Last week was a sad week for me. Not only was I hit by a car during the exercise, but I was also disturbed by the fluctuation of the market, causing great losses. The war between Russia and Ukraine is a great power war that has never been experienced since its employment, which underestimates its price and emotional lethality. Past losses cannot be recovered and can only be made up by the future. No matter how many setbacks you experience, you still need to calmly analyze the future market and continue to look for suitable opportunities.

Last week's volatility opened up the high volatility of the market. Many previous perceptions will be broken, and high volatility does not represent a trend. Today's daily limit and tomorrow's daily limit will become the norm in many varieties. Short-term speculators are paradise at this time (one day and one week); For trend traders, it will be a time to test their mentality, and profits and losses fluctuate greatly; For arbitrage traders, it is time to look at luck. The advantages and disadvantages are directly related to the news. The price difference or theoretical spread can be disorderly expanded or instantly contracted. There is no better way to provide everyone, and it can only be adjusted according to the actual situation. Although it is difficult, we will discuss the following market expectations with you.

I. Crude oil

Oil price is the big brother, and whichever news comes out first, Russia's crude oil ban or Iran's nuclear agreement, will have a short-term instant impact on the market. After all, oil price is not low, and there is room up and down. Technically, there are several positions of oil price worth learning from.

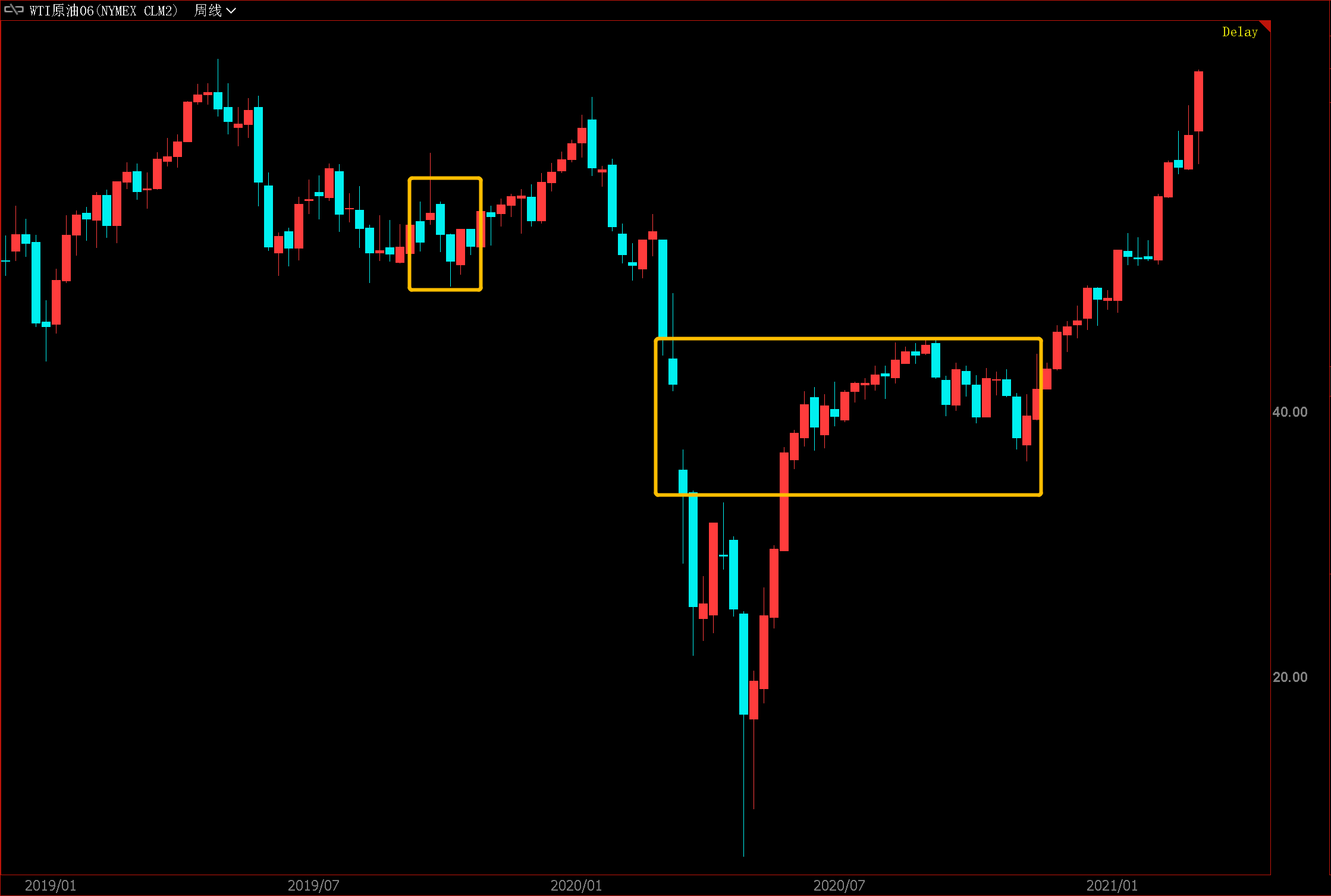

The first is the "negative" oil price fluctuation in 2020

The current fluctuation is close to that at that time, but in the opposite direction, so we can look at the graph upside down. Here, the weekly oil price fluctuation is 20% +, and the direction is related to the news, while the bullish one rebounds, while the bad one continues to kill down. Moreover, it often takes extreme news to reach the top (bottom). At that time, the 06 contract (the next month's contract of negative oil price contract) fell by 40% in a single week. If the price trend is turned over to top, don't be surprised.

The second is the gap

It is relatively rare for the weekly gap of crude oil to appear. In the past, if this kind of gap appeared in the current week, it would mean that the future market would take this as a watershed. Last week's gap was around $90, so in the future, the gap will become an important supporting position for oil prices, and it is highly probable that it will slow down near the price.

The third is to track the moving average

Previously, the 20-day moving average tracked oil prices, which was no longer applicable after the volatility soared. It is difficult to finalize the moving average of the medium-term trend at present. If you do short-term, please use the moving average of short period as the standard, for example, 5 days.

Second, agricultural products

After the war between Russia and Ukraine, I didn't expect American wheat to force its position in this way of daily daily limit, which really tested its determination to chase prices. According to past experience, there is always a huge earthquake in agricultural products in March, so please drop the bags if you do more, and those who do not enter the market can wait. This growth rate and range of American wheat has boosted corn and soybeans. Intervene after the huge earthquake.

III. Gold

The increase of gold was a bit straddled last week. It is reasonable to say that the risk aversion caused by the news of the war between big countries should not be so low. However, the increase of gold has not even exceeded 2,000 at present, which is dwarfed by the increase of oil price and wheat. I have discussed Russia's foreign exchange reserves with you before. To suppress Russia's foreign reserves, it is necessary to "cut the knife" with gold, and at least it cannot rise sharply. Therefore, gold is still not a good choice to chase more, and it may have to be reversed.

$E-mini Nasdaq 100 - main 2203(NQmain)$ $YMmain(YMmain)$ $Gold - main 2204(GCmain)$ $Silver - main 2205(SImain)$ $Light Crude Oil - main 2204(CLmain)$

Comments