In 2021, the performance of gold was relatively dull, and investors turned more attention to widely used commodities such as crude oil and copper, and even some small metal varieties. Due to the geopolitical tension, gold has been paid attention to by the market again, but we believe that the resistance above $2,000/oz is not small, and after the trading sentiment returns to rationality, the gold price may still run along its original track.

It is unlikely that safe-haven funds will cause gold to rise for a long time

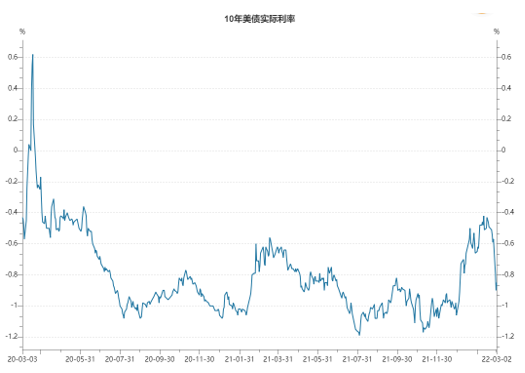

In mid-March, 2020, the real interest rate of 10-year US debt went down rapidly at a high level, while gold went up simultaneously. From July to August of the same year, gold price saw a staged top, and the real interest rate rebounded briefly. In the second quarter of last year, the real interest rate rose again, but gold did not break through the previous high, which means that gold has been desensitized to the real interest rate, but does not believe that the US dollar will default.

At the beginning of this week, the rapid decline of real interest rate lagged behind the response of gold, but the performance of gold and long-term US debt almost synchronized. From this phenomenon, it can be seen that the rise of gold price is unlikely to be driven by the debt side, but more likely to be a trading behavior. This fund is preferentially allocated with gold and long-term US debt, so it is unlikely that safe-haven funds will cause the gold price to continue to rise.

Short-term funds prefer gold and US dollars

As the earliest metal discovered by human beings, gold was regarded as a symbol of wealth by early human beings all over the world in primitive society because of its stable chemical properties, easy storage and nature worship. In the era of credit currency, credit currencies of major powerful countries tried to connect with gold.

After World War II, After the gold standard system was completely replaced by the financial system constructed by the Bretton Woods system and the disintegration of the Bretton Woods system, the currency of any country, including the US dollar, cannot be compared with gold, but the credit currency of major economic powers and gold still have many commonalities such as relatively stable value. The conflict between Russia and Ukraine escalated, and the US dollar and gold strengthened at the same time. In the month from February 1 to now, the international spot gold price rose by nearly US $200, approaching the US $2,000 mark, but the strong US dollar index slightly underperformed gold.

In this case, In a short time, Capital from Central and Eastern Europe tends to return to the United States to hold dollar assets. Wall Street traders are more inclined to allocate other stable assets such as gold other than the US dollar, while economic countries with more foreign exchange restrictions are difficult to fully allocate US dollar assets and have to over-allocate gold in the short term. Therefore, there will be a situation in which gold and US dollars are strong and gold is stronger than US dollars in the market.

The speed of the Fed's interest rate hike has become the focus

From the current perspective, it seems that there are traces to follow the rise of gold price, but from another perspective, gold, which is advancing by leaps and bounds, is going against the general trend. Erik Norland, executive director and senior economist of Chicago Mercantile Exchange, said that as investors seek gold as a safe-haven asset, the escalation of tensions around Ukraine also supports gold. According to the minutes of the January meeting of the Federal Reserve,The central bank may not raise interest rates as quickly as some investors expect, leading them to lower their expectations that the Fed may raise interest rates in increments of 50 basis points in favor of a smaller range of 25 basis points. However, Goldman Sachs is more pessimistic. It raised its inflation forecast in the United States and predicted that the Federal Reserve will raise interest rates more than expected in 2023. No matter which path the Fed finally implements monetary policy, the impact on reality is policy tightening, and the general direction will not change at all.

As far as the gold market is concerned in the long run, it is better to say that the game will shrink the table than the range of interest rate increase.At the congressional hearing on March 2, Powell said that he supported raising interest rates by 25 basis points in March, and if inflation is stubborn, he may raise interest rates sharply later. He also predicted that balance sheet normalization would take about three years, during which the process was flexibly adjusted.There is no mention of the time point of reducing the table.

From the perspective of term spread, different term spread implies that after raising interest rates, the short-term interest rate is not transmitted smoothly to the long-term interest rate, the spread is further narrowed, and the risk of economic recession increases. The Federal Reserve may have no time to shrink its table. On the premise that inflation expectations do not change much, the long-term nominal interest rate will not drive up the real interest rate, let alone touch the foundation of gold hovering at a high level. In other words, if the Fed moves quickly enough, gold may adjust.

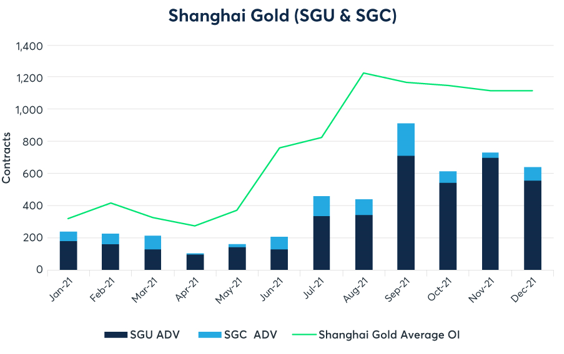

Overall, even if the cost of capital continues to decline, it is difficult for gold to hit a new high. If the Fed raises interest rates and shrinks the table too quickly, gold will face a lot of room for adjustment, and the lower space is much larger than the upper oneSquare space is a low probability event.Under the disturbance of safe-haven funds, the upper space is further compressed, and investors can pay attention to the opportunity of empty forward contracts of Shanghai Gold Futures Contract of Chicago Mercantile Exchange. One of the biggest features of this product is that it provides two contract options, namely, US dollar (transaction code: SGU) or offshore RMB (SGC), which best meet the needs of investors. In addition, it also provides arbitrage opportunities with COMEX Gold Futures Contract (GC), enjoys margin offset discount with COMEX Gold Futures Contract and other products of Chicago Mercantile Exchange, and uses Shanghai Gold Benchmark Midday Price (14:15 Beijing Time) for final settlement.

Spread trading opportunities between Chinese gold price and international gold price

China is the world's largest consumer and producer of gold. The price of Chinese gold traded on Shanghai Gold Exchange (SGE) is highly correlated with the international gold price (based on COMEX gold futures price), but the price of Chinese gold has always been higher than the international gold price (or "Shanghai Premium"). However, the outbreak of novel coronavirus pneumonia changed the relatively stable but long-standing premium situation in Chinese onshore gold market, which led to the "Shanghai Premium" becoming "Shanghai Premium" for most of 2020, and the transaction price once was-50 USD/oz. Since then, China's gold price has steadily rebounded, and the market has now resumed a stable premium. In other words, there is a spread trading opportunity between Chinese gold and international gold, and the Shanghai Gold Futures Contract of Chicago Mercantile Exchange provides investors with appropriate trading tools. Related futures contracts continued to be welcomed by investors in 2021, with average daily turnover increasing by 32% year-on-year and average positions increasing by 63% year-on-year (see the figure below).

$E-mini Nasdaq 100 - main 2203(NQmain)$ $YMmain(YMmain)$ $Gold - main 2204(GCmain)$ $Natural Gas - main 2204(NGmain)$ $Light Crude Oil - main 2204(CLmain)$

Comments