In 2022, a core contradiction of US stocks is whether economic fundamentals (corporate profits) can hedge the valuation contraction caused by interest rate hikes. For many years, earnigns are chief support of index. Therefore, every quarterly earnings and monthly economic data are a good falsification of economic recovery.

As the three major credit card issuers in the United States (Visa and MasterCard),$American Express(AXP)$ is one of the 30 representative companies of Dow Jones Industrial Average, and his performance reflects the recovery of online and offline economy directly. After releasing a strong fourth-quarter financial report yesterday, it not only effectively confirmed that the economy is still in a strong recovery cycle, but also led the DJI counterattack.

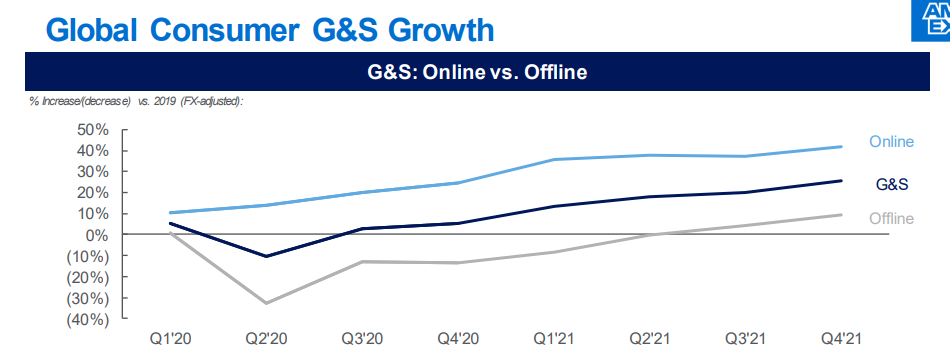

In the fourth quarter, consumers' spending on eating out and traveling by credit card continued to rise, which pushed American Express's revenue and profit beyond market expectations. Among them, the global consumer service sector increased by 23%, and the business service revenue increased by 30%. These two major businesses were driven by the increase in consumer credit card spending; Global business and network service revenue increased by 31%. Since 2021Q2, the company has basically stabilized at a growth rate of 25%-30%, and has basically emerged from the recession of the epidemic.

Other key data also show economic vitality: Q4 network transaction volume increased by 29% to 368.1billion dollars; The credit loss reserve was $53 million, compared with $111 million in the same period last year; The total expenditure was US $9.786 billion, up 29% year-on-year, which was mainly driven by higher marketing expenses, business development needs and card member rewards.

More importantly, in addition to the quarter's performance exceeding expectations, American Express also raised its revenue guidelines for 2022. It is estimated that the revenue in 2022 will increase by 18%-20% year-on-year, and the earnings per share will be between 9.25-9.65 US dollars. In the longer term, as the economy improves and stabilizes, the company is expected to achieve revenue growth of more than 10% and earnings per share growth of about 15%. In addition, the company plans to increase its regular quarterly dividend by about 20% to $0.52 per share from 2022Q1.

Earlier, several large banking stocks and Netflix issued weak performance guidelines. Investor worried that corporate earnings may not support the stock index, but the optimistic expectations of the management of an iconic financial institution like American Express added some confidence to the market, which somewhat dispelled the fear that the US economy might fall into recession again.

Comments