Crude oil, the recent star variety, is due to the difficulty in increasing the supply, which makes Wall Street bulls attempt to stage a forced market. The $100 oil price forecast has become the norm, and the $200 oil price forecast has begun to rise. Can crude oil only rise but not fall in 2022? Let's analyze it carefully.

First, the demand repair after the epidemic

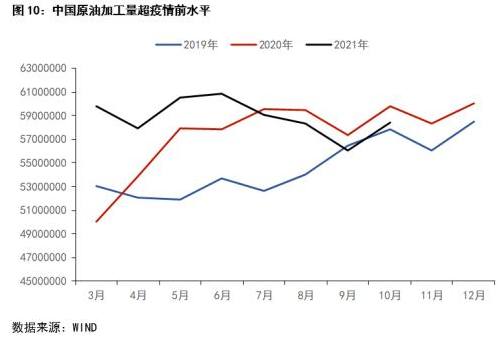

After the epidemic, the demand for crude oil in China and the United States, the two largest economies in the world, has been continuously repaired and has recovered to the level before the epidemic. I'm afraid with the further control of the epidemic, it is a consensus that the demand is improving.

The crude oil market has already experienced the test of variant virus Omicron. Even if I make bold predictions, I can't see any bad news on the demand side at present. Therefore, before the bad news on the demand side comes out, everyone can think that the demand will continue to grow.

Second, the supply that cannot be increased?

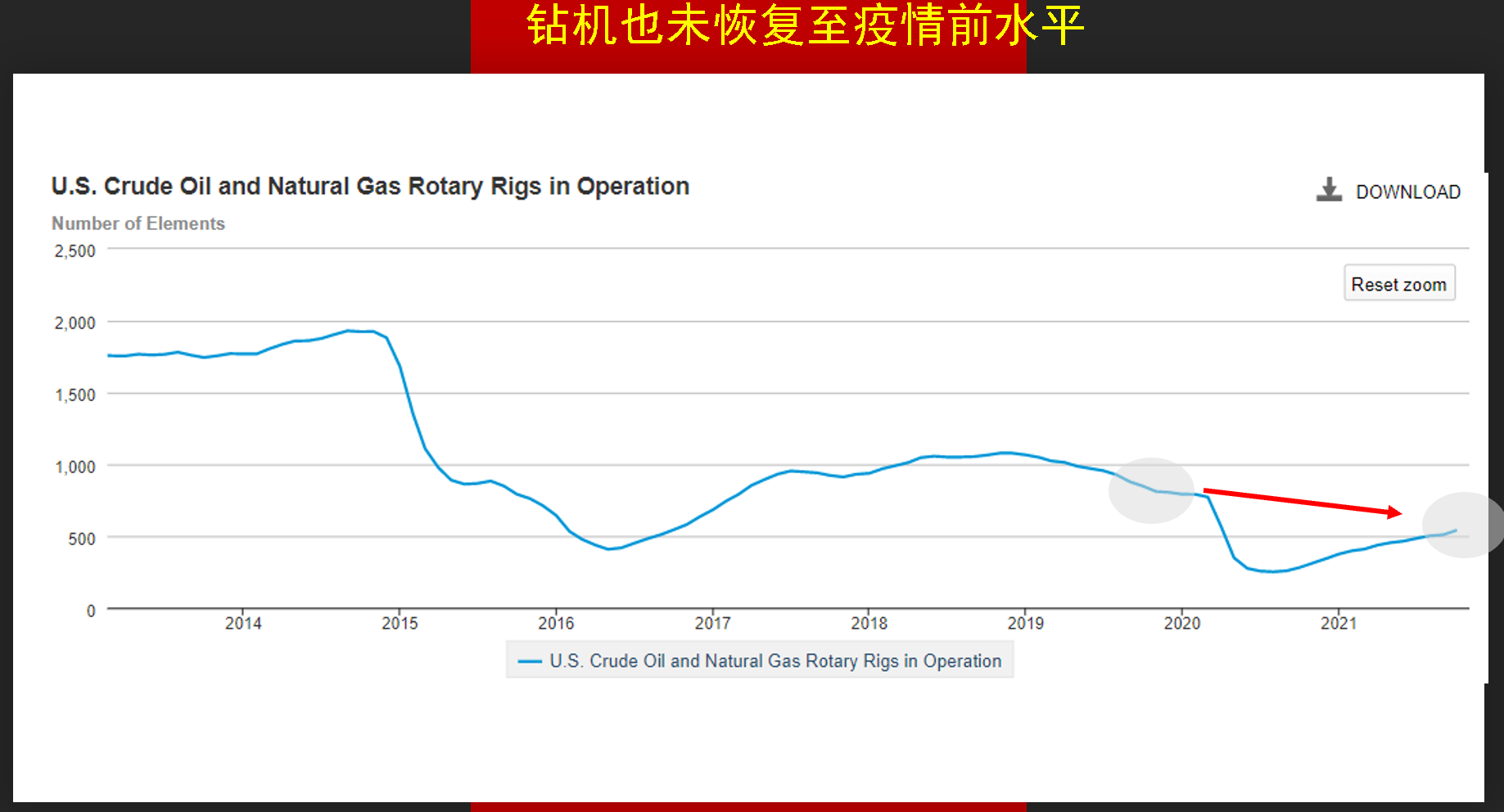

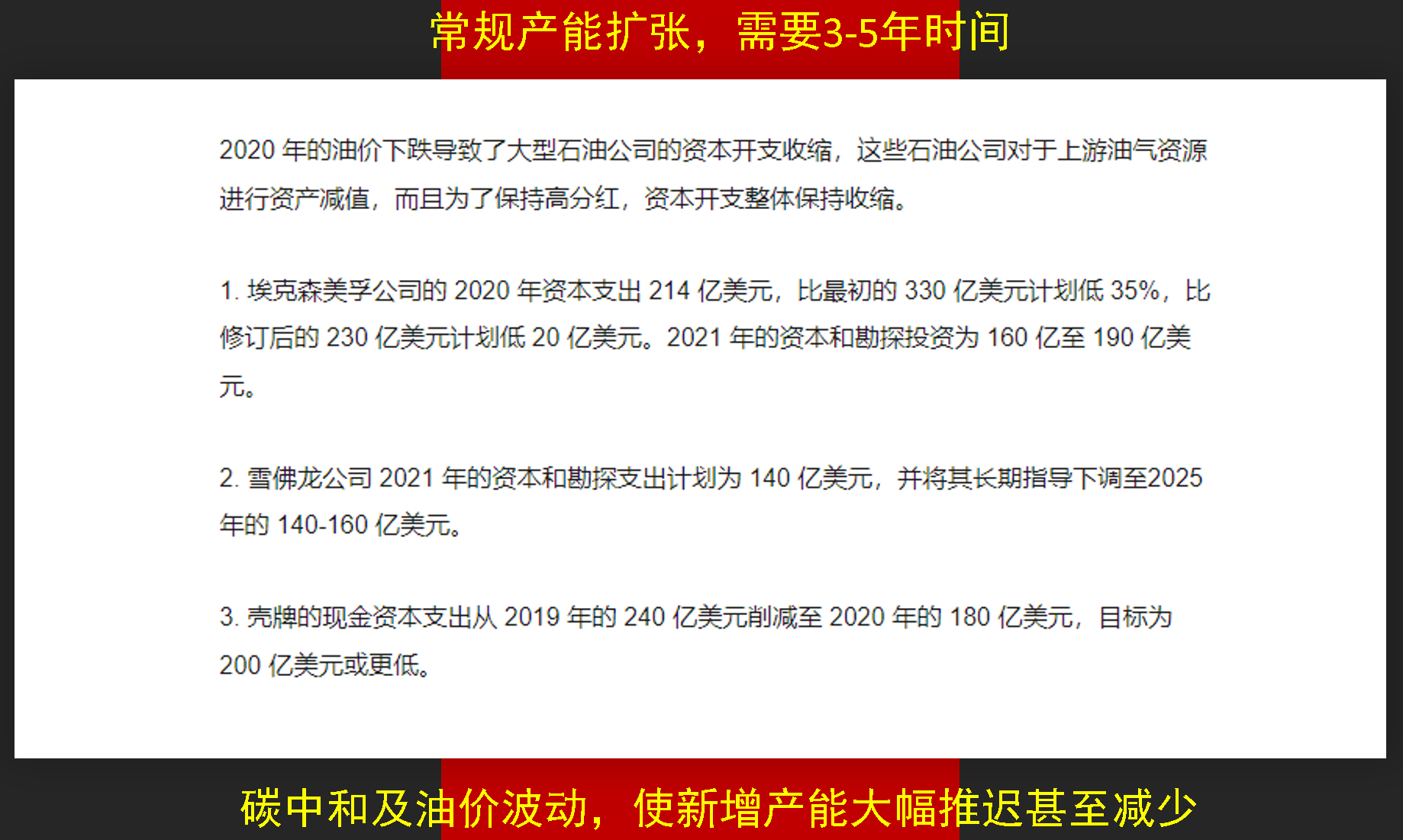

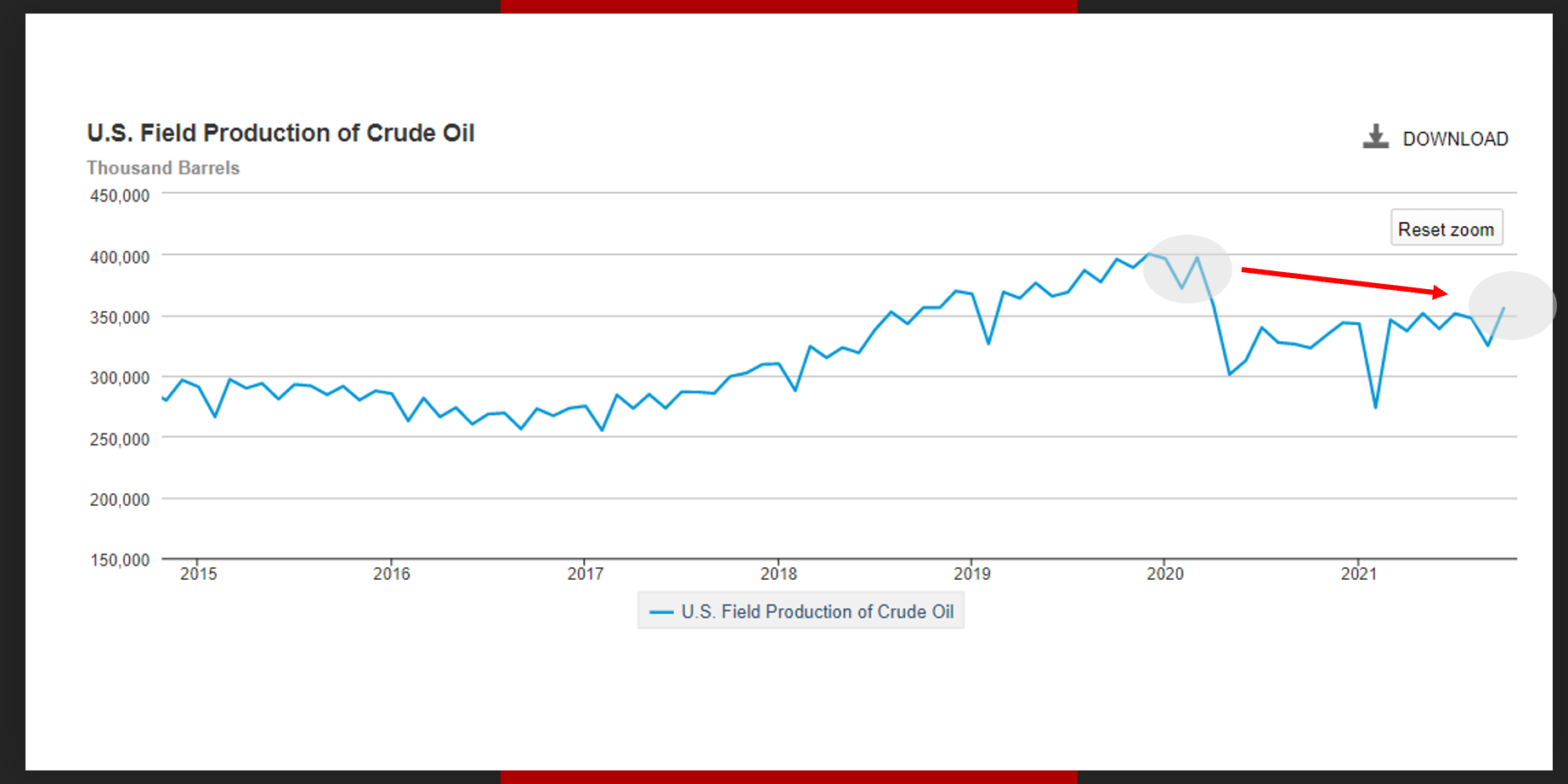

The peak of supply increase is the belief of crude oil bulls at present. Especially in 2021, the carbon-neutral agreement reached by countries all over the world fundamentally makes bulls think that in the next few years, the new investment in crude oil will drop sharply, and with the exit of old oil wells, the growth of crude oil production will be weak, resulting in insufficient supply. As long as it is out of stock, there is no lack of capital in the futures market, which is the core factor of the current strong oil price.

In the past, countries around the world increased production without restrictions, and when oil prices were high and profits were made. However, the situation is different now. First, the risk of epidemic duration should be considered for new investment, and second, the severity of petrochemical carbon policies in various countries should be considered. As a result, the production increase is slow, so even if the oil price is higher, the production growth rate is still limited.

What needs to be vigilant is the sudden increase in production.

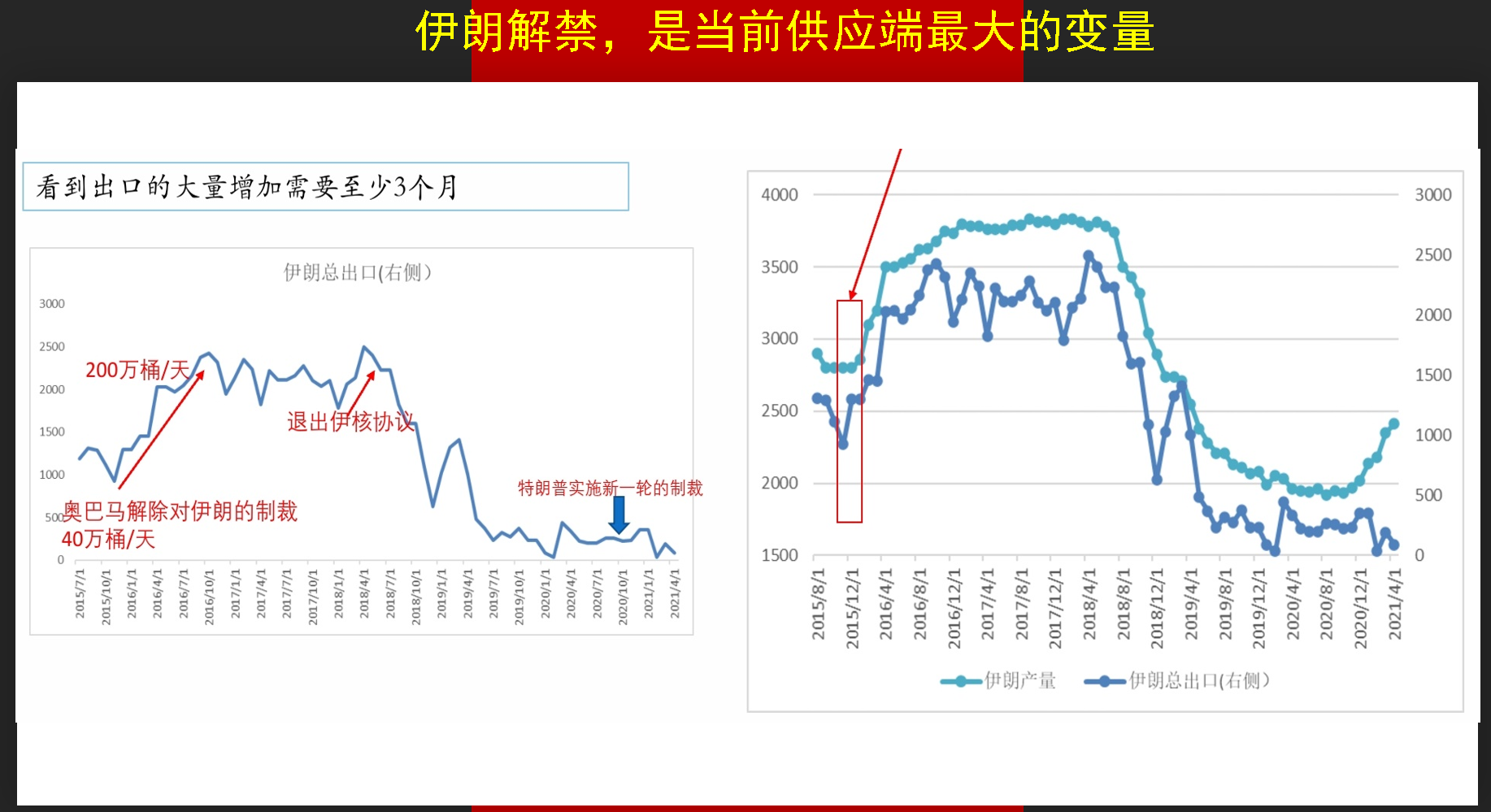

The release of crude oil reserves in consumer countries to control oil prices has been falsified by the market. After all, it will be bought back after release, which will increase long-term demand in disguise. Only by increasing supply can oil prices have a great shock. At present, the oil-producing countries with large production capacity are mainly the United States and Iran.

Oil prices are rising and inflation is rising. If the United States really wants to control inflation, it needs to consider any measures. The Iranian nuclear deal can be regarded as a big move to increase market supply immediately. After all, Iran has both stock and idle production capacity, which can greatly increase short-term market supply. As for whether the United States and Iran can negotiate, this can't be guessed, but can only be treated as an untimely bomb, so crude oil in 2022 is destined to be prone to turbulence.

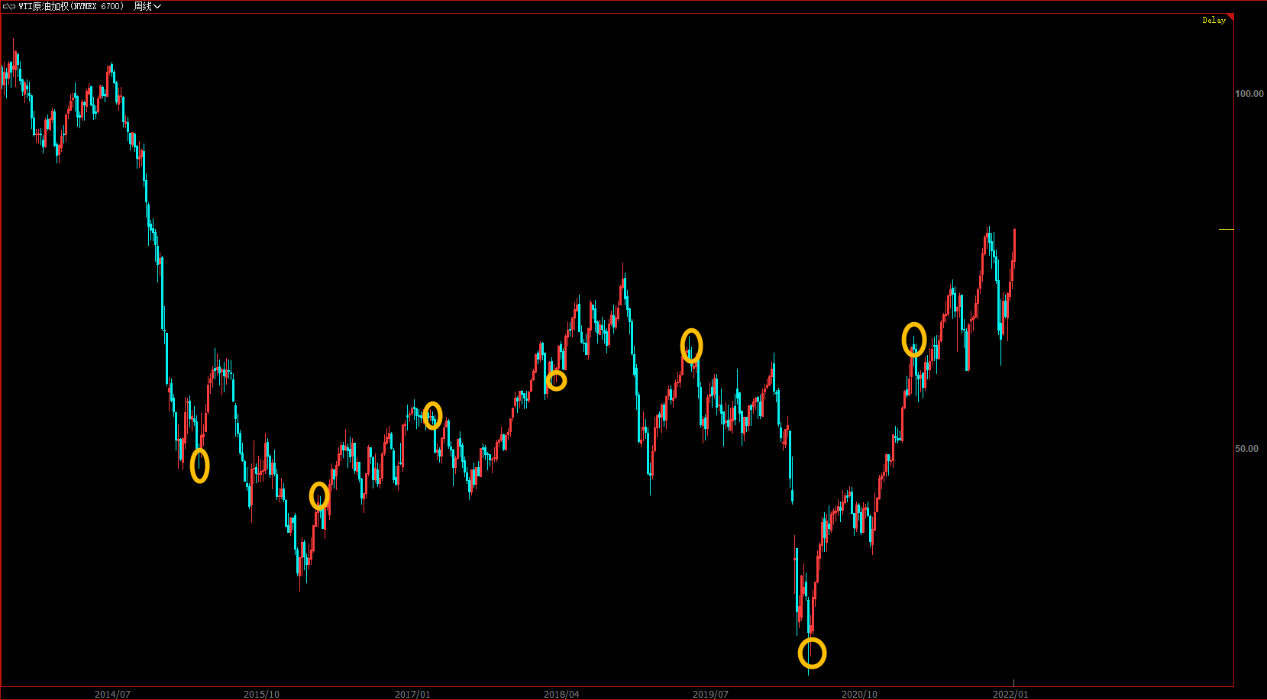

Third, the technical position of oil price

The price trend of bulk commodities is usually characterized by large intervals. After all, the price is high, the production increase is fast, the supply is large, and the price falls, so the historical price range needs considerable attention. Take WTI crude oil price as an example. The price of about US $100 is an important hurdle in history. The bottom of the range is around $60, which has been confirmed this year. If crude oil continues to drop sharply in the future, the price of $60 is an important watershed for observing the trend.

In terms of time, January and March/April are usually important price inflection points. From the current trend, unless there is a sudden bad news (foreign media say that China promised the United States to release its strategic oil reserves), I am afraid it will be difficult to peak in January. If it continues to rise to US $100, then March/April will be an important investment time for oil prices.

$NQ100指数主连 2203(NQmain)$ $道琼斯指数主连(YMmain)$ $黄金主连 2202(GCmain)$ $WTI原油主连 2202(CLmain)$ $天然气主连 2202(NGmain)$

Comments