Shares of financial technology company SoFi (NASDAQ:SOFI) are under pressure. The overall selling in the stock market amid the Omicron breakout and the expected moderation in SoFi’s adjusted revenue growth rate weighed on its shares. Further, the extension of the student loan moratorium remains a drag.

While SoFi’s member base and products continued to increase rapidly, management’s Q4 revenue guidance indicates a deceleration in growth on a quarter-over-quarter basis.

SoFi expects to deliver adjusted net revenues between $272 million to $282 million in Q4. This represents a quarter-over-quarter change of between -2% and +2%. In comparison, SoFi’s adjusted net revenue increased by 17% sequentially in Q3.

Moreover, it increased by 19% and 10% on a quarter-over-quarter basis in Q1 and Q2, respectively.

What’s Ahead?

Rosenblatt Securities analyst Sean Horgan lowered his FY22 estimates following the three-month extension of the student loan moratorium. Horgan lowered his “FY2022 revenue estimate by ~$40mn (or -3%)” and expects the “majority of the impact” of the extension to occur in the first half of the year.

While Horgan lowered his revenue estimate and price target to $28 from $30, he rated SoFi a “high-conviction Buy.”

His bullish outlook is centered around the “upcoming bank charter decision.” Notably, SoFi is awaiting a bank charter, which will significantly boost its growth prospects by lowering its capital costs and driving its margins. Horgan expects approval by 2Q22.

Though the extension of the pause on student loan repayments remains a near-term drag on its revenues, the strength in SoFi's personal loan business will likely support its top line. Further, during the Q3 conference call, SoFi’s CFO, Chris Lapointe, stated that the company is diversifying its lending segment beyond student loan refinancing “to navigate the evolving credit and interest rate environment.”

Notably, the decline in SoFi’s stock price has led investors who hold portfolios on TipRanks to accumulate shares. The data shows that about 3.4% of these investors have increased their exposure to SoFi stock in the past month.

While investors have been buying, hedge funds have been net sellers. TipRanks’ Hedge Fund Trading Activity tool shows hedge funds sold 3.1 million SoFi shares in the last three months.

Wall Street’s Take

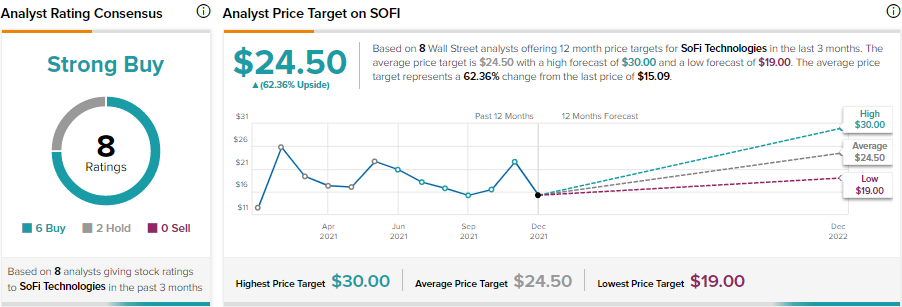

Along with Horgan, the majority of analysts have a bullish view of SoFi stock. On TipRanks, SoFi stock has received 6 Buy and 2 Hold recommendations for a Strong Buy consensus rating. Meanwhile, the average SoFi price target of $24.50 represents 62.4% upside potential to current levels.

Disclosure: On the date of publication, Amit Singh had no position in any of the companies discussed in this article.

source:NASDAQ

Comments