On Friday, U.S. stocks finally ushered in a long-lost sharp rebound. For friends who are deeply involved at present, at least they breathe a sigh of relief. As for whether U.S. stocks bottomed out or just rebounded slightly? Let's discuss it later.

I. The overall valuation of the US stock index

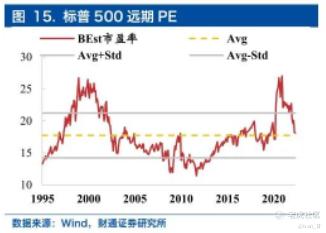

According to the tracking data of some research institutions on the valuation of US stock indexes, it can be found that after the recent correction of US stocks, their valuations have been greatly revised,Long-term PE has even returned to the average level. Although there is still a long way to go from the lowest PE level, it will no longer be the time to kill the decline for long-term investment institutions.

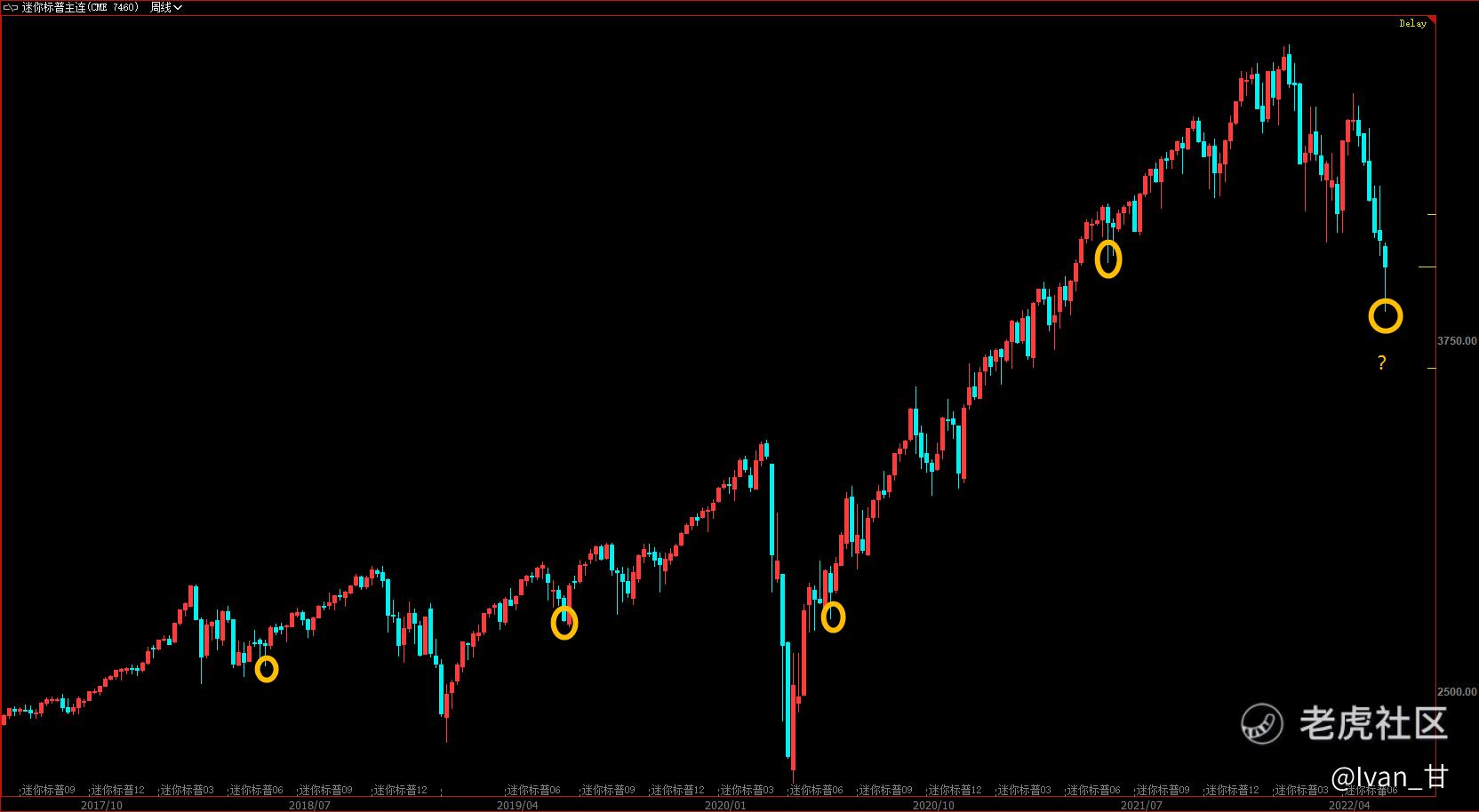

Therefore, from the short-term market, even if the index falls further, the step-by-step decline is its future characteristic. That is to say, some people bargain-hunting after falling more, and then further falling under bad news.

Second, the technical characteristics of the US stock index

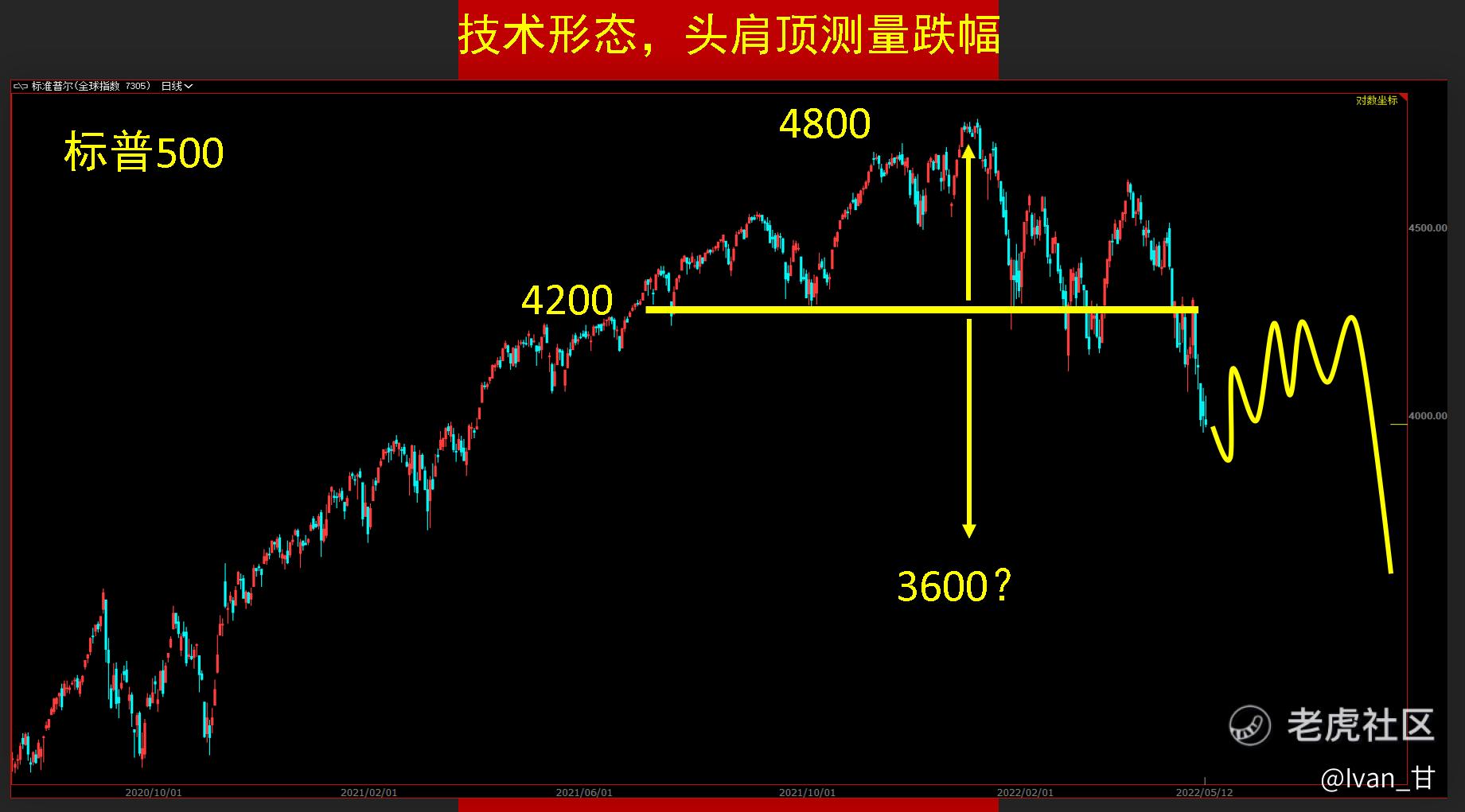

Thursday's live broadcast class gave the final expected range of the decline of the US stock index. In fact, the index price is only about 10% away from the target decline, so it is the normal state of the index to fluctuate and rebound violently when approaching the bottom position. Moreover, from the time, the index has always seen an important inflection point in October of 25810, so the rebound must be paid attention to.

So strategically speaking, in terms of S&P,Buying put options near 3850 and then holding stocks or stock index futures is a better bargain-hunting strategy. No matter whether this is the final low point or not, making good use of options can minimize the bargain-hunting loss.

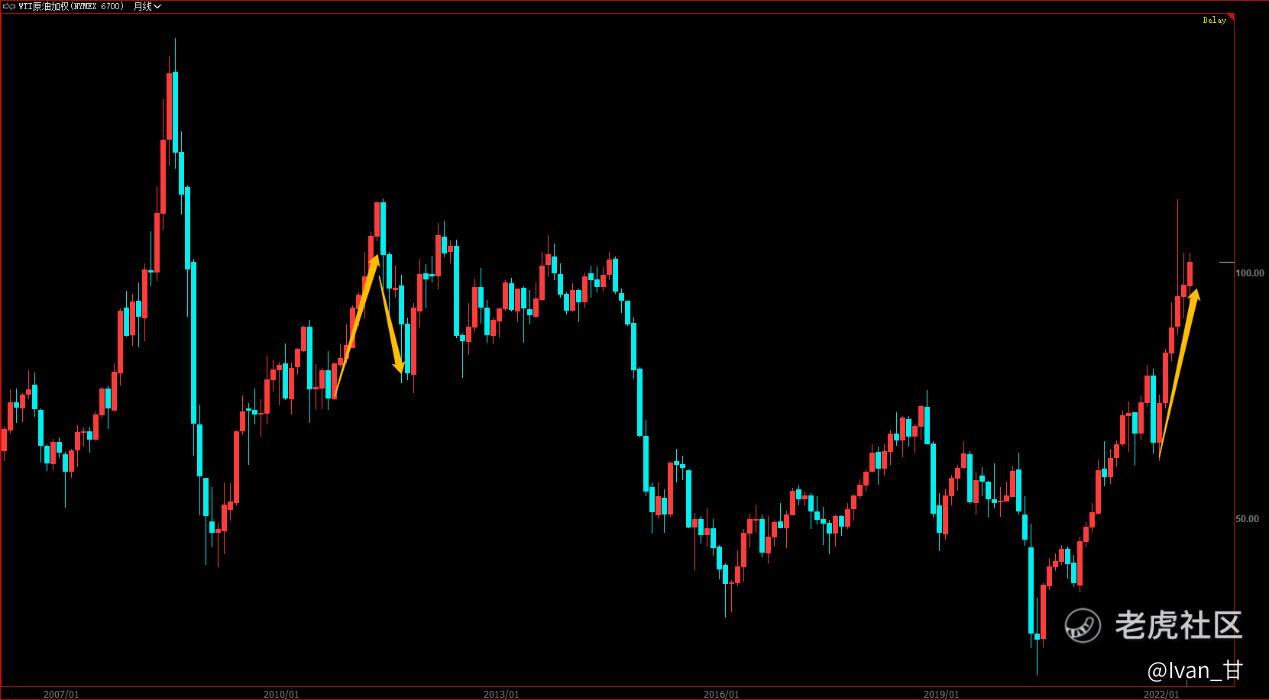

Of course, it is impossible for the stock index to rebound or reverse overnight. After all, the inflation index-oil price has not dropped sharply, and inflation still exists. Therefore, if the inflation data can't come down, the Federal Reserve will have to raise interest rates sharply, which can't have no impact on the stock market, so risk management is necessary.

Third, the oil price

The war continued and oil prices continued to rise. At present, oil price is the most unsolvable variety. At present, there is no potential news of the most bad oil price. How to lower the oil price depends on the future development. From the trend, the oil price is still strong, the tracking of the 10-week moving average is still effective, and the weekly closing price has not been broken, so bulls continue to hold positions.As for friends who expect to short, the only reversal technical feature I can find at present is the number of consecutive increases in oil prices on the monthly line. At present, oil prices have been rising for 6 months, and the longest consecutive increase is 8 months. Maybe we can catch a reversal of oil prices in another 2 months, but these are probabilities, and news is still the key to leading the market.

III. Gold

The price of gold is weaker than expected, and the annual line can't support the price of gold. After falling below, the annual line becomes a pressure position, so friends who do more gold should pay attention. It is estimated that it will rebound after falling below 1800 next week, but the position around 1830/50 (annual line pressure level) is already an important pressure position for gold price.

Many friends may wonder why gold prices will still fall sharply during the war. The mystery here is that Europe and the United States are going to suppress Russia at present, which will not change in the short term. In Russia's current foreign exchange reserves, gold occupies a very important part, and the effect of suppressing Russia will be weakened if the price of gold continues to rise.Incidentally, digital cash, because Russia is sanctioned, people may use digital cash as a tool in order to bypass the sanctions. It is conceivable that once digital cash is targeted at its fluctuation, it is amazing, and you should not take the risks lightly.

$NQmain(NQmain)$ $YMmain(YMmain)$ $S&P 500(.SPX)$ $ESmain(ESmain)$ $CNmain(CNmain)$

Comments