Most of the stocks have down 40~50%, Here are 3 directions that Institutional Money goes?

We've witnessed the sharp decline of stock market in January, and many stocks got big declined,and we've seen trends tend to be positive in recent weeks.

Aureus Asset Management chairman and CEO Karen Firestone shared on an interview said: " Most of the stocks have down 40%~50%, now that its time to buy……"

What's your opinion? Do you feel positive? Below are some data shows how the retail and insituional investors invests money in.

Retail investors "Buy The Dip" and Bought What?

U.S. stocks recorded their worst January since the financial crisis and retail investors saw the downturn as an opportunity to buy the dip.

Clients buying the dip in U.S. equities recorded $5.5 billion in total flows to stocks, the largest sum since late November and eighth-largest since 2008, per Bank of America’s data.

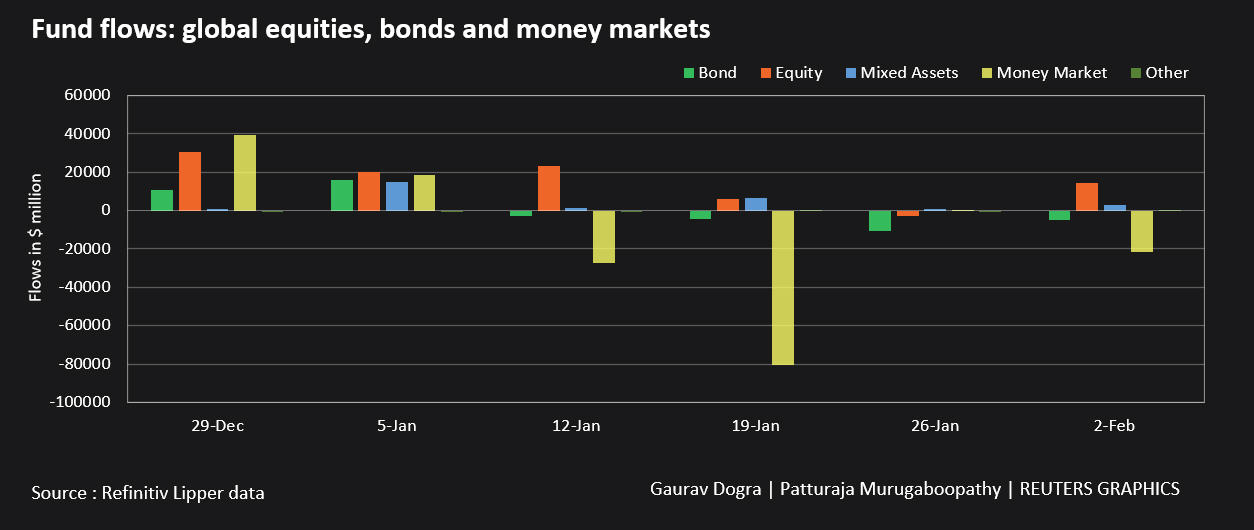

Cite From Refinitiv Lipper Data: Global equity funds lured big inflows in the seven days to Feb.2 on optimism over strong earnings from U.S. technology companies and on hopes that inflation would ease later this year.

Investors secured global equity funds of $14.34 billion in their biggest weekly purchase since Jan.12th.

Strong earnings from tech firms including Apple Inc (AAPL.O), Alphabet (GOOGL.O) and chipmaker Advanced Micro Devices (AMD.O), boosted investor appetite during the week.

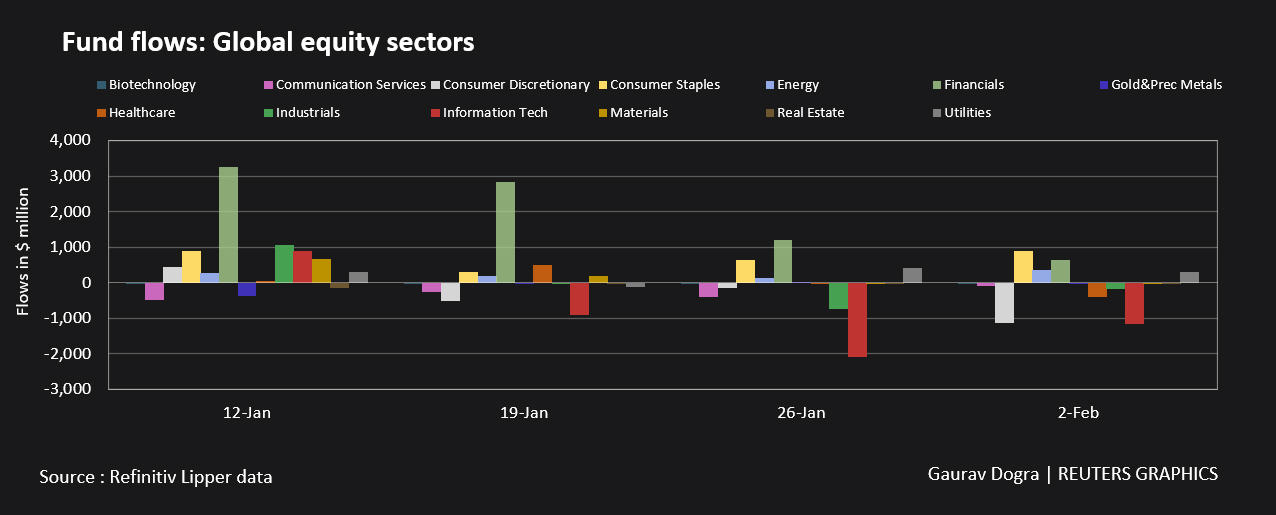

Besides that, Investors purchased European and Asian equity funds of $15.44 billion and $3.16 billion respectively while selling U.S. equity funds of $7.9 billion. Tech and consumer discretionary sector equity funds posted outflows of over $1.1 billion each, while financials obtained inflows worth $0.64 billion.

Research from Goldman Sachs that examines data going back to 1950 showed an investor buying the S&P 500 10% below its high, regardless of whether it was the trough, would have netted a median return of 15% over the next 12 months.

How About The Institutions Actions?

A Core Data Research study of almost 400 institutional investors worldwide finds the shift to actively managed, uncorrelated strategies stems from an uncertain backdrop of inflation and monetary policies.

Inflation was cited by over one-third of institutional investors as the biggest risk to investment portfolios and 40% of North American investors think inflation fears are the highest risk.

According to fresh data from Bank of America: Global institutional investors are diversifying into uncorrelated assets to hedge against rising inflation, such as hedge funds sold off assets.

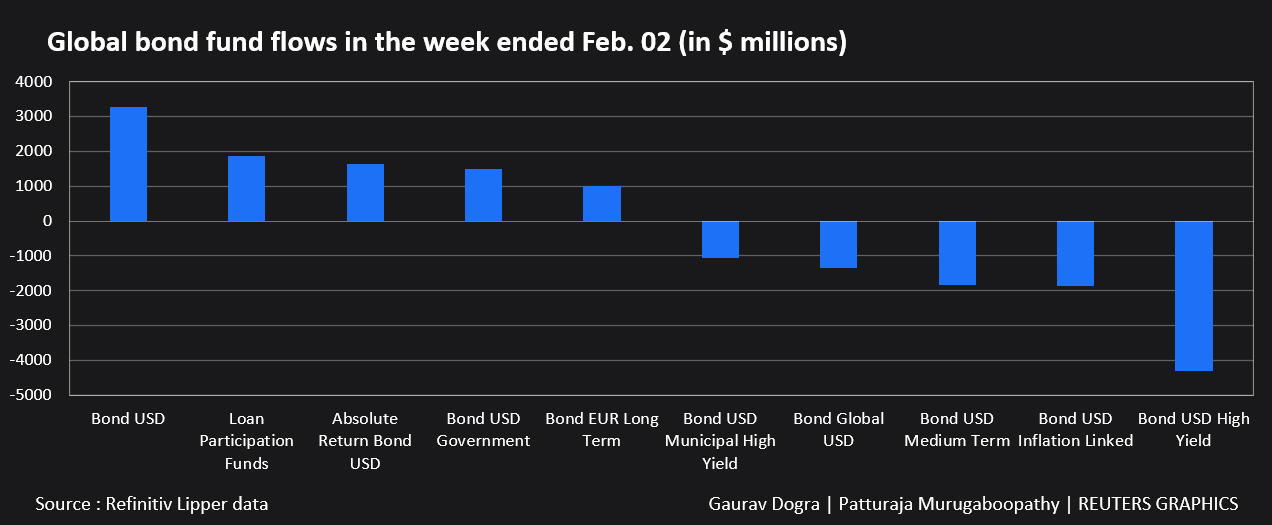

- Global bond funds witnessed net selling for a fourth successive week amounting to $4.85 billion.

- Global high yield bond funds led with outflows of $5.98 billion, the biggest since March 2020.

- Investors sold $2 billion worth of short - and medium-term bond finds. Government bond funds drew inflows of $1.19 billion.

- Meanwhile, inflation-protected bond funds posted outflows worth $1.95 billion, their largest in 22 months.

Some institutions were smaller net buyers last week (though still net sellers for the month) but hedge funds were sellers last week and across all of January.What did they buy?

Ryan Fause, a portfolio manager at Pinnacle Associates based in New Jersey said: "We do look for capital appreciation when markets are doing well and rely on income from dividends to help when markets become volatile or negative."

Belowis some data showing the institution's money wentinto 3 Directions: Dividend stocks, Precious Metal Fund, Specialty ETFs.

1.Dividend Funds

There has been elevated volatility in global equity markets this year on concerns over higher yields and inflation levels, which tend to squeeze corporate profit margins.

Dividend funds are seen as safe and offering some stability in that scenario, as they hold well-established companies that have better pricing power and a track record of providing stable income.

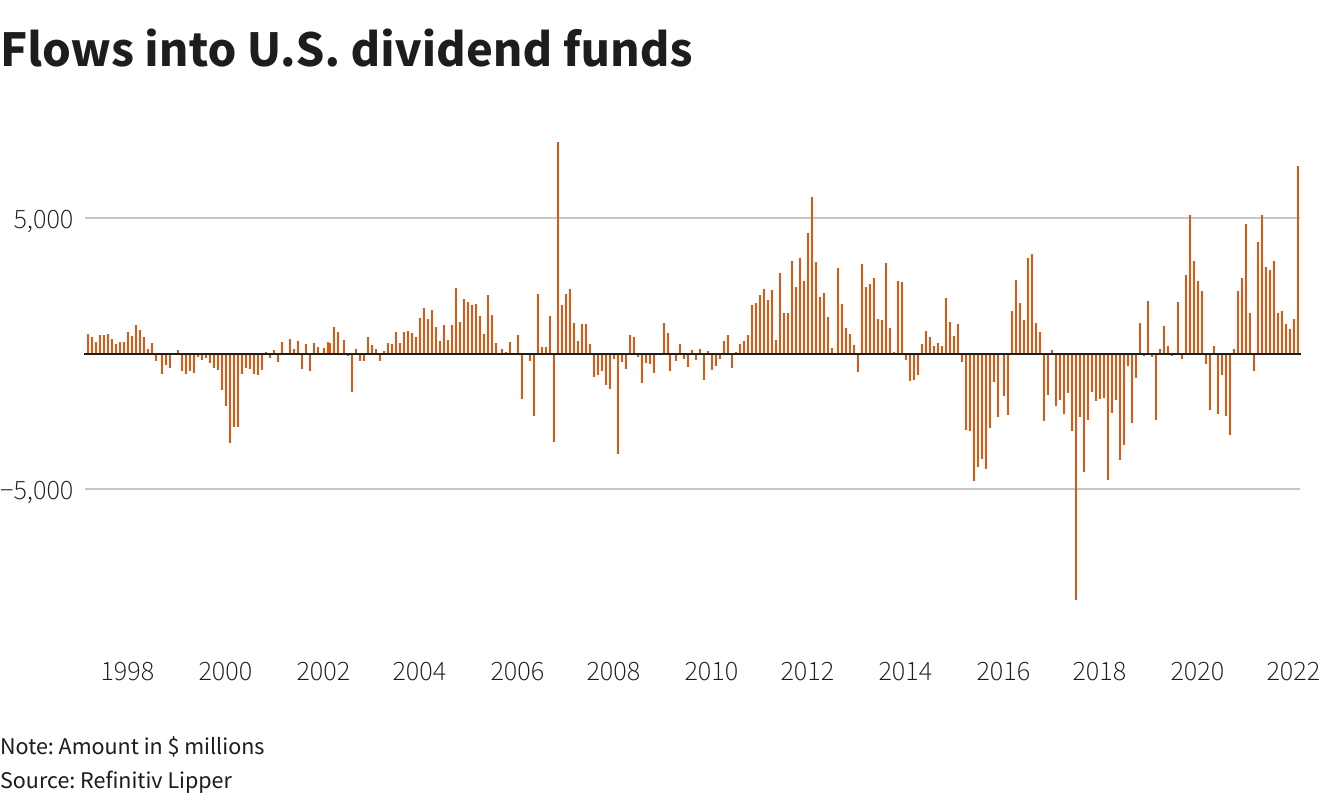

Investors bought $6.9 billion in U.S. dividend funds in January, the highest net purchases since October 2006.

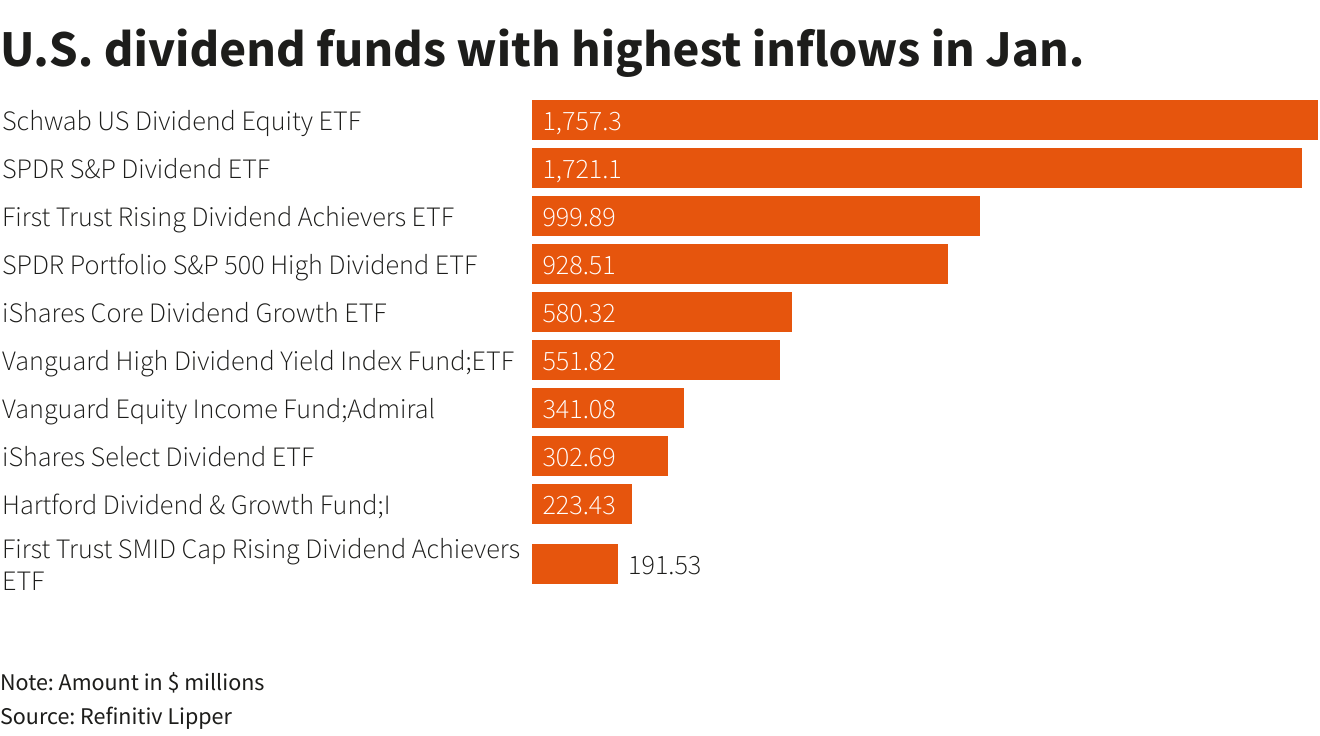

The Schwab US Dividend Equity ETF and SPDR S&P Dividend ETF led inflows, receiving about $1.7 billion each last month, while First Trust Rising Dividend Achievers ETF obtained $1 billion.

Dividend funds' higher inflows were also due to the recent investor shift towards what is called value stocks.

2. Precious Metal Funds, Emerging Market Funds

Among commodities, precious metal funds attracted inflows of $426 million in a third straight week of net buying, although energy faced a fourth straight weekly outflow, amounting to $308 million.

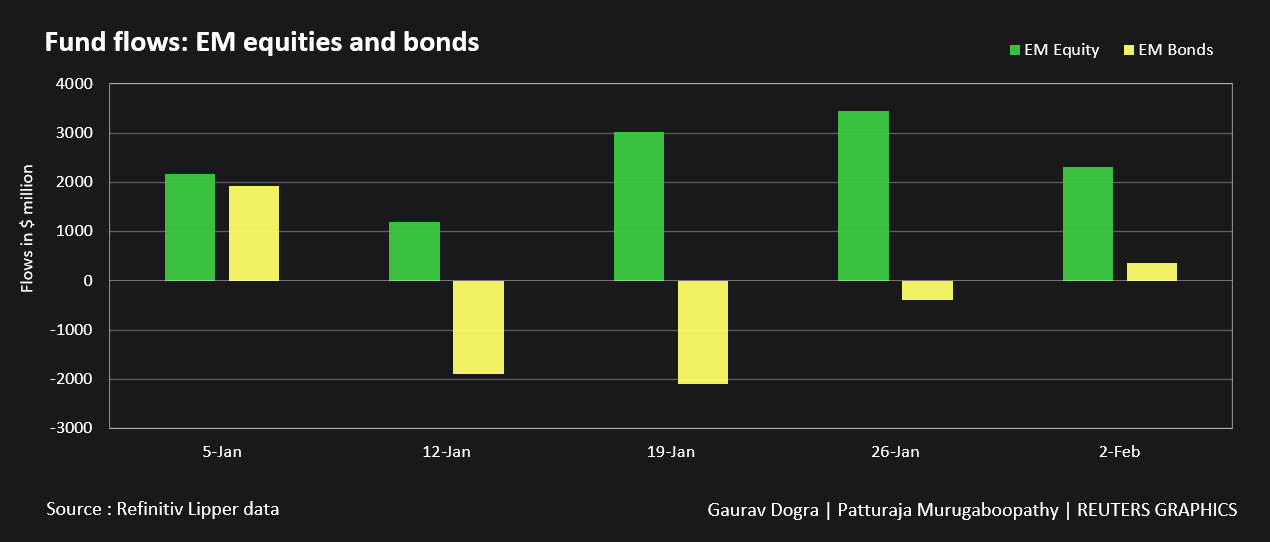

An analysis of 24,000 emerging market funds showed bond funds received $360 million in net buying after three consecutive weeks of outflows, while equity funds pulled in $2.31 billion worth of inflows.

3. ETFs

According to a separate study conducted by Institutional Investor (“Managing Market Volatility in 2021”), 70% of institutional asset owners turn to ETFs as a solution.

A portfolio manager interviewed for the Institutional Investor survey, "When you park it in an ETF, it helps to minimize performance drag and it’s a very smooth transition from an asset class perspective.”

In short, institutional asset owners recognized ever-versatile ETFs are among the primary tools under this period.

You May Interested In:

Don't Miss it: Three Postures to Buy Dip Of US Stocks!

Under Inflation Expectation: 6 Specialty ETFs to Rise

US10Y topping 2%? Three Treasury-related ETFs to buy

$(QQQ)$, $(PSQ)$, $(TQQQ)$, Which Leveraged ETF You Prefer To Buy?

Comments