$Tesla Motors(TSLA)$ reported second-quarter earnings after the bell Monday, and it’s a beat on both the top and bottom lines.Revenue increased by 98% year-on-year, and net profit increased by 10 times. Tesla Motors's financial report is definitely great. However, the stock price performance is not good enough.What happened?

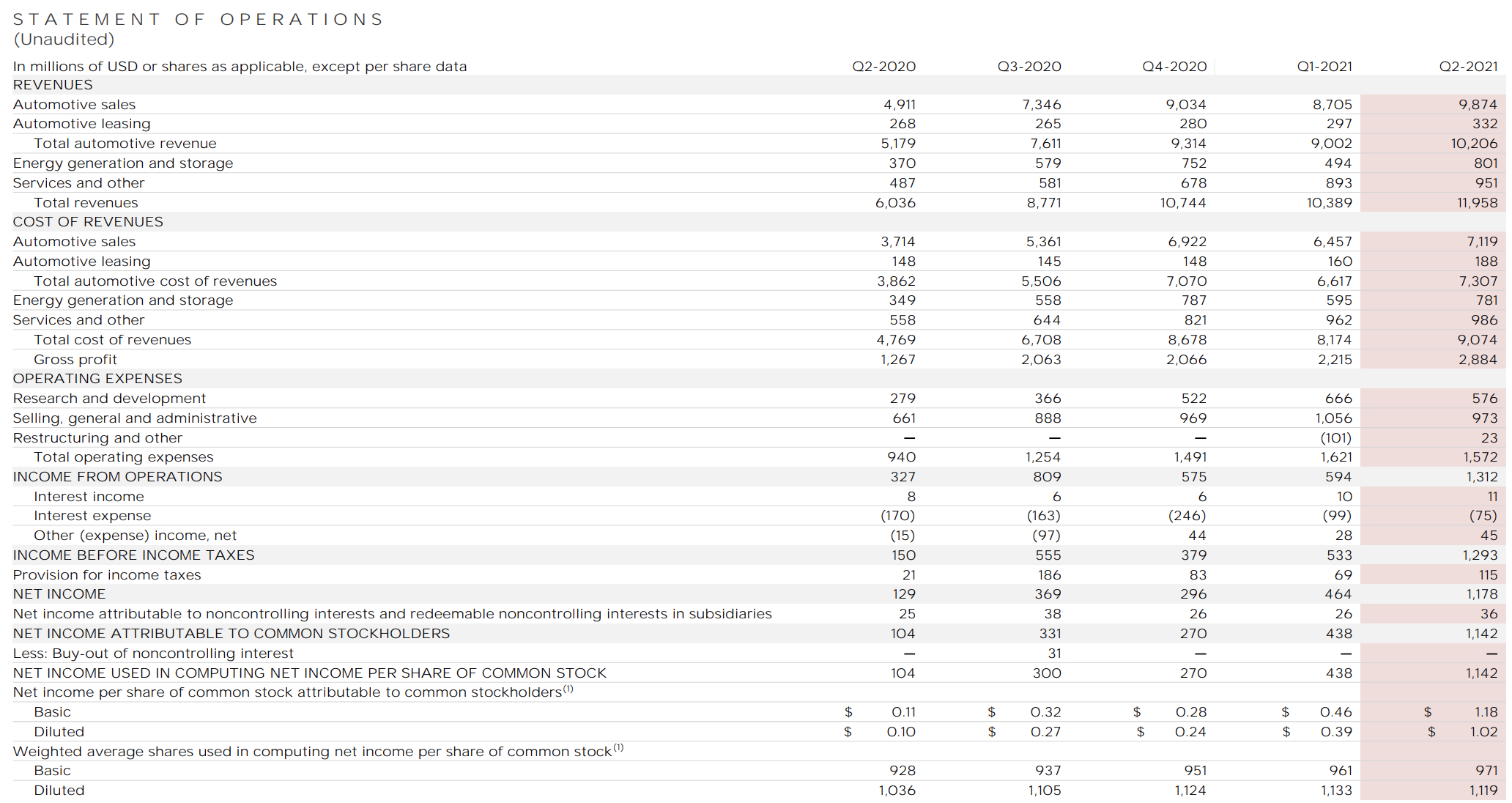

here is how Tesla did in the second quarter as per the just released investor letter:

- Revenue $11.96B, beating the est $11.36B

- Adjusted EPS $1.45, beating the est 97c

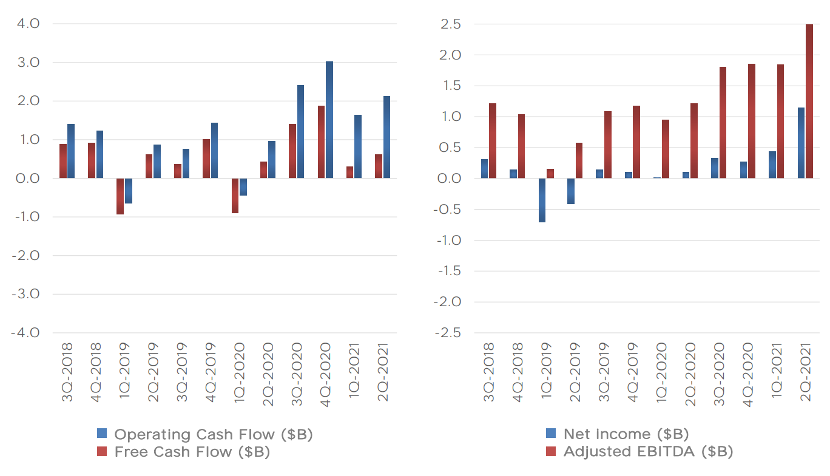

- Free Cash Flow $619M, beating the estimate of a Negative $319.1M

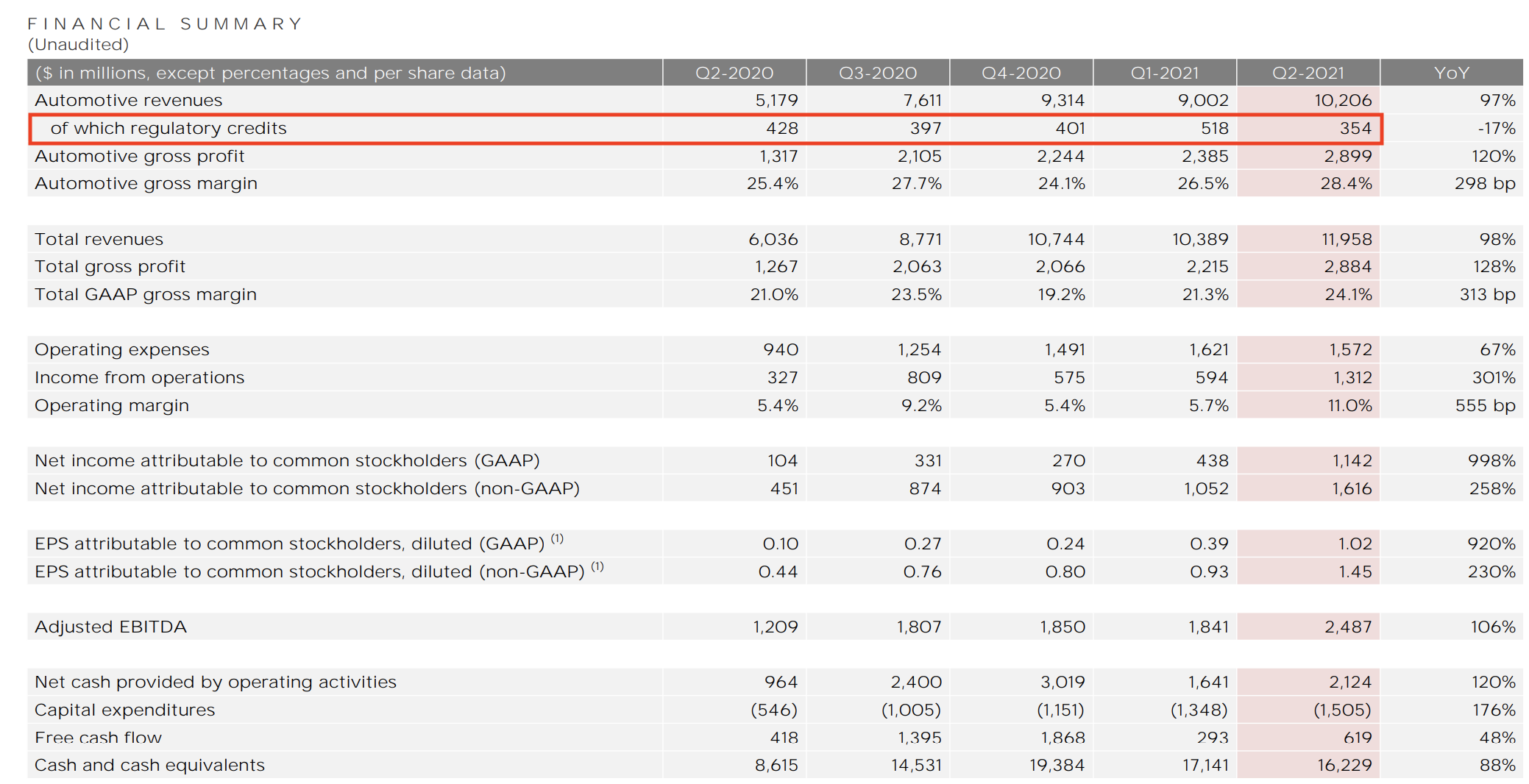

- Automotive gross margin 28.4%, beating the estimate of 25.0%

- Cash and cash equivalents of $16.229BN, missing the estimate $16.55 billion

Tesla Motors's revenue in the second quarter of 2021 was $11.96 billion, up 98% year-on-year, which was higher than analysts' expectation of $11.36 billion. In the second quarter of 2021, Tesla Motors's revenue from automobile sales was US $10.2 billion, up 97% year-on-year, which was similar to my previous expectation.

Let's take a look at the delivery data first. Despite the shortage of auto parts, Tesla Motors's delivery of electric vehicles increased significantly in the second quarter.According to Tesla's figures, it delivered 1,890 Model S and Model X vehicles, which left the vast majority of deliveries to the Model 3 and Model Y. The two more affordable EVs tallied 199,360 deliveries in Q2, despite multiple price increases throughout the year amid supplier difficulties. Total vehicles built in the quarter topped 206,421 cars.

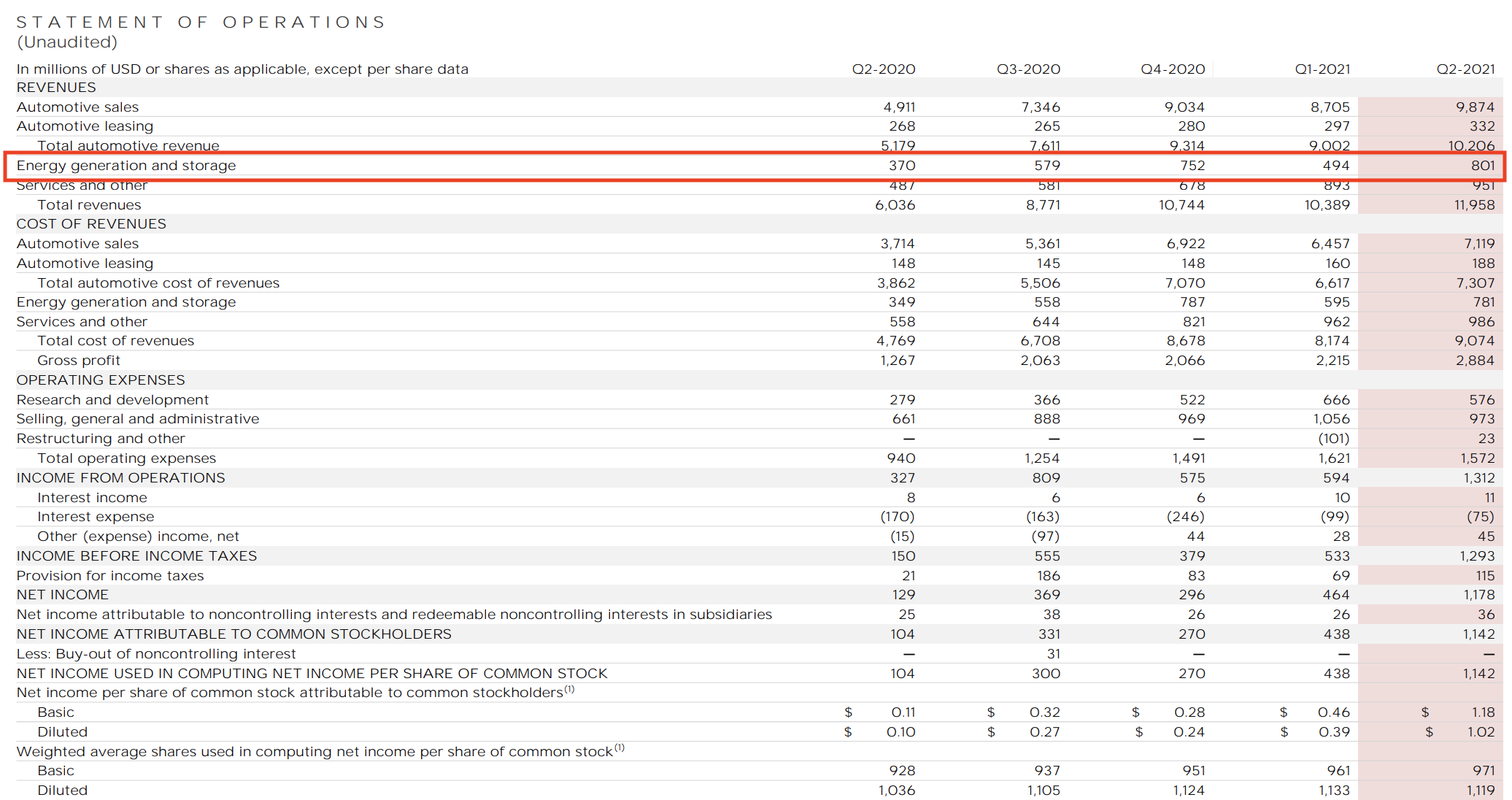

Of note, unlike previous quarter when virtually all the profit came from the sale of regulatory credits, in Q2 the situation normalized somewhat with $354MM from regulatory credits, which represents about 30% of the GAAP Net Income of $1.142BN, and is well lower than the $518MM in Q1.

Carbon credits, as its name implies, sell carbon emission credits to rival car companies, and Tesla Motors earns revenue by selling Zero Emission Vehicle (ZEV) credits and Greenhouse Gas Emission (GHG) credits to other car manufacturers. These manufacturers use the purchase credits to meet market requirements instead of making their own electrified or energy-efficient vehicles.

In fact, solar energy that plays a major role in Tesla Motor's revenue. According to the financial report, Tesla Motors's energy genration and storage revenue reached 801 million US dollars in the second quarter, up 60% month-on-month and 116% year-on-year.

Does that mean that solar roofs in Tesla Motors are selling very well? Compared with the same period of last year, it is definitely good, with a year-on-year increase of more than 2 times. However, on a month-on-month basis, there has been a decline, and the reason for the big increase is actually due to the price increase.

Musk said on last quarter's earnings call that his company made "significant mistakes" on the solar roof project, which led to further cost overruns and delays. Musk said Tesla Motors has had trouble assessing the difficulty of certain roofs, and said the complexity of roofs varies greatly. He noted that if existing roofs have bumps or the underlying structures are faulty or not strong enough to withstand Tesla Motors's solar panels, the cost could be two to three times higher than Tesla Motors's initial estimate. Musk said that if customers do not want to pay the price increase, Tesla Motors will refund the deposit to them.

In early April, after buyers made down payments, Tesla Motors suddenly raised the price of solar roofs sharply-in some cases by more than 50%.

According to foreign media Electrek, prices for Tesla’s solar roof product are starting to go up dramatically. One solar roof customer told The Verge he signed a contract in February to install the solar roof for $35,000, with an additional $30,000 for the batteries.Later, he received a “terse email” from Tesla stating that in several days he would receive a new contract with higher prices. He was told he now owed $75,000 for the solar roof — a 114 percent increase — and $35,000 for the batteries.

since the prices of solar roof product are starting to go up dramatically. it is not surprising that the revenue of solar energy has increased .

A big increase in net profit

In the quarter, the net income under GAAP was US $1.14 billion, which exceeded the US $1 billion mark for the first time in the company's history, higher than the market expectation of US $650 million. The non-GAAP net income has exceeded US $1 billion for two consecutive quarters.

Looking at profit next, the company attributes the beat to volume growth and driving costs down, while recording a “Bitcoin related impairment” of $23 million. There were a few other headwinds to overcome: supply chain costs as well as lower regulatory credit revenue.

Our operating income improved in Q2 compared to the same period last year to $1.3B, resulting in an 11.0% operating margin. This profit level was reached while incurring SBC expense attributable to the 2018 CEO award of $176M in Q2, driven by a new operational milestone becoming probable.

Operating income increased YoY mainly due to volume growth and cost reduction. Positive impacts were partially offset by growth in operating expenses including increased SBC, Model S/X ramp (negative margin in Q2), additional supply chain costs, lower regulatory credit revenue, Bitcoin-related impairment of $23M and other items.

The reason why Tesla Motors achieved a big increase in net profit is based on controling of expenses. Q2 Tesla Motors is particularly cautious in spending money, with a research and development expense rate of 4.8%, which is the same as last year's average level, and sales and administrative expenses dropped to a low of 8.1%.

Cybertruck mass production Delayed

the Cybertruck is currently in alpha stage as we finished the basic engineering architecture of the vehicle, with the Cybertruck we redefining how the vehicles as we made as Elon said, it carries much of the structural pack and large casting designs of the Model Y being built in Berlin and Austin.Obviously those take priority over the Cybertruck, but we are moving into the Beta phases of Cybertruck later this year and will be looking to rampant production and Giga, Texas after Model Y is up and going.

musk said“You know, in the grand scheme of things, it's not bad. So yeah, so decide if I can say my actually both are heavy use of cell capacity. So we got to make sure we have to sell capacity for those two vehicles or it's kind of pointless. We can make a small number of vehicles.But the but the effective cost if you make a small number of vehicles is insane, like they were literally cost $1 million a piece for more at that -- there's a reason why you think the volume production, which is to get the economies of scale that get the touchdown. So we are looking at a pretty massive increase in cell availability next year, but it's not like in January 1, it's it comes through, it ramps up through the course of next year, but even without Tesla Tales isn't Even without Tesla cell production, leave our suppliers will be able to deliver about twice as much sell out put in next year as this year. -- do you want to talk more about that?”

Now the not so good news: Tesla has shifted the launch of the semi truck program to 2022, citing “limited availability of battery cells and global supply chain challenges” in its decision to delay the launch of its semi truck product. The company also did not give any timeline for its Cybertruck, other than it will happen in Austin “subsequent to Model Y.”

Chip, Battery Shortages

With Intel reporting Thursday that the chip shortage is likely to last at least two more years, automakers including Tesla will be impacted for some time. But those shortages are also affecting other EV makers and auto production generally, giving Tesla pricing power.

Battery shortages are also an issue, as raw materials continue to be in short supply. As a result, on Thursday Tesla inked a supply deal with BHP (BHP) for nickel. Terms of the deal were not disclosed.BHP will supply Tesla with nickel from its Nickel West asset in Western Australia. Earlier this year, EV maker Tesla confirmed that the company was seeking to buy around $1 billion per year in battery minerals from Australia alone.Nickel is a key mineral in lithium-ion batteries, which is the linchpin of Tesla's next-generation battery cell.

"With all of these headwinds, Tesla still impressively hit 200k+ deliveries in the June quarter and appear to be on a trajectory to possibly hit 900k for the year with a stronger 2H on the horizon in our opinion," said Wedbush's Daniel Ives in a July 21 note to clients.

In kneejerk reaction the stock jumped as much as 3% on what appears to be a solid beat on revenue, earnings and Free Cash Flow, however it has since faded much of the gains, giving a negative answer to those wondering if this earnings report will be the one that finally send TSLA stock green for the year.

What do you think of Tesla Motors's financial report ? Do you like Tesla Motors?$Tesla Motors(TSLA)$

Comments