Meituan released Q4 and 2021 annual earnings. $MEITUAN-W(03690)$ $MEITUAN(MPNGY)$ $MeiTuan - main 2203(METmain)$

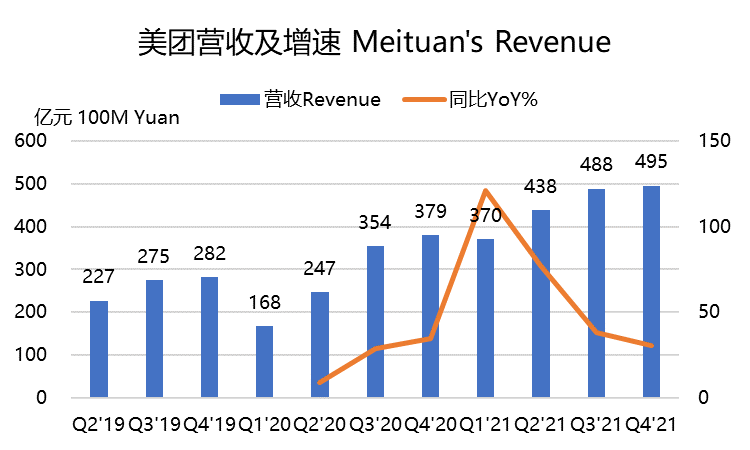

In 2021, Q4 revenue was 49.5 billion yuan, and the market expected consensus was estimated to be 49.3 billion yuan; The adjusted net loss was 3.94 billion yuan, which was better than the consensus loss of 5.79 billion yuan expected by the market, but increased from the loss of 1.44 billion yuan in the same period of last year.

In 2021, the annual revenue was 179.13 billion yuan, a year-on-year increase of 56%, and the market expected consensus was 179.54 billion yuan; The adjusted net loss is 15.6 billion yuan, and the profit in 2020 is 3.12 billion yuan.

In fact, the increased loss of Meituan Q4 has been shown in the recent stock price to a great extent. Even if it fell by 8% on March 25th, it symbolizes the pessimistic expectations of investors.

Takeaway business in attention

In Q4 2021, the take-out business earned revenue of 26.13 billion yuan 21.3%, a year-on-year increase, and the operating profit was 1.74 billion yuan, compared with 880 million yuan in the same period last year; The profit rate was 44.7%, exceeding the consensus of 40.8% expected by the market. Among them, the delivery cost of food and beverage take-out is 18.3 billion yuan.

On the whole, the food and beverage take-out business has achieved strong growth, with annual transaction users and per capita transaction frequency reaching a record high, and the peak of single-day orders reached a new high in December.

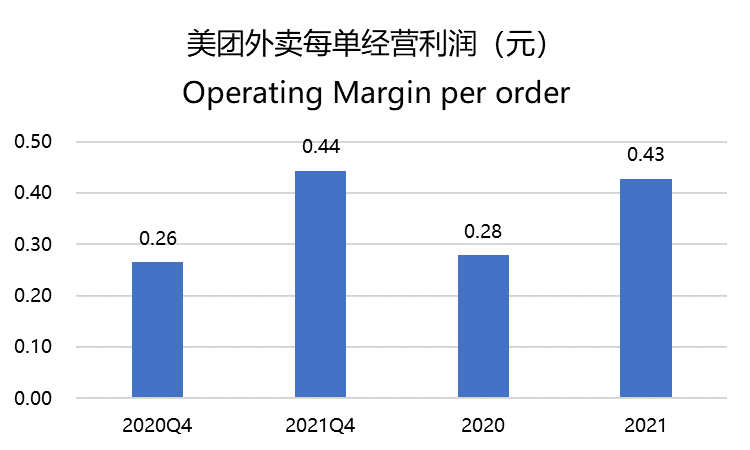

At the same time, by gradually reducing users' incentives and seasonally reducing rider subsidies, the profit margin of Meituan's take-out business Q4 has also been improved. From 3.3% in Q4 to 6.6% in Q4.

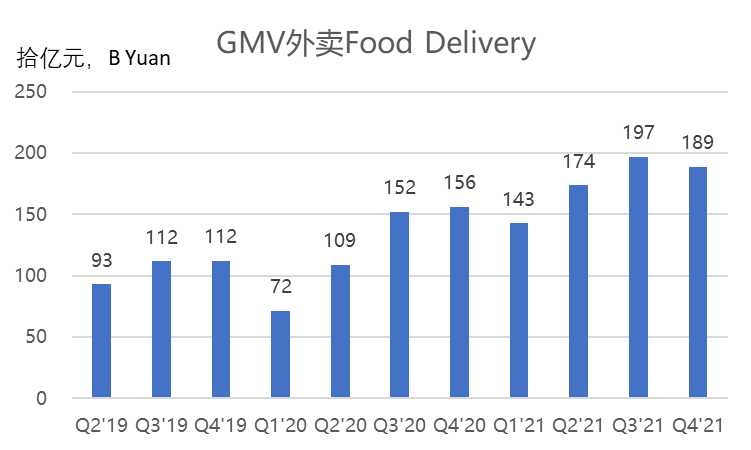

At the same time, we can also see that the take-out transaction amount (GMV) of Q4 increased by 20.7% year-on-year to 188.6 billion yuan, and the number of transactions also increased by 17.4% to 3.91 billion orders. The average annual transaction number per user is 35.8, up 27.2% year-on-year. The operating profit per order of Q4 is 0.44 yuan.

Combined with the operating profit of food and beverage take-out in 2021 of 6.174 billion yuan, the operating profit of one order is 0.42 yuan.

However, in March 2022, the US Mission announced that it will propose six relief measures to help small and medium-sized businesses with operational difficulties tide over the difficulties by reducing costs and increasing income. Two of them may affect the future food and beverage take-out commission income: Reduce the commission for small and medium-sized businesses in epidemic areas (halve, and cap each 1 yuan), and halve the technical service fee; The commission of small and medium-sized businesses in difficulty in non-epidemic areas is capped at 5%.

The market had previously voted with its feet for Meituan, thinking that the change of its take-out business commission would greatly affect the company's valuation level.

The wine travel business to the store that survives in the cracks

Meituan's in-store, hotel and tourism business contributed 8.72 billion yuan in revenue, up 22.2% year-on-year, which was almost equal to the consensus expected by the market. Operating profit is 3.9 billion yuan, with a profit rate of 44.7%.

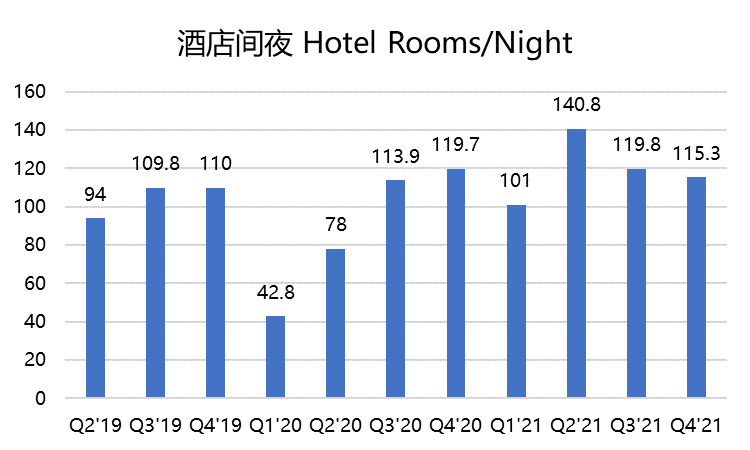

The market expectation has been constantly adjusted and cautious, mainly considering the impact of travel business under the influence of domestic epidemic. According to the whole year, the wine travel business in 2021 increased by 53.1% compared with 2020, and the operating profit rate increased from 38.5% in 2020 to 43.3%. It has also become the main source of cash flow.

The number of hotel nights in Q4 decreased by 3.7% year-on-year to 115.3. However, the number of nights in domestic hotels increased by 34.5% throughout the year, among which high-star hotels accounted for more than 16.5%.

The wine travel business to the store has always been the biggest contributor to the profit margin of Meituan, and it was also a business with high growth rate before the epidemic, and has become the biggest competitor of domestic wine travel business after Ctrip Group. However, the market after the epidemic is not as good as before. Of course, the impact of the epidemic is temporary, and the market expects it to improve after the second half of 2022.

Opportunities and challenges of innovative business

At the end of 2021, Meituan upgraded its strategy from "Food + Platform" to "Retail + Technology", aiming to open up a new capability circle besides take-out. Community e-commerce in innovative business will become the most growing part of retail sector.

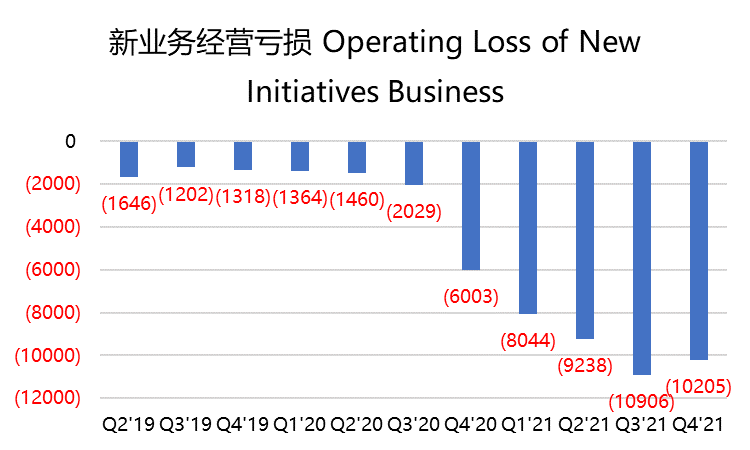

Q4 The overall revenue of new businesses including community retail, travel and finance was 14.67 billion yuan, up 58.7% year-on-year, and the annual revenue of new businesses increased 84.4% year-on-year to 50.3 billion yuan, which was the most important growth point. Of course, due to the fierce market competition of this business, the scale effect has not yet reached the highest, and its loss level has also reached a higher 10.21 billion yuan, higher than 6 billion yuan in the same period last year. However, the loss rate narrowed to 69.5%.

Community retail mainly includes community optimization, Meituan flash purchase and Meituan grocery shopping. In order to improve operational efficiency, a logistics network of "picking up goods the next day" has been built, which is more suitable for its rider team, and the user scale has gradually covered from first-tier cities to second-tier cities.

In fact, the competition of community group buying business is mainly in the competition of supply chain capability. The advantage of Meituan is the "short-distance, high-frequency" instant distribution network, but there is still room for improvement in sinking market and front warehouse.

According to the industry report, Meituan preferred and bought more food, which currently occupied 2/3 of the community group buying market, and with the deepening of Meituan's sinking degree, Meituan is expected to gain a larger market share.

On the other hand, increasing investment in warehousing, especially logistics such as cold chain, and improving performance ability will also become an important way to improve efficiency and reduce costs.

With the decrease of competition and the change of the overall environment in the first quarter of this year, we expect the new business input cost of Meituan to decrease in 2022.

In addition, the financial business backed by the huge resources of small and medium-sized businesses of Meituan is also expected to improve the profit margin of the overall innovative business in the growth. The travel business, after Didi's market share decreased, also gained a certain market share growth.

Expected management in 2022

Although Meituan's loss in Q4 is huge, it is generally better than market expectations, which can also alleviate investors' concerns about its demand for "reducing profit margins".

However, more concerns about its labor costs began in 2022, especially after Meituan introduced the policy of benefiting merchants and riders, the only way to maintain profit margins is to reduce subsidies and raise prices.

On the whole, Meituan needs more quarters to adapt to the impact of the new rate. However, we believe that the cost reduction in new business will also offset the headwind of the decline in take-out profit margin to a certain extent.

Comments