As tech stocks among other growth sectors take a breather,fintech stocksare arguably, in an interesting position. By and large, this part of the stock market today has and continues to experience volatility. For starters, the industry boomed as rapid widespread adoption hit the scene during the initial stages of the pandemic. With fintech services being the main means of transacting, the industry flourished. However, fast forward to now where pandemic conditions are somewhat improving, and fintech stocks appear to be less hot. This appears to be the case with more reasons for investors to turn towards defensive sectors.

Nevertheless, it is important to note that fintech firms, like it or not, are an integral part of the financial services industry today. With the immense market penetration seen throughout the pandemic, more consumers are signed up for fintech services than ever. Also, the industry continues to make strides forward as well. Take Sea Limited$Sea Ltd(SE)$ \ andBlock$Block(SQ)$ for example. Firstly, Sea’s fintech service business SeaMoney reported a revenue surge of 711% year-over-year in the company’s latest quarterly update. Secondly, Block recently provided glimpses into its work on a physical Bitcoin wallet. Should all these interest you, here are five more fintech stocks to consider in thestock marketnow.

Fintech Stocks For Your April 2022 Watchlist

- PayPal Holdings Inc.$PayPal(PYPL)$ (NASDAQ: PYPL)

- Wells Fargo & Company$Wells Fargo(WFC)$ (NYSE: WFC)

- Visa Inc.$Visa(V)$ (NYSE: V)

- JPMorgan Chase & Company$JPMorgan Chase(JPM)$ (NYSE: JPM)

- Apple inc.$Apple(AAPL)$ (NASDAQ: AAPL)

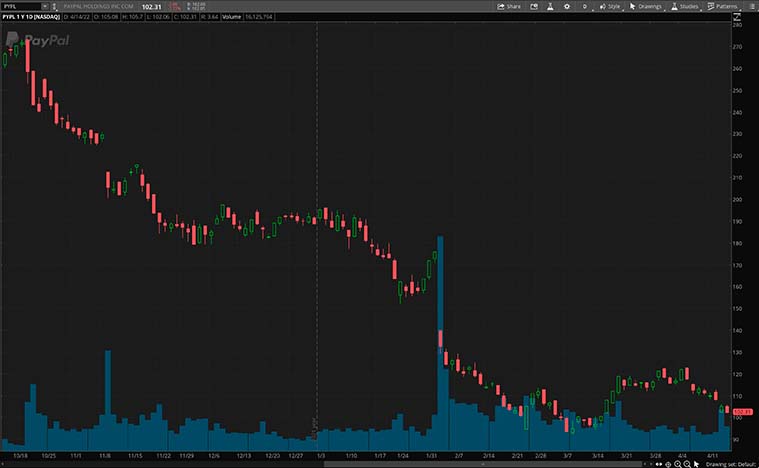

PayPal Holdings Inc.

Starting us off today, we have PayPal, a fintech company that has remained at the forefront of the digital payment revolution for more than 20 years. Today, it continues to leverage on technology to make financial services and commerce more convenient and accessible for all. Impressively, its platform is used by over 400 million consumers and merchants in more than 200 markets across the globe. Earlier in the week, the company announced the departure of John Rainey, its Chief Financial Officer and executive vice president for Global Customer Operations.

After almost seven years at PayPal, Rainey is leaving the company to join Walmart Inc. as its CFO. To support an orderly transition, Rainey will remain at PayPal until late May. The company’s board of directors has launched a formal search process to identify Rainey’s permanent replacement.“On behalf of everyone at PayPal, I’d like to express my gratitude to John for his outstanding leadership, selfless partnership and financial stewardship. John has been an instrumental contributor to PayPal’s growth by helping lay the solid foundation that supports the company’s innovation, global presence and financial strength,”said Dan Schulman, president and CEO, PayPal.”With that being said, is PYPL stock worth watching?

Wells Fargo & Company

Wells Fargo & Company

Wells Fargo is a multinational financial services company that manages approximately $1.9 trillion in assets. It also serves about one in three U.S. households and more than 10% of small businesses in the country. The company is also a leading middle-market banking provider in the U.S. In essence, it provides a diversified set of banking, investment, and mortgage products and services to its customers.

On Thursday, the company also reported its first-quarter financials. Diving in, Wells Fargo posted a revenue of $17.6 billion for the quarter. Net income on the other hand was a cool $3.67 billion. The company says that this quarter’s results reflect the continued economic recovery and progress that the company has made on its strategic priorities. It saw broad-based loan growth and grew both its commercial and consumer loans from the fourth quarter. All things considered, is WFC stock worth adding to your portfolio?

Visa Inc.

Visa Inc.

Visa is a world leader in digital payments and continues to facilitate payment transactions between its millions of users. Its payment systems facilitate transactions between consumers and merchants in over 200 countries and territories. The company will announce its fiscal second-quarter 2022 financials on April 26, 2022, after the market closes.

Last month, the company announced that it has completed the acquisition of Tink, an open banking platform that enables financial institutions and merchants to build financial products and services that move money. Through a single API, Tink enables its customers to move money, access aggregated financial data, and use smart financial services such as risk insights and account verification. With the completion of this transaction, Visa will enable clients to deliver substantial benefits for their consumers to better control their financial experiences. For these reasons, is V stock a buy?

JPMorgan Chase & Company

JPMorgan Chase & Company

Another name worth noting in the fintech space now would be JPMorgan Chase or JPM, for short. In essence, JPM is among the leading financial services firms in the U.S. today. Through its global portfolio, the company handles about $3.7 trillion in assets and over $290 billion in stockholders’ equity. Its main services include investment banking alongside commercial banking and financial transaction processing.

More importantly, JPM stock would be gaining attention in the stock market now seeing following the company’s latest financial release. In it, JPM posted earnings of $2.76 per share on revenue of $31.59 billion for the quarter. For reference, this is versus consensus analyst estimates of $2.69 and $30.86 billion respectively. While these figures may seem lackluster in year-over-year comparisons, JPM remains optimistic about the economy for now. CEO Jamie Dimon cites consumer and business balance sheets being at “healthy levels,” as a reason for this. As such, would JPM stock be a buy in your books?

Apple Inc.

Apple Inc.

Not forgetting,Apple’s increasingly prominent Apple Pay (AP) service is also a contender in the industry today. For those uninitiated, AP is the consumer tech giant’s mobile payment and digital wallet service. Through AP, Apple users can make cashless transactions using their Apple devices. These mainly include the iPhone, Apple Watch, iPad, and even Macs. Notably, all of this provides consumers with immense versatility and convenience.

Adding to that, Apple continues to seek ways to further bolster its AP solution now. Just last month, the company acquired British fintech start-up Credit Kudos for about $150 million. In brief, Credit Kudos develops software that employs consumer banking data to perform better credit checks on loan applications. Ideally, this could synergize with Apple’s credit card services in the long run. While that remains to be seen, will you be watching AAPL stock?

Comments