ASML, the leading semiconductor equipment provider for Photolithography machines is one of favourite company. With the recent development of Fire event in the Germany plant, China's announcement of their EUV breakthrough, and also there were split thought of semiconductor outlook, the upcoming Earnings Report on 19th Jan will be interesting.

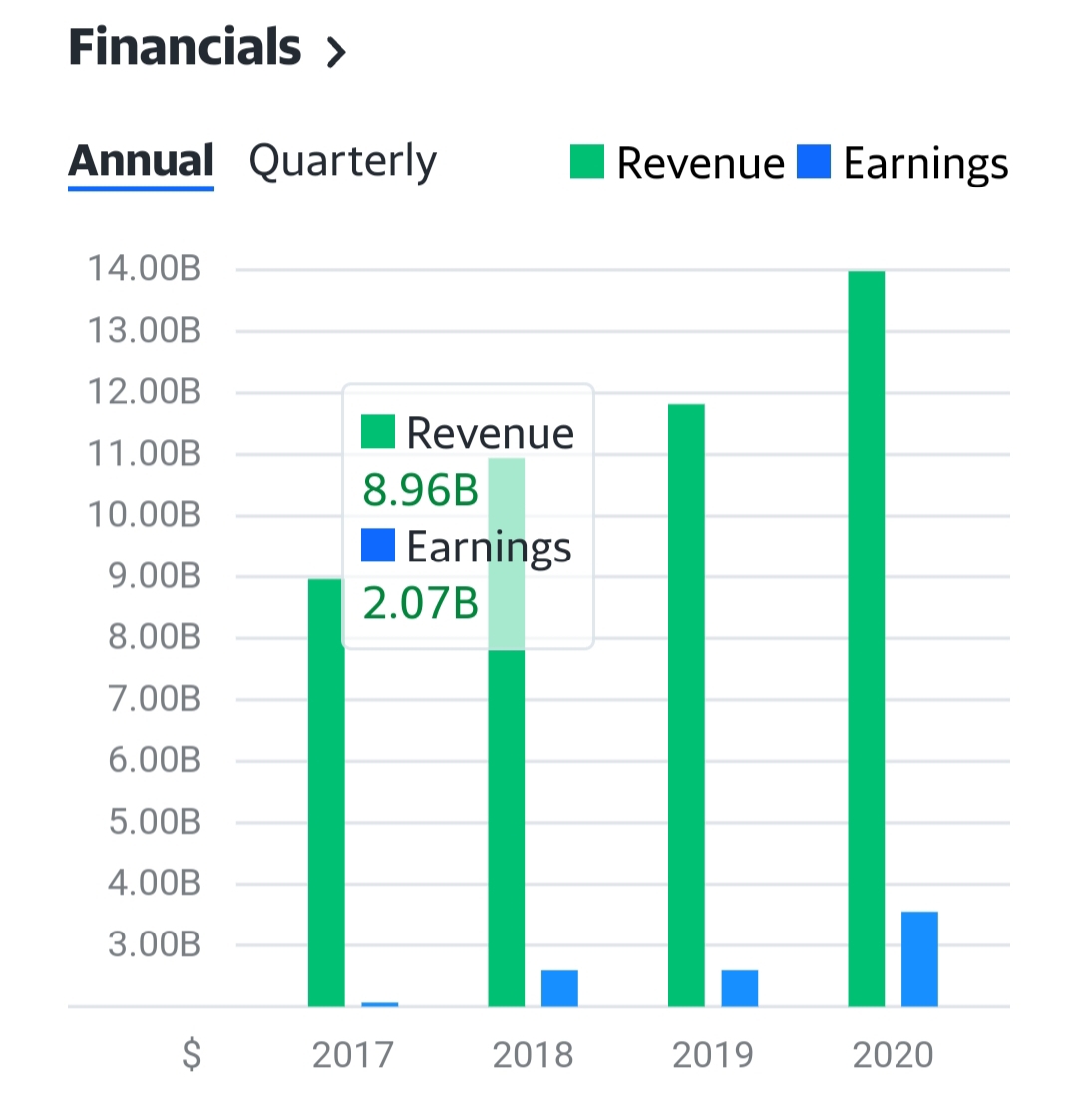

Go through the pass 4-5 years figure trending, Revenue has been increasing steadily.

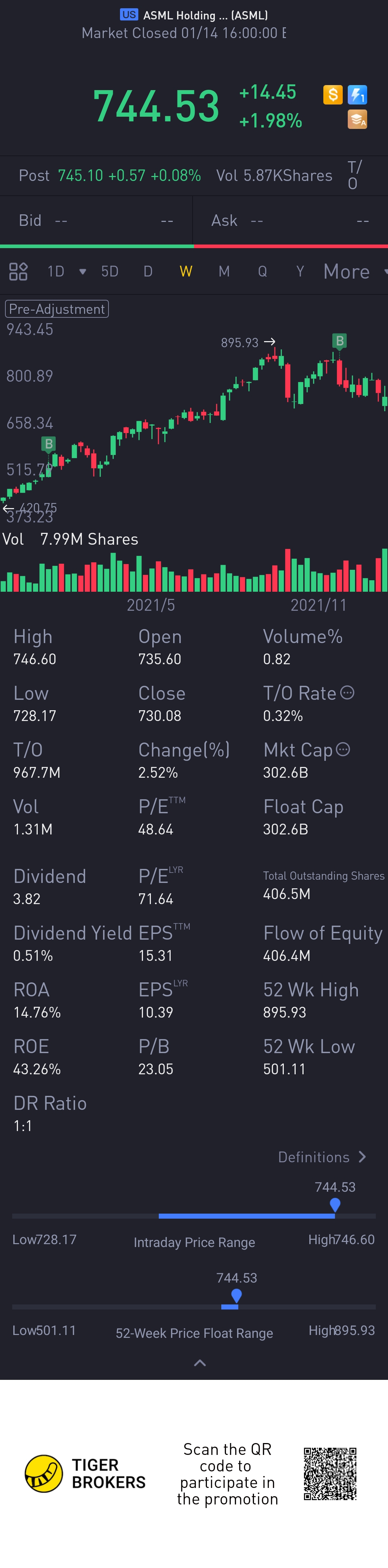

Market analyst expect upcoming EPS to be around $4.30

Personally I think this ASML will beat this EPS number again. Key will be their outlook beyond 2022.

Looking back at some of the past figures and trend.

ASML's net sales were 5.2 billion euros in Oct 2021, which was on the lower end of its expectations given in its previous earnings call. For the upcoming quarter, the company expects between 4.9 billion and 5.2 billion euros in sales. During the earnings call, management mention that some supply chain issues have caused guidance to be a bit weaker than expected.

ASML has a strong buyback program and intends to repurchase 9 billion euros worth of shares. During the third quarter, ASML purchased around 2.4 billion euros of shares.

Attached figure show the buy back trend. Really positive.

In terms of technology,

ASML’s dominance in semiconductor lithography will remain unchallenged for the foreseeable future, even we hear China's progress on EUV.

ASML is the only firm in the world capable of making the highly-complex machines that are needed to manufacture the most advanced chips.

These EUV machines, which cost approximately $140 million each, are sold to a handful chipmakers giants including TSMC, Samsung, Micron and Intel

The machines shine exceptionally narrow beams of light onto silicon wafers that have been treated with "photoresist" chemicals.

Intricate patterns are created on the wafer where the light comes into contact with the chemicals, which are carefully laid out beforehand

Demand for ASML's EUV machines and its DUV machines is soaring as chipmakers attempt to overcome a global crunch. Orders of tools were already in place till 2024.

In September, ASML said it expects a sales boom over the next decade. It believes annual revenue will hit 24-30 billion euros by 2025, with gross margins up to between 54% and 56%. The prediction is significantly higher than the 15-24 billion euro range it had previously forecast.

So in the event if investor are not please with the report and share price dip, I am ready to jump in to vest more in the company@Tiger Stars@小虎活动

Comments