The evening of the 4th of this week is the time when the Fed's interest rate meeting comes out, which coincides with the closure of the Chinese market. According to the past practice of doing things outside the market during the long holiday in China, I am afraid that the market volatility will intensify no matter what the outcome is. It has been two years since the Federal Reserve printed money indefinitely in the commodity market, which is in line with the characteristics of commodity bull market in history. At this time, FOMC policy is tightened, so don't be surprised.

As I expected before, when the Fed policy tightens and the US dollar index enters the middle period of depreciation, the upward trend of commodities will stall and usher in repeated adjustments, and now is the opportunity that may trigger major adjustments. When adjusting, the stock market commodities are estimated to be spared, but the difference in magnitude is only. Please be careful. Soft landing leads to commodity collapse (inflation slows down and economy grows again), while hard landing leads to stock market collapse (economic growth is dragged down by inflation). It is up to the market to choose which path in the end, and we can wait for the result.

I. Crude oil

If inflation is to be suppressed, oil prices cannot rise any more. Therefore, whether the adjustment of commodities is over or not depends on whether crude oil has fallen through. According to the price characteristics of crude oil, the adjustment range of the general trend generally starts from the high point of the average price, and the decline is usually about 35%. However, the average high price of crude oil refreshed in the Russian-Ukrainian conflict is about US $115 (the average price of futures for 12 months). If the high point falls by 35%, the average price of oil price is estimated to be US $75-80. If the adjustment occurs, the decline will be completed in 2-3 months, so it is expected that the second half of the year will be an opportunity for oil price bargain-hunting. At present, there is not much bullish news about oil prices. Unless the war continues to expand, it is still difficult to completely cut off Russia's crude oil supply. Therefore, there is no shortage of oil in the world at all, but only a shortage in some areas.

Second, precious metals

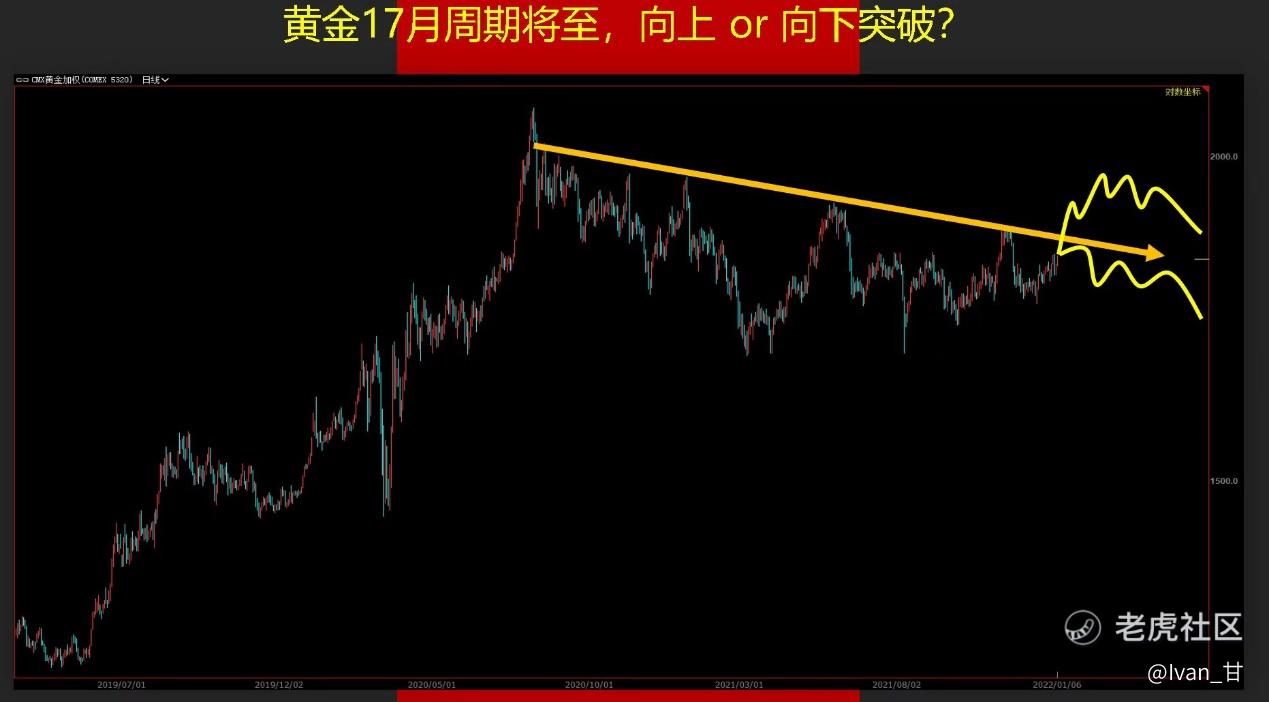

Do you still think about the big bull market of gold? Please look at the figure below. This is the expected figure of gold price given at the beginning of this year, which is quite in line with expectations.

Gold price can't even stand at 2000, so don't demand a bull market in gold price. Maintaining the large range volatility at the present stage is more in line with the current fundamental characteristics. Inflation expectation and interest rate hike effect are the two major attributes that influence the current operation of gold price. If inflation is strong, interest rate hike will be urgent, while if inflation is weak, interest rate hike will be slow. Therefore, it is the reason why gold price is not pessimistic when it falls more and not optimistic when it rises more. Want a big bull market? Stand firm for 2000.

III. Agricultural Products

In fact, the financial attribute of commodities is getting stronger and stronger. What is the financial attribute? Stockpiling goods is strange. The goods are not enough, but there is more money, and when everyone rushes to buy them, it seems that there is not enough. Originally, I prepared dishes for one week, but I was afraid of the high price in the future. When I prepared dishes for one month, the demand suddenly increased several times. When the price is expected to be cheaper in the future, everyone will stop stocking food, and the demand will suddenly return to its original shape. Therefore, when the prices of agricultural products rise sharply, we will always be told that there is a shortage, but after a long time, the output is actually increasing, and the rise and fall are dominated by financial demand, but the news is different in different periods.

Anyway, agricultural products are valuable after all, so you can bargain-hunt after falling through.

$Gold - main 2206(GCmain)$ $Light Crude Oil - main 2206(CLmain)$ $E-mini Nasdaq 100 - main 2206(NQmain)$ $Natural Gas - main 2206(NGmain)$

Comments