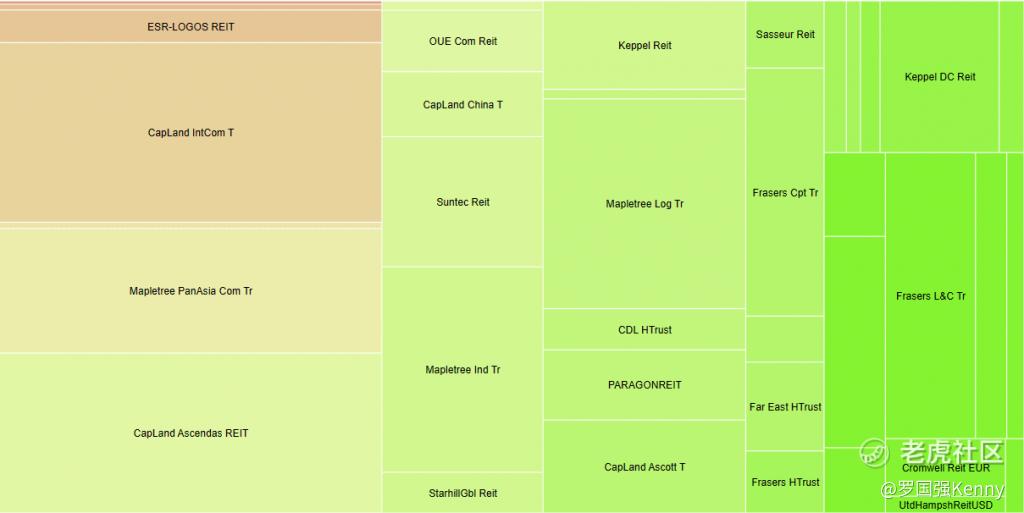

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation increased by 3.56%to S$98.76 Billion.

- Increased from S$95.36 Billion in January 2023.

- Biggest Market Capitalisation REITs:

- Capitaland Integrated Commercial Trust ($13.06B)

- Capitaland Ascendas REIT ($11.63B)

- Mapletree Pan Asia Commercial Trust ($9.06B)

- Mapletree Logistics Trust ($8.08B)

- Mapletree Industrial Trust ($6.29B)

- Frasers Logistics & Commercial Trust ($4.90B)

- No change in the rankings since September 2022.

- Smallest Market Capitalisation REITs:

- BHG Retail REIT ($244M)

- Lippo Malls Indonesia Retail Trust ($262M)

- ARA Hospitality Trust ($288M)

- EC World REIT ($368M)

- United Hampshire US REIT ($384M)

- Elite Commercial REIT ($408M)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you want to know more about investing in REITs, here’s asubsidised 2-day coursewith all you need to know about REITs and how to start investing in them.

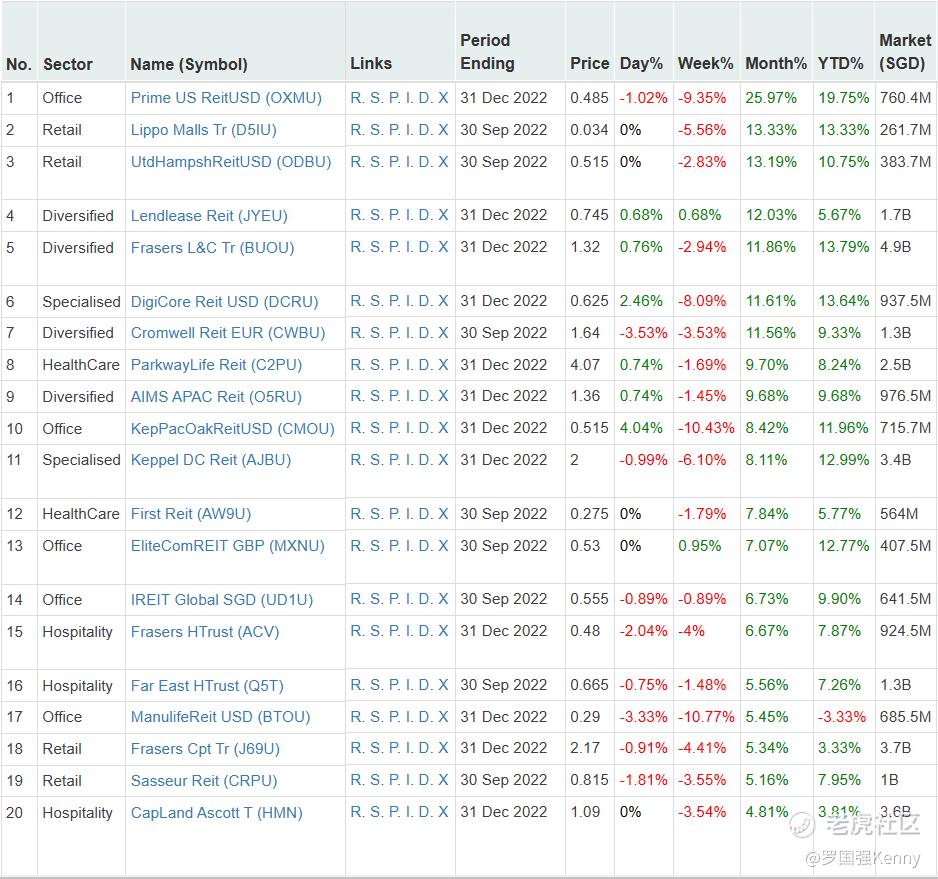

Top 20 Best Performers of the Month in January 2023

(Source:https://stocks.cafe/kenny/advanced)

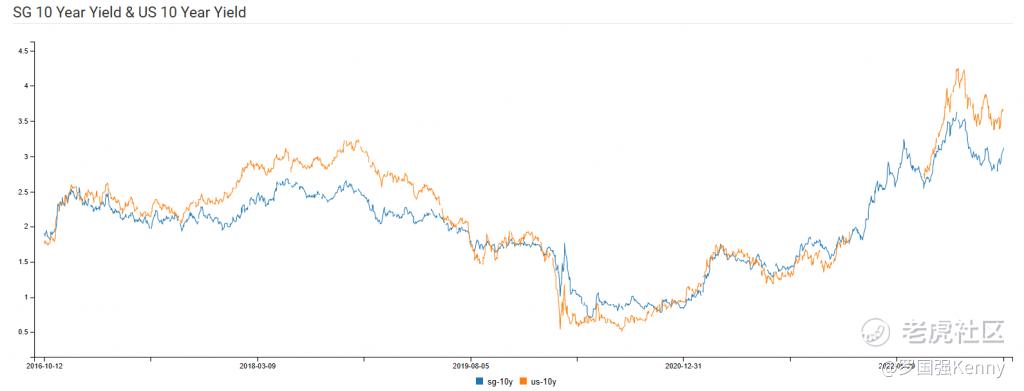

SG 10 Year & US 10 Year Government Bond Yield

- SG 10 Year: 3.13% (increased from 3.11%)

- US 10 Year: 3.74% (decreased from 3.88%)

Major REIT News in January 2023

S-REITs earnings/results for Q4 2022 are underway

As of 11th February 2023, 25 REITs have reported their earnings for Q4 2022.

Summary

Fundamentally, the whole Singapore REITs landscape remainsundervaluedbased on the average Price/NAV (at 0.85) value of the S-REITs, with a very attractive DPU yield of 7.33%!The valuation and DPU yield still attractive after the recent rebound since the beginning of 2023.

Interestingly, despite 24 REITs being bearish and only 10 REITs being bullish in the past month, market cap overall has increased very slightly by 0.26%.This is due to larger market cap REITs doing well (eg. $凯德雅诗阁信托(HMN.SI)$ (S$3.5B, 11.11%), $ESR-REIT(J91U.SI)$ (S$2.5B, 7.25%), $Frasers Centrepoint Trust(FRZCF)$ (S$3.6B, 3.45%).Only 3 of the bottom 12 performing REITs have market capitalisations of over S$1B. The top 5 largest Market Cap REITs have performances varying between -0.45% and -2.34%.

Yield spread (in reference to the 10-year Singapore government bond yield of 3.13% as of 10th February 2023) tightened from 4.69% to 4.12%.This is a huge decrease 0.57%, due to the rise of the REIT index and the relatively unchanged Bond Yields, bringing ttm yields down.

(Technically, FTSE ST REIT Index is trading in a short-term uptrend channel (higher high, higher low chart pattern) since finding the bottom in Oct 2022. After breaking up from the bull flag pattern, the S-REIT index is currently retracing to test the previous resistance turned support at about 740. If this support holds, it is expected the S-REIT index to continue the bullish rebound with the next target 790-800 to breakout to enter into bull market.

Based on the current overall S-REIT P/NAV of 0.85 and the potential peaking of interest rate in Q2/Q3 2023, the probability to have a severe crash in S-REIT is low unless we are entering into severe recession with big drop in DPU and US Fed continues to increase the interest rate fiercely beyond 5%.) 2023 would be a cautiously bullish for S-REIT with fundamentally strong S-REITs.

Comments