The market swung in shock on Monday. For Tiger friends who are familiar with VIX, they may have gained a lot. This article will explain why.

First of all, from the title that VIX is a product in the crown of trading, I think it deserves its name.

If you consciously understand VIX and related trading targets, futures, options and ETN, which are relatively complex financial products, should all be in your knowledge circle.

Because VXX, the most widely traded target of VIX index, is the product of the combination of these three concepts.

What is VIX

Since the calculation method of VIX index and the operation method of VIX futures are among the most complicated products available to retail investors, we will not elaborate on the details.

The VIX figure represents the implied volatility (IV) of SPX options due in 30 days, and IV is also the annualized fluctuation range of the market.$Cboe Volatility Index(VIX)$$S&P 500(.SPX)$

I can say more popularly, for example: If we have a VIX of 16 now, that means S & amp; The expected fluctuation range of P500 index in the next 30 days is 16% annualized. If our current SPX is 2300, the expected fluctuation price of SPX in one year is 1932 (2300*84%)-2668 (2300*116%), with a probability of 68.2%.

We note that VIX measures 30 days, so we monetize the annualized volatility with the formula 30-day volatility = VIX/sqrt (12). Substituting VIX into the formula, the result is 4.62, which means that investors expect the market to fluctuate by 4.62% in one month.

Relationship between VXX and VIX

VXX is a VIX-associated ETN. Almost all of the VIX derivatives on the market today are based on VIX futures because the VIX index itself cannot be traded. Let's take VXX as an example, which is almost the most widely traded VIX-related product.$VIX波动率主连 2202(VIXmain)$

VXX synthesizes a 30-day maturity VIX futures price by holding VIX futures in recent months and the next month.$Barclays iPath Series B S&P 500 VIX Short-Term Futures(VXX)$

VXX pricing formula:

VXX= (N1*F1+N2*F2) * C

-F1 is the price of VIX futures in the first month;

-F2 is the price of VIX futures in the second month;

-N1 is the number of contracts holding VIX futures in the first month;

-N2 is the number of contracts holding VIX futures in the second month;

-C is the adjustment factor (there will be a premium or discount with the actual VXX transaction price, and the factor is indicated by C)

Therefore, buying VXX is equivalent to buying futures contracts in the first two months of VIX, but the ratio of contracts in recent months and the next month is not 1: 1, simply speaking, it is a ratio that changes with time, and the proportion gradually shifts from the first month to the second month. For example, it is 80/20 now, 78/22 tomorrow, 76/24 the day after tomorrow and so on.

Although their attributes and algorithms are completely different, their correlation is about 80%.

At any time, there are 8 VIX futures contracts on the market, and these 8 contracts are 8 consecutive months, one per month. The delivery date of each month is 30 days ahead of the expiration date of SPX monthly options next month. The expiration date of SPX's monthly option is the third Saturday of each month, so the result of the previous 30 days is Wednesday of each month, which is the delivery date of VIX futures. For example, if the next SPX monthly option expires on February 18th, 2022, the corresponding VIX futures price date is February 16th. In addition, there are VIX small futures contracts for weekly delivery in the first 2 months, which are not covered in this article for the time being.$迷你VIX波动率主连 2202(VXMmain)$

Trading VXX posture

Knowing the above and delving into them for a short time may keep you away from trading VIX.

VIX products are popular because of the high volatility corresponding to the revenue potential; In addition, it provides an alternative to shorting the market. It is the one with more yield, and in the position of doing more.

< img src= "https://static.tigerbbs.com/b6222ce76208fa7497153ae9e65eb725 "tg-width=" 897 "tg-height=" 660 "width=" 100% "height=" auto ">

For example, VXX is up 105%, while the S&P 500 index is down 11.84%. Then when the S&P 500 rallied 10% from its lows, VXX fell 31.6%. This is when short-term and day traders want VXX.

The biggest intra-day opportunity, perhaps VXX provides one. When the S&P 500 index falls sharply (or then rebounds), in this case, buying or stopping losses means an opportunity to use VXX as a cash machine.

Why can't VXX last long

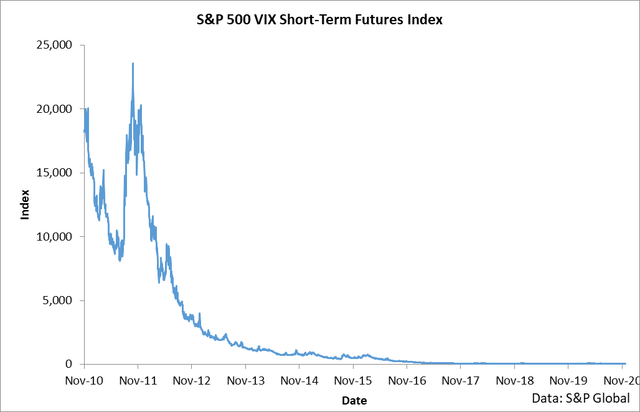

Do you know what the ten-year return rate of VXX is? The following figure shows one of them.

Like VIX futures, don't take years or even months as units for long-term VXX. This is one of the advice about VIX products, which is the crown product of trading, the short-term one.

Why is this so? It can be said that because of its product structure, because of the curve structure of VIX futures. Generally speaking, the curve of VIX futures is similar to the following figure, that is, the forward futures price is usually higher than the recent one, and the recent one is higher than the VIX index. Therefore, if the VIX index is assumed to be constant, the price of VIX futures will theoretically converge to the VIX index over time. This downward convergence process is also vividly called "Roll down".

Because VXX holds the futures of the first two months of VIX, and its proportion has been rolling towards the forward (as mentioned in Article 2 of this article), the contract price of the first month held by VXX has been falling, and at the same time, it is changing positions to the second month when the price is higher, and the price in the second month is usually higher and falling. Buying higher forward futures and then "Roll down" is the main reason why VXX can fall from $100 to $0.18 in 10 years.

Comments