In recent days, the performance of companies in the super-sector of US stock retailers is eye-catching,$Costco(COST)$,$Wal-Mart(WMT)$,$Macy's(M)$,$Target(TGT)$,$Dollar General(DG)$,$Dollar Tree(DLTR)$ all of them are outperformed the market, and some hit record highs.

Our article at the beginning of last month High Inflation? Top Retail Dealers for Watch has revealedseveral points:

1. High inflation makes price increases a matter of course. As the last link of retail, Shangchao can eat more price differences;

2. The pressure on the supply side makes the frequency of consumption higher, which also raises more consumer demand;

3. The combination of traditional offline and online retailing gives Shangchao more path choices and adds the application scenario of "membership system".

Retails isquite a big category, including COST and DLTR, which take the low-end route, and M and DLTR, which also have high-end department stores$Nordstrom(JWN)$These daily consumer goods are now in a very prosperous stage in terms of demand and supply.

But there are exceptions!

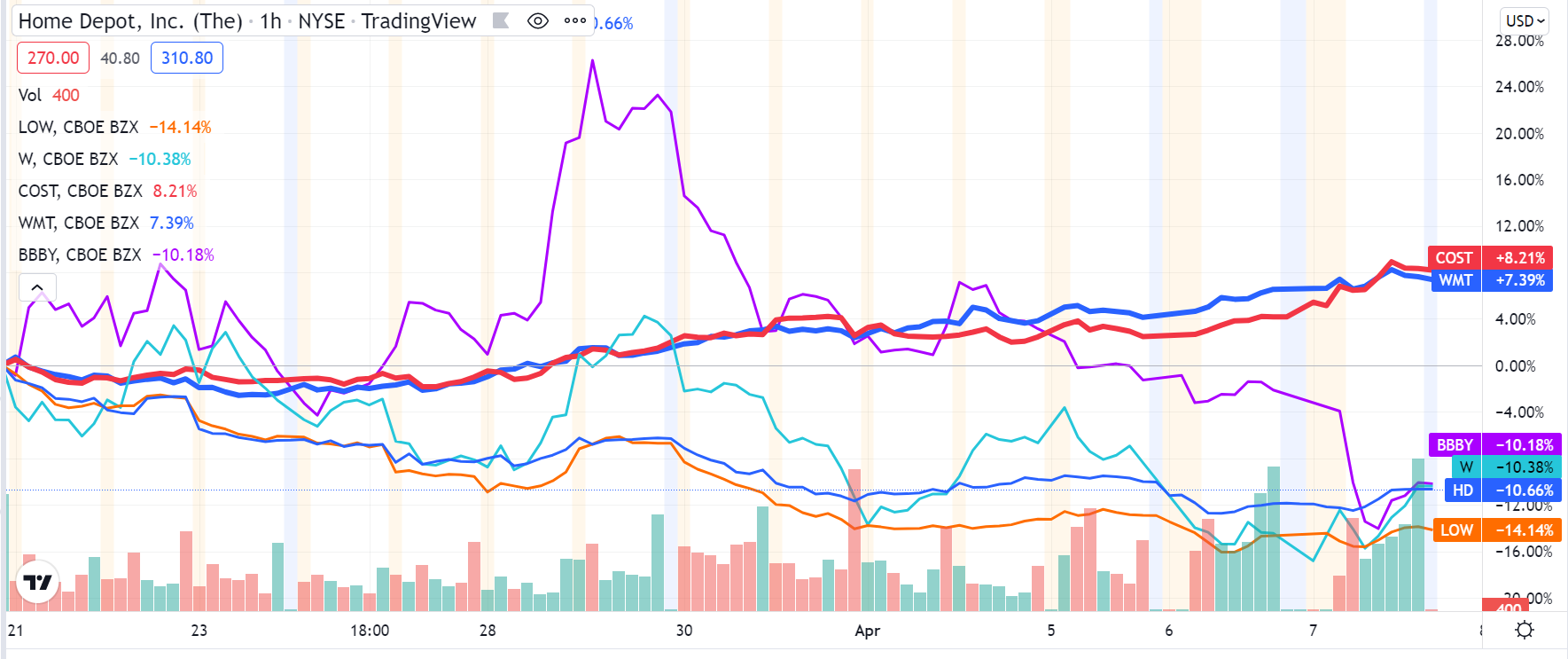

Supermarkets related to "houses" have not gained more favor from investors in the near future.For example,$Home Depot(HD)$,$Wayfair(W)$$Bed Bath & Beyond(BBBY)$$Lowe's(LOW)$. Among them, BBBY is a stock that retail investors prefer to play games, and its volatility is relatively large.

From the physical point of view, the performance of this kind of home retail supermarket is far inferior to that of other types of retailers.

Since March 21,$Lowe's(LOW)$Total down-14.1%,$Home Depot(HD)$Total down-10.66%,$Wayfair(W)$The total fell by-10. 38%; In contrast,$Costco(COST)$With an increase of 8.25%,$Wal-Mart(WMT)$The increase was 7.3%.

What caused the poor performance of real estate retail?

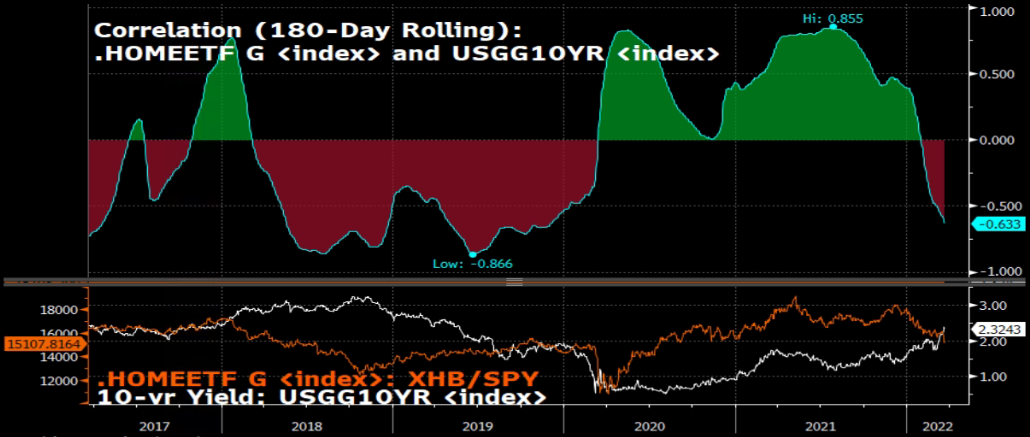

The important reason is to raise interest rates.As the benchmark interest rate rises, so will the interest rate on housing loans, which will restrict real estate transactions. The market thinks that the related expenditure of housing will be restrained in the future.

The Fed keeps turning eagles, and the pace of raising interest rates and shrinking the table is likely to become more and more radical in the coming months, which will hit investors' confidence in real estate-related assets in advance.

Of course, the assets of household companies are not always negatively correlated with interest rates, but the market sentiment at present is not good, which makes investors withdraw one after another. There is also a positive correlation between them in history.

In addition, raw materials and logistics still have an impact on the company's performance.

When the cost of raw materials is rising and the logistics efficiency is not high, the growth of sales of household products will stagnate. However, household products are not classified like other necessities of life, and most of them need to be used in combination. For example, wood boards and paint. You may need to buy it at the same time. Previously, in February, a short-term shortage of paint will also affect the sales of the whole household products.

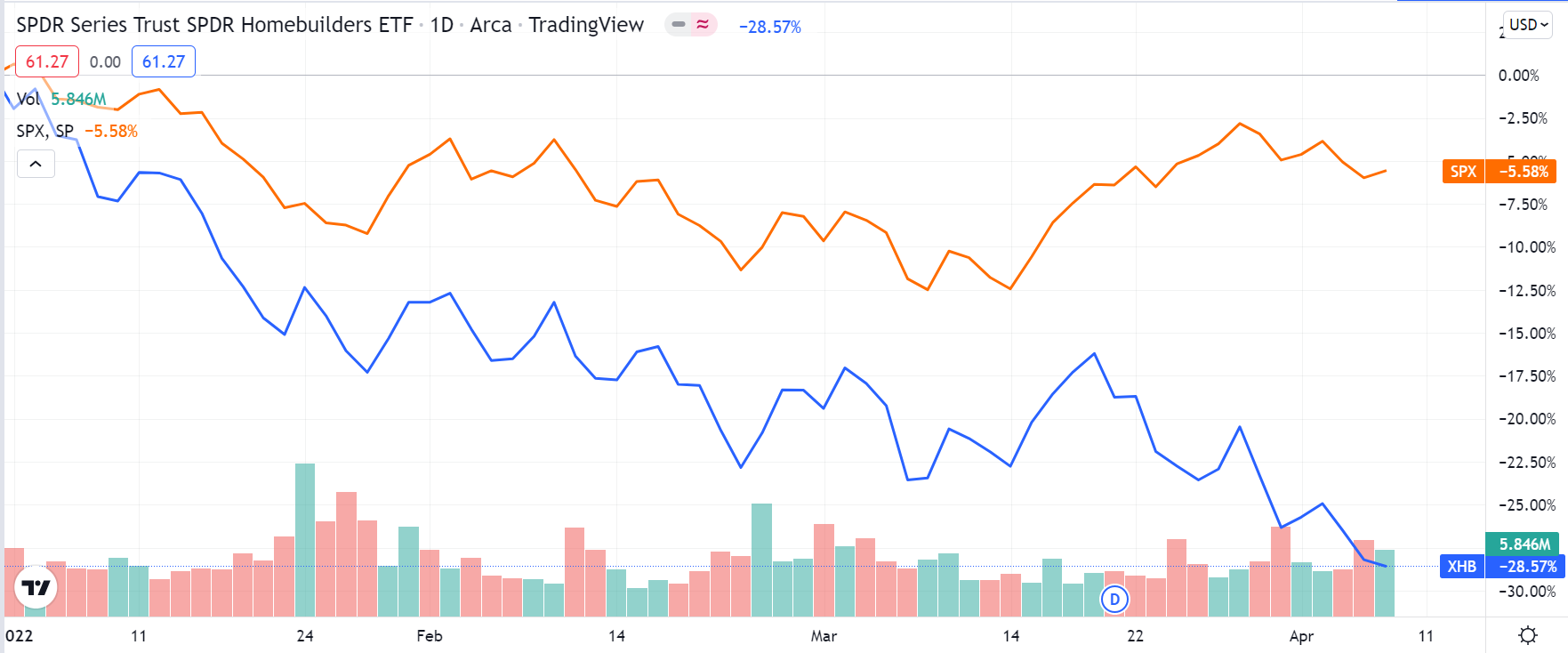

At present, the whole real estate construction sector has not performed as well as the market since this year$SPDR S&P Homebuilders ETF(XHB)$

At present, household supermarkets have also been "downgraded" or "target price lowered" by major investment banks. With the end of the last pre-interest rate hike cycle in Q1 this year, the market expectation in the future will become more conservative.

Comments

Did we missed the train?