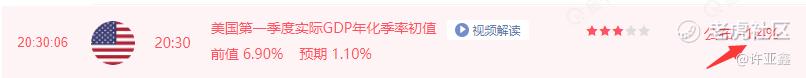

At 20:30 on April 28th, Beijing time, the GDP data of the United States in the first quarter of 2022 was released, which is also the first economic transcript since the Federal Reserve started balance reduction last year (it ended debt reduction and raised interest rates in March this year).

Before the data was released, the expectations given by major banks and financial institutions were as follows:

UBS:-0.2%;

Bank of America Merrill Lynch: +0.5%;

Dominion Securities: +0.5%;

Deutsche Bank: +0.6%;

Wells Fargo: +0.6%;

Deka Bank: +0.7%;

Industrial Bank: +0.7%;

Bank of America: +0.8%;

Citibank: +0.8%;

Standard Chartered Bank: +0.8%;

UOB: +0.8%;

Fannie Mae: +0.9%;

Faba Bank: +1.0%;

Ruijie Finance: +1.0%;

HSBC: +1.0%;

Oxford Economics: +1.0%;

Moody's analysis: +1.1%;

JPMorgan Chase: +1.1%;

Kaitou Macro: +1.2%;

Netherlands International: +1.3%;

Morgan Stanley: +1.4%;

Scotiabank: +1.4%;

Credit Suisse: +1.5%;

Goldman Sachs Group: +1.5%;

Westpac: +1.5%;

Nomura Securities: +1.6%;

Yuxin Bank: +1.6%;

Barclays: 1.7%;

Mizuho Securities: +2.5%;

Reuters forecast: +1.10%

Looking down, UBS is the most pessimistic at 0.2%, Mizuho is the most optimistic at 2.5%, and the median market forecast is around 1%.

What do you guess about the data?

It's surprise!

US real GDP fell at an initial annual rate of 1.4% in the first quarter, worse than the most pessimistic UBS forecast! In another data, the real personal consumption expenditure increased by 2.7% in the first quarter, which was also lower than the expected 3.5% and slightly higher than the previous value of 2.5%.

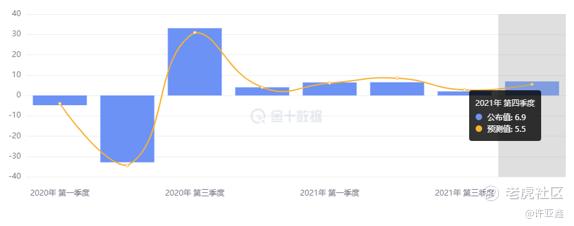

We all know that although GDP data is a lagging indicator, the signal revealed here is that medicine (stimulus) can't stop,!In the fourth quarter of last year, the GDP growth rate of the United States reached 6.9%.

Therefore, next, the trading logic of the market will probably move towards the "fourth stage" as we expect.

What do you mean?

Now we are in the third stage, that is, in the federal funds futures market, the year-end interest rate forecast has soared to 2.5-2.75%, and the total number of expected interest rate increases has reached 10 times (each time by 25 basis points).

In other words, it is equivalent to the market's expectation that the Fed will need to raise interest rates by 50 basis points four times and 25 basis points two times at the six interest rate meetings this year. Do you think the market's expectation is a bit excessive?

Especially when the Fed raised interest rates by only 25 basis points in March, the GDP data in the first quarter has already dropped by 1.4%, so who will give the Fed the courage to increase 50 basis points at each of the next four interest rate meetings?

Obviously, the fourth stage that the market will enter next is the stage when the market speculates on the Fed's interest rate hike and balance reduction.Tonight's GDP is just a letterNo, the real final decision actually needs to wait for the confirmation of the results of the Federal Reserve's interest rate meeting on May 4th!

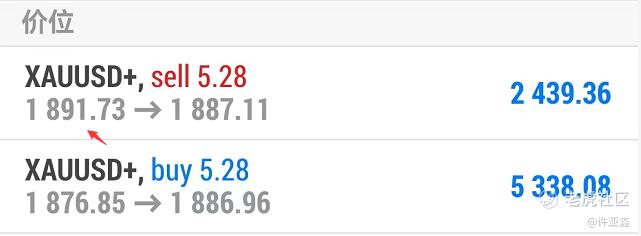

Of course, the cold GDP data of the United States in the first quarter will actually add a little more chance for gold and silver to change successfully in the change window on the 29th. Please pay attention to the PCE data of the United States in March to be released at 20:30 Beijing time tomorrow.

Finally, let's track the trend of A50 index. As shown in the above figure, A50 fell back again this week to test the support of 12800 line, and stabilized, echoing the previous low of 12294, which is equivalent to forming the second low. It is expected that the short-term shock will continue. After the Fed interest rate meeting landed on May 4 and the epidemic situation in Shanghai and Beijing became clear in mid-May, the market is expected to set off an upward trend.

$MSCI China A50 Index - main 2205(MCAmain)$ $China A50 Index - main 2205(CNmain)$ $E-mini Nasdaq 100 - main 2206(NQmain)$ $Gold - main 2206(GCmain)$ $Light Crude Oil - main 2206(CLmain)$

Comments