-Open your eyes every day, as if the weather changed overnight. Wall Street knew tensions in Ukraine would continue, but did not expect a major escalation so early.

If you use one word to describe the current financial market: it is completely chaotic.

There is no clear main line of trading, there are false news, there are news misread by the public, there are news released by news media, and every news may affect the market.

1. The tension between Russia and Ukraine has entered the next stage

When Biden left the White House to give a speech in Cleveland, he told reporters that the possibility of an attack on Ukraine is very high, and it feels like it will happen in the next few days. We have reason to believe that they engage in self-directed and self-acting operations and create excuses for attacking.

The situation in Russia and Ukraine is escalating again. Look at these chaotic news. It is strange that the financial markets are not chaotic.

In Asian trading yesterday, a report by Sputnik, a Russian government-backed news agency, said Ukraine had fired mortar shells and grenades at four parts of the "Luhansk People's Republic" in eastern Ukraine (news that sent Asian and European stock markets down). Ukraine, on the other hand, said mortar shells hit a kindergarten near a government-controlled town in the east of the country and near the separatist contact line (both sides accused the other of firing first, but now they are talking their own way, and investors cannot know the truth).

In New York trading last night, the United States escalated its warning that "Russia will attack Ukraine" (the US stock market plunged).

The United States says Russia has massed up to 150,000 troops around its border with Ukraine and says it has seen no evidence of what it says is a withdrawal.

Russia, on the other hand, said that the United States was hysterical, but it would continue to conduct the largest exercise in Belarus in many years. Russian troops also held naval exercises in the Black Sea, which are scheduled to end at the weekend.

Behind the news is the game of "public opinion war" between Russia and the United States.

U.S. Secretary of State Blinken changed her itinerary Thursday to address the United Nations Security Council on the crisis.

Biden said that the Russian army might "direct and perform" the incident to create excuses, and a senior diplomat also said that the attack was imminent.

In Moscow, Russia expelled Bart Gorman, deputy head of the U.S. mission (the second official of the U.S. Embassy in Moscow). A State Department spokesman called this an unprovoked move.

Between you and me, the stock market fell and gold soared. Financial markets smell smoke.

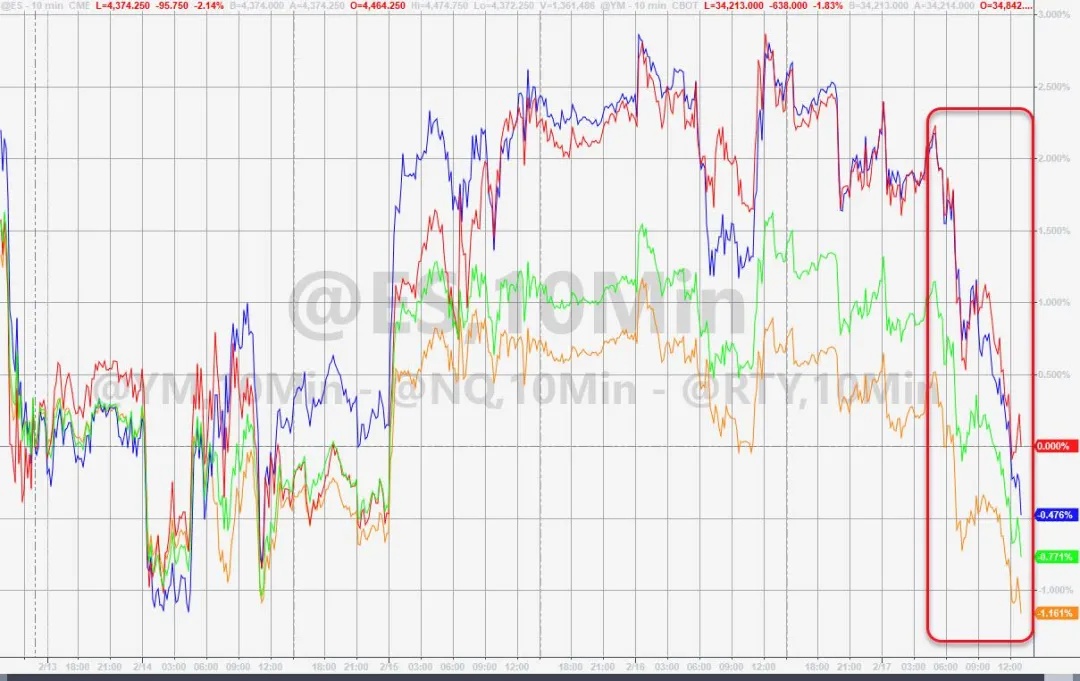

US stock market fell sharply

Gold surged above $1,900 for the first time since June 2021

Here are a few reminders:

First of all, we can't distinguish between true and false news, let alone make a correct judgment. Before the conflict happened, what we saw first was a public opinion war.

Secondly, we should not underestimate the duration of this incident, even more dramatic than the Sino-US trade consultation in that year, and we will see reversals many times.

Most importantly, this is a news-driven market at present, and all the value investment theories, castles in the air theories and random walk theories are temporarily invalid.

Goldman Sachs said that in the face of tensions between Russia and Ukraine, gold and oil seem to be the best risk hedging tools. Oil has an obvious upward trend, and this "risk premium" is based on the most tight inventory level in decades and the inelasticity of supply. The oil price only reached 125 US dollars/barrel, which led to a decline in demand, and then the market The field can regain its balance. Gold responds best to geopolitical risks that directly affect the United States, probably because the dollar itself is a safe-haven asset, which means investors tend to buy gold if the dollar is threatened.

2. The Fed has entered a chaotic period

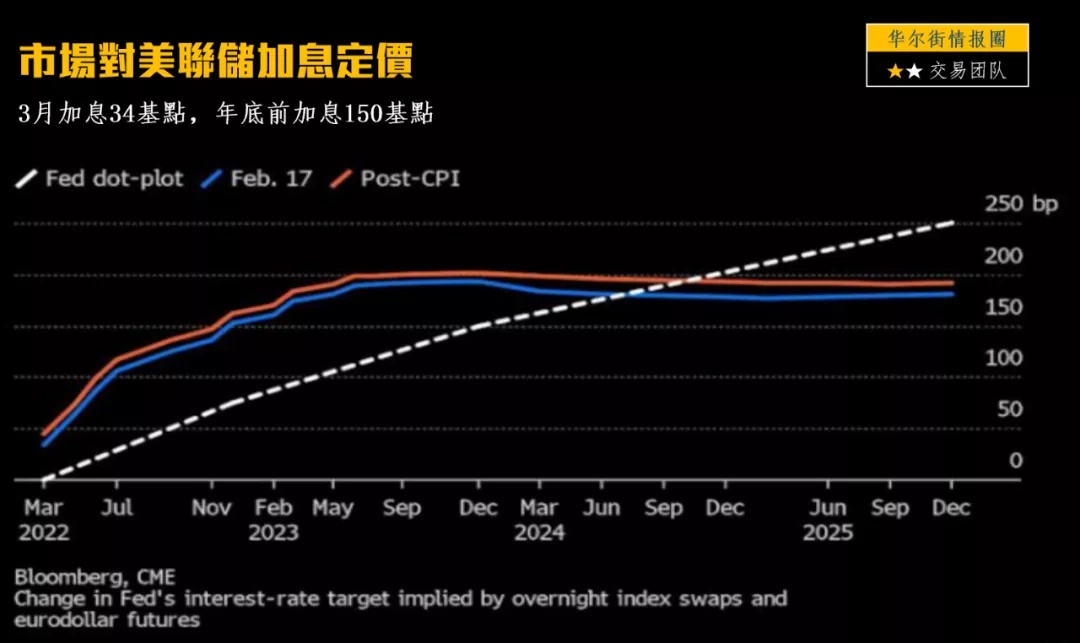

Last night, the market hype about the Federal Reserve raising interest rates by 50 basis points in March came to an abrupt end (geopolitical risks caused market changes). Swap market traders now expect the Fed to raise interest rates by 25 basis points at its March meeting more likely than by 50 basis points.

First, the minutes of the previous day's Fed meeting did not reveal any clues, which encouraged traders to bet on raising interest rates by 25 basis points;

Second, the tension between Russia and Ukraine has pushed up risk aversion, and it seems impossible to raise interest rates sharply.

At present, the market expects that the possibility of raising interest rates by 50 basis points in March has dropped to about 40% (it was 60% a day ago).

The market expects only six interest rate hikes by the end of this year (compared with seven a day ago)

Overnight Index Swap (OIS), which is linked to the time of the Fed's interest rate meeting in March, expects the federal funds target rate to be about 34 basis points higher than the current real effective rate of 0.08%. Since the Fed usually raises interest rates in multiples of 25 basis points, OIS prices indicate that traders believe that at least 25 basis points will definitely be increased in March, but the probability of 50 basis points is only about 40%.

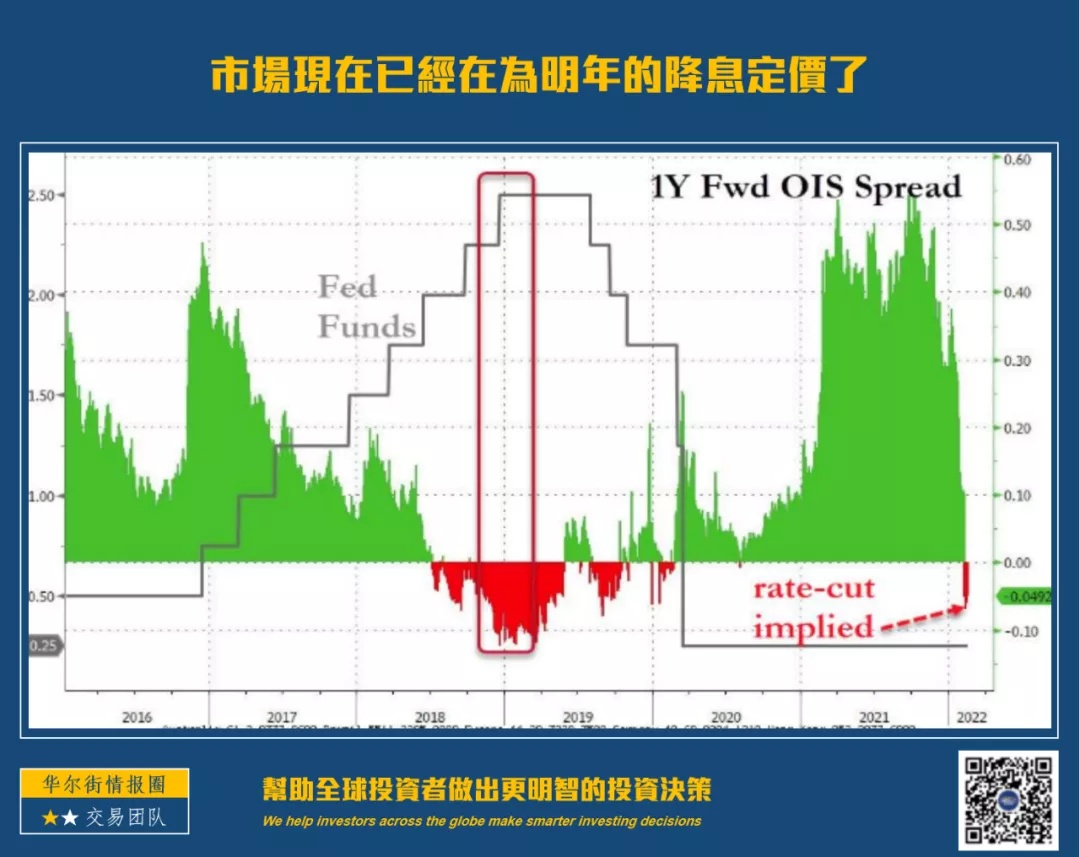

The market has priced the interest rate cut expectation for next year, and it is expected that the current interest rate hike cycle will end in the middle of next year

For the Fed, it is entering a chaotic period. The situation in Russia and Ukraine restricts the actions of the Federal Reserve, and there is no unified consensus within the Federal Reserve.

Last night, St. Louis Fed Chairman Brad added chaos to the market.

Brad told an event hosted by Columbia University and SGH Macro Advisers in New York that to suppress inflation, the central bank may need to adjust the benchmark interest rate above the neutral target rate of 2% (that is, raise interest rates by at least 200 basis points in this interest rate hike cycle). If inflation doesn't slow, there should be an asset sale plan. I want to play the balance sheet card as soon as possible. In addition, Bullard reiterated his view that the Fed should raise interest rates by 100 basis points cumulatively before July 1, and start shrinking its balance sheet in the second quarter to cope with the fastest inflation in 40 years.

After Brad's speech, the US stock market fell further.

There is a reference for when the Fed's interest rate hike will end. From the history of the past 50 years, once the federal funds rate rises above the five-year yield, the Fed will stop raising interest rates (the five-year US bond yield closed at 1.8499% on Thursday).

The Fed now finds itself in a lose-lose situation, triggering either a recession or a market crash, or both. Because the Fed doesn't know what to do, all its choices are wrong. Depressing inflation without triggering a recession has never been successfully achieved in the history of the Federal Reserve, and every tightening cycle of the Federal Reserve ends in crisis.

2000: The Federal Reserve raised interest rates to 6.5%, breaking the Internet bubble;

2008: The Federal Reserve raised interest rates to 5.5%, breaking the real estate market;

2018: The Federal Reserve raised interest rates to 2.75%, breaking the stock market first, then the economy and repo market.

If the Fed wants to keep the market at the time of raising interest rates, the best way is to actively create fluctuations (train in advance) before raising interest rates and let the market adapt. When the news really falls, the market will experience too much. Now the trend of the US stock market is worth pondering. The volatility is gradually increasing, but the volatility is controlled, as if there is an invisible hand behind it.

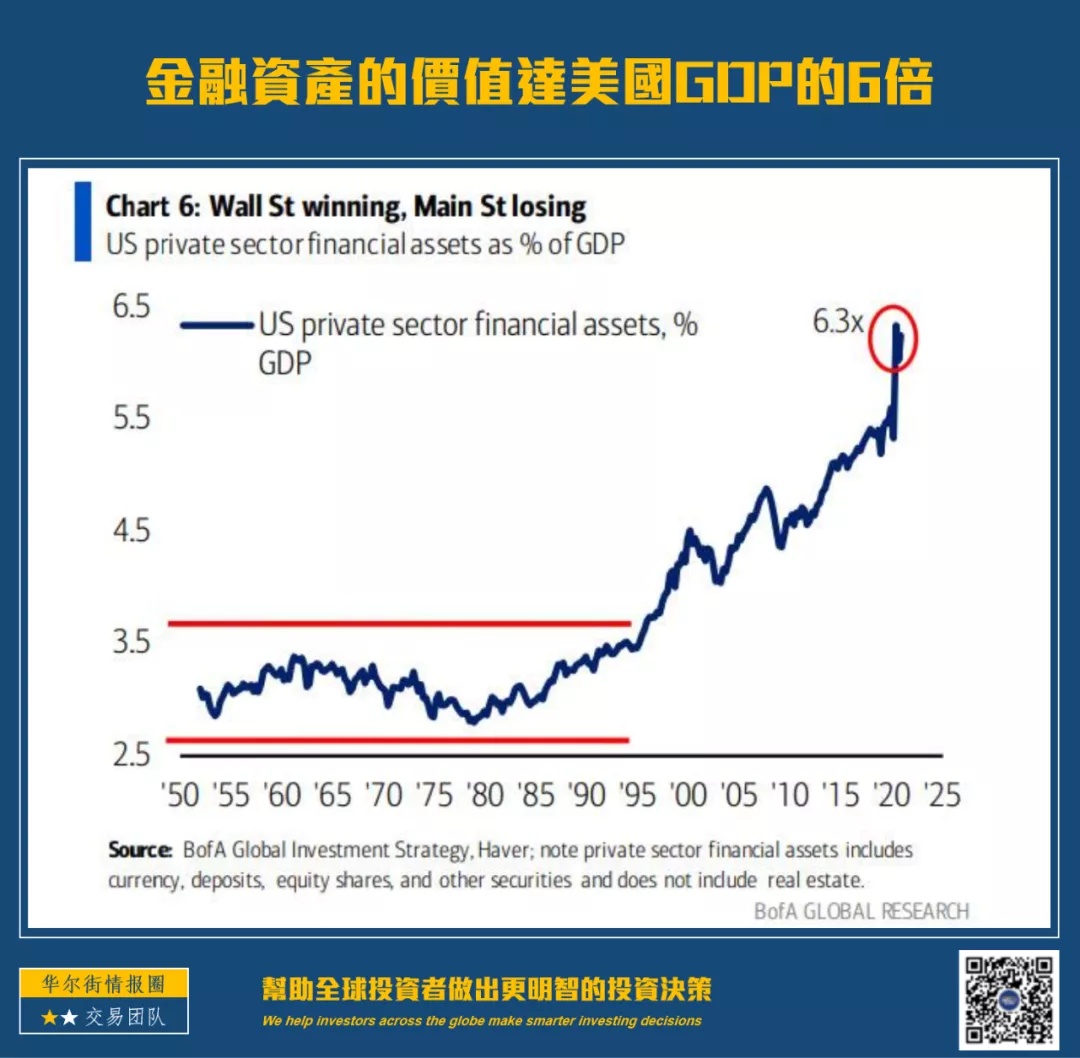

For the Fed, it must keep the market. In such a highly financialized world, the value of financial assets is more than six times the GDP of the United States, which makes the market collapse, even if it is not a complete depression, it will immediately lead to a serious economic recession.

3. The currency war has resurfaced

Looking back over the past two weeks, you will find that the US dollar index has fallen since the market speculated that the Federal Reserve raised interest rates by 50 basis points sharply. Behind this is the smoke of currency war.

The gray line in the figure is the US dollar index

Usually, what we understand as a currency war is that currencies are competing to depreciate, and countries start a downward competition in exchange rates. However, this round of currency smoke is a competitive appreciation of exchange rates (reverse currency wars).

First, currency appreciation increases the purchasing power of domestic currency, so as to offset the soaring prices of imported commodities (such as oil prices and natural gas);

Second, most currencies are rising against the dollar (with the exception of the yen), as the impending Fed rate hike will send the dollar up, before it moves. The appreciation of the US dollar has more advantages than disadvantages for developed countries in Europe and Japan. However, it has a great impact on other countries, which will lead to capital outflow, increase debt and worsen income and expenditure.

Third, the risk of currency war has not yet been integrated into the transaction price. Based on the analysis of known trends, this is the number one risk in 2022.

The Fed's interest rate hike means repricing assets.

Great changes are happening. The terrible thing is that even if the great changes are over, you still don't know what happened. I can't believe you are still living in a dream.

I have said more than once that this is an unprecedented time, and everything you have learned in the past is out of date. The key to successful investment is your cognitive ability to the market environment, and your ability to apply theories and operate in different environments. The former is to know each other, while the latter is a bosom friend. To do this, we must go through systematic study and have four skills:

First, you can see through the news;

Second, can see through the market;

Third, have superb technical analysis;

Fourth, according to the above three points, establish its own complete trading system.

Comments